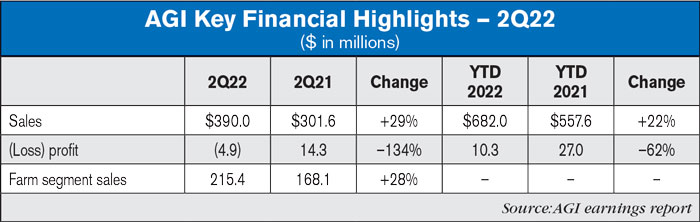

AGI report record sales and Adjusted EBITDA in its second quarter 2022 earnings, which increased 29% and 43% year-over-year for the three-months ended June 30, 2022, respectively. Record results were supported by strength across nearly all segments and geographies as the company expanded margins despite supply chain issues, regional disruption in Europe, Middle East and Africa and continued cost inflation pressure.

Farm segment sales and Adjusted EBITDA increased 28% and 23%, respectively, in Q2 with strong results from Canada, U.S., Asia Pacific, and South America. Commercial segment sales and Adjusted EBITDA increased 31% and 102% respectively, in Q2 with a significant growth in Canadian sales and continued growth in the U.S. and Asia Pacific markets. The momentum in Brazil continued with sales and Adjusted EBITDA growing 80% and 105%, respectively, in Q2 and India also experienced significant growth in sales and Adjusted EBITDA, growing 38% and 56%, respectively, in Q2.

With strong order intake, Digital segment sales increased 31% in Q2, despite continued industry-wide component shortages of critical chips required for production which impacted the company's ability to meet customer demand. Order intake was very strong and outpaced AGI's ability to manufacture due to the component shortages.

“Our strong results and momentum continued in the second quarter with another record result,” noted Tim Close, president & CEO of AGI. “Broad-based strength across our segments and geographies continues to achieve significant growth along with expanding margins. Solid demand across regions and platforms combined with our global strategy to have full systems capabilities in each region continue to deliver strong visibility for continued growth. Our record results year to date combined with this increased visibility going into the second half of the year provides confidence in raising our full-year guidance for Adjusted EBITDA to at least $215 million."

Farm Segment

Farm segment sales and Adjusted EBITDA increased 28% and 23%, respectively, in Q2 with strong results from Canada, U.S., Asia Pacific, and South America. The demand for portable farm equipment continues to be very robust as this equipment is critical to ensuring smooth farm operations. High crop demand and prices have resulted in robust crop sales resulting in lower overall storage levels on the farm ahead of the upcoming North American harvest which has consequently led to lower grain bin demand. However, this impact is expected to be temporary as the combination of high crop prices and strong crop volumes drive renewed pressure to install and expand farm storage, supporting both maintenance spend to ensure ongoing functionality and incremental investment in storage and handling equipment to accommodate an expanding overall crop size. The segment backlogs remains strong, and looking ahead, the company says it anticipates the strong results in the Farm Segment from the first half (“H1”) of 2022 will continue into the second half (“H2”) of 2022.

Canada

Sales increased 11% while backlogs decreased 6% in Q2 as many parts of Western Canada continue to recover from the extreme drought conditions in 2021 that impacted the demand for storage and handling equipment. AGI says it anticipated this impact to the Canadian Farm segment in H1 2022 but noted signs of a rebound towards the end of Q2 2022. Management expects that the Canadian Farm segment will continue to rebound in H2 2022 as dealers begin to move their inventory in the upcoming months.

United States

Sales increased 25% in Q2 as brisk demand for portable equipment continued across many growing regions. Demand for portable equipment remains strong with many dealers continuing to report low inventory levels. The company's strategy to expand its U.S. dealer base has helped build demand for AGI products within a key sales channel for the segment. Together, these factors have resulted in a 42% increase in U.S. Farm backlog as compared to June 30, 2021. AGI continues to expect strong results from the U.S. Farm segment in H2 2022.

International

Farm segment sales increased 127% in Q2, with significant growth in permanent handling equipment in South America and Asia Pacific, supported by favorable macroeconomic conditions. Specifically, Brazil’s sales increased 238% in Q2 as strong demand for permanent handling equipment and systems continues in step with expanding crop volume. The results in EMEA have been impacted by the sudden halt to projects affected by the Russia-Ukraine conflict. However, the company has been able to redirect our efforts in other regions thus limiting the disruption on AGI operations and results. Our ability to temporarily pivot away from this region without significantly impacting our overall results highlights the benefit of our diversified growth strategy. With robust quoting pipelines, the company anticipates strong results from the various international regions in H2 2022.