In this episode of On the Record, we take a look at John Deere's latest earnings report. In the Technology Corner, Noah Newman gives us a deep dive into Ecorobotix's precision spot-sprayer ARA. Also in this episode, dealer customer satisfaction scores and Buhler Industries' second quarter earnings.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Deere’s Large Ag Sales Up 12% YOY in 3Q23

- Dealers on the Move

- Ecorobotix ARA Precision Sprayer Scans Field in Less Than 250 Milliseconds

- Buhler Industries: Canadian & U.S. Revenue Up in 2Q23

- Smaller Dealers Outscore Large Dealers in Parts, Service Customer Satisfaction

- DataPoint: Canadian Consolidation

Deere’s Large Ag Sales Up 12% YOY in 3Q23

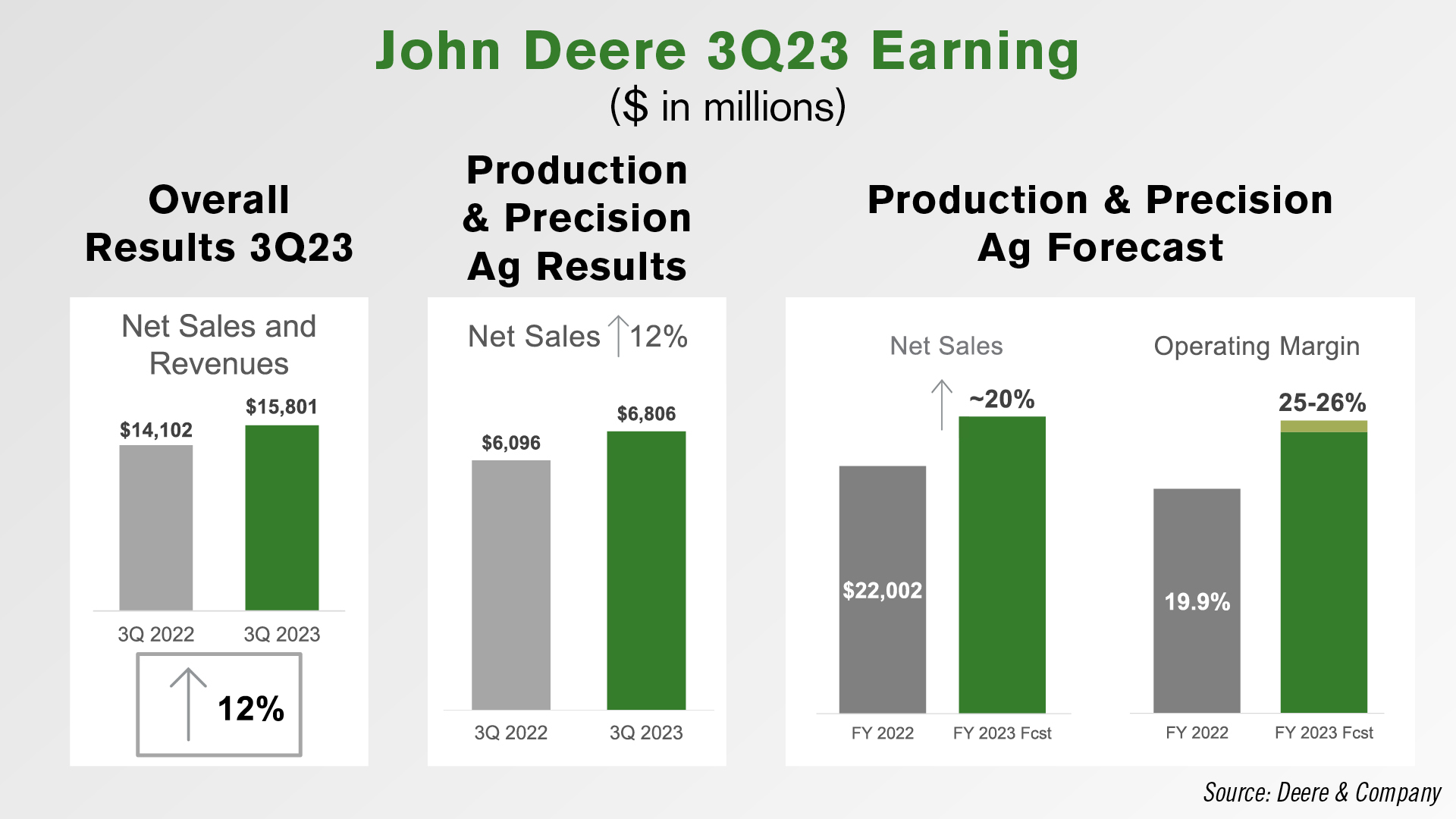

In its earnings release for the third quarter of fiscal year 2023, John Deere reported $15.8 billion in net sales, which is an increase of 12% year-over-year.

Sales in Deere's Production & Precision Ag segment also rose 12% to $6.8 billion in the quarter. The segment’s operating profit for the quarter was $1.8 billion, up 38% year-over-year, with operating margin up 26.2%. John Deere forecast production and precision ag net sales for its full fiscal year 2023 to be up about 20% year-over-year and operating margin to end the year up between 25-26%.

By region, the company said it is forecasting large ag equipment unit sales in North America to end the fiscal year up 10%. Sales of tractors and combines to South America, meanwhile, will likely be flat to down 5%.

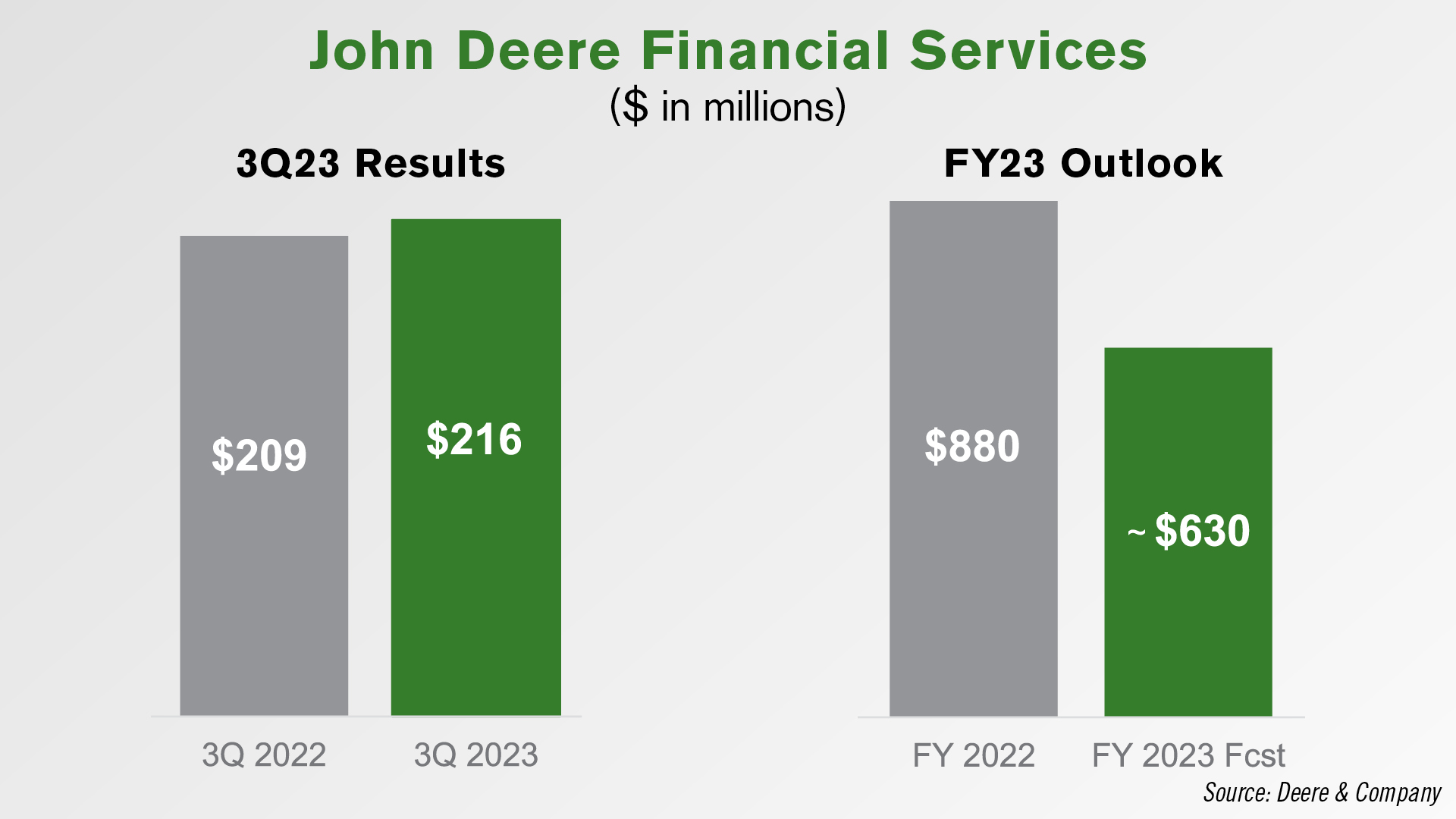

For John Deere’s Financial Services segment, net income attributable to Deere & Co. in the third quarter was $216 million, a 3% year-over-year increase. The company kept its outlook for the segment at $630 million, or a year-over-year decline of about 28.4%.

Overall, Deere forecast its net income at the end of the fiscal year to be $9.75-$10 billion.

In the third quarter earnings call, Chief Financial Officer Josh Jepsen said that the high level of cash flow allowed Deere to effectively execute on its strategic investment priorities.

“This is, first and foremost, a direct reflection of the strong performance this year, which is projected to yield between $10.5-$11 billion in operating cash flow for the equipment operations.

“During the year, we've increased R&D 15%. We pulled ahead some capex projects into 2023 and have still managed to simultaneously deliver over $5.5 billion to shareholders year-to-date through dividends and share repurchases.”

In a note to investors, J.P. Morgan said it’s too soon to forecast large ag volume in the coming year, citing a number of factors. These include large ag products being sold out in North America for 2023 as well as early order sellouts for model-year 2024 sprayers, with unit sales up double-digit percentage points vs. the 2023 model year due to last year’s supply chain constraints. Early orders for planters are currently flat year-over-year and 5% lower than last year’s early orders, J.P. Morgan said. Meanwhile, the company said early orders for tractors and combines just opened in the beginning of August as did tractor order books that go through the second quarter of 2024.

Dealers on the Move

This week’s Dealers on the Move include Hoober Inc. and Landpro Equipment.

Case IH and Kubota dealer Hoober Inc., which has stores in Delaware, Maryland, New Jersey, Pennsylvania and Virginia, is adding its 12th location in Somerset Pa., according to The Tribune-Democrat. Hoober plans to have the dealership fully operational by fall, expanding its local workforce to seven full-time employees.

The Centre Daily Times reported that John Deere dealer LandPro Equipment has plans to relocate its store in Centre Hall, Pa. The dealership plans to build a 19,000-square-foot facility with an additional 7,500-square-foot storage building on a 9.5-acre site.

Ecorobotix ARA Precision Sprayer Scans Field in Less Than 250 Milliseconds

I remember first learning about Swiss Agtech company Ecorobotix and its precision spot-sprayer ARA at FIRA USA last fall. At the time, the company was looking to expand after selling out their sprayers in Europe in 2021. We’re seeing that vision play out, as the company has recently entered markets in Canada, South America, and now the U.S. Ecorobotix Americas Regional Manager Jose Marchetti shows us how ARA works.

“On each of the modules you have 2 very powerful computers with 3D sensors and cameras that take hundreds of pictures per second. The computers process those pictures, identify crops and weeds, and in only one-fourth of a second from taking the picture we can decide what nozzle we open and spray either fungicide, liquid fertilizer, herbicide or insecticide. We save up to 95% of chemicals, water and energy.”

Ecorobotix will showcase ARA at the Farm Progress Show in Decatur next week. We’ll have updates on PrecisionFarmingDealer.com.

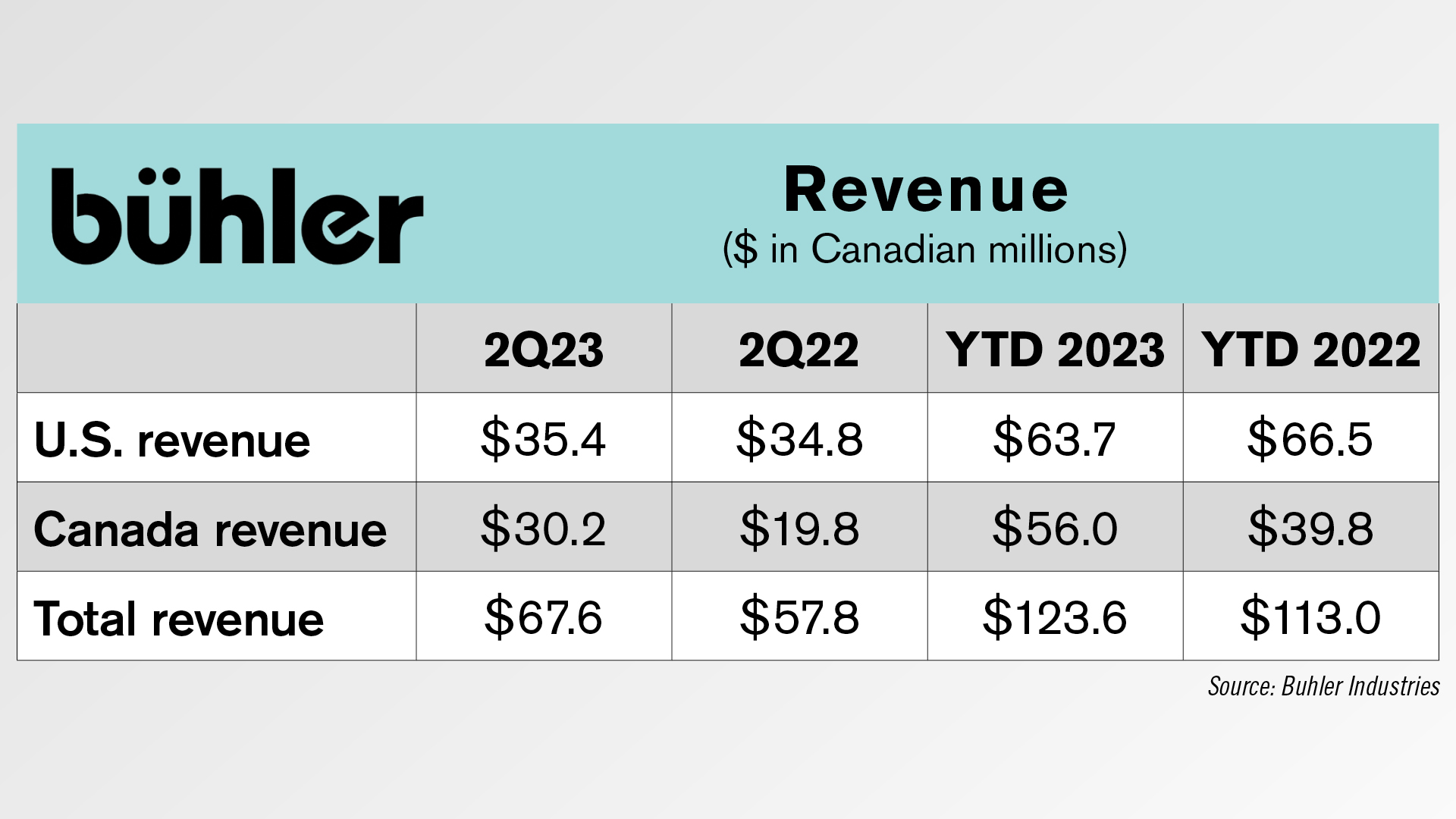

Buhler Industries: Canadian & U.S. Revenue Up in 2Q23

Buhler Industries, manufacturer of the Versatile and Farm King equipment lines, released its second quarter 2023 earnings on Aug. 14, showing C$67.6 million in revenue for the quarter. This was up 17% year-over-year from $57.8 million in its second quarter last year.

Canadian revenue was up 52% in the second quarter to $30.2 million and was up 71% for the first half of the year to $56.0. This brought the percentage of Buhler Industries’ second quarter revenue coming from Canada to 44.7% vs. 34.4% in last year’s second quarter.

Buhler’s U.S. revenue surpassed Canadian revenue for both the second quarter and the first 6 months of the year but saw less year-over-year improvement. U.S. revenue for the quarter was up 1.6% to $35.4 million and down 4.3% to $63.7 million for the first half of the year.

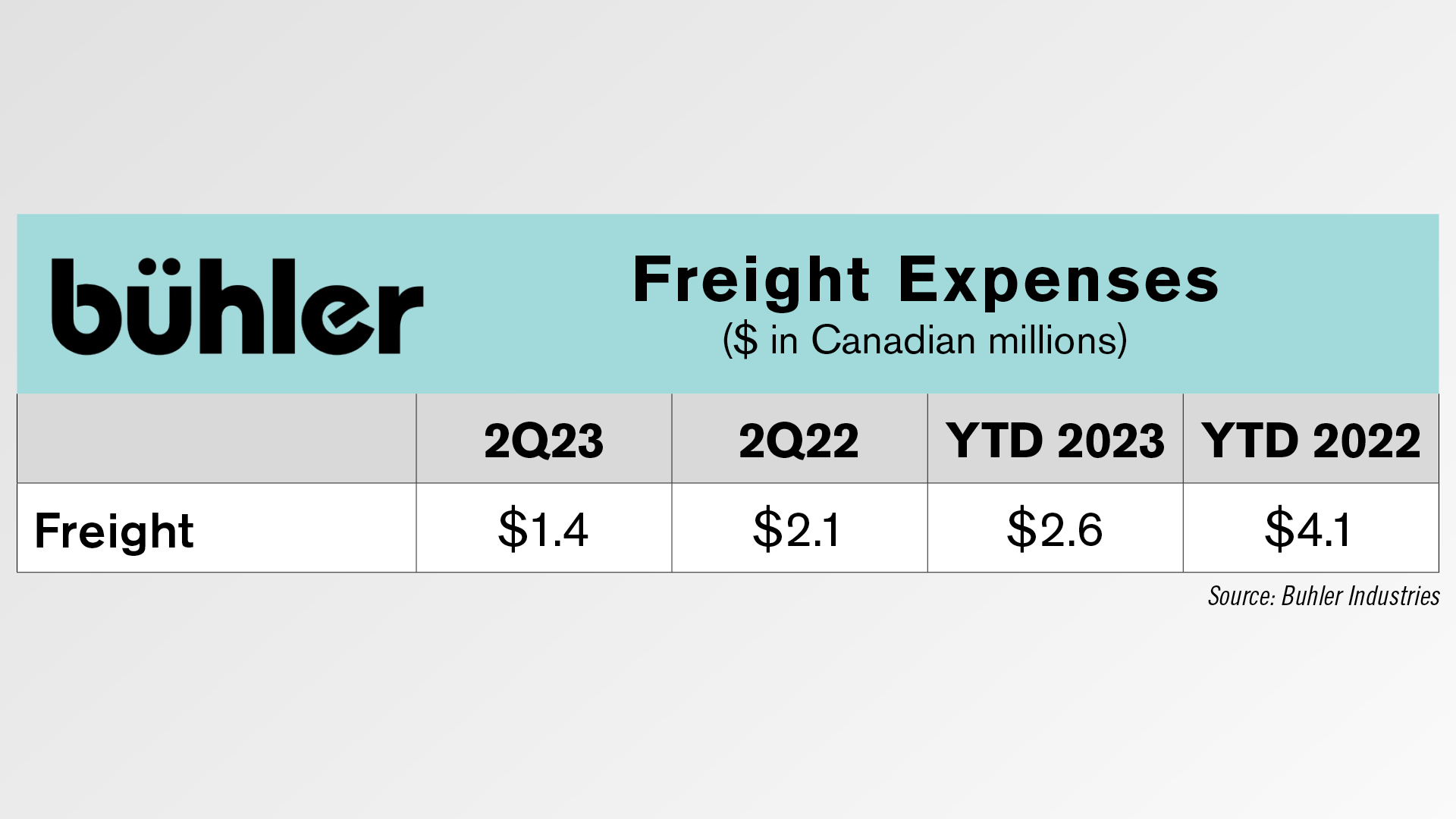

Looking at expenses, one notably declining expense in Buhler Industries’ earnings was its freight expenses. The company spent $1.4 million on freight in the second quarter of 2023, down 35.4% from $2.1 million in the same quarter last year. Total freight expenses for the first half of the year were down 36.4% to $2.6 million.

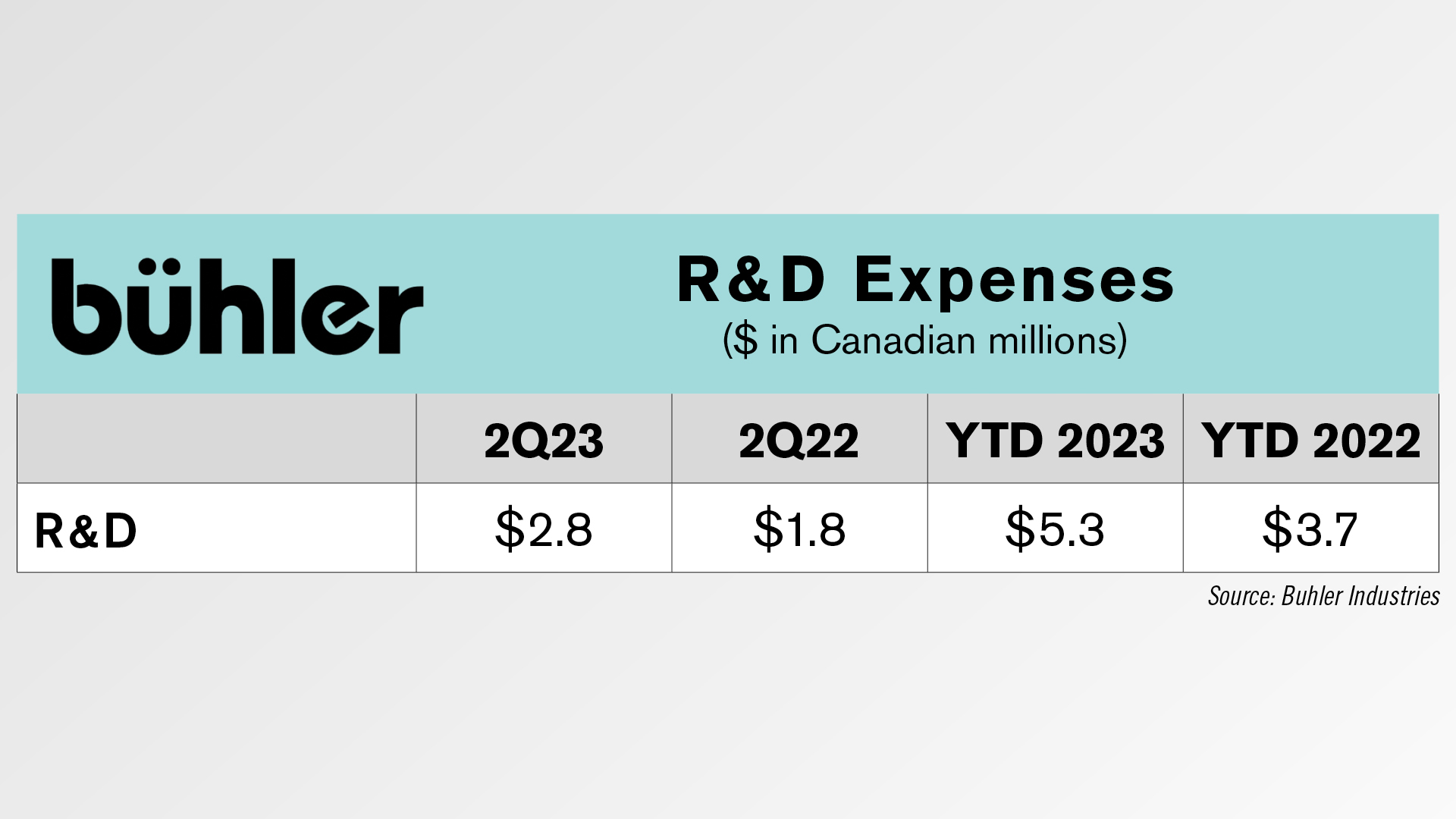

Buhler’s second quarter earnings also showed a notable increase in its research and development spending. R&D expenses for the quarter were $2.8 million and $5.3 million year-to-date, representing increases of 56.6% and 46.6% respectively. Buhler’s second quarter R&D expenses were also its highest in the last 8 financial quarters.

Smaller Dealers Outscore Large Dealers in Parts, Service Customer Satisfaction

Recent data from dealership management program provider Satisfyd found dealers with 1-5 locations achieve higher customer satisfaction scores than larger dealerships in their parts and service departments.

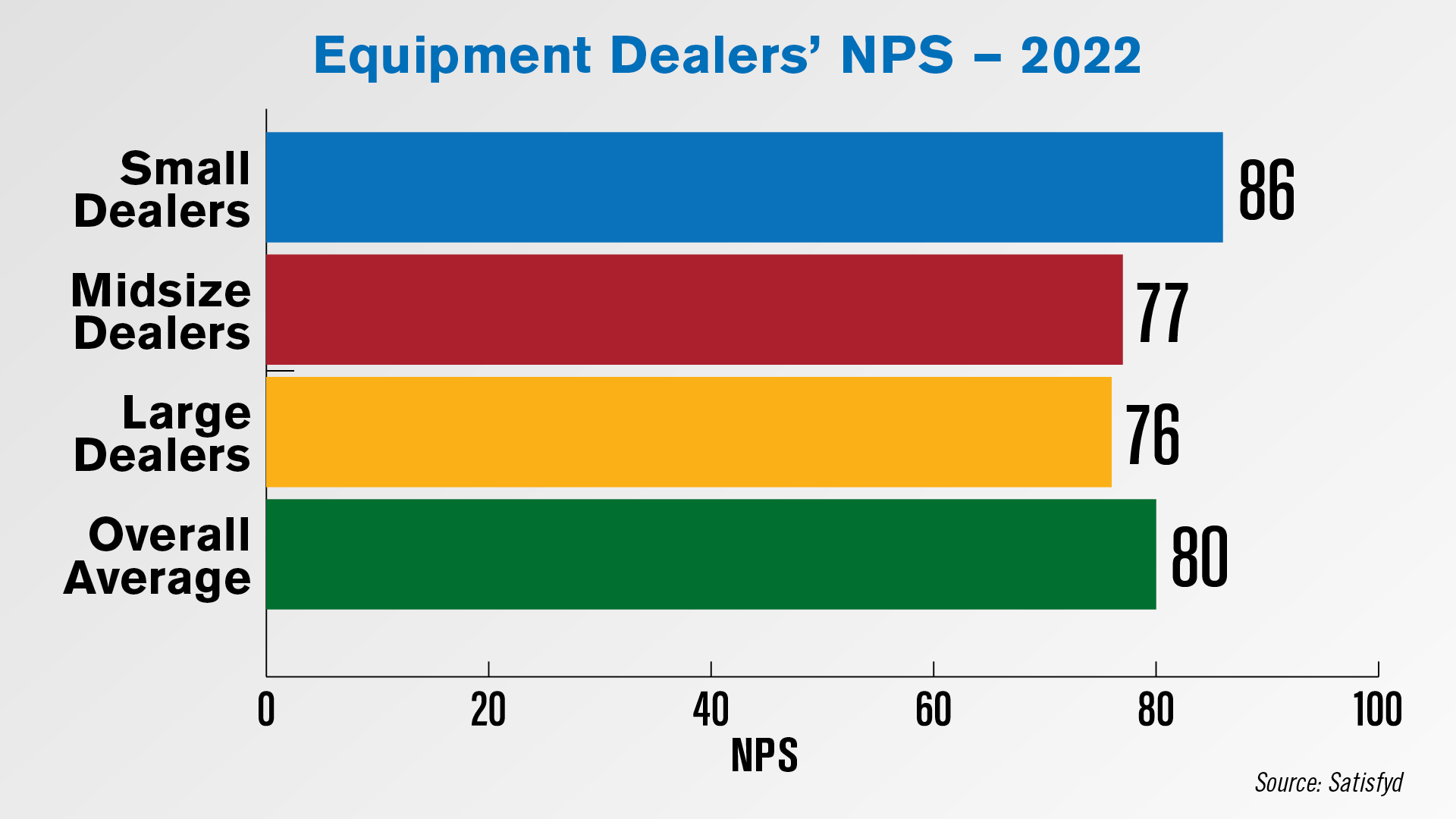

Satisfyd’s 2022 Customer & Employee Experience Benchmark report found small dealers have the highest overall NPS or net promoter score of 86 compared to midsize and large dealers. The report defines small dealers as having 1-5 locations, midsize dealers having 6-19 locations and large dealers having 20 or more locations.

NPS is defined as measuring the likelihood of customers recommending a company’s product and services to others and is based on the performance of 1,000 equipment dealers in the U.S., Canada and Australia.

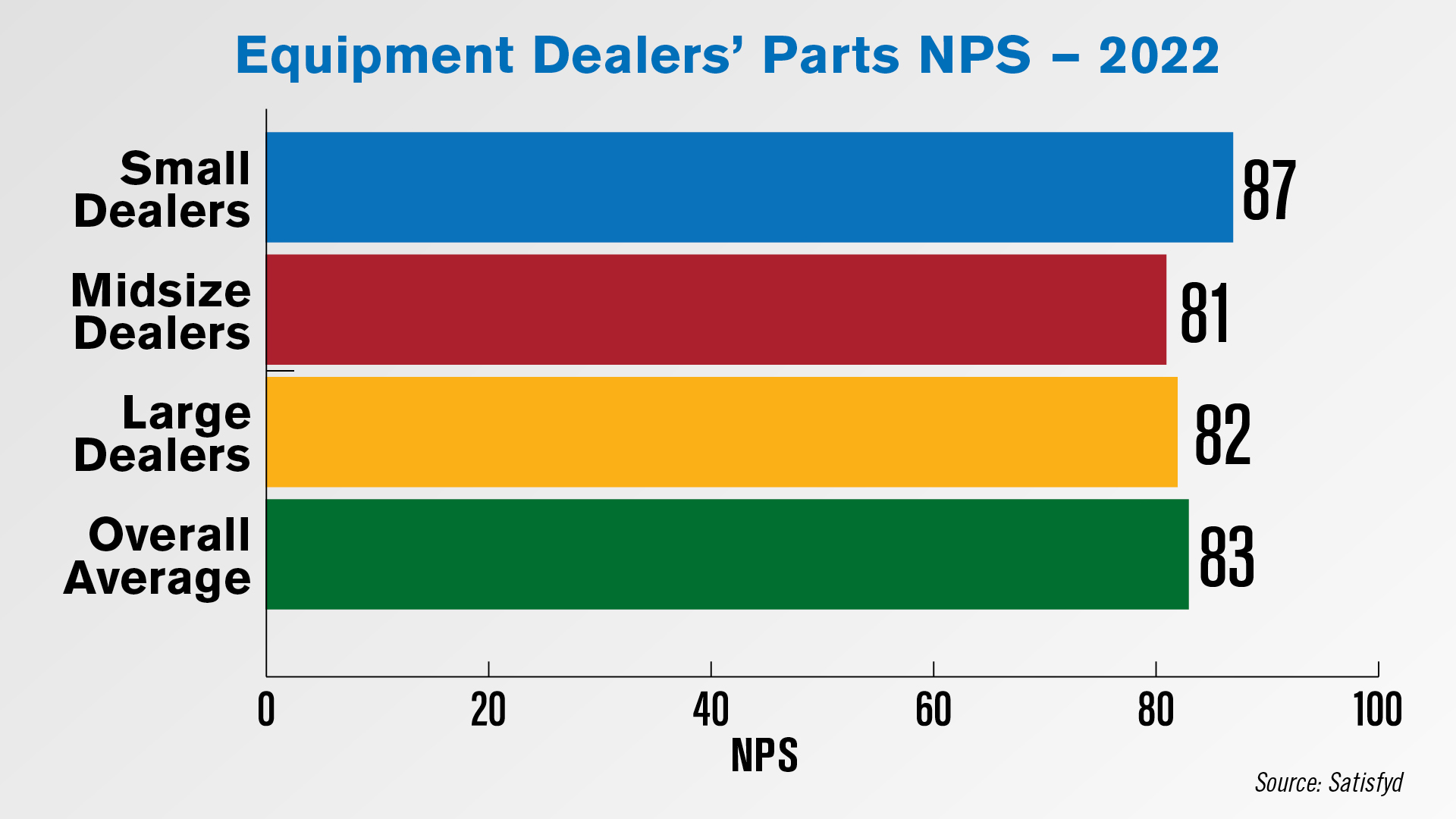

Small dealers had the highest NPS for their parts departments at 87. The report stated that overall, most parts department scores have exceeded pre-pandemic levels. In-stock parts availability still requires improvement, although this score has been steadily increasing since July 2021. Additionally, the score for friendly attitudes has not yet reached its pre-pandemic peak, suggesting room for improvement in customer service.

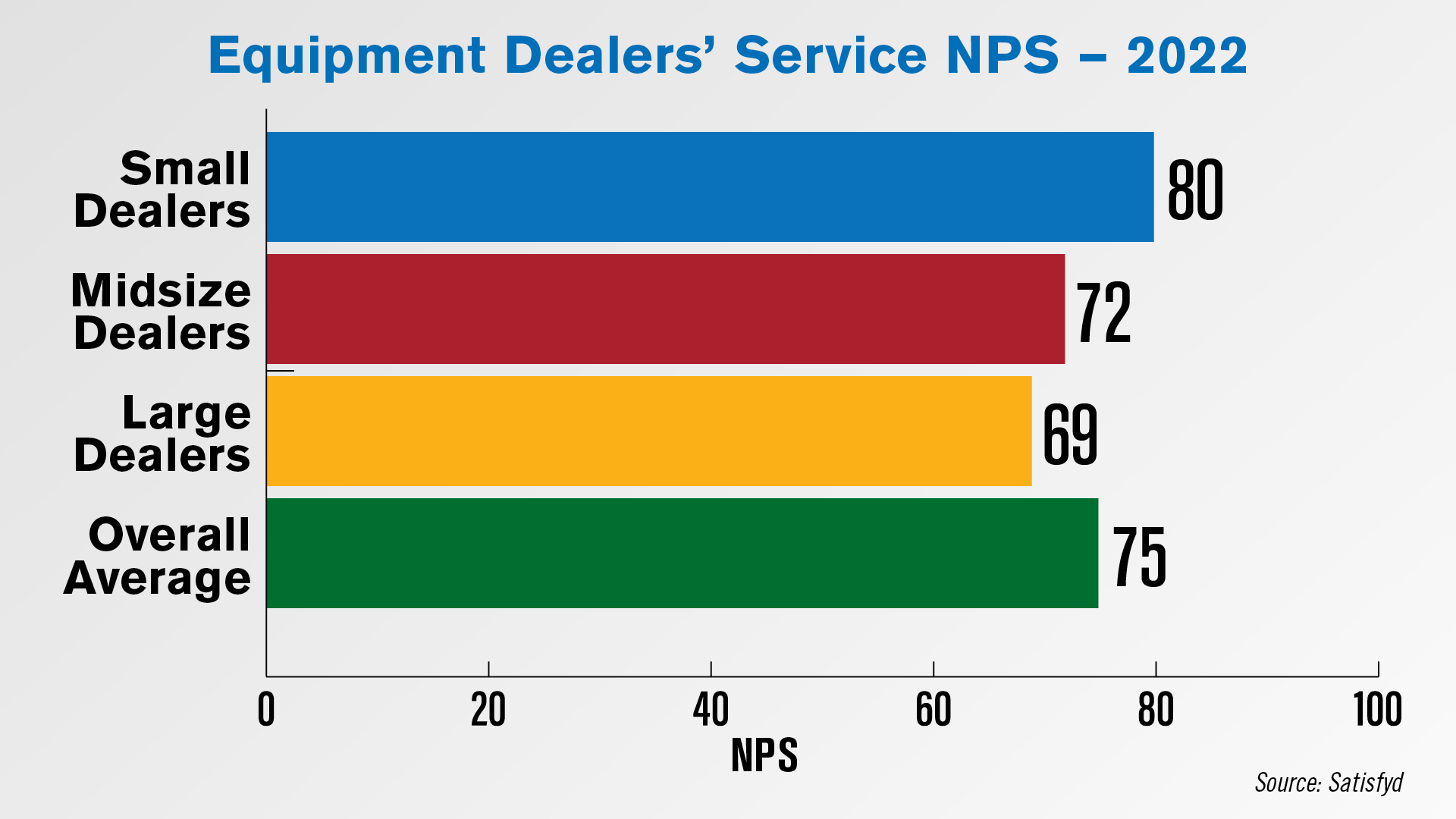

Scores by department were the lowest for dealers of all sizes in their service departments with an overall average of 75. Here again, small dealers performed the best with an NPS of 80.

Unlike in the parts department, the report said service department customer experience has not yet fully returned to pre-pandemic levels and presents an opportunity for improvement. One possible reason the report gave for this slow recovery is prevailing tech shortage issues. Following a bottom point in July 2021, service department NPS experienced a second “trough” in September 2022. The report said scores have increased steadily since then, though there are some indications the trend may be starting to flatten or even trend back down in some cases. The only service department score not below pre-pandemic levels was for repairs made correctly the first time.

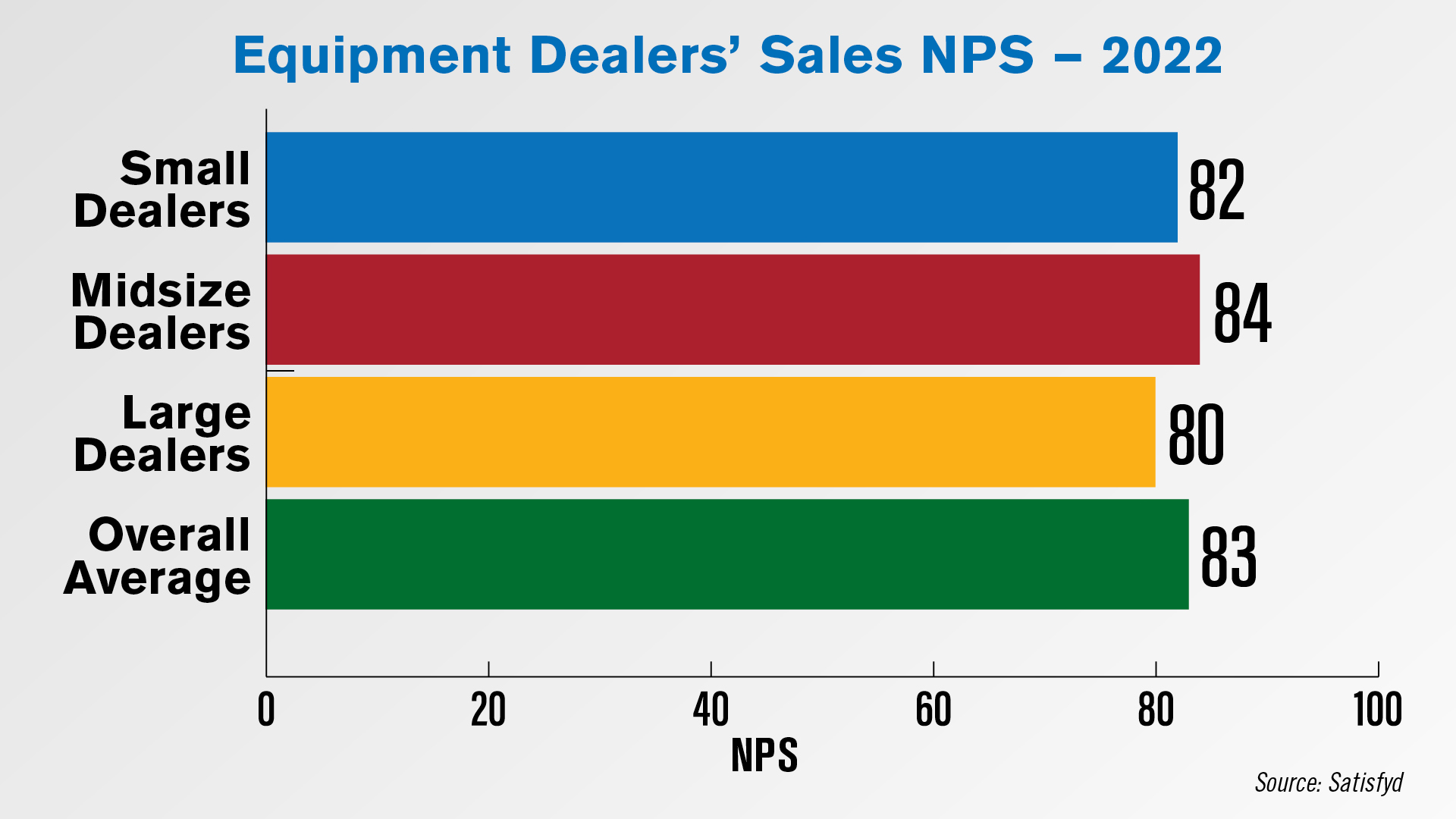

Where larger dealers excelled was in the sales department, with midsize dealers taking the highest score at 84, with small dealers receiving the lowest net promoter score of 80. The report found that all sales department scores have increased since pre-pandemic levels, with the exception of scores for being treated fairly and honestly and being helpful and courteous.

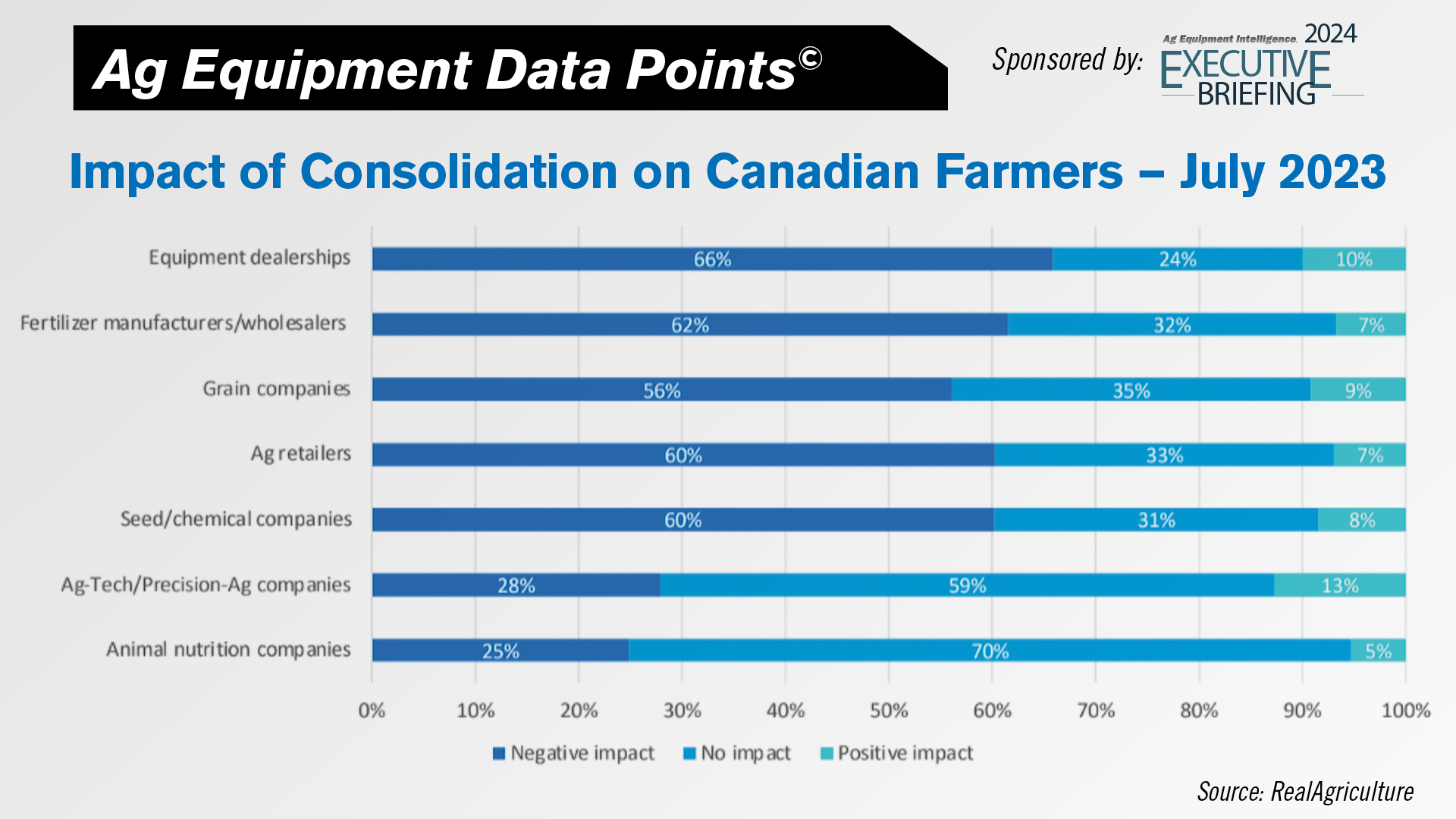

DataPoint: Canadian Consolidation

This week’s DataPoint is brought to you by the Ag Equipment Intelligence 2024 Executive Briefing.

When it comes to consolidation in agriculture, Canadian farmers are most concerned about consolidation of equipment dealers, with 66% saying it has a negative impact, according to an Aug. 4, 2023, report from RealAgriculture. Fertilizer manufacturers were the second-highest concern at 622%. Farmers were least concerned about the impacts of consolidation of ag tech/precision ag companies at 28% and animal nutrition companies at 25%.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.