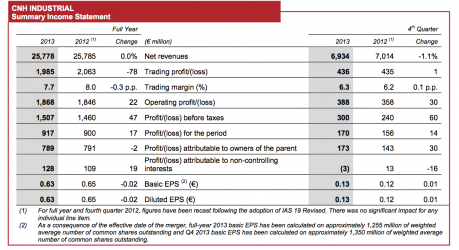

- Net revenues totaled €25.8 billion ($35 billion), in line with 2012; on a constant currency basis revenues increased 4.3%.

- Trading profit for the year was €1,985 million ($2,692 million), with trading margin of 7.7%. On a constant currency basis, trading profit was in line with 2012.

- Net profit increased 2% to €917 million ($1,243 million) vs. €900 million ($1,220 million) in 2012.

- Net industrial debt stood at €1,592 million ($2,158 million) vs. €1,642 million ($2,226 million) on December 31, 2012. Group available liquidity totaled €6.3 billion ($8.54 billion) compared to €6.2 billion ($8.4 billion) on December 31, 2012.

- The Board of Directors is recommending for 2013 a dividend of €0.20 ($0.27) per share, totaling approximately €270 million ($366 million).

- CNH Industrial expects improved performance in 2014, with revenues flat to up 5% and trading margin between 7.8% and 8.2%.

CNH Industrial N.V. (NYSE:CNHI) today announced Group revenues of €25,778 million for 2013 (+4.3% on a constant currency basis). Revenues from Agricultural and Construction Equipment were in line with the prior year at €16,006 million; on a constant currency basis, revenues increased by €759 million (+4.7%) as a result of the strong demand for agricultural equipment, partially offset by challenges faced by the construction equipment business. Trucks and commercial vehicles revenues were €8,752 million (+1.5% on a constant currency basis) as a result of a recovery in demand in Europe, largely due to the Euro V pre-buy effect mainly in Q4 2013, and increased volumes in LATAM. Powertrain revenues at €3,331 million (up 14.6% on a constant currency basis), were driven by higher volumes for both internal and external customers.

Group trading profit for the year was €1,985 million (trading margin of 7.7%), down €78 million largely as a result of negative exchange rates. On a constant currency basis, trading profit was in line with 2012 as higher volumes and positive mix in the Agricultural and Construction Equipment Segment and higher revenues and better capacity utilization for Powertrain compensated for Euro VI transitional costs and a less favorable product mix and pricing environment in the Trucks and Commercial Vehicles Segment.

- Operating profit increased €22 million to €1,868 million in 2013 mainly as a result of reduced restructuring costs from the prior year.

- Net financial expense totaled €463 million for 2013, compared with €467 million for 2012.

- Income taxes totaled €590 million, representing an effective tax rate of 39% for the year, slightly above full year Group expectations mainly due to one time merger related impacts. For 2014, CNH Industrial Group expects an effective tax rate between 35% and 38%.

- Group net profit was €917 million for 2013 (€900 million for 2012), or €0.63 per share (€0.65 for 2012).

- Net industrial debt of €1,592 million at December 31, 2013 was €50 million lower than year-end 2012.

- Available liquidity of €6,318 million, inclusive of €1,613 million in undrawn committed facilities, slightly increased over December 31, 2012.

Fourth Quarter

For the fourth quarter, Group revenues totaled €6.9 billion, an increase of 4.2% on a constant currency basis (-1.1% on a reported basis) driven by positive performance for Agricultural Equipment, Powertrain and Trucks and Commercial Vehicles, partially offset by a decline in revenues for Construction Equipment due primarily to announced actions to realign dealer inventory to retail demand.

Group trading profit totaled €436 million for the fourth quarter (€435 million in the same period of 2012), with a trading margin of 6.3% (6.2% in Q4 2012). On a constant currency basis, trading profit increased by €21 million, as improved results for the Agricultural Equipment business, driven primarily by positive pricing.

2014 Outlook

Projected improvements in operating performances in the Trucks and Commercial Vehicles and Construction Equipment businesses, coupled with continued industrial efficiencies, are expected to offset the projected decline in unit demand of agricultural product equipment forecasted for 2014. Accordingly, CNH Industrial is setting its 2014 guidance as follows:

- Revenues flat to up 5%;

- Trading margin between 7.8% and 8.2%; and

- Net industrial debt between €1.5 billion and €1.7 billion

The Group will be releasing a new business plan in May of 2014 at an investor event to be held in the United States following the 1Q 2014 results release. Prior to the release of the 1Q 2014 results, the Group will be holding a conference call with analysts to present the changes from the 2014 transition from IFRS to U.S. GAAP accounting standards and the change from the euro to the U.S. dollar as the Group reporting currency, including a recast of prior years’ data.