Aftermarket upgrades give growers an opportunity to turn their existing equipment into high-tech precision agriculture machinery. For the industry to build broader adoption, dealers must play a pivotal role.

“You need boots on the ground, and you have to employ some precision-savvy people at your dealership,” says Eric Shuman, general manager of Raven and Precision Technology Operations for CNH. “If you have someone who can go to a farm and understand the customer’s pain points, and then identify the right precision tech solutions and express the value proposition, that’s when you can really start gaining some ground.” Raven is a subsidiary of CNH Industrial.

The more often growers see other growers using precision technologies, the faster and more widespread adoption will become. To that point, it makes sense to target those who are more inclined to embrace new ideas.

“Most progressive growers are often more analytical in understanding their expenses and the impacts of their decisions on profitability,” says Kyle Afrank, precision ag director at AKRS Equipment, a John Deere dealership with 27 locations throughout Nebraska and into Kansas. “Progressive growers can see the value technology can bring to their operation.”

According to Gabe Gantz, a precision ag specialist at ModernAg Inc. with locations in Wamego, Kan., and Blackwater, Mo., product adoption is happening across a range of customer demographics. Younger growers seem especially interested, and it’s not just because they are more technologically savvy. Gantz says younger growers are less brand-loyal and more interested in simply buying the best tool for the job.

“Progressive growers can see the value technology can bring to their operation…”

“With an aftermarket upgrade, you can turn any planter into a hot rod planter,” Gantz cites as an example. “You could even buy an older planter that still has good bones to it. A lot of the cost of a new piece of equipment is just in the iron. So if they can keep using that same planter but add the technology to it, they could get the benefits they’re looking for while saving money.”

ModernAg was started in 2014 as the precision tech arm of KanEquip, a Case IH and New Holland dealership with 14 locations in Nebraska and Kansas. ModernAg’s offering includes Trimble, Ag Leader, Precision Planting, Capstan Ag Systems and Sabanto.

Helping Growers Grow Comfortable

To convince a grower to invest in a precision tech upgrade, a dealer needs to explain how the upgrade is going to give that grower an advantage. “A grower wants to know that they’re going to increase efficiency, and save time and money,” Gantz says. “They want to know that these products will pay for themselves.”

As crucial as ROI is, Gantz says there are other benefits that are also important to highlight. He’s talking about the ROI on a grower’s wellbeing. Simplifying equipment operation and reducing stress can be a pretty compelling message.

Another key message is whether or not the grower can utilize their existing equipment. Some aftermarket upgrades are designed to work with certain brands and models. Others can work with just about anything if the right person is installing it. “If you’re experienced enough with a certain system, like most of our specialists and technicians are, you can usually make something work,” Gantz relates.

Takeaways

- Commit to having at least one precision specialist who is fully supported with training and other resource.

- Educational events are an effective way to build awareness and establish credibility.

- Validate the potential benefits of a particular aftermarket kit with field data and other research.

- Most growers will want to see a 2-year payback on most upgrades, coming in the form of reduced labor and/or inputs, and/or increased yield.

When it comes down to it, the expertise of the individual doing the installation can make or break the customer’s experience with a new technology. The same can be said about after-sale support.

“A lot of growers get sold things, but they aren’t always sold a solution that includes a partner and support,” says Pete Youngblut, owner of Youngblut Ag, a precision ag dealership in Dysart, Iowa, specializing in Topcon, Ag Leader, Precision Planting, Headsight and 360 Yield Center. “We focus on educating people.”

Youngblut Ag also sells equipment, including Yetter attachments and strip-till units, Harvest International planters, and Fast sprayers, side-dress bars and strip-till bars. “This enables us to custom-build certain things based on what the customer wants,” Youngblut says.

Greeneye Sprayer — The Greeneye Precision Spraying System will seamlessly integrate with any sprayer. It uses artificial intelligence and deep learning technology to selectively target weeds in real time. A dual-line configuration also allows growers to simultaneously spray contact herbicides precisely on weeds, while residual herbicides are sprayed on a broadcast basis. Photo by: Greeneye Technologies

Precision technologies, especially aftermarket upgrades, aren’t something the average dealer can simply dabble in. A grower is naturally going to expect the dealer to have a strong command of the technology. But the bar has been set higher in other ways, as well.

“Being able to speak intelligently about agronomics is really important to a precision ag specialist,” Gantz says. “A seed salesperson might get away with just tossing a few fancy words around. But a precision ag specialist is expected to really know what they’re talking about.”

Dealer Skip Klinefelter agrees, while adding one caveat.

“I don’t think you can have just one precision specialist at your dealership,” says Klinefelter, owner of Ag Technology Solutions Group, a collection of precision agriculture dealerships including Linco-Precision, Linco-Precision Northeast, Bottom Line Solutions and others. “If your one specialist gets sick or quits in the middle of planting or harvesting, that creates a problem. Supporting precision products requires a commitment to both staffing and training.”

Based in Illinois, Ag Technology Solutions Group has been providing precision solutions for more than 20 years. The dealership now provides coverage in 39 states for brands like Ag Leader, Raven, Greentronics, Precision Planting, Sabanto and Trimble. It also provide a focused offering of equipment including Brehmer fertilizer tenders, New Leader spreader beds, Walinga grain vacs, Duo-Lift wagons and others.

Raven Cart Automation — Raven offers a range of aftermarket upgrades including steering and guidance, application control and real-time sensing and autonomy. Pictured here is Raven Cart Automation. When a grain cart driver is within range of the harvester, the operator can sync the cart’s direction and speed with the auger of the combine. This allows the combine operator to take control of bin positioning for more efficient, spill-free harvesting. Photo by: Raven Ind.

For precision tech staff to develop the expertise they need, there is no substitute for supplier-provided training — especially in-person events. Then dealers can turn around and provide education to their own customers.

“Having things like field days and training events at the dealership are great ways to draw in growers from all over the area,” Shuman says. “There is no better way to show people what technologies are available. Let them touch it and experience it, and then answer their questions to keep building their interest.”

Ag Technology Solutions Group has also found that educational events are key. “We’ll bring in guest speakers like Jason Webster who runs Precision Planting’s research farm in Pontiac, Ill.,” Klinefelter says. “He’ll talk about the technologies and present the latest data from different research plots.

Determining what an individual customer truly needs can’t be done at a training event, however.

“You have to get an on-farm feel for that customer’s operation and goals,” Gantz relates. “If all the customer is ever going to want is guidance, you might steer them toward a certain system. If they’ll eventually want to get into variable rate with a sprayer or spreader, you probably want to steer them toward a different, more sophisticated system. It really comes down to that initial consultation to find out what their expectations are.”

Charting a Pathway to Payback

To ultimately sell an aftermarket upgrade, a dealer needs to clearly define the value. That will typically vary by technology type. Here are some insights on some of the more popular aftermarket upgrades today.

Guidance & Operator Assist

“Operator assist solutions — such as automated steering, end of row turns and row guidance — take the guesswork and stress away from the customer,” Shuman says. “With our VSN Visual Guidance system, which you’ll typically see on spraying equipment, we’ve done studies that show a 48% reduction in operator stress events as compared to driving manually. With a technology like this, the ROI is being able to simplify operation.”

Sabanto Steward — Once installed on an existing tractor, Sabanto’s Steward autonomy kit uses advanced cameras, obstacle detection sensors, GNSS systems and robotics to autonomously tackle mundane work like mowing, tilling (pictured), rolling, aerating and seeding. Photo by: Sabanto

When it comes to steer assist upgrades specifically, Klinefelter says one demo is typically all it takes. “When someone tries out one of our systems, 85-90% end up coming back to buy one in a day or so,” Klinefelter relates.

A lack of skilled labor is helping to further drive interest in operator assist upgrades. The same can be said about another precision ag technology.

Autonomy. Growers are becoming increasingly interested in autonomy but want to know they can trust it. That’s why monotonous tasks are turning out to be a good match for getting started.

“We’re seeing growing interest in autonomous tractors, especially sod farms that have hundreds of acres that need to be mowed once or twice a week,” Klinefelter says. “We’re also seeing interest from organic growers who would like a tractor that could cultivate all the time. In this application, an organic grower usually has guidance on their cultivator, as well, because they want to be really tight on their rows.”

A third application is tillage. “Some customers are telling us they wouldn’t mind having something autonomous out in front of them while they follow behind with a planter,” Klinefelter says. “We’re hearing that they’d still like a human running the planter, but something autonomous they could see and trust to handle the tillage is of interest.”

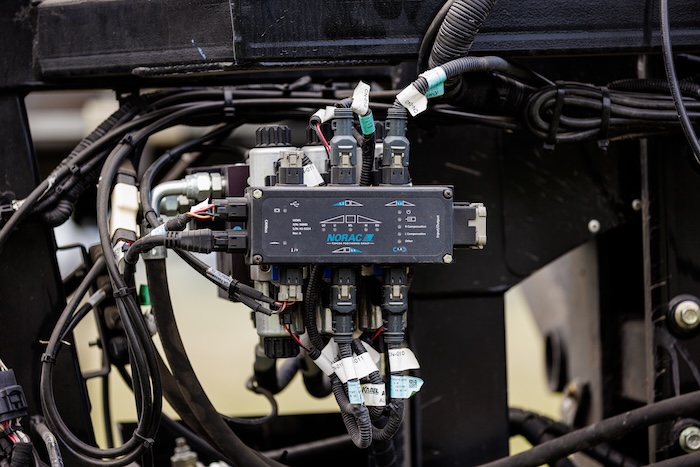

TOPCON NORAC UC7 — Boom Height Control can be retrofitted to a variety of sprayers. The system uses a boom-mounted ultrasonic sensor that knows how far it is from the canopy or ground. The sensor feeds that reading to a control module, which tells the hydraulics to move up or down. That helps ensure consistent application regardless of terrain. Photo by: TOPCON Agriculture

“Most growers would rather not have to put a worker in a tractor for eons of time to drive back and forth at 2 or 3 mph,” Gantz says. “Autonomous equipment can also run overnight. Labor and productivity are the biggest drivers for autonomy upgrades.”

Smart Sprayers. When it comes to any application control upgrade, including “smart sprayers,” the ROI message ties to accuracy, consistency and input reduction.

“It’s easy for growers to see the value in being able to do things like turn off individual nozzles with a prescription map,” Shuman says. “They’re receptive to the idea that their savings on chemicals will help pay for the technology in a fairly short timeframe, generally within a couple of years depending on how many acres are being managed.”

When selling smart sprayer upgrades, it’s important to be transparent about the true cost. Any system will have an upfront cost for the equipment and installation. But some systems will also charge recurring fees, often on a per-acre basis. Some systems may also require the purchase of a new boom. To set the customer up for a positive experience, it’s important to go over all of that so they can get an accurate picture of what the ROI trajectory looks like.

Speaking of ROI, any legitimate field data a dealer can get their hands on will typically help nudge a grower closer toward making a purchase.

Trimble’s WeedSeeker 2 — Trimble’s WeedSeeker 2 can be adapted to any spray boom. “Intelligent” sensors attach to individual nozzles. Then, advanced optics and processing power detect and eliminate resistant weeds at speeds up to 25 mph, day or night. Photo by: Trimble Agriculture

Greeneye Technology, an Israeli-based manufacturer of selective spraying systems, is touting some positive results coming out of a field trial undertaken by the Univ. of Nebraska-Lincoln’s Agricultural Research Division. That trial showed an 87% reduction in non-residual herbicide use in post-emergence spraying, compared to broadcast application. Additionally, there was a 94% reduction in burndown herbicide use.

As desirable as reduced chemical use is, growers also want to know that the chemicals they do apply will be able to do their job. Nebraska grower Brad Janzen can relate to that. Heading into the 2022 season, he had grown frustrated with the level of chemical resistance many weeds had begun showing. He started doing some research and talking to his agronomist about his options. The option he kept coming across was smart spraying. He filled out Greeneye’s website form.

“I asked if they could bring a unit to demonstrate, and they agreed,” says the co-owner of Janzen Brothers in Henderson, Neb., which manages roughly 5,000 acres of corn, soybeans and seed corn. Janzen demoed the spraying system on roughly 3,000 of those acres. He was impressed with the results and ended up purchasing his own system at the end of 2022. He had it installed on his existing Hagie STS16 sprayer, which was another factor in his decision to go with the Greeneye unit.

“I found that a lot of other options were more slated to vegetable farming,” Janzen says. “But we needed something 120-feet wide that could work up to 15 mph. If we went to a smart sprayer, we did not want to give up the speed and productivity we had with our existing sprayer.”

Janzen also liked the fact that it was a dual-solution system. He continues to apply pre-emergent with a broadcast boom, while the camera-equipped boom on the smart spray system delivers the burndown application. In 2023, Janzen says he reduced burndown inputs by 97% on some fields, though other factors also played a role in that. Regardless, the cost savings was profound. More importantly, Janzen got the results he’d been looking for on those herbicide-resistant weeds.

Boom Height Control. Another popular precision spraying upgrade is boom height control. Some growers are finding that it’s a worthwhile complement to a smart spray system. Most, however, use it as a standalone technology to help ensure consistent application.

The Topcon NORAC UC7 is one example. “The core of the system is a boom-mounted ultrasonic sensor that knows how far it is from the canopy or the ground,” says Ryan Pieper, regional development manager for the eastern U.S. at Topcon Agriculture. “The sensor feeds that reading to a control module, which tells the hydraulics to move up or down.”

“They want to know that these products will pay for themselves…”

Youngblut says the NORAC UC7 can be retrofitted to a variety of sprayers, which makes it easy for any grower to implement. The rest of the sales pitch is equally straightforward.

“Boom height control allows you to set your height and keep it there,” Youngblut says. “Then the operator knows their pattern will be correct. If a boom gets too low, it’s not covering. If it gets too high, the chemical might not even get there.” In other words, boom height control helps ensure the efficacy of the product the grower is putting down.

“Reduced stress can be another selling point,” Youngblut adds. “Sprayer operators have to keep their eyes on the boom at all times, watching to see if it’s on the ground or if the spray is drifting. And what if that boom gets in the ground and breaks? How much is that going to cost to replace?”

Planting. Gantz says “emergence” is the big motivator behind investing in precision planting upgrades.

“That’s the start of a grower’s entire year,” Gantz says. “The hydraulic downforce market is big on getting even emergence, especially in corn. If you don’t have uniform emergence with your crop, you’re just going to be behind all year. If one plant is a day or two behind the others, it’s done. The other plants are going to pass it up and rob all the nutrients.”

A planting upgrade with downforce control will provide individual row downforce. “If you’re planting a field with varying conditions, the equipment will adjust at a very fast rate to keep your planter at depth,” Gantz explains. “Depth is one of the main things that affects emergence. So we tell customers that downforce control is one of those upgrades that will provide the biggest payback right off the bat.”

Final Hurdles to Adoption

Gantz says a lot of growers want to know if the upgrade they are looking to purchase will be replaced soon and become obsolete. Given how quickly technology evolves, it’s an understandable concern. But Gantz says the bigger concern is missing an opportunity to begin leveraging a game-changing technology sooner than later.

“We tell customers that they can only buy what’s available now,” Gantz relates. “There’s just no way around that with anything. If you need it, you need to buy what’s available. Fortunately, it’s never that big of a hang-up. Price is typically the bigger hang-up, especially when some of these systems can be worth more than the older machinery we’re putting it on.”

But even price is a hurdle that can easily be overcome. Dealers just need to articulate the value proposition of the technology upgrade they’re selling. When a grower can see how an upgrade will alleviate one of their pain points while also paying for itself within a couple of years, selling an upgrade doesn’t have to be an uphill battle.