CALGARY — March 14, 2018 — Rocky Mountain Dealerships Inc., Canada's largest agriculture equipment dealer, reported its financial results for the quarter and year ended December 31, 2017. All financial figures are expressed in Canadian dollars.

“Strong margins and lower costs allowed us to deliver another strong quarter to close out 2017, despite a year-over-year decrease in used equipment sales,” said Garrett Ganden, president and chief executive officer. “As expected, our inventory levels went through their seasonal expansion in the fourth quarter and we remain satisfied with the composition and size of our inventory profile. Our confidence in the Canadian agriculture equipment market continues to grow and we remain focused on customer service and financial performance in our market.”

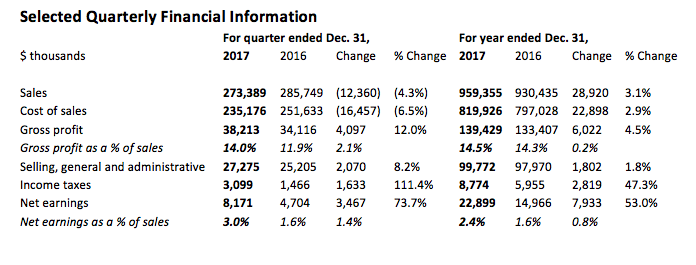

Summary of the Quarter Ended December 31, 2017

Sales and Margins

- Total sales decreased 4.3% or $12.4 million to $273.4 million compared with $285.7 million for the same period in 2016 due to an $18.5 million decrease in used equipment sales year-over-year offset by an increase in new equipment, parts, and service revenues. Used equipment sales in the fourth quarter of 2016 were higher than usual as a result of lingering harvest activity and our concerted effort to downsize our used equipment inventory levels.

- Fourth quarter gross profit increased by 12% or $4.1 million to $38.2 million compared with $34.1 million for the same period in 2016, due to increased profit margins as explained below.

- Gross profit as a percent of sales increased to 14% for the fourth quarter of 2017 compared with 11.9% during the same period of 2016 due to higher transactional margins on equipment sales.

Balance Sheet and Inventory

We continue to focus our attention on maximizing the return on assets deployed, namely inventory. Through targeted sales efforts as well as disciplined procurement, including factory-direct orders, we strive to maintain an inventory balance and profile which is conducive to continued improvement in inventory turns. As anticipated, RME’s inventory increased during the fourth quarter of 2017, due to a combination of trades taken on fourth quarter new equipment deliveries and restocking in preparation for the coming sales season.

Since the third quarter of 2017:

- Used equipment inventory increased $54.5 million, due in part to late model trade-ins (1-2 years old) associated with recent new equipment sales. Trade value is typically correlated to age, with later-model equipment incorporating newer technology, having fewer hours and a higher market price relative to the profile of units sold out of inventory during the period. Used equipment inventory growth was distributed across equipment categories and is in line with our overall inventory plan; and

- New equipment inventory increased $9.5 million in preparation for future sales.

Inventory turned 1.80 times during 2017, up from 1.64 times last year, a 9.8% improvement year-over-year.

Market Fundamentals and Outlook

Supply

In recent years, the number of new agriculture units delivered to Canadian farmers trailed historical levels as the market digested an elevated equipment population as well as price increases associated with new technology and a depreciating Canadian dollar.

In response, agriculture equipment manufacturers curtailed production and focused on moving existing inventory levels through the supply chain by providing price relief to farmers. After having absorbed this supply, demand for new equipment remained relatively satiated for a period of time where new unit deliveries declined.

In recent quarters, we have begun to see signs that Western Canada’s agriculture equipment profile is reverting to a more typical composition, with customer demand for new equipment beginning to pick up. With supply and demand now largely realigned, we have also begun to see manufacturer delivery lead-times grow on certain products during peak demand times.

Post a comment

Report Abusive Comment