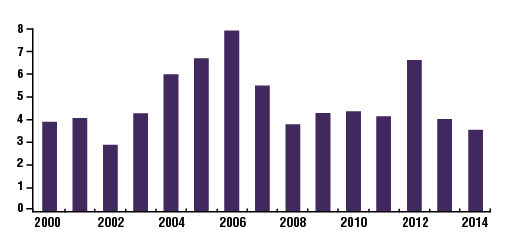

Farm Equipment Loan Volumes — 2000-14

(billions of dollars)

As short-term borrowing in the farm sector ramped up, intermediate-term loan volumes for farm equipment purchases fell further. Demand for farm equipment weakened as record crops led to lower prices.

Source: Agricultural Finance Databook

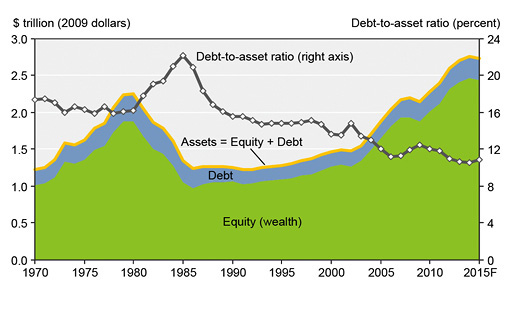

Farm Sector Assets, Debt & Equity

Note: F = Forecast. Data for 2014 and 2015 are forecasts. The gross domestic product (GDP) chain-type price index is used to convert the nominal (current-dollars) statistics to real (inflation adjusted) amounts (2009=100).

Source: USDA, Economic Research Service, Farm Income and Wealth Statistics. Data as of Feb. 10, 2015.

U.S. farm sector assets and equity (inflation-adjusted) are forecast to decline in 2015 for the first time since 2009. The rate of growth in U.S. farm sector assets and equity (assets minus debt) is expected to moderate in 2015 compared with recent years, and to decline for the first time since 2009 after adjusting for inflation.

The Federal Reserve Bank of Kansas City reports, “Tighter profit margins for crop producers drove increased lending to the agricultural sector for production loans but trimmed farm capital spending and demand for equipment loans.”

According to data released by USDA on Feb. 10, 2015, decreases in financial assets and a small drop in farm real estate value are driving lower projected farm asset growth. These declines reflect lower forecast net cash income for 2014-15, along with expectations of slightly higher interest rates. Farm sector debt is expected to increase in both nominal and inflation-adjusted terms in 2015.

As the data from the Kansas City Federal Bank indicates, debt is led higher by an increase in non-real estate borrowing because lower cash income is expected to reduce cash available to cover operating expenses. As a result, the debt-to-asset ratio is expected to increase from 10.6 to 10.9 in 2015, marking the first increase since 2009.

“Agricultural bankers reported sufficient funds were available to satisfy a rise in loan demand but also noted some deterioration in loan repayment rates and indicated collateral requirements had tightened slightly. After narrowing in 2014, the direction of farm sector profit margins in 2015 will be a key factor in determining whether agricultural credit conditions improve or worsen in the coming year,” reports the bank in the most recent edition of the Agricultural Finance Databook from the Kansas City Fed (Jan. 28).