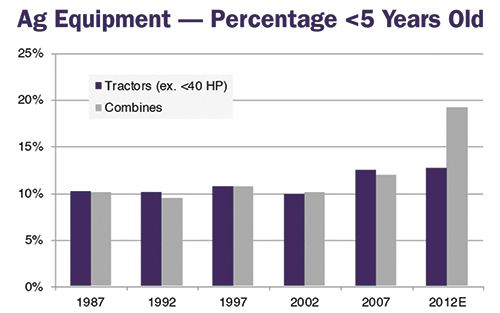

If sales of tractors and combines do slow in 2014, part of the reason may be attributed to the young age of the current fleet of farm equipment. With increased sales of farm equipment, particularly in the past 5 years, “the average ag equipment fleet age appears to be the youngest in the past 25-plus years,” says RW Baird machinery analyst, Mircea (Mig) Dobre.

With increased sales of farm equipment in the past 5 years, the average ag equipment fleet age appears to be the youngest in the past 25-plus years.

Source: USDA, AEM, Baird Estimates

“Based on our estimates, as well as USDA and AEM data, the percentage of combines aged 5 years or less has increased to 19% in 2012 from 12% in 2007, while tractors, excluding those less than 40 horsepower, has increased to 13% from 12%,” Dobre said in a January note to investors.

At the same time, Dobre estimates that far more high horsepower and 4WD tractors are less than 5 year old, considering unit sales of these tractors increased by 34% since 2008. For the same period, sales of mid-size tractors (40-100 horsepower) were down by 24%.

This, of course, could create opportunities for increasing mid-size tractor sales. With livestock receipts forecast to outpace crop receipts in 2014, this would appear to be a favorable signal for possible growth of tractors in this category that are generally used by livestock operators.

4Q Loans Decline as Farm Spending Slows

A slowdown in lending for capital purchases contributed to lower farm loan volumes in the fourth quarter, according to the January 2014 Federal Reserve System’s Agricultural Finance Databook.

In recent years, strong incomes and tax incentives prompted many producers to upgrade or replace farm machinery and equipment, says Nathan Kauffman and Maria Akers of the Federal Reserve Bank of Kansas City.

But according to national survey data collected during the first full week of November, the volume of loans for farm machinery and equipment purchases dropped to the lowest level in more than 2 years. This drop occurred despite attractive loan terms of low interest rates and longer average loan maturities.

With solid incomes and lower operating costs, November survey data indicated fourth-quarter operating loan volumes fell 10% short of last year’s levels.

Farm real estate lending also eased during the fourth-quarter survey period. While farmland values generally were still rising, agricultural bankers reported gains had moderated from the brisk pace of the past few years.

Ag Sales Remain Robust in December

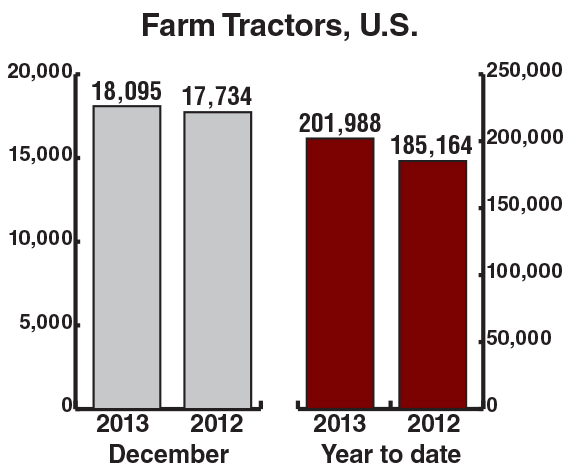

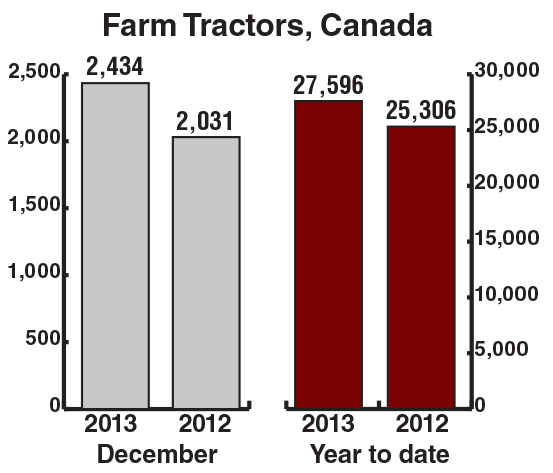

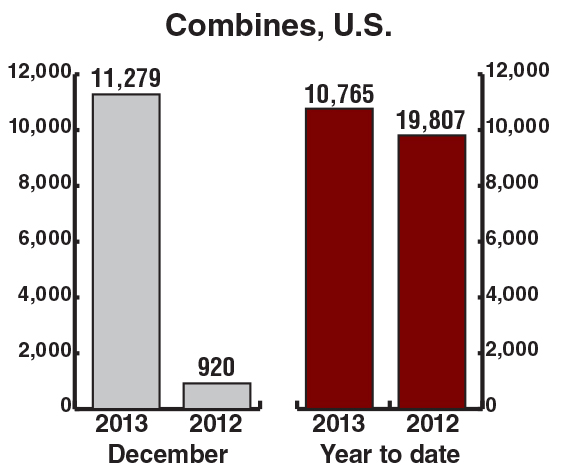

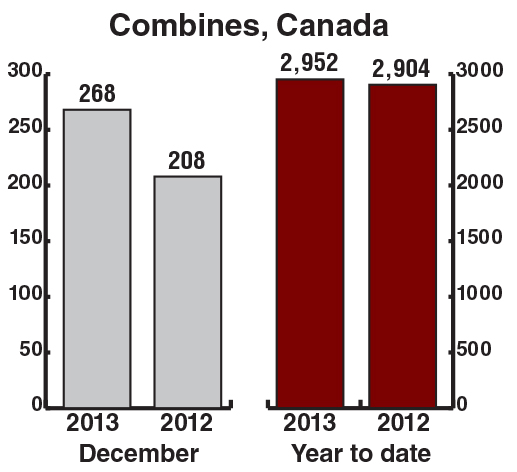

North American large ag equipment retail sales increased in December, with 4WD tractor sales up 6.9% year-over-year, combines up 37.1% and row-crop tractors increasing 13.9%, according to the Assn. of Equipment Manufacturers. Inventory levels and days-sales of inventories rose across all large equipment categories year-over-year, which adds to the growing risk for inventory destocking in 2014 given projected sales declines, Mircea (Mig) Dobre, analyst with RW Baird, said in a note to investors.

Combine sales saw a 37.1% increase year-over-year following a 25.8% increase in November. December is typically an above average month for combine sales, accounting for 9.7% of annual sales over the last 5 years. Row-crop tractors posted a 23.9% increase vs. the same period last year, accelerating from the 7.2% increase in November. December is typically a strong month for row-crop tractor sales, accounting for 10.9% of annual sales over the last 5 years.

4WD tractor sales were up as well, with a 6.9% year-over-year increase vs. a 1.9% increase in November. Mid-range tractor sales strengthened in December, up 10.3% year-over-year after a 2.7% decrease last month. Compact tractor sales were down 6.7% year-over-year.

—Ag Flash Reports, Assn. of Equipment Manufacturers