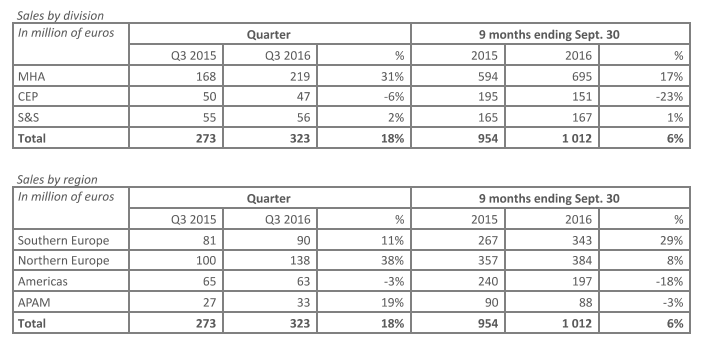

- Sales in Q3 2016 of €323 million, + 18% vs. Q3 2015, +21% at constant exchange rate

- Cumulative 9 month sales of €1012 million, a + 6% increase vs. to the 9 month period in 2015, +8% at constant exchange rate

- Order intake for equipment in Q3 of €206 million, vs. €189 million in Q3 2015

- Order backlog at the end of Q3 of €244 million, vs. €253 million in Q3 2015

ANCENIS, France — Michel Denis, president and chief executive officer stated: "The Group recorded strong growth in the third quarter with very contrasting market dynamics. Growth is particularly steady in Europe notably in the construction sector due to the increased penetration of Manitou forklift trucks and aerial work platforms in a strong market. In the agricultural sector, the regulatory end to the commercialization of machines equipped with Euro 3B engines at the end of September this year increased the demand for these products in September but does not reflect the sector's underlying trend which remains depressed. In North America, markets are still weak and under competitive pressure.

These market dynamics should last until the end of the year and this good quarter permits us thus to confirm and consolidate our outlook for the current financial year."

Business Review by Division

With third quarter sales of €219 million, the Material Handling & Access Division - (MHA) reported growth of +31% compared to Q3 2015 and +17% over the first 9 months of the year (+19% at constant exchange rate). Demand in the construction sector was strong especially in Northern Europe. In the agricultural sector, the regulatory end to the commercialization of machines equipped with Euro 3B engines in Europe created a one-time acceleration in business activity of approximately €15m but its effects over the year as a whole will be neutral. Lastly, the industrial range continues to grow significantly.

The Compact Equipment Products Division - (CEP) reported sales of €47 million, -6% compared to Q3 2015 and -23% over the 9 month period (-22% at constant exchange rate). In North America, the division is continuing to suffer from weak demand and increased competitive pressure in the construction and agricultural sectors. Furthermore, business competitiveness outside the United States is continuing to suffer from the impact of foreign currencies.

With sales of €56 million, the Services & Solutions Division - (S&S) reported a 4% increase compared to Q3 2015 at constant exchange rate. The division is continuing to develop and structure new offers of services and tools. The result of this work is the steady increase in its sales.

Post a comment

Report Abusive Comment