Titan International (TWI), manufacturer of off-highway tires and wheels, posted third quarter 2019 net sales of $345.9 million, a decrease of $38.8 million, or 10% vs. the third quarter of 2018, ended Sept. 30. On a constant currency basis, net sales would have been $351.6 million.

Net sales for the first 9 months of 2019 were $1,146.9 million, compared to net sales of $1,239, or million for the first 9 months of 2018, representing a $92.1 million, or 7.4%, decrease. On a constant currency basis, net sales would have been $1,194.4 million.

“Our third quarter results reflect the continued softening in our business across all regions and segments with net sales declining approximately 10%,” said Paul Reitz, president and chief executive officer. "Conditions in North America Ag have not improved from the difficult planting season and uncertainty abounds from a global economic perspective. These factors have added to weakening demand beyond North American Ag and into the global construction market, which led to OEMs producing below retail demand levels during the quarter, which had a significant effect on our performance.

“Despite ongoing actions to react to these continually evolving conditions, our demand visibility remains extremely limited. In addition, we continued to experience underperformance in our North American Wheel operation from reductions of inventory at higher than current prevailing prices of steel, which compressed gross profit by approximately $7 million during the quarter,” said Reitz.

“Over 10 years ago, we experienced similar issues in the North America Wheel steel procurement process that cost the Company millions of dollars in excess costs. Corrective actions were put in place with the belief that the situation was rectified, but a similar problem arose again in 2019. We are taking strong actions to drive necessary changes in the North America wheel procurement and operations management personnel and the related processes to ensure these types of anomalies are completely eliminated going forward.”

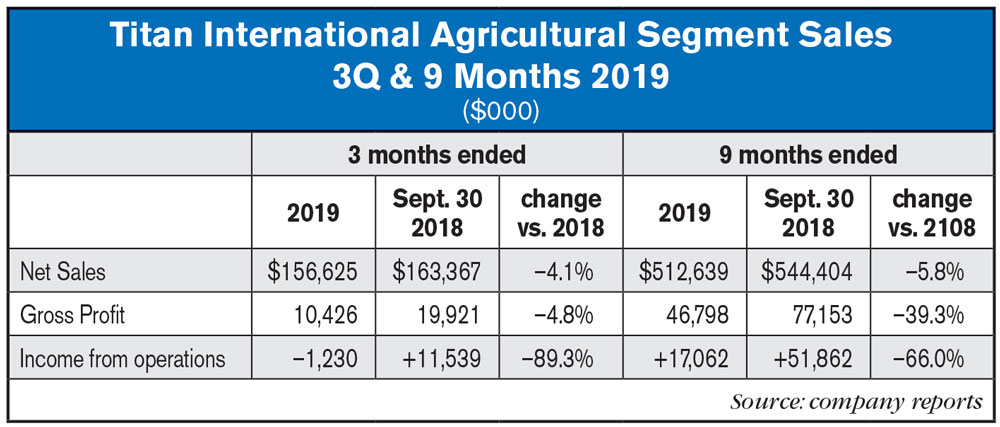

According to TWI management, during the quarter, lower sales volume contributed 0.6% of the decrease in agricultural net sales, while unfavorable currency translation, primarily in Latin America and Europe, decreased net sales by 1.1%. Unfavorable price/mix further decreased net sales by 2.4%, primarily reflecting price adjustments related to lower raw material costs. Lower sales volumes were primarily caused by challenging market conditions and economic softness in most geographies as well as ongoing global trade issues, which continue to cause significant uncertainty for customers.

The company said, during the 9 months ended Sept. 30, 2019, lower sales volumes contributed 3.3% of this decrease while unfavorable currency translation in all international locations further decreased net sales by 3.6%. Favorable price/mix partially offset these decreases with a 1.1% positive impact on net sales. Lower sales volumes were primarily a result of the difficult market conditions due to global trade issues, a volatile agriculture economy and adverse weather conditions in North America during the majority of the first nine months of 2019. Lower sales volume, unfavorable foreign currency translation and production inefficiencies drove the overall decrease in gross profit. In addition, we experienced underperformance in our North American Wheel operations from reductions of steel inventory at higher than current prices, which compressed gross profit by approximately $12 million during the period.