North American equipment dealers’ latest outlook for 2014 calls for equipment sales to decline about 2%. This is slightly better than the 4% falloff dealers projected in the previous month. This compares with John Deere, which has forecast a drop in North American ag equipment sales of 5-10% for the year, and AGCO’s outlook that calls for flat to down 5% for sales in the year ahead.

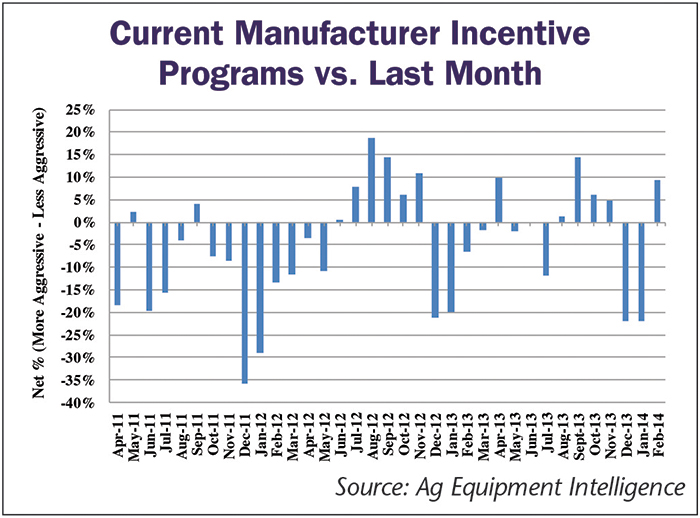

Results from the Dealer Sentiments & Business Conditions survey conducted in mid-March by Ag Equipment Intelligence and Cleveland Research Co., also indicated that farm equipment manufacturers were somewhat more assertive with sales incentives in February.

Overall, a net 9% of dealers report that manufacturers were more aggressive with incentives in February — 21% more aggressive; 67% same; 12% less aggressive — up significantly vs. the net 22% who reported manufacturers were less aggressive in December and January.

Inventories Remain a Concern for Dealers

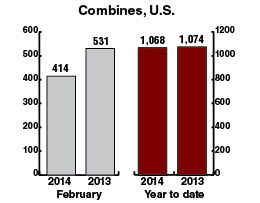

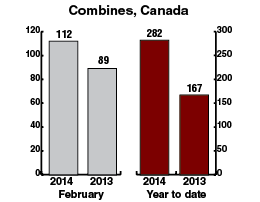

A net 30% of dealers reported used equipment inventory as “too high” in February — 44% too high; 42% about right; 14% too low — somewhat better than the net 42% of dealers who reported used inventories as “too high” in January. A net 46% of dealers reported used combines inventories were “too high” — 54% too high, 39% comfortable, 8% too low — which was flat with the previous month.

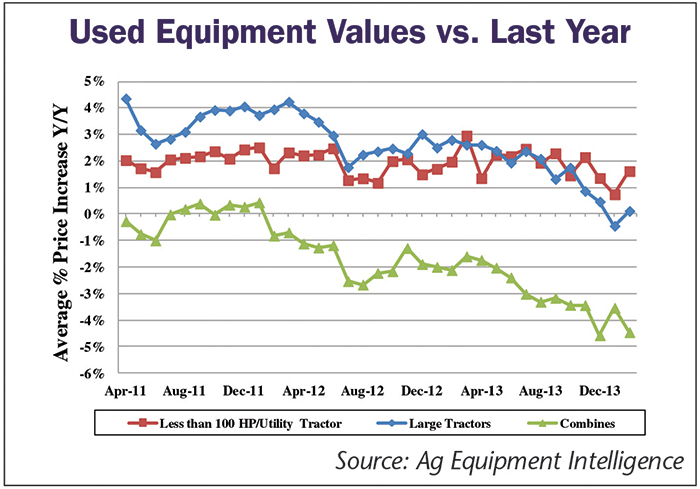

Dealers reported used combine values got worse in February on both a year-over-year and sequential basis to down about 4.5% year-over-year compared to down 3.5% in January. Used high horsepower tractor values rebounded slightly compared to last month and were reported flat year-over-year in the March Dealer Sentiments report.

In terms of new equipment, a net 9% of dealers categorize their new inventory as “too high” — 22% too high; 65% about right; 13% too low — slightly better than the net 12% of dealers last month who categorized their new equipment inventory as “too high.”

Ag Equipment Sales Soften in February

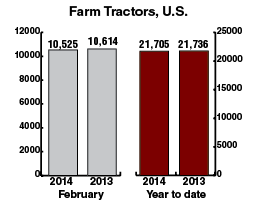

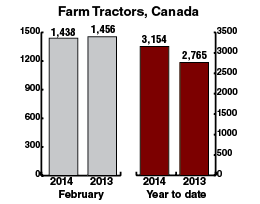

North American large ag equipment retail sales fell in February, with 4WD tractor sales down 14.1% year-over-year, combine sales down 15.2% and row-crop tractors down 6.4%, according to the Assn. of Equipment Manufacturers.

Inventory levels and days-sales of inventories rose year-over-year across all large equipment categories (except combines), with growing risk for inventory destocking in 2014 given projected sales declines, Mircea (Mig) Dobre, analysts with RW Baird, said in a note to investors.

U.S. and Canada large tractor and combine retail sales decreased 9% year-over-year in February, down from the 12% increase in January. U.S. sales decreased 9% vs. the same period last year and Canadian sales were down 8%. Combine sales were down 15.2% year-over-year.

—Ag Flash Reports, Assn. of Equipment Manufacturers