Editors’ Note: During the long Thanksgiving weekend, the news section of www.farm-equipment.com will feature news stories compiled by Farm Equipment editors that cover areas of agriculture business that, directly and indirectly, impact ag equipment sales.

Considering that farm real estate (land and buildings) is the single largest asset on the farm-sector’s balance sheet, trends affecting farmland values are always a good thing for ag machinery dealers and manufacturers to keep an eye on. Right now, it appears farmland values have reached their zenith and will begin to plateau or decline somewhat.

According to USDA’s Economic Research Service (ERS) farm real estate accounts for 84% of the total value of U.S. farm assets, which means it’s also the principal source of collateral for farm loans, enabling farm operators to purchase equipment and finance operating expenses.

An Extended Run Up

In a September 2, 2013, report, Andrew Swenson, farm and family resource management specialist at North Dakota State Univ.’s Agribusiness and Applied Economics Dept., said, “No one knows the future, but there is a good possibility that we have seen the last of the rising land value reports for a while.”

Swenson goes on to point out that, “It has been a historic run that culminated with an exclamation mark. On August 2, the U.S. Department of Agriculture reported results from a June survey showing average North Dakota cropland values at $1,910 per acre, which was a 41.5% increase from the previous year. At 30.2%, South Dakota had the next highest increase. The national average was 13%.”

According to Swenson, in 2003, North Dakota cropland was less than one-fourth, $460 per acre, compared with its current value. During the past 10 years, it has averaged an annual increase of nearly 16%. During the past 100 years, the closest comparisons to this multiyear increase in values were 1973 through 1981 and 1942 through 1949.

Interest Rates & Commodity Prices

Investment in U.S. farmland is still competitive with alternative investments, but the era of extremely low interest rates and extraordinarily high commodity prices is drawing to a close, according to a new report from the Rabobank Food & Agribusiness (FAR) Research and Advisory Group.

“We’ll likely see lower commodity prices this year, but they aren’t going to be low enough long enough to substantially impact land values over the coming year or so,” says report author and Rabobank Food & Agribusiness Research and Advisory (FAR) senior analyst, Sterling Liddell. “In the short term, strong farmer balance sheets and high rental rates will support current levels. However, decreasing commodity prices will keep the values from accelerating as rapidly as they have been.”

The report, “Land Values Peaking Out — But Not Down,” finds in the medium term, the single greatest risk to U.S. agricultural land values is looming higher interest rates. Interest rates have been increasing through the first half of 2013, but based on the current Federal Reserve policy, a significant increase isn’t expected until 2014 or 2015.

“We are entering an era where planning how you’re going to pay for your land is likely to become as important as planning for marketing your crop,” notes Liddell.

The report forecast finds a decline in land values in the central U.S. of 15-20% over the next 3 years. In the Western and Southeast U.S., the decline will be less marked than in the Midwest. The key determinant in the susceptibility to land value changes is an area’s reliance on grain and oilseeds. While an increase in interest rates will have a similar impact on agricultural land values throughout the country, the amount of change will depend on the type of crop production and proximity to urban areas.

Current Trends in Land Values

Three of the major Federal Reserve districts that cover major agricultural regions reported on the current situation in each, which included current trends in farmland values. Here is a summary of each of their reports.

Federal Reserve Bank of Chicago — Seventh Reserve District

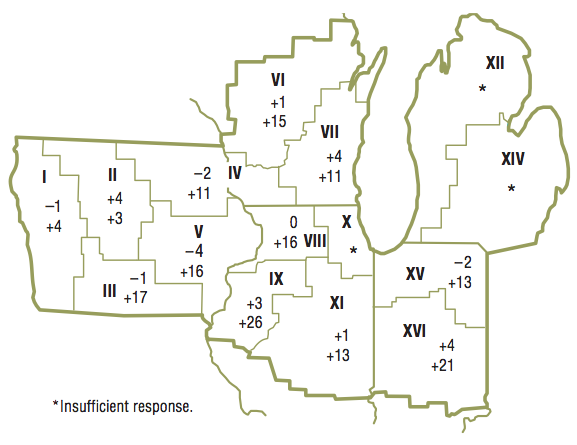

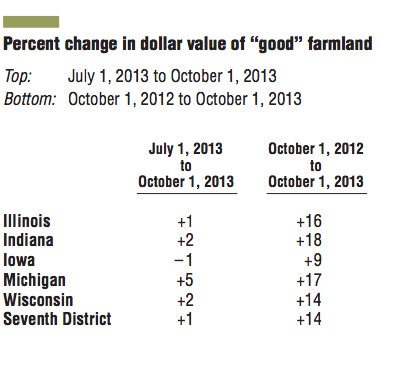

On a year-over-year basis, farmland values in the Seventh Federal Reserve District gained 14% in the third quarter of 2013. However, the return of drought seemed to temper the year-over-year gain in Iowa farmland values. There was a 1% increase in “good” agricultural land values in the third quarter relative to the second quarter of 2013, according to the 195 agricultural bankers that provided responses for the October 1 survey.

While District farmland values increased on the whole in the third quarter of 2013, this upward trend was not expected to continue. The respondents’ expectations leaned toward a decrease in farmland values in the fourth quarter of 2013, as only 4% anticipated an increase and 21% forecasted a decrease (75% foresaw stable farmland values).

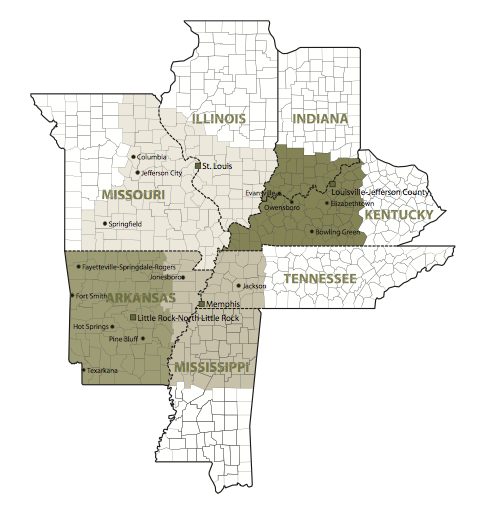

Federal Reserve Bank of St. Louis — Eighth Reserve District

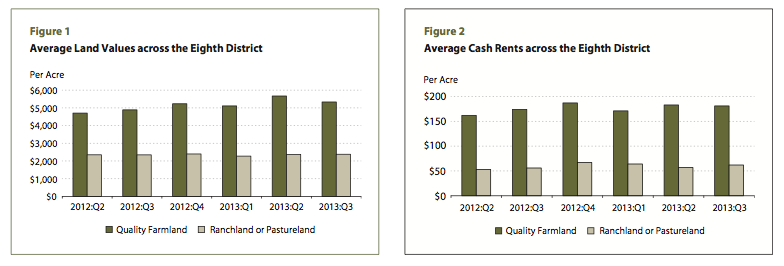

Quality farmland values across the District averaged $5,332 per acre in the third quarter of 2013. This was a noticeable decrease (6%) from the second quarter average ($5,672). Despite this decline, District quality farmland values have increased by 9.1% since the third quarter of 2012. Bankers expect a further erosion in District quality farmland values over the next 3 months. The value of District ranch or pastureland averaged $2,377 per acre in the third quarter, a gain of 1.4% over the past 4 quarters. Unlike quality farmland, survey respondents expect no change in the value of ranch or pastureland over the next 3 months relative to a year earlier.

Quality farmland values across the District averaged $5,332 per acre in the third quarter of 2013. This was a noticeable decrease (6%) from the second quarter average ($5,672). Despite this decline, District quality farmland values have increased by 9.1% since the third quarter of 2012. Bankers expect a further erosion in District quality farmland values over the next 3 months. The value of District ranch or pastureland averaged $2,377 per acre in the third quarter, a gain of 1.4% over the past 4 quarters. Unlike quality farmland, survey respondents expect no change in the value of ranch or pastureland over the next 3 months relative to a year earlier.

Federal Reserve Bank of Kansas City — Tenth Reserve District

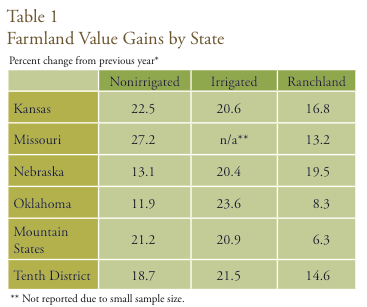

Despite weaker farm income, growth in District cropland values was only slightly slower than the previous 2 years. With drought still lingering in the Plains, irrigated cropland has posted the strongest annual value gains for the past year, rising almost 22% above 2012 levels in the third quarter. Non-irrigated cropland values increased 19% in the third quarter compared with last year while year-over-year gains in ranchland values held steady at just below 15%. In addition, irrigated, non-irrigated and ranchland values rose 0.9, 2.8 and 2.0%, respectively, from the second quarter to the third quarter of 2013.

Farmland value gains have continued to outpace increases in cash rental rates, highlighting the potential for a future adjustment in farmland values. The ratio of non-irrigated cropland values to cash rents, historically less than 20, recently reached 27 in the District, according to survey results.

This district includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri.

Related Pages: