Bankers have been telling me the strangest thing: credit standards for business are easing. Not by a whole lot, but they are definitely coming down. I’ve heard it enough, though, that the trend is clear. That leaves small business owners and corporate CFOs asking, “What do I do in a world of easier credit?” or possibly “Where can I get some?”

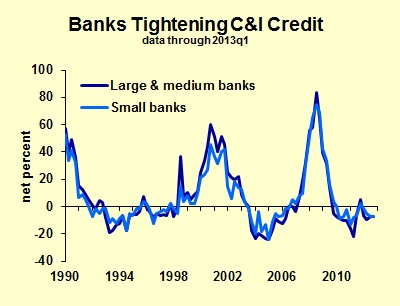

The latest survey of senior bank lending officers, conducted by the Federal Reserve, confirms a mild form of the anecdotes I’m hearing. The chart below shows the percentage of loan officers who say they are tightening credit minus the percentage who say they are easing credit. The negative numbers that we see recently indicate more easing than tightening. Note that bankers never tell the Fed that they are easing a lot. Take any small easing and assume that it’s even better than the official reports.

Loan volume has been rising for over two years, though it remains below the pre-recession peak. Most of the increase in loans outstanding reflects more borrowing by those companies that always had strong credit quality. Some of the gain reflects more companies that are meeting the old credit standards. Finally, a portion of the recent gain comes from banks easing credit standards.

Bankers are desperate for loan growth. If they don’t make loans, they park their deposits in short-term assets. One of my bank clients has several billion dollars of cash and short-term assets on which it is earning just 27 hundredths of 1% interest. If they found a few good loans to make, they would earn significantly more profit. So banks have been fighting one another on price, offering cheaper and cheaper credit to the most credit-worthy customers. Only recently, however, have they started easing their standards.

Credit standards are not dramatically looser, but any business that was right on the margin six months ago is probably bankable, by someone, today.

Here are four strategies for small business owners and corporate CFOs. Two of these strategies should be right for you in this credit environment.

First, if you don’t have credit now, know where you stand. If you don’t qualify for bank credit today, sit down with one or two loan officers and ask them what has to change for you to be bankable. They should be able to give you a clear idea of how far you’ll have to move your financial numbers to qualify. If a bank officer cannot answer your question, scratch that bank off your list of prospects.

Second, if you do have credit now, know where you stand. If you currently have a bank loan or line of credit, talk to your banker about how close you are to the dividing line between bankable and not-bankable. Are you right on the edge, or do you have a good wide margin for error? One good way to ask the question is to sketch out what your financials would look like in a mild recession. Assume that you don’t cut expenses too much, on the theory that your sales drop is temporary. Run the pro forma financials and show them to your banker. If he or she goes pale, say that you’re simply preparing contingency plans.

A banker might say something like, “We could lend to a company with these financials — but only for one year. Then we would need to see clear improvement: costs under control and sales rebounding.” Now you have a good target for your contingency planning. (You might want to watch my videos, “Business planning with risk of recession.”)

Third, if you don’t need credit, get a line anyway. Some strong companies do not have loans outstanding, nor do they want any. That’s fine, but consider the advantages of flexibility. As an example, Japan’s earthquake and tsunami forced the closure of many industrial manufacturing plants. Producers outside the affected area saw a surge of orders. But filling those new orders required buying materials from other vendors, adding staff or at least getting overtime hours from current employees. Typically, a good deal of cash had to be shelled out before the company was paid. Taking advantage of this opportunity required financial flexibility.

Companies that could not move quickly because of cash limitations lost out.

New opportunities can come out of left field, to be lost forever if not grasped quickly. Other examples include acquisition possibilities that you did not expect to arise, new markets that arose quickly and proposed legislation that makes your product suddenly desirable (as gun companies are now experiencing.)

Fourth, keep your banker informed. If you have credit, or are anywhere close to having credit, talk to your banker regularly. Those who have a loan now are probably sending quarterly financial statements over to the bank. If your conversations led you to think that you’re close to being bankable, start sending quarterly reports to your most likely bankers.

Supplement the financial reports with a conversation every quarter, and do it in person at least twice a year. Give the story behind the numbers: “We’re making progress in our southeast division. Our costs rose because of a maintenance problem.” Be honest. It’s not natural to share bad news, especially if your access to credit is dicey. However, bankers love honesty.

One of my clients is beloved by lenders. Several bankers that I know have worked with this guy, and the bankers’ faces just beam when his name is mentioned. What really turns on the bankers is that they are totally confident that this customer shares all information. He talks about his risks and worries as well as his opportunities and successes. The bankers never have to report surprisingly bad news to their bosses — a real plus in the banker-lender relationship.

This new banker attitude about risk offers opportunities for businesses that want to grow or just be ready if good luck comes their way. Credit approval is not automatic, and companies that become reliant on credit can be in deep trouble if their financial condition deteriorates or their bank becomes nervous. Companies large and small benefit from some advance planning for credit.

Post a comment

Report Abusive Comment