Titan Machinery posted solid top and bottom line increases during its fiscal first quarter as each of its business segments saw healthy growth in sales of equipment, parts and service. Its first quarter results were better than many analysts were forecasting.

For the period, CNH Industrial’s largest distributor of farm equipment reported revenues of $278.3 million vs. $243.7 million in the first quarter of last year. Equipment sales were $194 million compared to $167.8 million in the first quarter of fiscal year 2019. Parts sales were $51.9 million vs. $46.9 million a year ago. Revenue generated from service was $22.8 million during the period compared to $20 million in the first quarter last year. Revenue from rental and other was $9.6 million for the first quarter of fiscal 2020, compared to $9 million in the first quarter last year.

Gross profit for the first quarter of fiscal 2020 was $53.9 million, compared to $47.6 million in the first quarter last year. According to the company, the increase in gross profit was driven by higher revenue. Gross profit margins decreased 10 basis points to 19.4% vs. the comparable period last year due to slightly lower equipment margins and a shift in gross profit mix.

Operating expenses increased by $5.8 million to $52.6 million, or 18.9% of revenue, during the period compared to $46.7 million, or 19.2% of revenue a year earlier. Floorplan interest expense of $0.9 million for the first quarter of fiscal 2020 decreased $0.5 million compared to the first quarter of last year.

Analysts’ Initial Comments

In a note to investors, Rick Nelson, analyst with Stephens, said, “Growth in equipment sales and international segment outpaced our estimates by a wide margin although margins were below forecast. All segments showed better year-over-year results with Ag and International segments showing profits and construction narrowing its loss.”

Commenting on Titan’s first quarter margins, Nelson added, “Gross margins decreased 10 bps to 19.4% vs. 19.5% last year. Our estimate was 19.7%. Equipment margins narrowed 40 bps to 10.7% vs. 11.1% a year ago and our estimate of 11.3%. The revenue mix shifted away from higher margin service/parts to equipment.”

Mircea (Mig) Dobre of RW Baird, added, “Topline growth remained strong in spite of challenging weather conditions (delayed planting) and deteriorating farmer sentiment. Most importantly, Titan saw double-digit growth in high margin Parts and Service — the best in several years.”

Segment Results

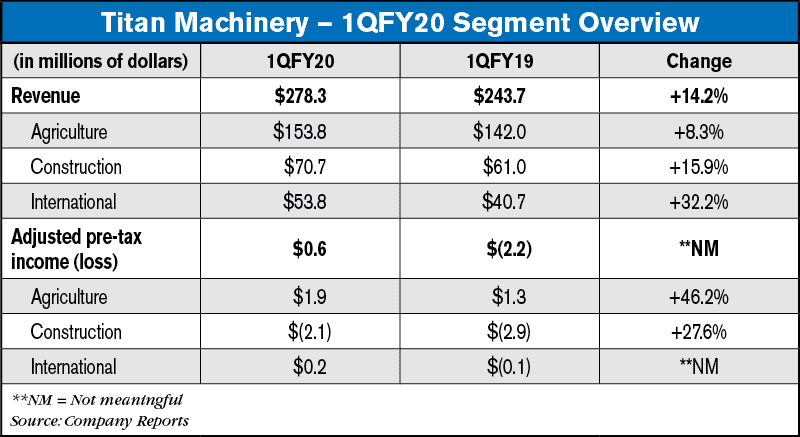

Each of Titan’s major business units reported revenue gains during the first quarter.

Agriculture. Revenue for the first quarter of fiscal 2020 was $153.8 million compared to $142 million in the first quarter last year. The increase in revenue was primarily the result of increased equipment revenue compared to a weaker first quarter in the prior year. Pre-tax income for the first quarter was $1.9million, compared to pre-tax income of $1.3 million in the first quarter last year.

Construction. Revenue for the first quarter of fiscal 2020 was $70.7 million compared to $61 million in the first quarter last year. The increase in revenue was primarily the result of increased equipment revenue. Pre-tax loss for the first quarter of fiscal 2020 was $2.2 million compared to a pre-tax loss of $2.9 million in the first quarter last year. Adjusted pre-tax loss for the first quarter of fiscal 2020 was $2.1 million compared to an adjusted pre-tax loss of $2.9 million in the first quarter a year ago.

International. Revenue for the first quarter of fiscal 2020 was $53.8 million compared to $40.7 million a year earlier. The increase in revenue was the result of revenue contributed by the AGRAM business following its acquisition in the third quarter of fiscal 2019 and a same-store sales increase in our other international markets. Pre-tax income for the first quarter of fiscal 2020 was $0.2 million, compared to pre-tax loss of $0.1 million in the first quarter last year.

FY2020 Outlook

Titan Machinery doesn’t expect significant changes to its earlier outlook for the remainder of this year.

| Current Outlook | Previous Outlook | |

| Segment revenue | ||

| Agriculture | Flat | Flat |

| Construction | Up 5-10% | Up 0-5% |

| International | Up 10-15% | Up 10-15% |

Commenting on Titan’s outlook, Dobre said, “Flat agriculture revenue guidance was maintained despite the clear erosion in farmer sentiment and OEM production schedules being adjusted lower in response to choppier/softer demand outlook against elevated inventories, though OEMs did reiterate their North American industry retail outlooks for modest growth, albeit talking down toward the lower end, large ag specifically.

“Titan’s intact guidance is likely a confluence of somewhat conservative initial guidance and relative near term stickiness of equipment sold under early order programs. Management’s commentary on customer sentiment/activity will be a key barometer of progression through FY20,” said Dobre.

He also suggested that ag industry retail sales comparisons get significantly tougher over the next few months. “Titan’s guidance embeds modest declines, industry retail sales should provide good clues on achievability of guidance.”