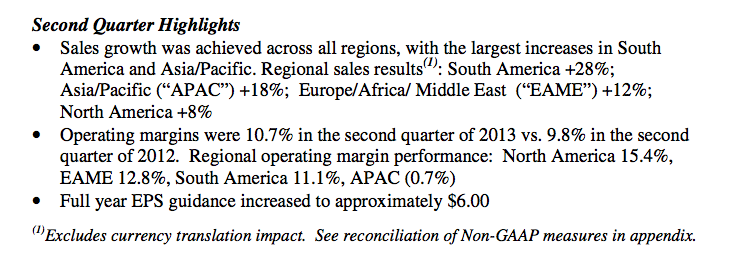

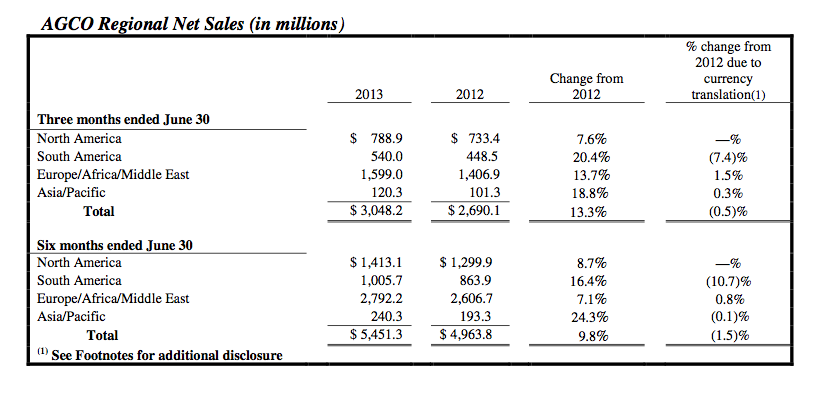

AGCO (NYSE:AGCO), a worldwide manufacturer and distributor of agricultural equipment, reported net sales of approximately $3.0 billion during the second quarter of 2013, an increase of approximately 13.3% compared to net sales of $2.7 billion for the second quarter of 2012. Net income for the second quarter of 2013 was $2.15 per share. These results compare to net income of $2.08 per share for the second quarter of 2012. Excluding the unfavorable currency translation impact of approximately 0.5%, net sales in the second quarter of 2013 increased approximately 13.8% compared to the second quarter of 2012.

Net sales for the first six months of 2013 were approximately $5.5 billion, an increase of approximately 9.8% compared to the same period in 2012. Excluding the unfavorable impact of currency translation of approximately 1.5%, net sales for the first six months of 2013 increased approximately 11.3% compared to the same period in 2012. For the first six months of 2013, net income was $3.34 per share. This result compares to net income of $3.29 per share for the first six months of 2012.

“AGCO’s strong performance in the second quarter produced record earnings and operating margins in excess of 10%,” stated Martin Richenhagen, Chairman, President and Chief Executive Officer. “Healthy market demand in North and South America generated growth in both sales and production. Low levels of material cost inflation coupled with our margin improvement initiatives also contributed to our improved results. We are successfully increasing margins through purchasing actions, factory efficiency projects and new product development. Our performance against our working capital targets is on track, and we are positioned for another year of strong cash flow generation.”

Market Update

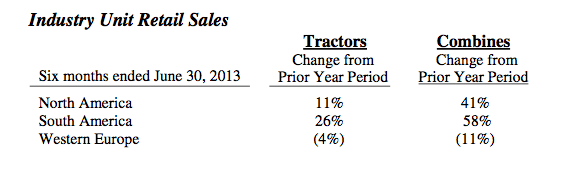

“Elevated levels of farm profitability continued to drive global demand for agricultural equipment this quarter,” stated Mr. Richenhagen. “North American industry sales remain strong, despite the late and compressed Spring planting season. Crop conditions are tracking well, and the projected yields are well above last year’s drought- impacted production. Crop prices have declined, but remain at attractive levels. Market demand is mixed across Western Europe. The lingering impacts of a poor 2012 harvest and a cold, wet Spring are negatively impacting industry sales in the United Kingdom, Finland and Southern Europe. Strong levels of demand continue in the larger European markets of Germany and France. Market sales are robust in Brazil, where improved crop production, expanded government financing programs and favorable grain prices are supporting farm equipment investments. The growing population and the shift to higher protein diets are expected to drive increases in the consumption of food and demand for grain, providing long-term support for farm income and our industry.”

Regional Results

North America

Net sales grew 8.7% in AGCO’s North American region during the first half of 2013 compared to 2012. The expectation of improved crop production and attractive soft commodity prices supported elevated levels of industry demand. Sales were strongest in the professional producer segment, with the most significant increases in high horsepower tractors, implements and combines. Higher sales, a favorable product mix and margin improvement initiatives contributed to growth in income from operations of $47.8 million for the first half of 2013 compared to the same period in 2012.

South America

South American net sales grew 27.1% in the first half of 2013 compared to the same period in 2012, excluding the negative impact of currency translation. Higher sales in Brazil and Argentina produced most of the increase. Brazilian farmers benefited from an improved first harvest compared to the drought-impacted production in early 2012. Operating margins improved to 10.7% for the first six months of 2013 compared to 7.6% in the same period last year due to higher sales and the benefit of cost-reduction initiatives. Income from operations increased $42.4 million for the first half of 2013 compared to 2012.

EAME

Net sales improved by 6.3% in AGCO’s EAME region in the first six months of 2013 compared to the first half of 2012, on a constant currency basis, despite softer market conditions. Sales growth in France and Germany was partially offset by declines in the other European markets. EAME’s income from operations in the first half of 2013 was approximately flat compared to the same period in 2012. The benefit of higher sales was offset by increased engineering expenses and transition costs associated with the new Fendt tractor assembly facility during the first half of 2013.

Asia/Pacific

Excluding the negative impact of currency translation, net sales in the Asia/Pacific region were 24.4% higher in the first six months of 2013 compared to the same period in 2012. Growth in China, East Asia and Australia produced most of the increase. Income from operations in the Asia/Pacific region declined by $1.3 million in the first half of 2013 compared to the same period in 2012. The benefit of higher sales was offset by increased market development costs in China.

Outlook

Global industry demand is expected to be relatively flat in 2013 compared to 2012. Growth is projected in South America and North America while modest declines are anticipated for Western Europe. AGCO is targeting earnings per share of approximately $6.00 for the full year of 2013. Net sales are expected to range from $10.8 billion to $11.0 billion. Gross margin improvement is expected to be partially offset by increased market development expenses and higher engineering expenditures to meet Tier 4 final emission requirements.

“Following our strong performance in the second quarter, AGCO is on track for another year of record earnings. Our outlook for the remainder of the year remains solid, and we have increased our 2013 sales and earnings guidance,” continued Mr. Richenhagen. “Our priorities in 2013 are focused on meeting margin improvement targets while continuing to make strategic investments to benefit our long-term results. These investments include construction of a production facility in China and significant expenditures on new product development and market expansion. ”