Tom Owen and Nick Mast opened the Dealership Minds Summit with a 90-minute workshop on “Strategies for Capital Access & Transitional Wealth Management in Equipment Dealerships.”

The pair, who has decades of experience in both OEM and dealer operations (most recently with CNH), formed ChannelMASTERS in 2014 to advise the capital goods equipment industry in strategic concepts. In their interactive workshop presentation, the pair covered a wide range of topics related to the succession planning picture, including valuation considerations and methodologies, sources of capital, benchmarks and strategic planning fundamentals.

In addition to these topics, dealers in attendance found the guidance on the capital expenditures portion — and its impact on the enterprise’s value — to be of paramount interest.

Dealership Valuations

Valuations are necessary ongoing activities to a business, whether buying or selling, or just being prepared to approach a lender for a rainy day. And if you don’t take control over the valuation now, say Owen and Mast, someone else will.

“The valuation process should start now,” says Mast. “You want to minimize disruption in your business. At minimum, it will communicate on a consistent basis how things are supposed to be transitioned and could impact future strategies, such as selling or transitioning to an heir.”

And even if the transition date for the plan is decades away, it’s not too early to start. For example, they shared a client outside of the U.S. who is planning its entrance for 10 years from now.

Technology Gives ‘Snapshot’

Into Attendees’ Planning

ChannelMASTERS debuted audience response technology at the Dealership Minds Summit to gain real-time answers to 12 individual polls during their workshop presentation.

Below are a few nuggets about the dealers in attendance, which were presented back to the audience (confidentially) in real-time during the presentation.

- 10% would avoid disruption in leadership, finances and operations if a surprise event were to occur

- 45% have a binding agreement in place on valuation, liquidity and control among all stakeholders

- 62% completed a professional valuation within the last 5 years

- 51% carefully planned and forecast their investments made in capital expenditures

- 21% plan capital expenditures as a percent of revenues/profit

- 80% have a succession plan; 51% review and update it annually

- 44% of facilities are owned through a real estate investment trust

- 44% renovated or rebuilt new facilities within the last 5 years

You can obtain the raw and graphed data in a 4-page document via download at: www.farm-equipment.com/2015-CapEx-Dealer-Review-free-ebook

By planning, you can do the things today that will achieve yield results now and increase your business’ value over the longer term, says Owen. Getting a professional valuation supported by audited financials is necessary, and it needs to be done with regularity as the business has changed.

“There can be surprises when you do the professional valuation,” Owen says. “And with the changing of the guard, the time to put this on the table is right now.” Taking an honest look at inventories, write-downs and the processes that brought those inventories on is also a timely exercise, he says.

Intergrated Valuation Methodology

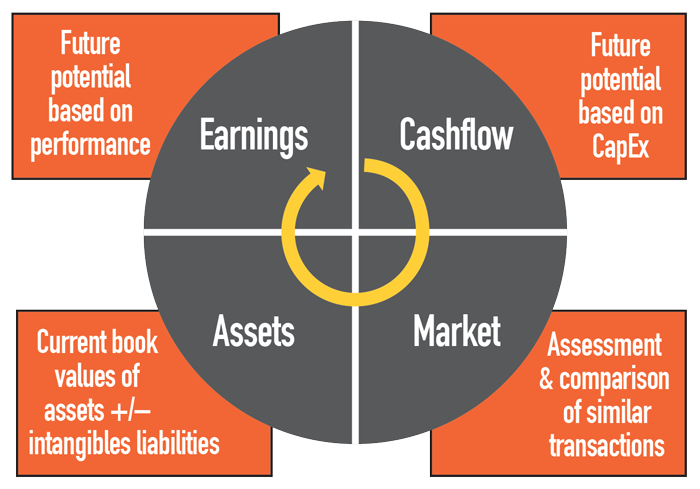

An integrated methodology works best for determining a dealership’s value, considering the four elements of earnings, cashflow, market and assets, with consideration of the intangibles of the business.

Reality Impacts Valuations

Beyond the finances, how the business is perceived by a disinterested third party is how the value of the business is perceived.

Mast says that a technical valuation provides a purely financial look at revenue, profitability and EBITDA, but sound valuations also consider qualitative aspects such as the historical performance and the broader environment. “Less tangible but certainly as important is how leadership is developed and retained,” he says.

Also coming into view are the dealership’s policies and procedures, and how they’ve been communicated throughout the organization. One institutional investor looking to acquire a dealer platform demanded to see the dealer’s policies and procedures. Why? “Because that signals a consistent approach to the business operations and the market,” says Mast.

He adds that beyond the earnings and cashflows, “you argue value in the future based on the amount of investment you’ve made into the business — historically, currently and what you’re projecting.”

Driving Value

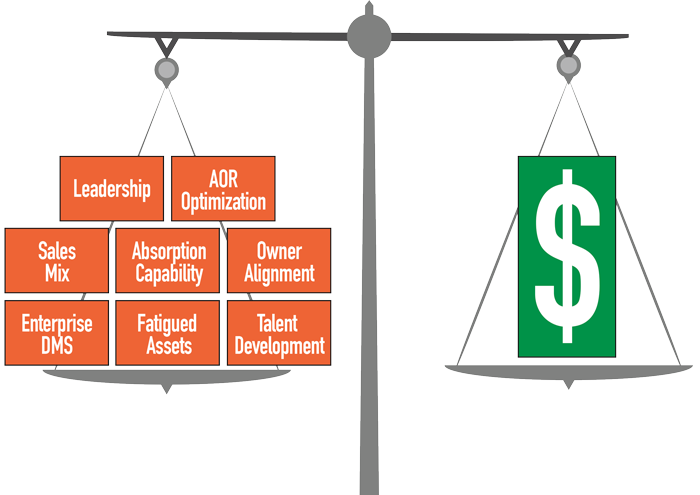

The pair uses the word “optimization” frequently, applying it to profitability, liquidity and equity. “If you’re optimized in your enterprise, you’ll get more for your assets,” says Owen. “You’ll have an easier time transferring them without burdening the new owners or the heirs coming into business.”

The pair reiterated through their presentation that “capital expenditures really do drive value.”

In discussing the art of the valuation process, Owen says, “At the end of the day, what you’ve put into the business is what someone else is willing to say that it’s worth. It’s going to be a combination of what people believe and perceive has been your investment over time.”

Mast maintains that a business will be sustainable if it’s well positioned. “Obviously that has an impact on the performance of the overall financials,” he says. “A focus on investment creates better leaders, and better leaders allow for organizational solidity and retention.” Investment, he says, certainly delivers dealers a benefit that they wouldn’t otherwise see if they didn’t make it.

Investment and leadership development work in tandem, says Owen. “You’ve got to look beyond just the farm equipment business — other industries want your best employees, too. The real talent wants to work for the best.”

So planned capital investments naturally drive a higher valuation. “That’s a given,” he says. The challenge is doing it in a way that it doesn’t burden the next generation. He and Mast discussed how to pull capital out of the business to get the next generation in as operators and also attain the wealth for those dealers passing the baton.

Mast says capital investment should be viewed the same way as competitive positioning, and to make some degree of plans now, regardless of ultimate timeframes, resources and objectives.

A key part of the process, he says, is benchmarking your finances and operations, and then assessing the enterprise-wide performance of those components that constitute a good dealer operation. “You can have a very good functioning sales and profitability, yet still discover a gap in your organizational structure, your communication or your IT reporting. These things are obstacles holding you back from best practices.”

When moving their operations from “the small circles” (original locations that often were in low-traffic areas and once had smaller areas to serve) to the larger “optimized locations” along high-traffic areas, dealers gain a larger customer base and more aftermarket business. ChannelMASTERS cites a benchmark of 1,000 square feet of facility for every $1 million in revenue.

In addition to explaining common internal and external sources of capital, Mast stressed the importance of tracking and measuring results from capital expenditures. ROI is almost always a factor in facilities planning, and he urges similar approaches to all types of capital expenditures. “The time period and the assumptions you use to generate a decision for a go/no go on an investment is fraught with risks, but needs to be supportable by good assumptions.”

Optimizing Your Footprint

Clearly, the presenters believe in the power of the physical facility when it comes to resource decisions. “Many of you already know I like buildings,” Owen says. “They’re productive and generate more profit — that’s a fact.”

Owen and Mast showed a slide (see p. 26) they use with dealers to explain “footprint optimization,” a concept that Owen began demonstrating by tracing coffee cups around dealers’ locations on a road map in the early 1980s. “We show 10-15 mile circles around older dealerships, which often had smaller original coverage areas,” says Owen. Often, these circles involve fatigued buildings and a market or customer base that has changed significantly from where that dealer originally set up shop.

Tom Owen, ChannelMASTERS

In examining the dealer sites in this way, he and Mast discuss where brick-and-mortar would be put in today’s climate to optimize the business. “If you want to move from the old shop into a more optimized location that has a larger coverage area, a high traffic thoroughfare helps your aftermarket business,” says Owen. “And that’s what the investment in infrastructure is all about.

“That helps change the sales mix away from just wholegoods and starts building that necessary parts and service revenue to give you that really good gross margin.” That’s what happens when a dealer moves from that small circle location to the big circles where location, facilities and employees are at their best. A good benchmark for facility size today, he says, is 1,000 square feet of facility for every $1 million in top-line revenue.

Dealers with older facilities have too high a dependency on wholegoods, something the market permitted over the past several years — before the recent slowdown. “We’ve seen dealers get caught in the trap with income statements that are 90%-plus dependent on wholegoods, with little attention to gross margin,” Owen says.

Nick Mast, ChannelMASTERS

Mast adds, “One of the mantras is to extract the greatest amount of gross margin of profitability. Aftermarket operations have better margin and return than selling equipment.”

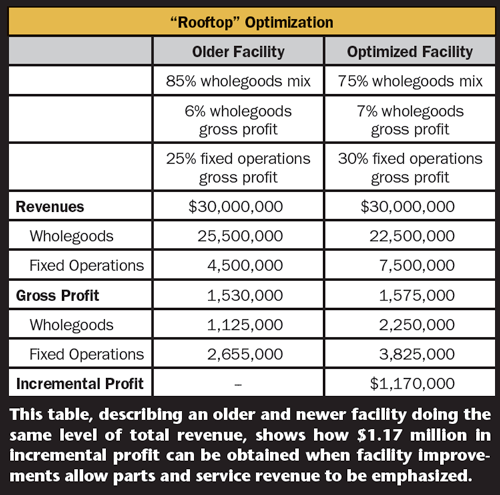

Owen explains the opportunity through a model he describes as a “rooftop optimization” (see left). He illustrated a dealer with an older facility that has an 85% wholegoods mix, a 6% gross profit and a 25% fixed operations (aftermarket) gross profit.

“In optimized facilities,” he says, “the mixes tend to change.” The model shows the sales model of an optimized facility with 75% wholegoods/25% aftermarket, 7% wholegoods gross profit and a 30% fixed operations gross profit. “Thus, the optimization of the facilities in this example adds $1.17 million of incremental profit.”

These are numbers he and Mast have seen dealers commonly achieve with just one rooftop. He adds that an investor can build this type of building for the next generation and structure a 15-year buyback.

“If you improve your sales mix by building your absorption business, and you have a facility that can increase productive margins on parts and service, you’ll achieve retained earnings that allow you to pay for it. Competitively differentiated facilities strengthen the business — and your valuation. In 3 years, if you’re looking at trying to transition the business, the new digs will give you the valuation you need.”

They cited another example of a dealer who recently doubled its size (to 45,000 square feet) with the construction of a new facility on a four-lane highway. With bigger machinery, and equipment needed to service the machinery, the dealership needed more capacity to serve farmers. The new dealership now has 32-foot high vaulted ceilings with overhead cranes for increased efficiency and safety.

And now employing 40 people, the operation went from $600,000 to $1 million per employee.

Owen and Mast stress that it’s not just about buildings; it’s also the infrastructure investment’s impact on culture and support in things like CRM, the best rolling stock to sell more parts and a showroom that enhances the customer’s experience.

“If you don’t have a decent retail environment, you’re just not going to get where you need to be,” says Owen. He advises a gap assessment across all categories of the business followed by an action-plan that addresses the low-hanging fruit that increases performance, bottom line and in turn the valuation.

Web Only Exclusives

View the following exclusives from the workshop presentation: