In this episode of On the Record, we take a closer look at the used combine market. In the Technology Corner, Noah Newman talks about the versatility of drones with a Corn Belt farmer who owns and operates his own aerial application business. Also in this episode, AGCO and CNH Industrial released their second quarter earnings this week.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Canadian Demand for Harvest Equipment Remains High

- Dealers on the Move

- Corn Belt Farmer Uses Drones for Multiple Tasks to Maximize ROI

- AGCO Reports 2Q Sales Up 30%

- Used Combine Inventories Growing

- CNH Reports 2Q Revenue Up 8%

- DataPoint: U.S. Steel Production Remains Below 2021& 2022 Levels

Canadian Demand for Harvest Equipment Remains High

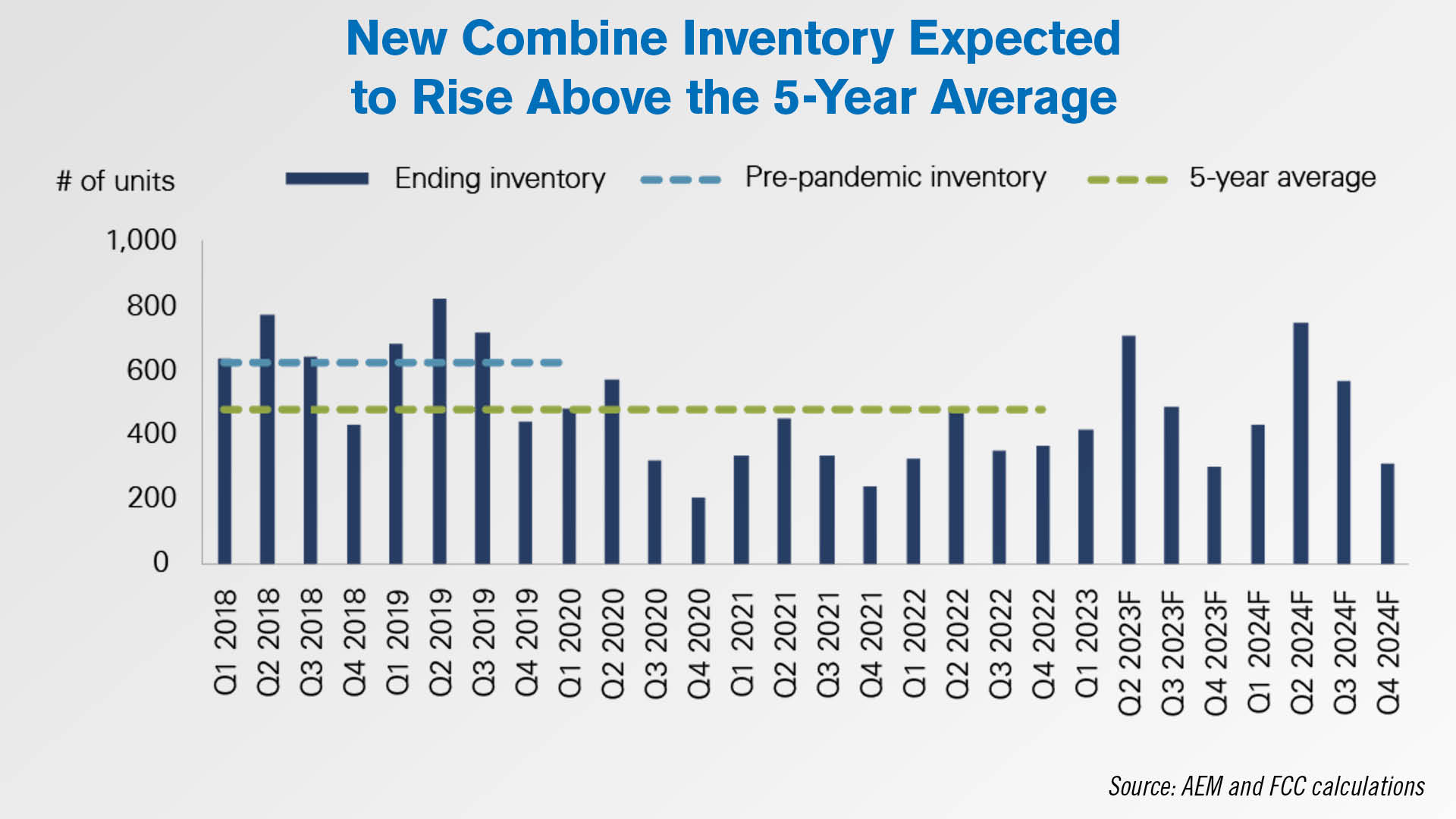

According to a recently released report from Farm Credit Canada, new combine inventory is expected to rise about the 5-year average. Leigh Anderson, senior economist with FCC and author of the report, says they predict used combine prices could potentially pull back heading into harvest and through remainder of 2023.

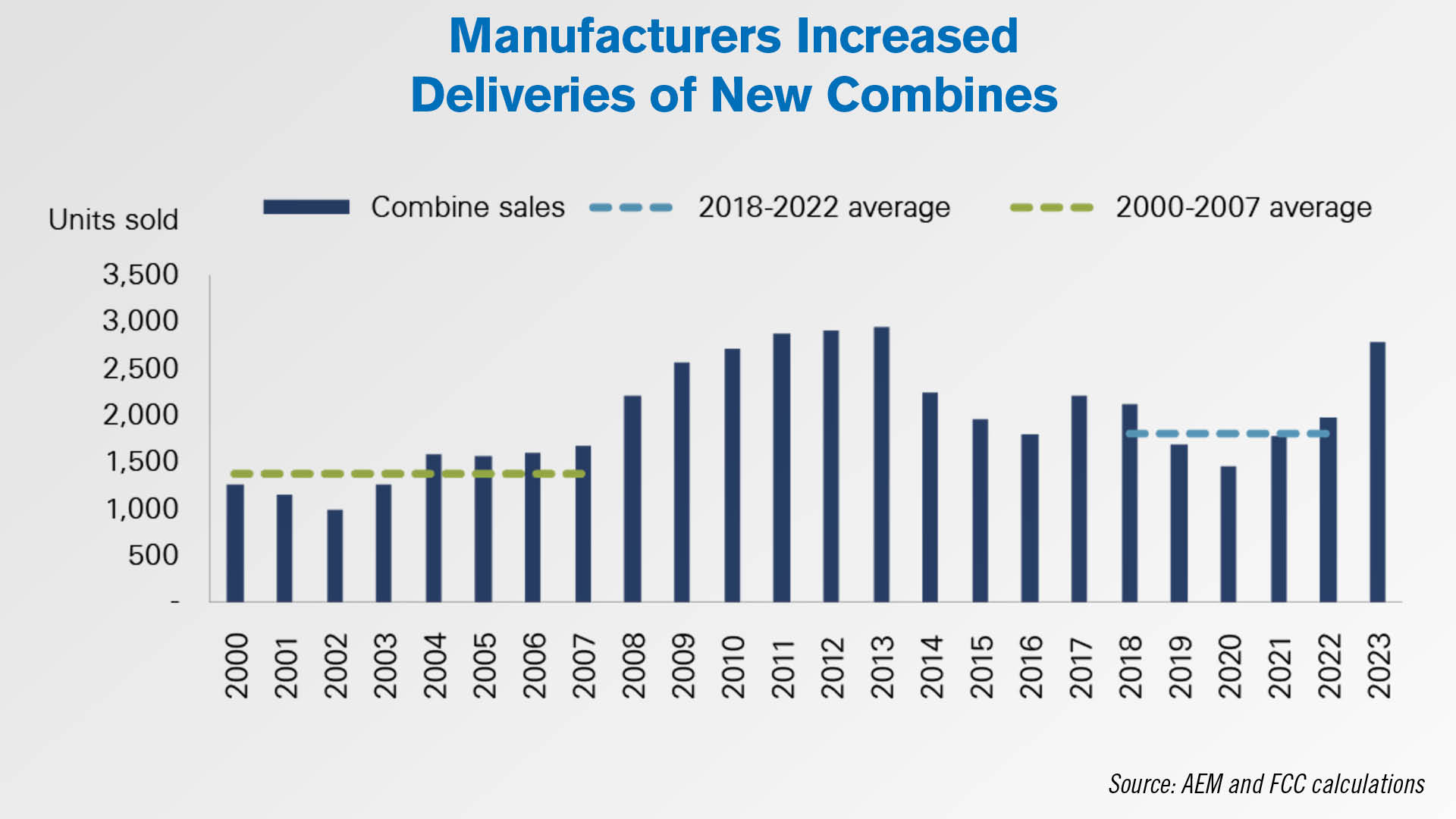

Supply chain constraints over the last 2 years have led to delayed deliveries of new combines, which in turn led to a decline in new combine sales and inventory levels, he says.

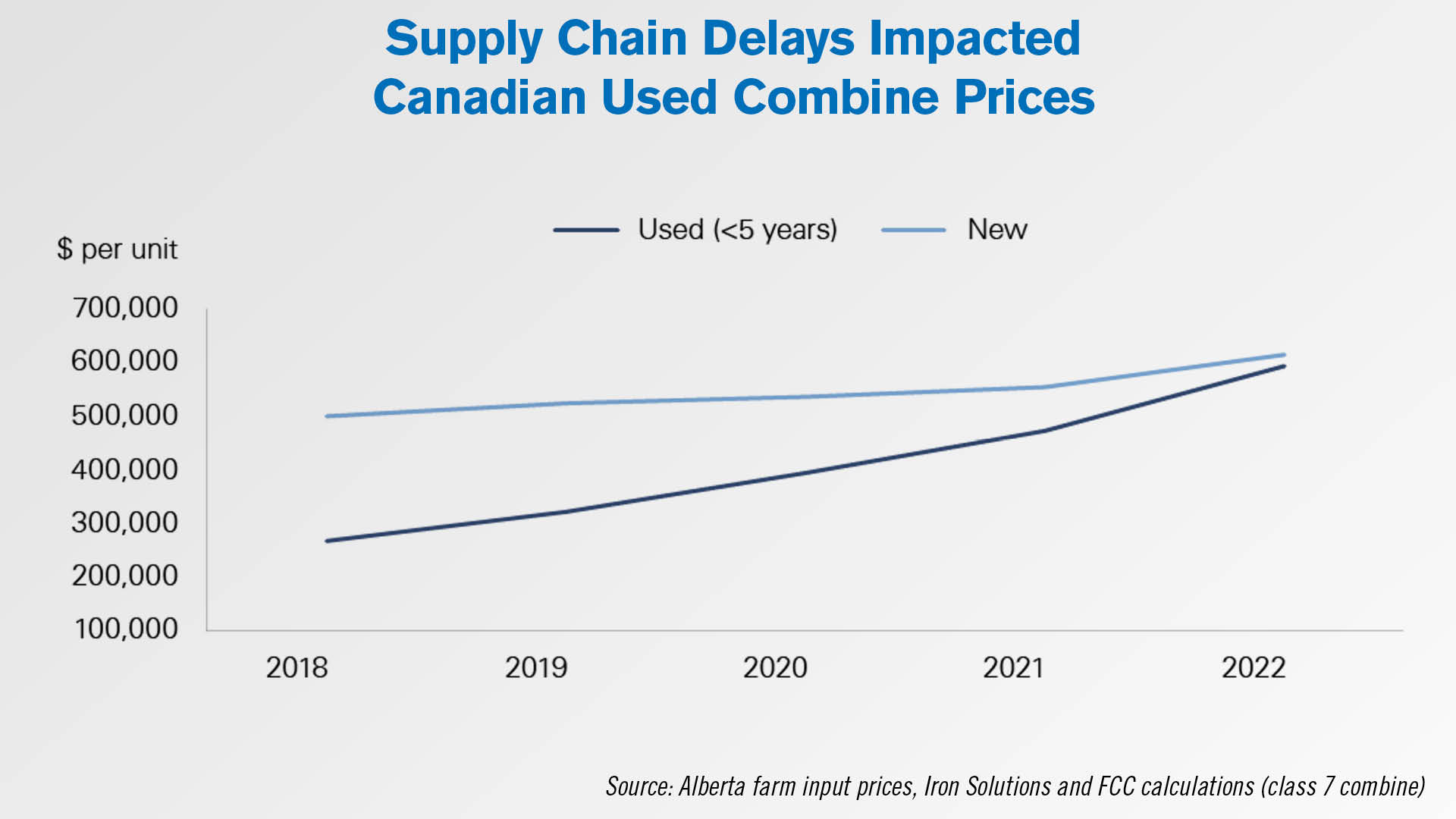

According to the report, the tight supply of new and used combines led to higher prices, with the spread between used and new combines becoming very narrow in 2022.

The FCC report notes that year-to-date combine deliveries from the manufacturers have increased by over 100. With most of these units being pre-sold, FCC is projecting combine sales to rise 40% in 2023.

With the trades coming in on the pre-ordered combines, FCC says the new combine inventory levels will likely trend above the 5-year average for the rest of 2023 and into 2024. As a result, the organization says used combine prices may drop.

Dealers on the Move

This week’s Dealers on the Move include Birkey’s Farm Store, Farm-Rite Equipment, Brandt and LMS Ag Equipment.

Case IH dealer Birkey’s Farm Store has entered into an agreement to acquire the dealership stock of Selby Implement. The acquisition includes full-line Case IH agriculture and power sports dealerships located in Quincy, Ill., and a power sports location in Hannibal, Mo. Finalization of the acquisition is expected on July 31.

Minnesota Shortline line dealer Farm-Rite Equipment has begun construction on a new building at its Willmar, Minn., location. The new building will include a showroom, shop and office space.

John Deere dealer Brandt Agriculture opened a new location in Red Deere County, Alberta. The 43,975-square-foot facility is an expanded version of the company’s previous Red Deer location.

And AGCO dealer LMS Ag Equipment has opened a second location in Steinbach, Manitoba.

Corn Belt Farmer Uses Drones for Multiple Tasks to Maximize ROI

We’re talking about drones this week, because they seem to be generating a lot of buzz amongst growers and dealers we talk to. In fact, nearly 18% of strip-tillers surveyed in the recently published Strip-Till Farmer Benchmark Study said they plan on purchasing drones next year.

Let’s go right to the source. Luke Schultes owns and operates Viola Drone Services in Audobon, Iowa. The business uses drones to perform fungicide and pasture spraying, seed cover crops and scout with multi-spectral imagery. He also uses them on his own farm to apply pre-emergence herbicide, biologicals, cereal rye and red clover as a relay crop into standing soybeans.

There are several steps to take before operating a drone. For example, Luke says in Iowa he had to get a drone pilot license, a crop duster license, an aerial commercial applicator license and register with the Iowa Depart of Transportation. The process is paying off for Luke, who says the return on investment has been great.

“It’s pretty versatile and cost efficiency is huge. A machine like this that can cover our family farm, costs 10% of what a sprayer would. A late model sprayer from the big manufacturers, as a young farmer, they’re outside of my budget. Having a smaller machine on smaller acres is the name of the game. It’s more efficient. My ROI and margins have been huge, definitely a good investment so far.”

Luke’s not alone in his usage of drones. According to the most recent No-Till Farmer Benchmark Study, 15% of no-tillers are using drones in 2023. In the Technology Corner, I’m Noah Newman.

AGCO Reports 2Q Sales Up 30%

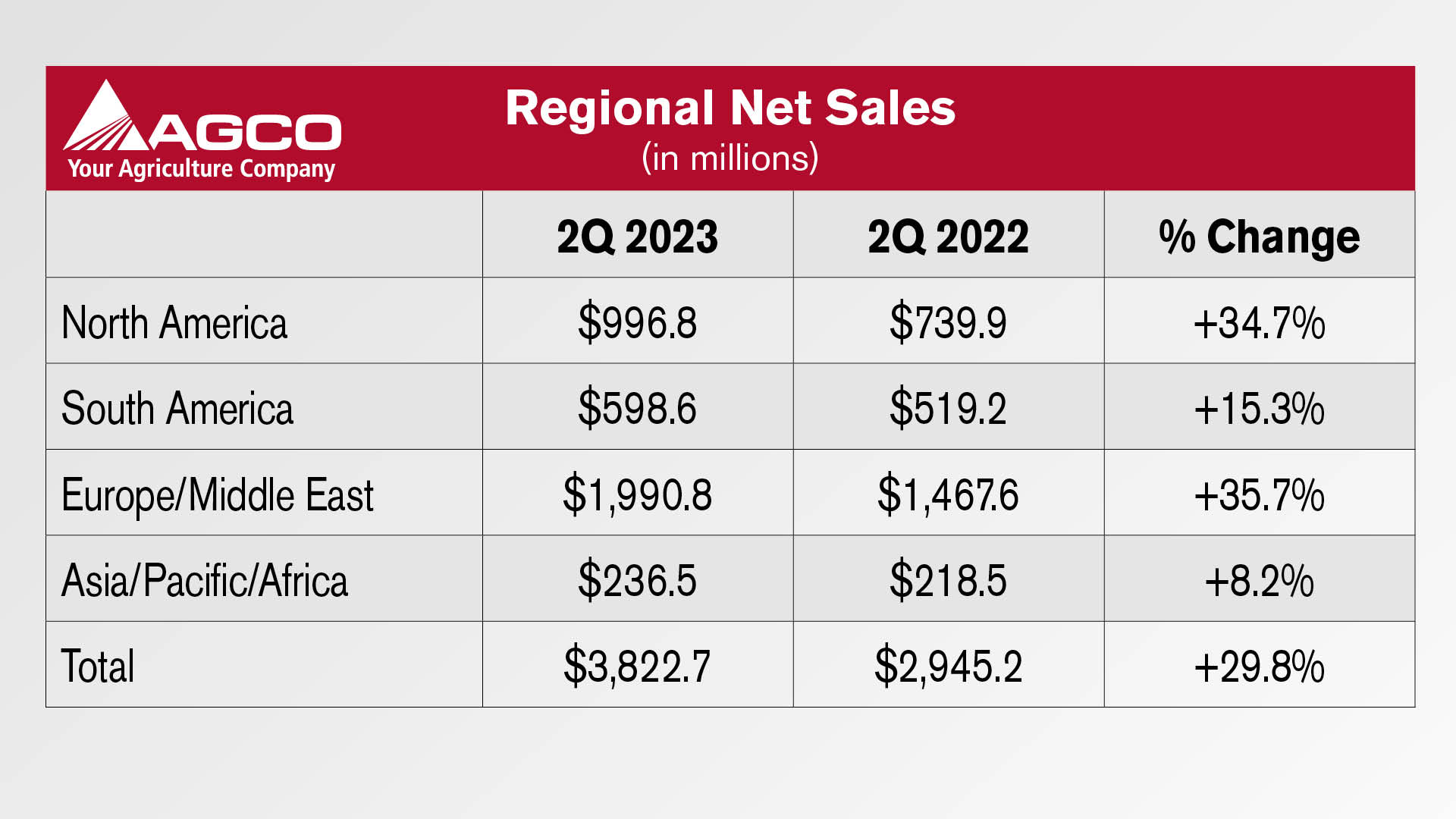

On July 27, AGCO reported its second quarter net sales were up nearly 30% year-over-year. Net sales for the quarter were approximately $3.8 billion. For the first half of the year, net sales were about $7.2 billion, up 27% vs. the same period of 2022.

On a regional basis, North American net sales for the second quarter were up nearly 35% to $996.8 million. AGCO says the growth was primarily from increased sales of high-horsepower tractors, combines and application equipment along with the positive effects of pricing to mitigate inflationary cost pressures.

Net sales were up about 15% in South America to $598.6 million. The largest growth in net sales was in Europe/Middle East, where AGCO recorded $1,990.8 million — an increase of nearly 36%. In Asia/Pacific/Africa, net sales for the quarter were up 8.2% to $236.5 million.

AGCO’s net sales for 2023 are expected to be approximately $14.7 billion, reflecting improved sales volumes and pricing. Gross and operating margins are projected to improve from 2022 levels, reflecting the impact of higher sales and production volumes as well as pricing and a favorable sales mix.

Used Combine Inventories Growing

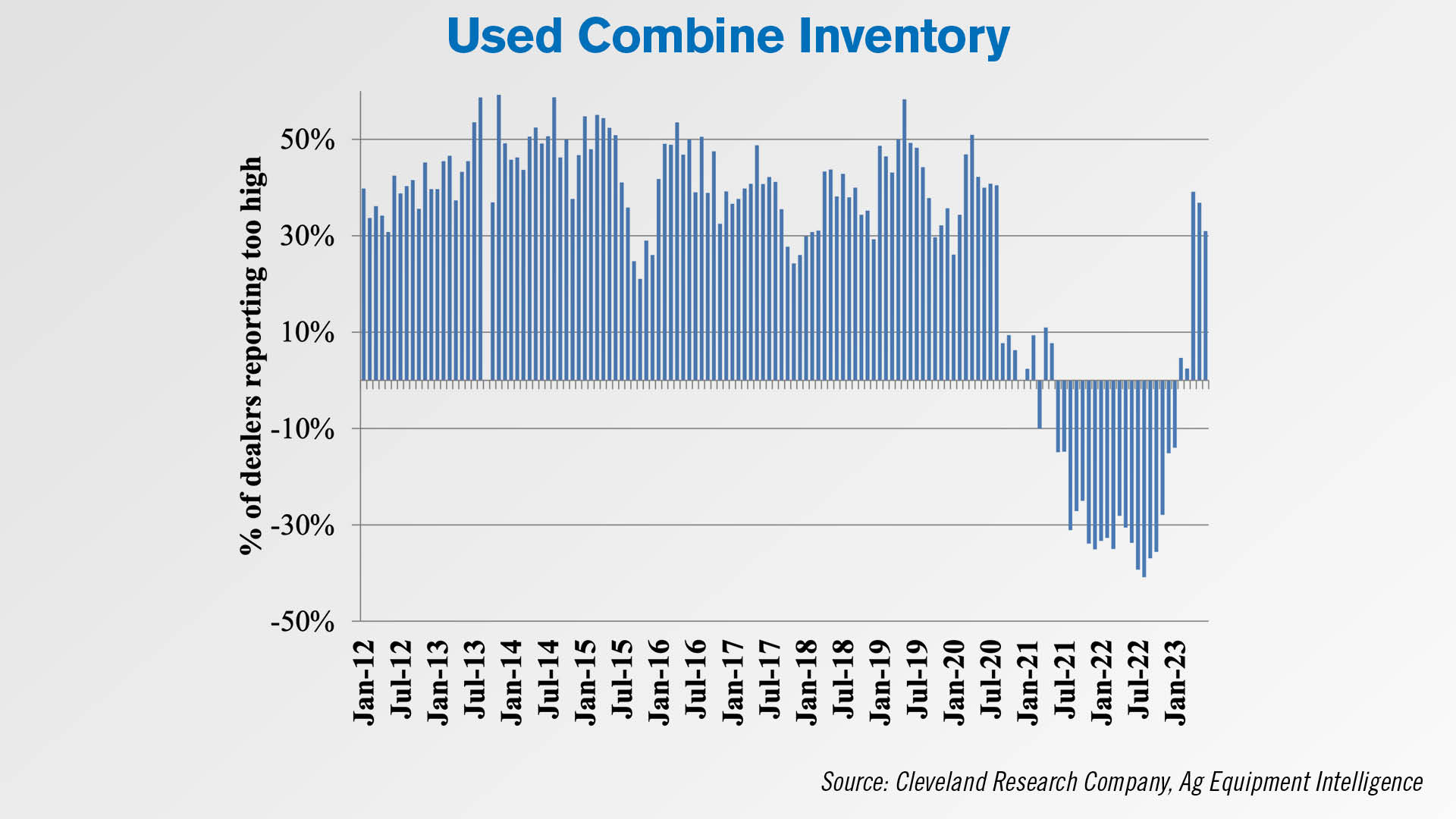

According to the results of our latest Dealer Sentiments & Business Conditions survey, used combine inventories remain elevated. In June, a net 31% of dealers reported used combine inventories were “too high.”

This marked the fifth month in a row dealers reported used combine inventories are too high.

One corn belt dealer said, “Used inventories are growing. We are exceeding plan on combines and becoming more concerned on inventory levels over the next 6 months as used values fall.”

Used equipment pricing was reported down for the second time since July 2020 at 4% year-over-year in June, similar to last month.

CNH Reports 2Q Revenue Up 8%

CNH Industrial announced its second quarter earnings this morning. For the second quarter, consolidated revenue was up 8% to $6.6 billion.

Agriculture net sales for the quarter were $4.89 billion, up 4% from $4.72 billion during the second quarter of 2022.

Financial services revenues were up 28% due to favorable volumes and higher base rates across all regions, the company says. This was partially offset by lower used equipment sales due to diminished inventory levels.

Stifel analyst Stanley Elliot said in a note to investors that the second quarter results were slightly below expectations for industrial activity sales.

Elliot says, “Top-line miss vs. consensus appears to be due to the Ag segment and driven by destocking in South America as well as delayed sprayer production in North America. We suspect weaker small ag sell-in trends is also a contributor. Bottom-line beat appears to be driven by better-than-expected margins, which is likely at least in part due to better mix in Ag (more large equipment sales) and pricing.”

U.S. Steel Production Remains Below 2021& 2022 Levels

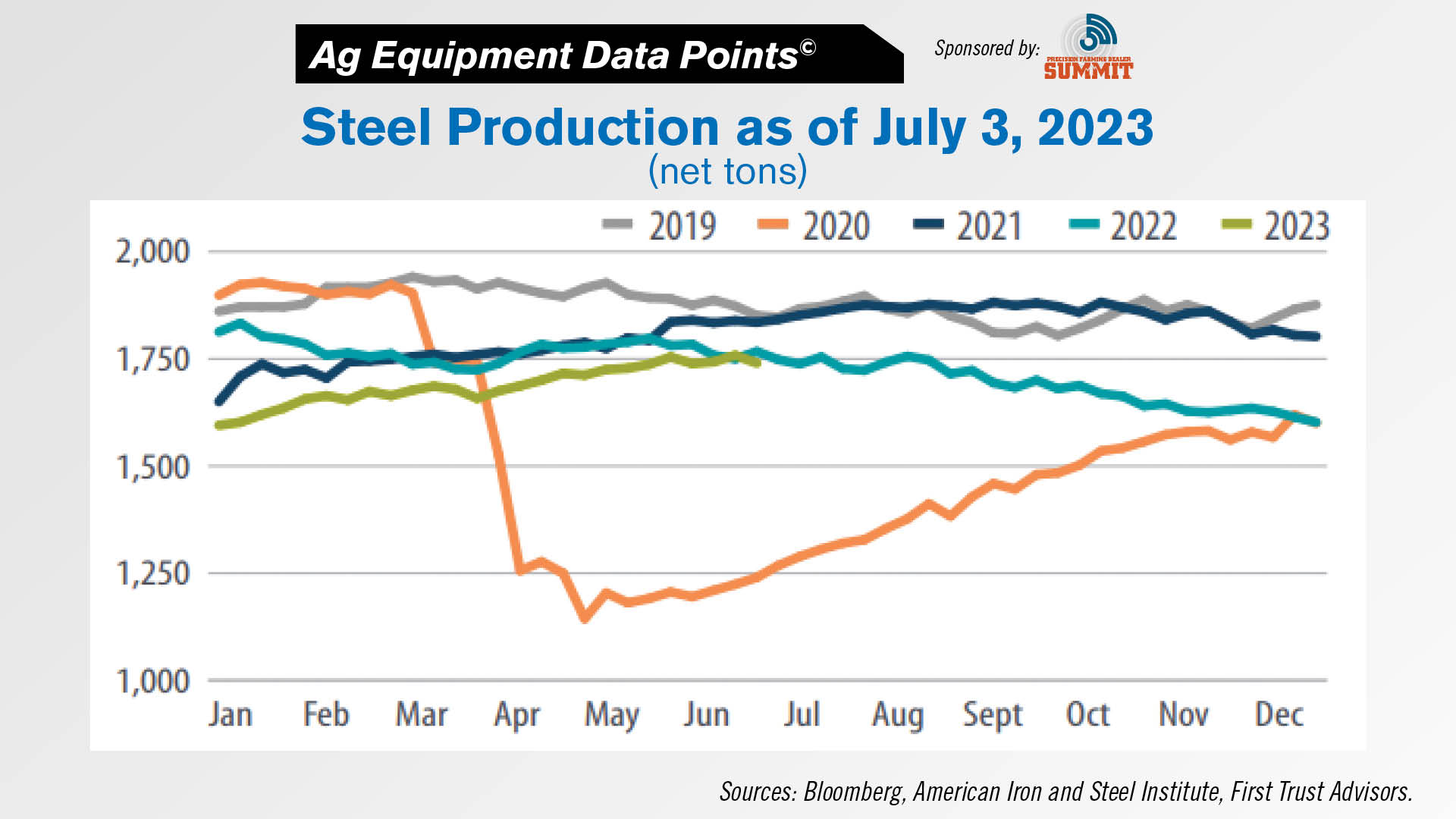

U.S. steel production as of July 3 remains below 2021 and 2022 levels, surpassing only the record lows seen throughout 2020.

Steel production for the year began at a 5-year low of around 1,600 net tons, though it has slowly risen since then.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.