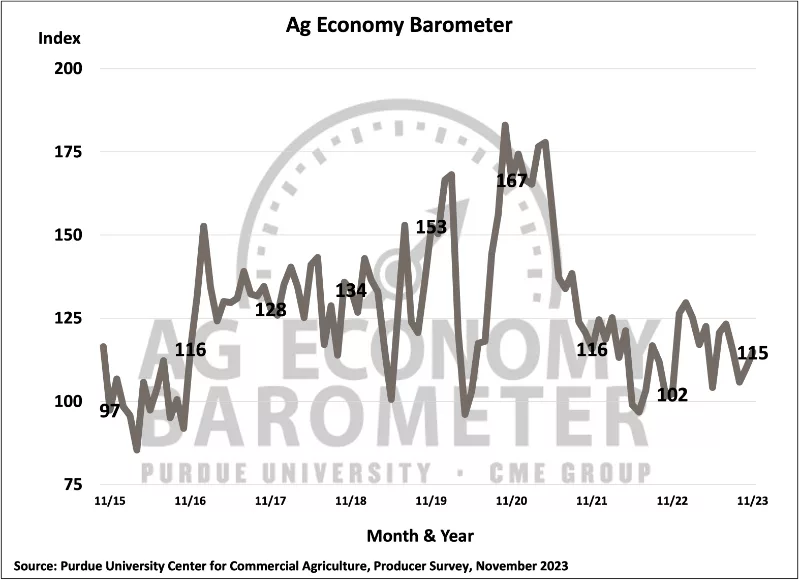

Agricultural producers’ sentiment increased for the second consecutive month, as the Purdue University/CME Group Ag Economy Barometer index rose 5 points to a reading of 115, a 12% increase compared to the previous year. The sentiment growth is largely attributed to farmers’ improved perceptions of their farms’ financial conditions and prospects. This month’s Ag Economy Barometer survey was conducted from November 13-17, 2023.

The Index of Current Conditions rose 12 points to 113 while the Index of Future Expectations improved by 2 points to 116. The Farm Financial Performance Index also rose in November to a reading of 95, which is up 3 points from October. The financial conditions index reached its low point back in the spring. The November reading was 25% higher than in May and 10% higher than at the start of fall harvest in September. Farmers’ expectations regarding financial performance improved this fall, with fewer producers expecting their farms' performance to be worse than a year ago.

The Farm Capital Investment Index has fluctuated throughout 2023 but rebounded this month to a reading of 42, up 7 points from October. Over the last several months, producers who view the investment climate as favorable were asked why they feel that way. The percentage of respondents choosing “strong cash flows” as a reason to invest has been drifting lower since summer when approximately 40% of respondents chose that as their primary reason. This month just 22% of respondents chose “strong cash flows,” with “higher dealer inventories” chosen by 29% of respondents, claiming the top spot as to why now is a good time to make large investments and implying a potential change in market conditions. The shift in responses suggests that farmers might be seeing a moderation in farm equipment price rises, making it a more favorable time for large investments.

In November, perspectives on farmland values changed little compared to October. The Short-Term Farmland Values Expectations Index maintained its position at 125, while the long-term index fell 5 points. Among respondents who expect farmland values to rise over the next five years, they overwhelmingly attribute their optimism to non-farm investor demand, followed by inflation.

Top concerns for the upcoming year include higher input costs (32%), rising interest rates (26%) and lower crop and/or livestock prices (20%). Notably, there has been a shift in concerns throughout the year, with fewer producers expressing worry over higher input costs compared to the beginning of the year. Instead, more producers are now concerned about rising interest rates and lower crop and livestock prices.

This month’s survey was conducted the same week that Congress voted to extend the 2018 Farm Bill’s provisions to September 30, 2024. Anticipating the extension by Congress, the November survey gauged the preferences of corn and soybean producers regarding farm safety net programs for 2024. Among respondents who expressed a program preference, just over two-thirds of them chose the ARC farm program, while nearly one-third leaned towards enrolling in the PLC program, assuming an extension of the current Farm Bill’s provisions. Despite preferences emerging, uncertainty still prevails, particularly for soybean (52% declining to choose a program for 2024) and corn (43% declining to choose a program for 2024) producers when deciding to choose between programs.

Related Content

Farmer Sentiment Rises, Interest Rates Remain Top Investment Concern

Putting Upcoming Economic Concerns into Perspective

16 Ag Equipment Manufacturers Reveal Concerns & Optimism for 2024