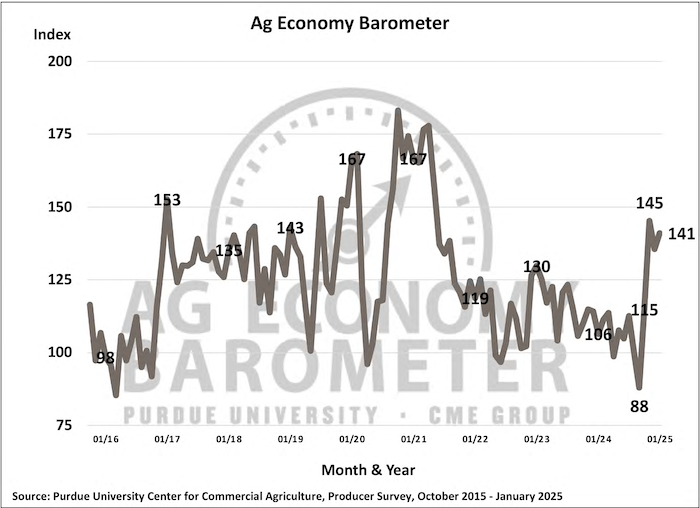

U.S. farmers retained their post-election optimistic outlook at the start of the new year as the January Purdue University-CME Group Ag Economy Barometer Index rose 5 points above a month earlier to a reading of 141. The barometer’s rise was primarily attributable to a 9-point rise in the Current Conditions Index, while the Future Expectations Index rose just 3 points. Compared to recent surveys, fewer producers this month pointed to lower crop and livestock prices as a top concern, which helped explain why producers felt better about the current situation. The shift in attitudes was attributable in part to an improvement in crop prices from the time of the December to the January survey. For example, Eastern Corn Belt prices for near-term delivery of corn and soybeans rose 9% and 5%, respectively, from early December to mid-January. Although producers’ appraisal of the current situation improved in January, U.S. farmers remain markedly more optimistic about the future than the current situation, as the Future Expectations Index this month was still 47 points above the Current Conditions Index. The January barometer survey took place from January 13-17, 2025.

In a note to investors J.P. Morgan analyst Tami Zakaria wrote, “Producers' concerns about lower crop and livestock prices have diminished compared to recent surveys, contributing to a more positive outlook on the current situation. This shift is partly due to improved crop prices, with Eastern Corn Belt prices for near-term delivery of corn and soybeans increasing by 9% and 5%, respectively, from early December to mid-January. Despite this improvement, U.S. farmers remain significantly more optimistic about the future than the present, as indicated by the Future Expectations Index being 47 points higher than the Current Conditions Index.

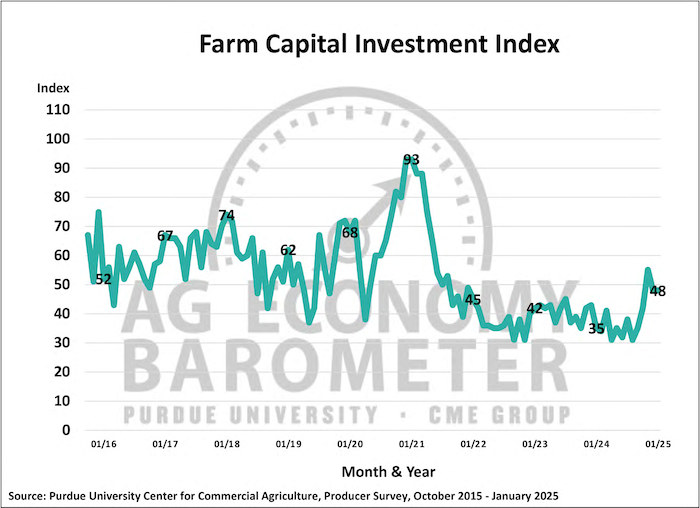

The Farm Capital Investment Index, at a reading of 48 in January, was unchanged compared to a month earlier. The investment index continues to be notably stronger than last summer when it dipped to a low of 31, with this month’s index the second-highest reading of the last three years. Optimistic expectations for the future appear to be behind the strength in the investment index, but it remains to be seen whether producers’ improved attitude translates into more farm machinery and new construction investments.

Since 2020, each January barometer survey has included questions about farmers’ operating loans for the upcoming year. The percentage of respondents who said they expect to have a larger operating loan this year compared to a year ago rose to 18%, up slightly from last year’s 15%. In a follow-up question, producers who expect to have a larger loan were asked why their loan size was increasing. This year, 23% of farmers who expect their loan size to increase said it was because they were carrying over unpaid operating debt from the prior year, up from 17% last year and just 5% two years ago. The shift is reflective of the decline in farm income, particularly crop income, that has taken place in the last two years and could be an early sign that financial stress among producers is increasing.

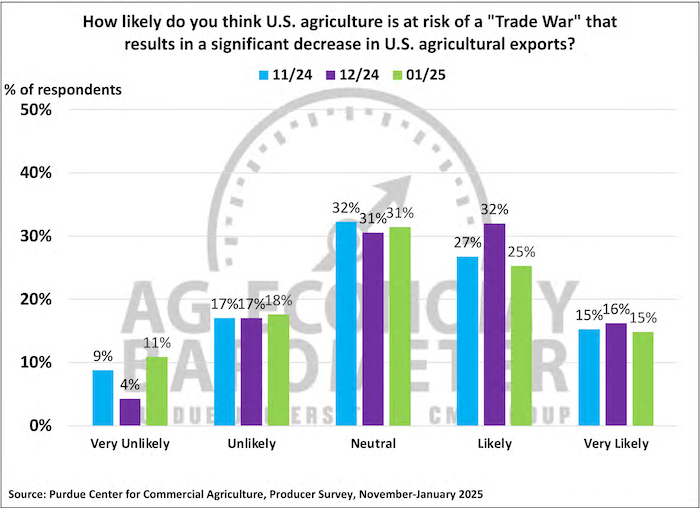

The future of agricultural trade is on many producers’ minds. When asked in January which policy or program will be most important to their farm in the next five years, 42% of respondents chose “trade policy,” which was more than double the percentage who chose “crop insurance program.” Unsurprisingly, there is significant concern among U.S. farmers that a trade war could break out that negatively impacts U.S. ag exports, although attitudes did appear to shift from December to January. Over the last three months, the percentage of U.S. producers who think a trade war is either “likely” or “very likely” has ranged from a high of 48% in December to this month’s low of 40%. Meanwhile, the percentage of producers who think a trade war is either “unlikely” or “very unlikely” rose to 29%, up from 21% in December.

James Mintert, Ph.D., professor emeritus, Dept. of Agricultural Economics at Purdue Univ., provides a breakdown of the report each month.