In this episode of On the Record, brought to you by Associated Equipment Distributors, we talk about the 10-year trend for dealer wholegood revenue forecasts, Titan's third quarter earnings for fiscal year 2024 and the next steps for spray drone technology. Also in this episode a look at dealers' ability to fill retail orders from their current inventory and in the Technology Corner, Noah Newman takes a closer look at Susterre's ultra-high pressure water jets.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Nearly 49% of Dealers Forecast New Equipment Revenue to Drop in 2024

- Dealers on the Move

- Susterre’s Ultra-High Pressure Water Jets Boost Yields by 12%

- Titan Reports Record 3Q Revenue

- What’s the Next Step for Ag Spray Drone Tech?

- Inventory on Hand Largely Filling Retail Orders

- DataPoint: 2024 Early Orders

Nearly 49% of Dealers Forecast New Equipment Revenue to Drop in 2024

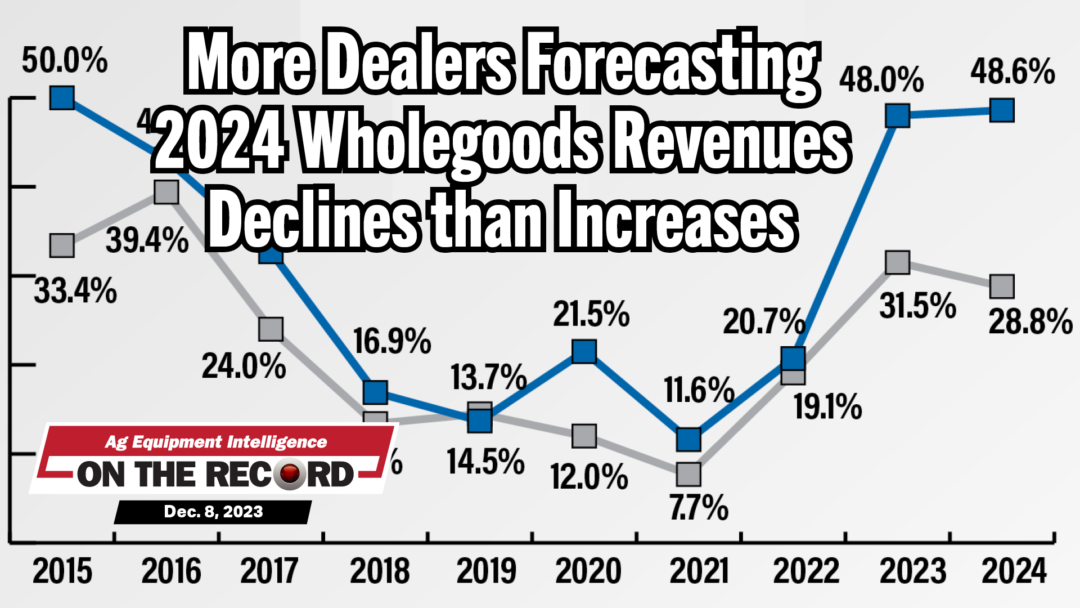

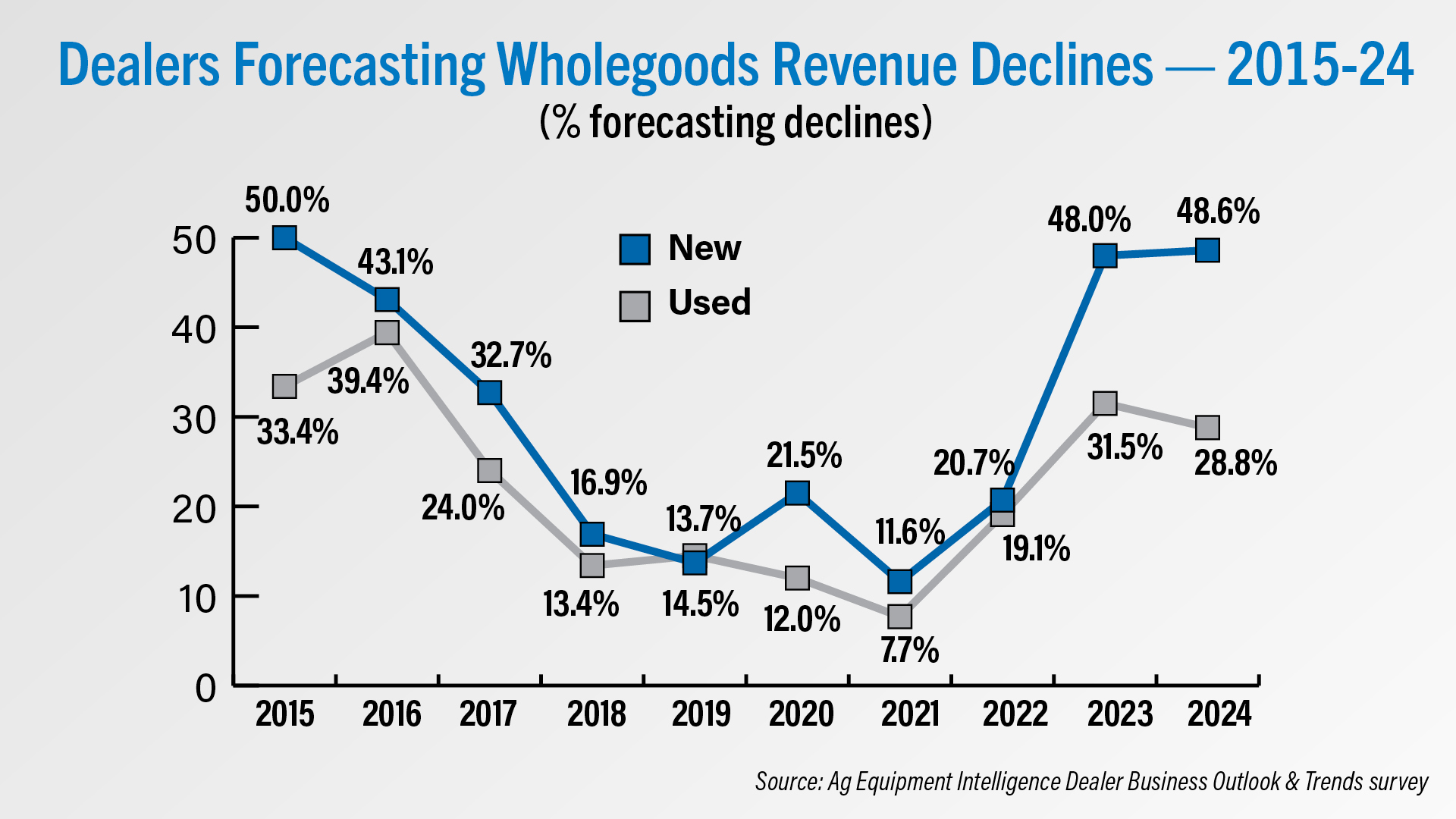

Looking at data from the last 10 years, while the percentage of dealers forecasting wholegoods revenue declines is rising, it’s not quite to the levels seen during the previous ag equipment market downturn.

According to the 2024 Dealer Business Outlook & Trends Report, just under 49% of surveyed dealers are forecasting a decline in new equipment revenue for 2024, a hair below the 50% who, 10 years ago, forecast declines for new equipment revenue for 2015.

The percentage of dealers forecasting declines in new equipment revenue has risen for 3 years in a row. At the same time, 29% of dealers are forecasting declines in used equipment revenue for 2024, but higher percentages were seen in forecasts for 2015 and 2016, which was a 10-year high of 39.4%.

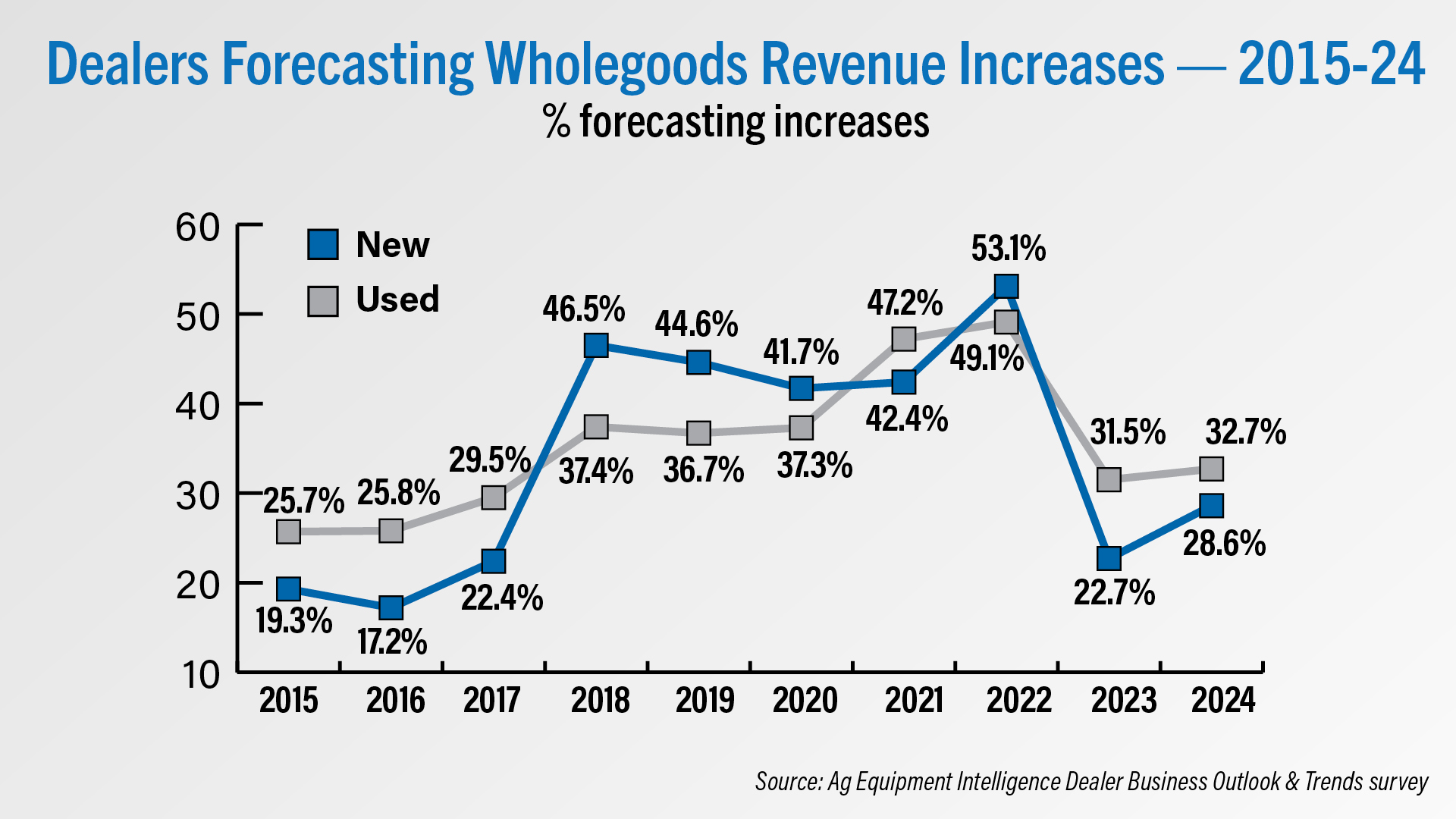

Looking at the percentage of dealers forecasting increases, data shows results are down from the 2022 forecast peaks but again, not to levels seen at the tail end of the last downturn in 2015 and 2016.

32% of dealers are forecasting used wholegoods revenue will be up for 2024, only up slightly year-over-year and below percentages seen between 2018 and 2022. The percentage of dealers forecasting increases in new wholegoods revenue has actually risen for 2024 to 28.6% and is above percentages seen in 2015, 2016 and 2017.

This 28.6% puts dealer sentiment for new wholegoods revenue below the upswing in forecasts seen from 2018 to 2022.

The 2024 Dealer Business Outlook & Trends report is now available. To learn more, visit agequipmentintelligence.com

Dealers on the Move

This week’s Dealers on the Move include Tellus Equipment, Belkorp Ag and United Ag & Turf.

John Deere dealer has acquired 3 dealership locations in Marble Falls, San Antonio and Bulverde, Texas. Tellus now has 28 locations across south and central Texas.

Belkorp Ag is under contract to acquire the Deere assets of Turf and Industrial Equipment in Santa Clara, Calif.

Deere dealer United Ag & Turf has acquired Chad Little Outdoor Power Equipment, a 2-store dealership with locations in Brunswick and Scarborough, Maine.

Susterre’s Ultra-High Pressure Water Jets Boost Yields by 12%

This week, we’re heading to the Innovation Hub at the 2023 Nebraska Ag Expo, where over 50 ag tech companies gathered to showcase some of the best cutting-edge technology in the industry. We caught up with Susterre CEO Michael Culley, who gives us a rundown on the company’s use of ultra-high pressure water jets to cut through residue in no-till farming.

“Our product is a retrofit row unit that we can install on any existing planter. It consists of 2 parts, a ski part that presses down the residue on the field, and the jet that pumps water at 60,000 pounds per square inch. We’ve designed the product so it cuts through any amount of residue without having a hairpinning of residue, and without applying additional downforce onto the field. Our side-by-side testing has shown that we can produce 6-12% yield increases in most residue situations. And our goal is to keep regenerative farmers in the practice of no-till and the use of cover crops for more seasons.”

As for a sales pitch, Culley says if a farmer purchases their technology, it would pay for itself within two planting seasons. For more information about the company’s plans for selling the product, check out contributing editor Dan Crummett’s interview with Culley on No-Till Farmer.com.

Titan Reports Record 3Q Revenue

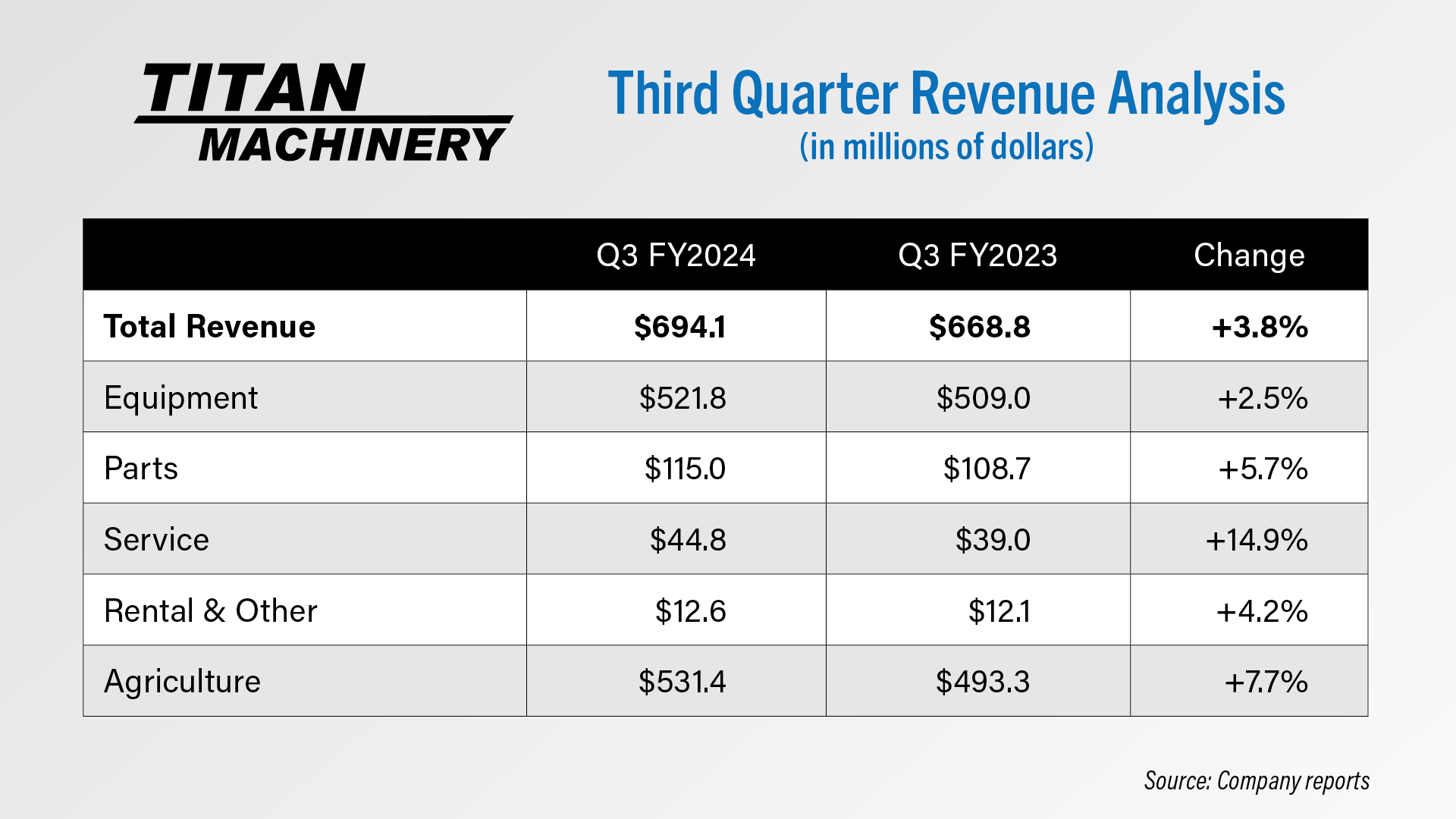

Titan Machinery reported record third quarter earnings for fiscal year 2024 on Nov. 30. The Case IH dealership group achieved revenues of $694 million for the period ending Oct. 31, 2023, up 3.8% vs. the same period last year.

While Titan hit record revenues for the quarter, during the call with analysts, Chairman David Meyer said results came in below Titan’s full potential. He credited the shortcomings to delayed OEM deliveries, prioritizing customer uptime throughout the harvest and end of season construction projects and increased preparation time to complete pre-delivery inspections of new machinery.

Breaking down the quarterly results, equipment revenue came in at $521.8 million, up 2.5% year-over-year. Parts revenue saw a 5.7% increase to $115 million, while service revenue was up 14.9% to $44.8 million. Rental and other revenue accounted for $12.6 million, up 4.2%.

Ag segment sales increased 7.7% to $531.4 million in the third quarter. CFO Bo Larsen said during the analyst call that the growth was driven by Titan’s acquisition of Pioneer Equipment along with same store sales growth of 3.5%. That was on top of a “very robust 46.4% same store sales increase in the prior year, and same store sales growth of 28% the year prior to that,” he adds.

Looking ahead, Larsen says Titan expects the ag segment to finish the year up 20-23%.

What’s the Next Step for Ag Spray Drone Tech?

The presence of spray and seeding drones in the ag equipment space is growing and so are their capabilities.

Some drones available in the North American market are capable of spraying over 50 acres an hour and flying for up to 10 minutes before needing to swap batteries.

Two hurdles the ag spray drone is currently facing, however, are the high price point and a complex user experience when it comes to mapping fields to avoid obstacles. This is according to Arthur Chen, founder of XAG drone distributor Pegasus Robotics.

Associate Editor Ben Thorpe caught up with Chen at this year’s Nebraska Ag Expo in the show’s Innovation Hub and discussed how some of the key advancements drone tech needs to see in the next 3-5 years is a lower cost and improved obstacle avoidance.

“I think the key advance is the obstacle avoidance, and also how simple the drone can be. So I want it to be cheap enough, maybe very dispensable. Just like cars, trucks. You have a working truck and it's not that expensive. You can easily find parts anywhere to fix it, and that's the most efficient way to own a truck for work. Another thing is, the process of mapping a field is still [not] very user-friendly. If the obstacle avoidance is very advanced, you don't need to map the field. The drone will pick up all the obstacles. It's just like Tesla, you drive on the road, you never say, ‘I created a map’ for Tesla.

“Then that saves a lot of headache and also gives you productivity, because you can just run the drone right away. It will figure out where to go, and you just say, ‘Spray this field,’ and it will do the work without crashing. But I think that part also has a cost associated with it, because there's technology you can put on the drone right now, like the LiDAR, radar or even the vision guided cameras. You can put a lot of stuff on there. Again, that'll be very expensive. Nobody is going to buy it. I think that's where, when the technology becomes cheaper, cheaper, cheaper, and then that makes sense to put on the drone for the real operation, because that's what’s most cost effective.”

You can read more about how dealerships are getting involved with ag spray drones in the upcoming January issue of Farm Equipment.

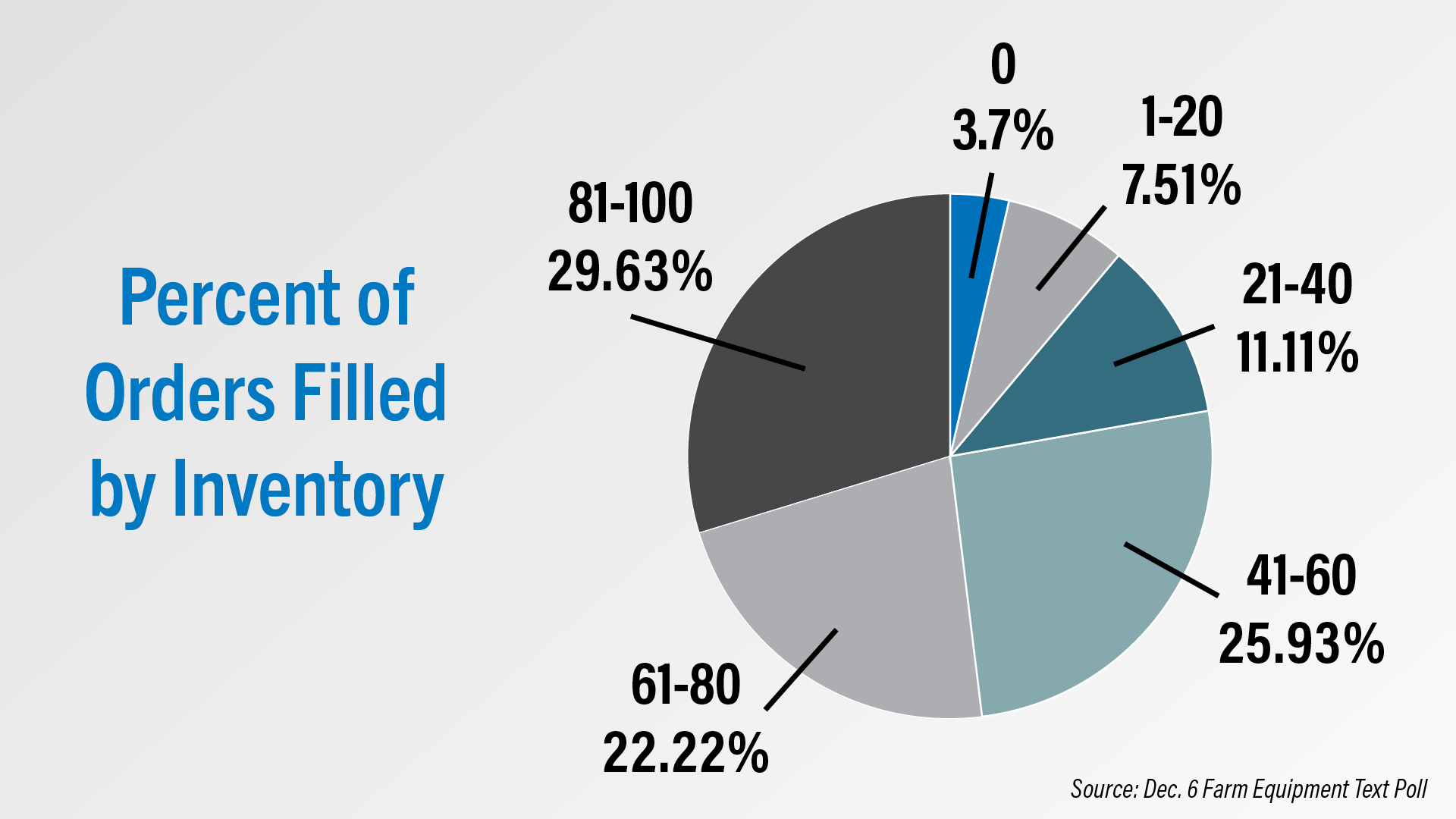

Inventory on Hand Largely Filling Retail Orders

According to the latest Dealer Sentiments Report, a net 22% of dealers say their new equipment inventory levels are too high. When it comes to used equipment, a net 4% of dealers say their inventory is too low.

A December 6 Farm Equipment text poll asked dealers what percentage of their retail orders they were currently able to fill out of their inventory. Consistent with the Dealer Sentiments results, the majority of dealers aren’t having any problems filling orders. Nearly 30% of responding dealers said they can fill 81-100% of orders. About 22% can fill 61-80% and nearly 26% are filling 41-60% of retail orders.

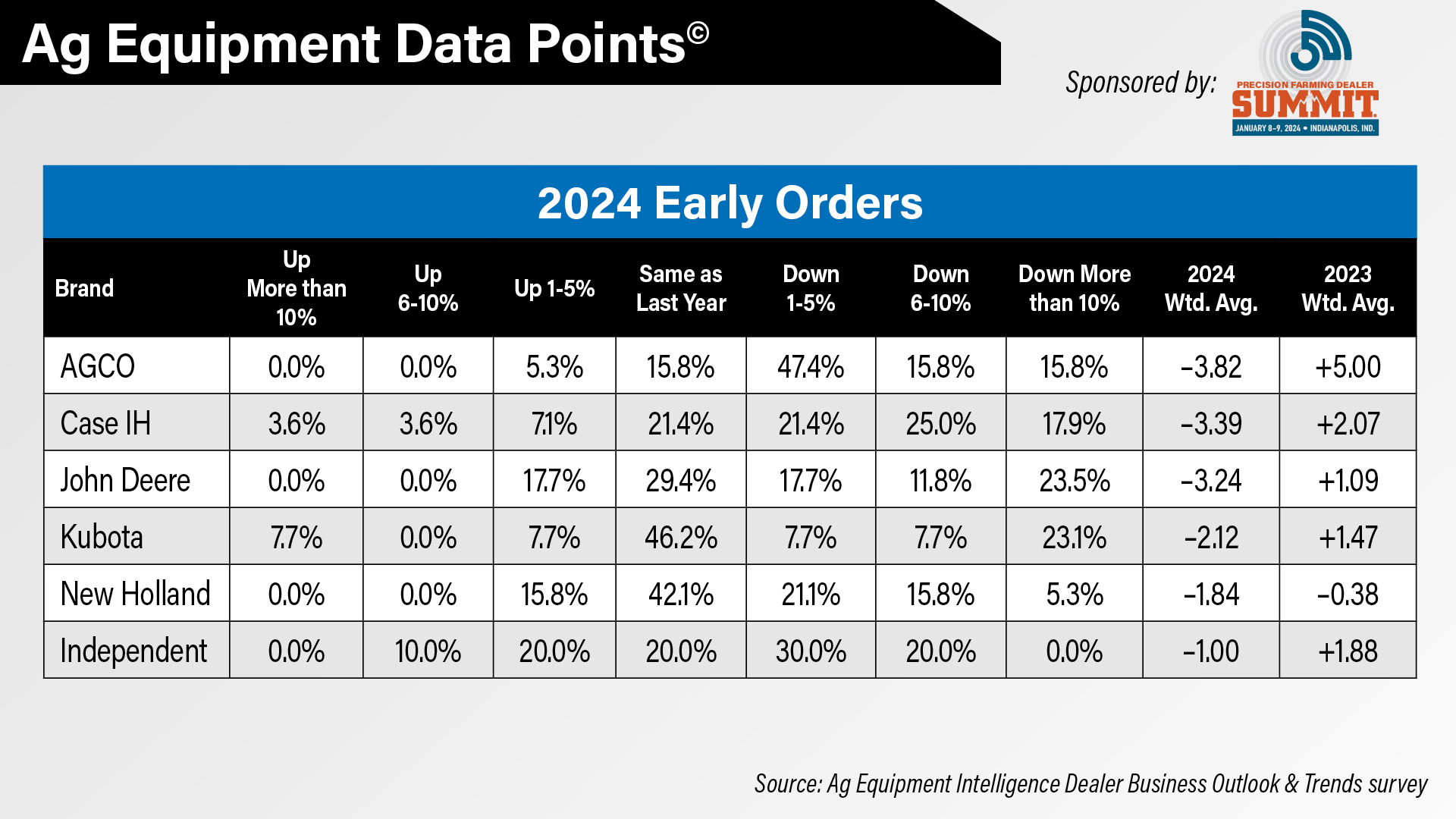

DataPoint: 2024 Early Orders

This week’s DataPoint is brought to you by the Precision Farming Dealer Summit.

According to the 2024 Dealer Business Outlook & Trends report, the weighted averages of all branded dealers’ early orders were down from the previous report and entered the negative range. Last year, only New Holland dealers had a negative early order weighted average.

Shortline dealers had the least negative results when it comes to early orders with a weighted average of –1.00 and 50% seeing a decline for 2024. No shortline dealers are forecasting an increase of over 10%, while only 10% said their early orders had risen 6-10%.

The dealers with the lowest weighted average for 2024 early orders were AGCO dealers at –3.82. Some 79% reported early order declines of 1% or more for 2024 and 15.8% reported declines over 10%.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.