Titan International has reported results for the first quarter ended March 31, 2021.

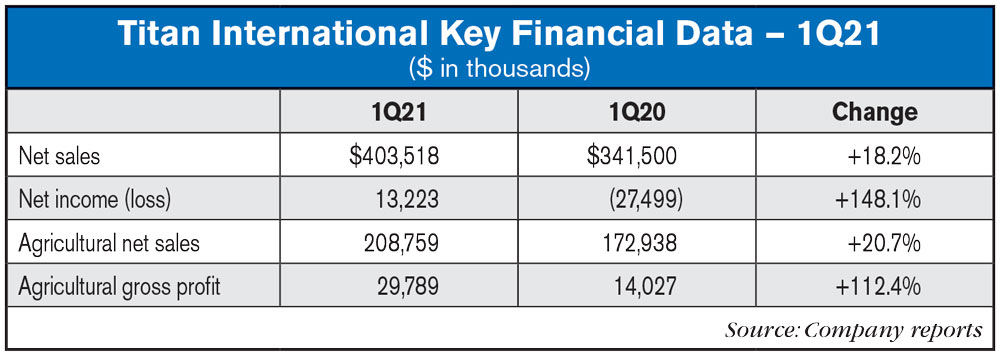

Net sales for the first quarter of 2021 were $403.5 million, compared to net sales of $341.5 million for the first quarter of 2020, representing a $62 million, or 18.2%, increase. On a constant currency basis, net sales for the first quarter 2021 would have been $409.3 million.

"The positive momentum we highlighted during our most recent earnings release in March has continued and has increased further over the past couple of months," stated Paul Reitz, president and Chief Executive Officer. "The first quarter of 2021 was our strongest quarter since the first half of 2018 with net sales over $403 million and adjusted EBITDA above $26 million. These results are on the high side of our Q1 outlook. The strong recovery we began to see in our global Ag markets in the fourth quarter has now accelerated and includes additional demand within our earthmoving and construction (EMC) businesses beyond our initial expectation at this point in the year. During the first quarter of 2021, Ag and EMC experienced volume increases over 15% and 19% respectively. These market dynamics, as well as our continued cost discipline emphasized over the last year, led to a gross margin percentage of 13.2% representing a 450 basis point improvement from last year's first quarter.

"Based on a number of positive factors in the Agricultural sector, including higher crop prices, low inventory levels for new and used equipment, strong farmer income, and the age of existing equipment, we believe that the current market trends experienced in Q1 will continue, and in some cases even improve throughout 2021 into 2022.

"Many companies around the world are facing supply chain and logistics shortages, but we are managing well to this point, due to well-coordinated supply chain management that requires continuous attention and action. At the same time, we have been and will continue to take, appropriate pricing actions to cover the rising costs of raw materials, labor and logistics. The second quarter will likely be much of the same, with volatility, but we are up to the task of managing through the opportunities and the challenges in front of us. Due to this volatility, it is prudent to hold back on providing specific guidance for the remainder of the year, and we will address this as we progress through the year.

Morry Taylor, Chairman of the Board, commented, "At our last Board meeting, we discussed the long history of Titan's Tire and Wheel business, specifically in the Agriculture sector, and it was suggested that I provide a refresher on that to our shareholders. We also discussed the positive trends we are seeing in the marketplace. I have been involved in this business since 1973, and have seen a fair number of business cycles. Nobody knows for certain what is going to happen with this cycle, but I am going to share some thoughts on what could be important for Titan going forward.

- In October 2020, major global OEMs were forecasting 5% Ag growth for 2021 – today their forecasts are much higher and likely will go higher as their order books are full and beyond their production levels

- The price of soybeans and corn had a strong surge at the end of 2020 and has kept on climbing in 2021

- OEMs and their dealers significantly reduced inventories for large tractors and combines over the past couple years and now it is time to rebuild those channels. However, with demand levels rising so rapidly, new equipment is hard to find in 2021 and it could take as much as 2-3 years to catch up on certain equipment.

- OEMs are trying hard to build more equipment to meet market demand, but the supply base for steel and many other components used in their equipment is a current problem.

- Large farmers started buying tractors, combines and sprayers near the end of the year to get tax depreciation benefits, while smaller farmers continued to buy both new and used equipment. The result is pricing on new equipment at some OEMs went up in Q4 – big time, over 8% in some cases.

- Delivery dates of new equipment are being delayed for many months with some situations seeing deliveries a year out. As a result, farmers are needing to replace tires on tractors and combines as equipment ages.

- South America is booming in Ag and is sold out for 2021. Farmers are going to larger equipment and that means larger tires/wheels – Titan's real strength!

Morry Taylor continued, "As you can see, there are good reasons to believe that Titan's business for 2021 looks strong. Titan has the productive capacity to satisfy the needs of our customers during this crazy market.

Results of Operations

Net sales for the first quarter ended March 31, 2021, were $403.5 million, compared to $341.5 million in the comparable quarter of 2020, an increase of 18.2% driven by sales increases in the agricultural and earthmoving/construction segments. Overall net sales volume and product price and mix was up 15.1% and 4.8%, respectively, from the comparable prior year quarter, due to increases in demand in both the agricultural and earthmoving/construction segments. Pricing increases have been occurring due to the rise in raw material and other inflationary costs in the markets, including freight. The contributing factors to the increase in demand were increased commodity prices, lower equipment inventory levels and pent up demand following the economic impacts of the COVID-19 pandemic during 2020. In Europe we experienced over $14 million in reduced sales during the first quarter of 2020 directly as a result of plant closures in Italy and China due to the COVID-19 pandemic, which did not repeat during the first quarter of 2021. The increase in net sales was partially offset by unfavorable foreign currency translation, which negatively impacted net sales by 1.7 percent or $5.7 million.

Gross profit for the first quarter ended March 31, 2021 was $53.3 million, compared to $27.2 million in the comparable prior year period. Gross margin was 13.2 percent of net sales for the quarter, compared to 8.0 percent of net sales in the comparable prior year period. The increase in gross profit and margin was driven by the impact of increases in sales volume as described previously and overhead cost reduction initiatives executed across global production facilities following the COVID-19 pandemic.