Dealership valuations are an important step not only in mergers and acquisitions but in sales and divestitures, buying or selling partial interest of a dealership, purchase price allocations, estate and gift tax planning and employee stock ownership plans (ESOP). As the chief financial officer of the North American Equipment Dealers Assn. (NAEDA) and president of Equipment Dealers Consulting in Kansas City, Mo., I have worked with farm equipment dealers for over 40 years and performed over 500 valuations in the U.S. and Canada since 2003.

Though purchase price allocations are a small portion of valuations, they are an important step post-acquisition. Usually, it’s a dealer who put down a lump sum and wants assistance in how to allocate that purchase price into fixed assets, goodwill and things of that nature.

Valuations also come into play when dealers are estate and gift tax planning. Per person, dealers can shelter $13.5 million of their estate tax-free and $27 million for married couples. Establishing a fair market value for the estate is crucial not only to give heirs a level of comfort but is needed with IRS filing of the estate/gift tax return.

With ESOPs, valuations are required every year, and it’s common to have life insurance buy/sell agreements updated or reviewed yearly so you can ensure you have enough coverage to buy out a shareholder if needed.

Final calculations of the value of a dealership can be based on several numbers, including unadjusted or adjusted EBITDA and the multiples, or comparison ratios between businesses based on relevant metrics, to determine intangible value. Together, these numbers provide a good idea of what your business is worth.

Valuation Methods

There are multiple ways to approach a valuation process. The first way to assess a dealership is an asset approach using adjusted book value and liquidation value. However, because book value does not identify current market value since it accounts for depreciation over time, it is not equivalent to a dealership’s actual fair market value. Intangible assets, which are not necessarily included on balance sheets, are also not considered in an asset approach, allowing the final value to differ from what it should be — why I often avoid this method.

The market approach, while valuable, can be difficult to assess. Going through BizComp, the Institute of Business Appraisers or performing mid-market comparisons can assist in this process. Considerations for these comparisons should include size, whether the dealerships offer identical products, whether the dealers are operating in multiple locations and have a notable similarity in profits.

“The longer you’ve been in the business, the better for minimizing risk…”

While this data is public and not dependent on subjective forecasts, there is very little market data for farm equipment dealerships, and if there is, it’s hard to get the different volume sizes and locations that would actually be comparable to individual dealerships.

Another approach is to assess income through the capitalization of earnings or excess earnings. Used especially for estate planning and gifting, it’s also used in mergers and acquisitions. Mergers are the most common because it necessitates treating all parties equally, something the income approach allows.

I’ll fair value all the assets and liabilities, and then look at a dealer’s income stream to determine if there’s any intangible blue sky value.

The Valuation Process

The first step in the 5-step valuation process is to gather relevant information that will help accurately determine what a dealership is worth. This means 6 years of tax returns, 6 years of financial statements or 6 years of audited financial statements, a history of the dealership, market share, employee turnover, current ownership and management structure. This is needed to determine risk rate. The lower the risk a dealer has, the more likely they are to have a higher intangible value.

In addition, a current list of fixed assets is needed to fair value them and make adjustments to inventory at the end of the year if needed. While current parts inventory is used in the valuation process, the need to adjust them is less common because of the databases that update this information throughout the year. Most dealerships do not require an adjustment for a disparity between parts inventory that is on Dealer Net and what is actually on the ledger.

Another aspect that factors into the dealership valuation process is ownership benefits.

Has the owner taken out 2 or 3 cars to use personally, or do they have any excess life insurance? Do they go on hunting trips? That all factors into the cashflow of the business.

The second step in the process is to normalize a dealer’s income statement. Compensation adjustments can differ depending on whether the dealership is an S-corp., C-corp. or ESOP. Looking at an executive’s compensation can determine whether they’re taking out what they should be or taking excess.

For tax purposes, many dealerships take advantage of Section 179 expensing and bonus depreciation. Both of these allow businesses to take an immediate deduction in business expenses related to depreciable assets such as equipment and vehicles. The only difference is that Section 179 is a set dollar amount while bonus depreciation is a percentage. Both can be used.

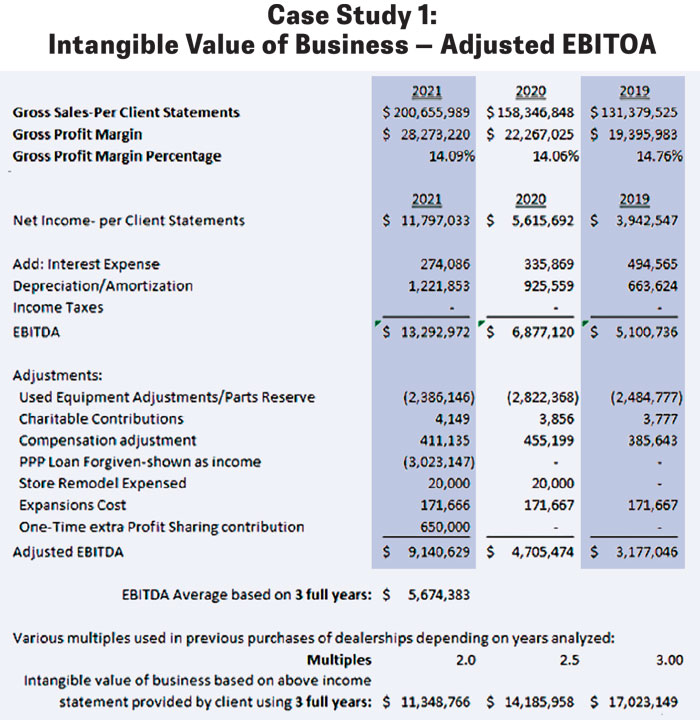

Merger valuations may include more adjustments than usual in order to treat both parties as equally as possible. Curt Kleoppel likes to include gross sales, profit margin and percentage to determine whether it trends up or down as a barometer of dealer health. Intangible value here is determined by multiplying the EBITDA average by the multiple. Source: Curt Kleoppel

In 2024, Section 179 caps out at $1.22 million that can be expensed.

Section 179 phases out at $3.05 million and totally phases out if dealers buy more than $4.27 million of qualified property. Above that, dealers can’t Section 179 anything. But they can do bonus depreciation, which changed in 2023 to 80%. That is then phasing out in 2026. It goes to 60% the next year, 40% then 20% in 2026.

Along with unusual or extraordinary events, PPP loans and ERC credits must be taken into account when normalizing an income statement.

Risk to Consider

The third step in the valuation process is the development of a capitalization rate, which is calculated through 4 different components. When determining a final capitalization rate percentage, we need to add the safest rate of return to it, which is the yield percentage on a 30-year Treasury note at the time of the valuation date.

There are 4 components to the risk factors that need to be assessed to determine capitalization rate. The first is the competition component. These include considering a dealership’s overall competition, the relative size of the company and quality of its products and services, pricing competition, market share, covenant not to compete and ease of market entry.

Ease of market is a little different for the ag industry. Dealers have to get manufacturer approval to sell and manufacturer approval for the buyer.

The second is the financial component, which involves looking at metrics such as current and quick ratios. These are short-term liquidity ratios that gauge a dealer’s ability to pay all debt should it come due immediately. Current ratio is calculated by dividing current assets by current liabilities, and quick ratio divides liquid assets by current liabilities.

Financial risk also requires looking at sales and inventory to working capital, net sales to inventory, debt to net worth, total debt to assets and long-term debt to equity.

Establishing risk factors means looking at the industry average compared to an individual dealership. Are they over performing or under performing below industry average?

NAEDA’s annual Cost of Doing Business Study, conducted by Equipment Dealers Consulting, will establish different volume groups in subsequent editions to improve industry guidelines by including monetary categories such as $50-100 million, less than $50 million and even over $350 million.

The third risk factor is management ability and depth. This includes the turnover rate for accounts payable and receivable, inventory and employee turnover, gross profit margin, facility conditions and family involvement. It also includes the quality and history of a dealer’s records and management structure. If the management structure is poor or there is a high turnover rate, the risk to the dealer is higher.

“If that multiple is 1 or above, it’s good quality earnings…”

The final risk factor is the profitability and stability of the dealership. The longer you’ve been in business, the better it might be.

This minimizes risk by demonstrating security along with sales growth rate, operating earnings growth, return on assets, return on equity and how that compares to the industry average.

Determining Value & Trends

The fourth step in the valuation process is determining the intangible value of a dealership. This includes looking at any excess earnings based on the industry’s return on assets or equity, meaning a dealership is performing above the industry. Also important is to look at potential for future growth.

Is there growth that’s not disclosed in the income statements? A lot of times, when dealerships are in expansion mode, the previous 3 years tend to be up. Then more potential growth can be structured for the future with something to substantiate it on.

The final step in the valuation process is to combine this information to determine the total value of the company. Adjusted assets and liabilities as well as added intangible value are all taken into consideration to come to a final number or EBITDA — earnings before interest, taxes, depreciation and amortization.

Currently, acquisitions tend to use multiple adjusted EBITDA, usually 3 years of data, in order to get the most well-rounded look at the performance of a dealership. When quantifying value in a merger or acquisition, intangible value can be found by multiplying a dealer’s average EBITDA by the established multiple. This multiple, or ratio, depends on the brand, number of buyers and locations being compared.

Quality of earnings is also a good indicator of how reliable a company’s reported net income is and is calculated by dividing net cash from operating activities by net income.

If that multiple is 1 or above, that means the core operations are producing sufficient cash, and it’s a good quality of earnings. Looking at just financial statements and net income can be deceiving. Is that net income driven off the core operations of the business or is it produced through financing activities or tax issues?

Instead, using years of data, assessing risk and performing value calculations can provide the most accurate picture of a dealership’s tangible and intangible worth.

Check Out Parts 1 & 3 Here

Part 1: “How to Navigate the Moving Parts of a Dealership Transition“ Farm-Equipment.com/articles/22127

Part 3: “Assess Dealer Culture & Values To Ensure Success After a Transition“ Farm-Equipment.com/articles/22311