While some industry people are still fretting that the current slowdown in the sale of farm machinery is setting the stage for a return of the farm crisis of the early 1980s, in large part because of declining land values, Ryan Larsen says, “Perhaps we should be more concerned with the impact of falling intermediate asset prices.”

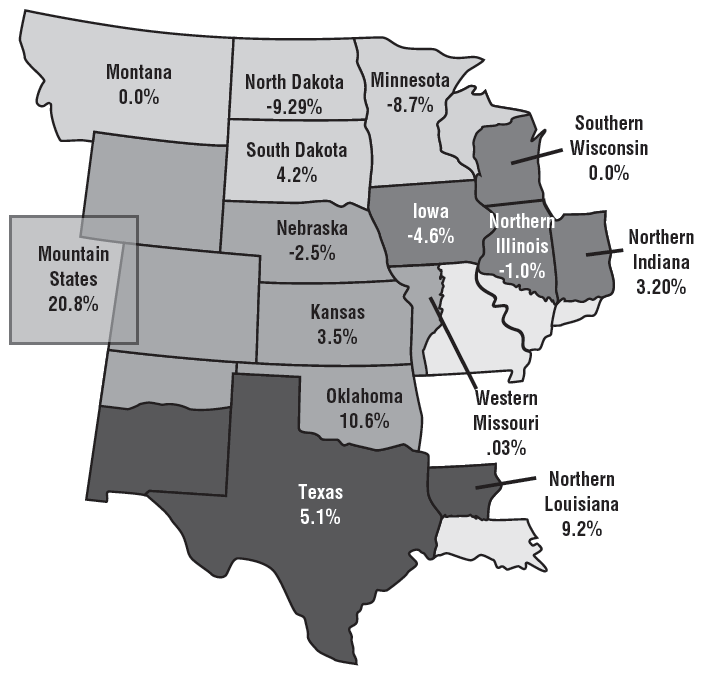

In a recent NDSU Agriculture Communication, “Monitoring Asset Values in 2015,” Larsen, who is an assistant professor in North Dakota State University’s Agribusiness and Applied Economics Department, says, “The recent boom in land values and subsequent drop in commodity prices have many worried about the impacts of falling farmland values. Land value data coming from the Kansas City Federal Reserve show that land prices have leveled off and even are showing a slight reduction.” (See map below)

But Larsen says one of the most significant impacts brought on by the farm crisis of the 1980s were the changes it forced in farm lending practices. “Prior to the farm crisis, lenders relied heavily on asset values to justify granting credit. The drastic reduction in farmland values highlighted the danger of relying solely on assets.”

According to Larsen, in response to the farm crisis, lenders began using cashflow-based financial measures to justify loan decisions. At the same time, to justify loans, they also began to rely heavily on farmers’ balance sheets, with specific focus on ag assets, as the main criteria in their loan decisions.

“Agricultural-related assets complicate the standard accounting definitions,” says Larsen. “Traditionally, assets are grouped into two categories: current and long-term assets. The categorization of assets is based on how quickly an asset can be converted to cash. For example, crop inventory is considered to be a current asset because it can be sold and converted to cash quickly. On the other hand, land would take time to convert to cash, so logically it is considered to be a long-term asset.

|

Value of Non-Irrigated Cropland — 3Q 2014

Ag bankers reported that non-irrigated cropland values have edged down from recent peaks in several states while year-over-year value gains have moderated in others. Ranchland values, however, continued to rise with strong demand for high-quality pasture. While the majority of survey respondents expected cropland values would stabilize, some anticipated additional declines in 2015. Source: Federal Reserve District Agricultural Credit Surveys (Chicago, Minneapolis, Kansas City and Dallas)

|

Because many ag assets fall somewhere between current and long-term, lenders have also adopted the use of intermediate assets, which are those that have a life of 3-10 years. These types of assets include machinery, breeding stock and other equipment. “Intermediate assets are the largest asset category on the average farmer’s balance sheet. They make up roughly 38% of total asset values,” says Larsen. “An average farmer’s intermediate assets have grown from $337,796 in 2007 to $727,633 in 2013. This is a change of more than 100%.

“Long-term assets also have grown during the same time period but only by 84%.” The NDSU assistant professor points out that recent machinery sales data reveal that, on average, there has been a 16% reduction in the sale price of farm machinery during the past year, which, he says, may be a conservative estimate.

Larsen suggests that farmers and lenders closely monitor farmland and machinery values in 2015. “Low commodity prices are going to make it difficult for many farmers to have a positive cashflow. Lenders are going to have to use the strength of the farmer’s balance sheet to help support the loan justification.

“Throughout 2015, if necessary, the balance should be adjusted to capture the most recent asset values and provide a more accurate picture of the strength of the balance sheet,” he says.