Fourth Quarter 2020 Highlights

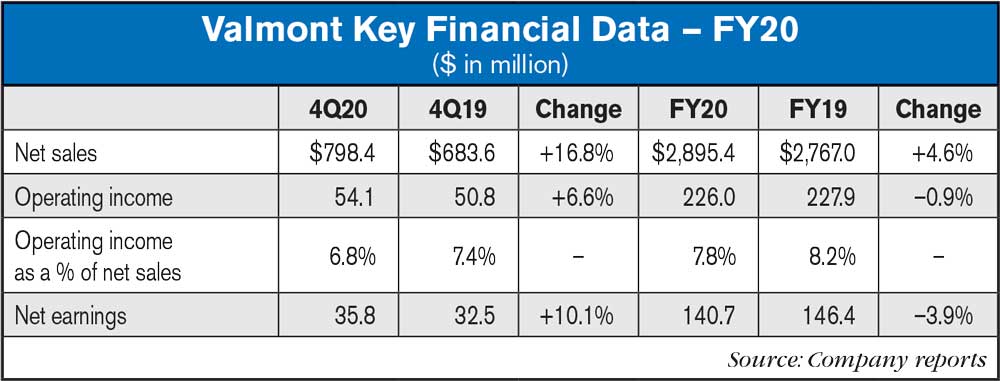

- Net sales of $798.4 million increased 16.8% led primarily by significantly higher sales in Irrigation and Utility Support Structures

- Operating Income of $54.1 million, or 6.8% of sales ($68.8 million or 8.6% of sales adjusted) compared to $50.8 million or 7.4% of sales last year

- Record year-end backlog of more than $1.1 billion, reflecting strong market demand

- Commenced shipments for the recently-awarded, multi-year $240 million supply agreement to provide irrigation products and services for the Egypt market

- Completed the acquisition of the remaining 40% stake of Torrent Engineering and Equipment in the Irrigation segment

Full Year 2020 Highlights

- Net sales of $2.9 billion increased 4.6%

- Significantly higher sales in the Utility Support Structures and Irrigation segments were partially offset by lower sales in the Engineered Support Structures and Coatings segments due to COVID-19 impacts; excluding $22.2 million of unfavorable currency impacts, sales grew 5.4%

- Operating Income of $226 million, or 7.8% of sales ($268.5 million or 9.3% of sales adjusted) compared to $227.9 million or 8.2% of sales last year; profitability was similar to last year on a GAAP basis, and increased $40.6 million, or 17.8% on an adjusted basis

- Profitability improvement was led by higher volumes in Utility Support Structures and Irrigation, and favorable pricing in Engineered Support Structures

- Operational performance improved in all segments except Coatings, where end-market demand was negatively impacted by COVID-19

- Generated strong operating cash flow of $316.3 million, driven by higher receipts of customer advance payments and other working capital management initiatives; strong liquidity led to a reinstatement of share repurchases in September, with year-end 2020 cash and cash equivalents of $400.7 million

- Capital expenditures were $107 million, including $42 million for strategic investments, which included capacity expansions in existing North American operations, a greenfield expansion in Pittsburgh, PA in the Coatings segment and technology investments to support global market growth

- Deployed $75.3 million of cash for strategic acquisitions, including $15.9 million inclusive of two acquisitions in the Irrigation segment: Solbras and PrecisionKing, and $59.4 million for the remaining stakes in AgSense and Torrent Engineering and Equipment

- Advanced ESG to be a top strategic imperative, including formation of a CEO-led ESG Taskforce, elevating our tagline of 'Conserving Resources. Improving Life®.'

Irrigation Segment

Global sales of $199.3 million increased 49.8% year-over-year, due to higher volumes across all markets, particularly in the Middle East, partially offset by $6.3 million of unfavorable currency impacts primarily from the depreciation of the Brazilian Real.

North American sales of $97.1 million increased 14.8% compared to 2019, due to higher volumes across all irrigation product lines, and higher industrial tubing sales.

International sales of $102.2 million more than doubled year-over-year and increased more than 120.0% in local currencies. Sales growth was led by initial deliveries of the large multi-year Egypt project, higher volumes in South American and European markets, including continued strong demand in Brazil, and sales from recent acquisitions.

Operating Income was $22.3 million, or 11.2% of sales ($25.3 million adjusted or 12.7% of sales), compared to $11.8 million, or 8.9% of sales in 2019. Profitability growth was driven by higher volumes and improved operational efficiency, partially offset by higher SG&A expense, including $1.4 million of incremental R&D expense for technology growth investments.

1Q 2021 Financial Outlook

- 1Q Net Sales estimated to be $740-$765 million, an increase of 10-13% vs. prior year

- 1Q Operating Profit Margin estimated to be 9-10%

- 1Q Irrigation segment sales estimated to be $235-$245.million, an increase of 50-56% vs. prior year

Full Year 2021 Financial Outlook and Key Assumptions

- Net Sales estimated to increase 9-14% vs. prior year

- Favorable foreign currency translation impact of approximately 2% of Net Sales

- Irrigation segment sales estimated to significantly increase 27-30% vs. prior year

- Capital expenditures to be in the range of $110-$120 million to support strategic growth initiatives and Industry 4.0 advanced manufacturing initiatives

- No closures of large manufacturing facilities, workforce disruptions, or significant supply chain interruptions due to COVID-19