Robert Ratliff, retired chairman, CEO and founder of AGCO Corp.

Career: Robert J. Ratliff founded AGCO Corp. in 1990 and served in various executive positions, including as chairman, president and CEO, before his retirement in 2006. During his tenure, AGCO made dozens of acquisitions and grew into the third largest full-line farm equipment manufacturer in the world.

Prior to the start up of AGCO, Ratliff worked in several executive positions with the International Harvester (IH) truck group. When he left the company after 25 years, he was president of its export group. He had also been senior vice president of sales and marketing.

He went on to become president of Uniroyal Tire until it was sold. In 1988, he joined Deutz-Allis as its president. At the “urging” of Deutz-Allis’ parent company in Germany, Ratliff, along with other associates acquired the maker of the Allis-Chalmer tractors and Gleaner combines in 1990.

Ratliff retired at the age of 75 and says, “I thought it was only appropriate that I leave period and stay away. I felt it was only fair to my successor. I say this modestly, but I did cast a pretty big shadow in the building and you can’t have that happening if somebody else is trying to run the business.”

He remains active in other businesses including with the Piedmont Bank of Georgia, which he helped organize following his retirement from AGCO.

“I had spent 25 years with the truck group of International Harvester (IH). In its heyday, IH was a force to be reckoned with when it came to trucks and farm machinery. Until the mid-1960s, the company was considered the largest manufacturer of ag equipment and the truck group was number one in market share in North America.

“With the exception of Caterpillar, the IH truck group had the strongest dealer organization for heavy goods in the U.S. It was a very strong group of dealers. They were very loyal and supportive. They were leaders in the trucking industry and we learned a lot from them. And the IH truck group initiated a lot of new concepts in distribution that became industry standards when we put them in place in the 1970s.

“But there was little crossover between IH’s truck and farm machinery groups. I had direct contact with our truck dealers as senior vice president of sales and marketing. When I left IH after 25 years with the company, I was president of its export company, which was rather sizeable.

“My next job was as president of Uniroyal Tire, which was eventually sold. In 1988, I went to work for Deutz-Allis and was told to stop the bleeding. The German owners of the company, Klöckner Humboldt and Deutz, or KHD, were doing about $300 million in annual revenue and losing about $80 million. My job was to do something about it.

“This was my first exposure to the agricultural business but the similarities between retailing trucks and farm machinery were very evident. Quite frankly, in spite of the difference in end products and customers, the activities and distribution methods for trucks and farm equipment were very similar. It’s just a different customer base. So I was familiar with the business structures, but I certainly had a lot to learn about the product.

“My goal was to affect the turnaround of Deutz-Allis in one year and we initiated several dramtic changes, including moving its headquarters from West Allis, Wis., to suburban Atlanta. We only took 35 people with us in the move, which was a major shift.

“During this time KHD continued seeking buyers for its North American operations, which was was difficult considering the losses they had generated. No buyers were found during my first year at the company’s helm. But it was a now famous event that took place in 1989 that completely changed how the KHD decided to handle the sale of its Deutz-Allis operations. That event was the fall of the Berlin Wall.”

AGCO Gets Its Start

“KHD immediately ‘faced east’ and redoubled its efforts to get out of North America so it could focus on developing the potential of the newly opened East German ag equipment market.

“KHD called me to Germany for a meeting and suggested that I buy the company. I wasn’t very interested, but they kept pursuing it and I thought I’d never get home if I didn’t agree. I finally told them I’d go home and talk to my associates and we’ll see what we could come up with.

Online Exclusives:

- How AGCO Grew During Bob Ratliff’s Tenure

“We decided to make a very low offer of about 40 cents on the dollar thinking KHD would never accept it. But they accepted it immediately, so I guess we weren’t low enough. Of course, we didn’t anticipate that the Germans would accept the bid and we had made no plans for financing the deal.

“We really couldn’t find the money anywhere, long term or short term. It seemed like we called on every bank in the world but no one would finance the purchase. It wasn’t a good time as it was somewhat similar to today’s economy.

“It wasn’t an entirely new idea, but we finally proposed selling the company’s receivables to finance the acquisition and we’d take the cash and pay off the original owner. In a sense, we would use their money to buy their company. The receivables were quite large because they represented all the dealer inventory out there.

Don Millard of AGCO, and Cleve Buttars (ctr), owner of Agri-Service, accepts top volume dealer award for 2004 from Bob Ratliff, chairman and CEO of AGCO Corp.

In fact, their receivables were so large, we were able to pay for the acquisition and had money to put in the bank. Without borrowing any money, we started AGCO in June 1990. (See “How AGCO Got Its Name” at www.farm-equipment.com.) The company turned a profit in 12 months, so we knew there was good potential for profitability in the longer term.”

An Industry Consolidator

“The Deutz-Allis acquisition included the Allis Chalmers tractor line and the Gleaner combines, but we knew we had to offer more.

“It was a period of time when profits were difficult to come by and a great many companies were getting out of business. So we became a consolidator of a lot of smaller, but very familiar equipment brands. (See “How AGCO Grew During Bob Ratliff’s Tenure” at www.farm-equipment.com)

“With each acquisition, our dealer network expanded. But, we quickly discovered, a lot of dealers on the roster didn’t mean a lot of dealers were actually selling our products.

“When we acquired the Deutz-Allis business, they had a roster of 2,000 dealers, but in reality there were only about 800. The rest weren’t really handling any of our lines or selling any of our products.

“It was really a sad situation as far as the dealer organization. They had suffered from at least five years of products that hadn’t worked very well, and they were being squeezed by the competition, the economy and high interest rates. We realized right from the outset that our future was in our dealer organization and if we couldn’t resurrect a pretty strong group, we wouldn’t last very long.

Two of AGCO Corp.’s founding fathers, John Shumejda, CEO, and Bob Ratliff, chairman, proudly show off AGCO’s newest tractor. On January 4, 2002, Shumejda and Ed Swingle, AGCO’s vice president of marketing, were killed in a plane crash in England.

“We really focused on it. In fact, we believed it was such an important function within our business that I spent more than 50% of my time working on it. We were really fortunate to find a core of dealers looking to build with us. When I think back about why we succeeded, it would have never happened without that core of dealers.”

A Cross-Over Strategy

“Again, each time we bought another company, we also acquired their dealers. By the time we finished building our organization, we were probably back up to 2,000 dealers, but they had all come from different cultures and different product backgrounds.

“We began a strategy of cross-franchising brands among all of the dealers. For instance, if a Massey dealer didn’t have a hay tool, we would want to sign him as a Hesston dealer. Or if it was a Hesston dealer and he didn’t have a tractor, he could take his choice, Massey, Allis or White. This helped our dealers expand their revenue opportunities, which we tried every way we could to make them profitable, while at the same time growing our business. Because of the opportunities that were presented to us, we inadvertently created what we called the cross-over strategy with our dealers.

“We also went to market a little differently than the traditional approach to distribution. Most everybody had regional managers and regional or county areas that were handled by a manager or a company representative. Since we had so many different brands, we had to create a system where one zone manager handled all of our brands in a given geographical area. Many of our dealers said this approach would never work. They believed the loyalty of the zone manager would be conflicted and they wouldn’t know how to handle that.

“We were able to accomplish it without any difficulty whatsoever. It took a while, but it worked. And this approach allowed us to be much more efficient and it also helped us avoid internal competition. When I say this, you only need to look at Detroit and the internal competition with Chevy vs. Buick vs. Cadillac. That internal competition drives up costs and you’re not as efficient as you should be. When I was trying to sell tires to GM, I found out about all this myself. So that tire business was quite a good experience for me.”

Our Best Partners

“As our strategy unfolded, we grew and improved our products. Then we went overseas and got into the international markets. We began to pick up other technology we didn’t have and began building it into our other products. It was a very, very successful strategy and it got to the point where the dealers were the best partner we had.

“We communicated with them frequently. One of our trademarks was our town hall meetings where we went out and sat down with our dealers in groups. We would ask them questions like, ‘How do we fix this issue? What can we do to help you? What do you need?’ And we responded to those suggestions and ideas on the spot.

“It didn’t take us long to make a decision because we were very, shall I say, narrow at the top. We didn’t have a lot of staff functions because everybody had a line function. When we needed a decision, it only took three or four people and we were off and running. So the dealers realized we were there to move quickly and, as you know, the bigger you get, the slower everything gets. In the early days we had the advantage of that flexibility and it paid off.”

Creating Dealer Competition

“While we continued to accumulate dealers with every acquisition, we actively recruited new dealers as well. There were some energetic people that we wanted to be dealers badly enough, that we even lent them money to get started. I look back on that and they are some of the largest dealers that AGCO has today. They turned out to be good investments in people that could get the job done.

“What set the best dealers apart? There was probably more than one situation like this, but there was one town in California where there were four farm equipment dealers on the four corners of the main intersection, and they were all our dealers. Someone asked me, ‘How in the world do you manage that situation? It must keep you up at night trying to figure that out.’ I said, ‘No, to the contrary, I slept better because I knew we got the deal on one corner or the other, I just didn’t know which dealer got it.’

“What we allowed to happen was clean competition between independent, franchised dealers that really focused on who serviced their customer the best. And that’s what it’s all about. If you serviced the customer extremely well, he’ll come back to you. This has been proven over and over again, no matter what brand you sell. The farmer will come to the dealer who services him the best. It proves that, in agriculture, loyalty to the dealer is stronger than the loyalty to the brand.

“My good friends at John Deere and Case probably wouldn’t want to hear me say this, but I’ve said it in public many times.”

Succession Planning

“I also believe that some dealers need to go out of business. Confronting some dealers about this is a problem that has always bothered me. I think it’s still difficult today. If you’re an independent franchise dealer out in a small town and you finally reach the age of retirement but don’t have any kids to take over the business, both of us have a problem. There’s probably not a huge market for your dealership because the value of it is often tied to you and your personal relationships and not the brick and mortar.

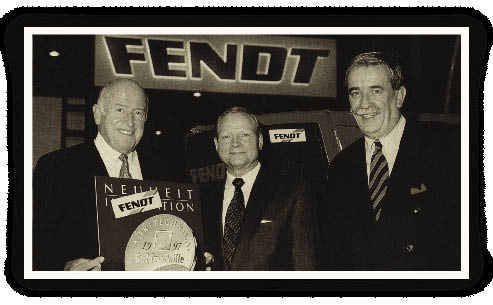

In 1997, AGCO added German tractor Fendt to its growing list of farm equipment brand names. Bob Ratliff, Georg Bickeleiter and Hermann Merschrot (l-r) of Fendt display the gold medal awarded to Fendt for its Vario transmission.

“We worked with our dealers to address succession planning and how they could preserve that growth. This became a bigger challenge as the number of dealers began shrinking but the markets they were covering were getting larger.

“Our acquisition of Caterpillar’s Challenger tracked tractor in 2002 helped the situation somewhat, as it provided Caterpillar dealers the opportunity to broaden their base. Some of them bought AGCO dealers who wanted to retire but wanted to keep the franchise alive. Some even went to work for Caterpillar dealers for a couple of years for a smooth transition.

“This became a solution in some areas and in some situations to preserve our dealer network, and at the same time provide our dealers an opportunity to maximize recovery of their investments. It’s not something you go out and push, but we used it as a tool of transition.”

Bigger Dealers

“I understand that dealers must get bigger because the trend toward corporate farms is going to continue and someday the family farm will only be a piece of history, unfortunately. But trends are trends and, there are economic reasons that are forcing agriculture in that direction. I see corporate farming growing much larger than it is today. That will dictate the way the distribution of equipment changes.

“At the same time, it’s becoming a bigger challenge for dealers because as they expand they lose that personal touch with customers. Nobody runs your store better than you will if you own it. I don’t care who you are, in my mind, it goes back to the values that I placed on service and customer support, which usually is the best from the guy who owns the business. The challenge is to get a manager who is as dedicated to the success of your business and supports his customers as if he owned the business. It can be done with incentives and so on, but I worry that trend may have backlash in time.

“The only thing that I can say that’s a benefit to getting bigger is with the trend to corporate farms, there are fewer customers. It then becomes incumbent on distribution to stay proportionate to the number of customers in the market.

“I still am a strong believer in the franchise dealer network as a distribution strategy. Even with the corporate farmer, attention to service is the most important factor in their business. That’s not going to change because, if a farmer spends a quarter of a million dollars on a combine and it doesn’t do what it’s supposed to do, that may be the last time you ever see him. You just can’t afford that risk and so you’re going to have to make sure everything works and it works to his satisfaction. This will be more important than ever as the prices get higher and the equipment gets bigger — the whole challenge gets bigger.”

Post a comment

Report Abusive Comment