Sometimes it’s not a specific piece of equipment you are selling a customer on, but a change in farming practice. H&R Agri-Power has created a strip-till feasibility calculator to help introduce customers to the practice, which still is relatively new in their AOR. “I use this as an ice-breaker when I get called into a particular customer who may have expressed interest in strip-till,” says Jeff Morgan, regional manager for the 17-store Case IH dealership based in Kentucky. Those customers want to know how much it’s going to cost, what’s it going to do, what should their expectations be and how are they going to manage their fertilizer, for example.

“Before we get too far down the road as to what size tractor they’re going to need and how’s it going to impact their rotation and that type of thing, I’ll ask the question, ‘What do you think your N, P and K costs are on average on your corn acres?’ We know $200 an acre is a good number to talk about,” he says. “And we also know that there is a fear among these people when they go from fertilizing and managing fence row to fence row when we go to managing by row, they don’t want to mine the fertility they’ve built over years. In their mind, that’s money in the bank. They don’t have to mine that investment.

“But they also realize we’ve got to change the economy of growing corn, soybeans or whatever in a strip-till environment. They know there’s going to be some type of N, P and K reduction. So we’ll start off conservatively. I try to use their number and ask what they feel comfortable reducing their rate by. Usually 10% is the number.”

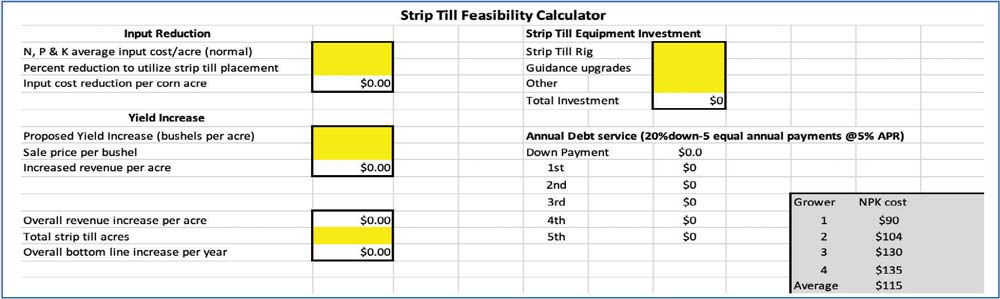

Plugging the number into the calculator, at $200 an acre, cutting the rate by 10% is a savings of $20 per acre. Then Morgan asks, “Based on what you’ve read and what you think you know, what kind of yield increase do you think you’re going to get in terms of bushels?” He says once again 10 bushels an acre is a typical response. At today’s market of $4 corn, that’s an added $40 an acre. “So the net gain through input reduction and yield increases, we should be $60 an acre to the good,” he says.

Next, they talk about how many acres the farmer thinks he can manage through strip-till. Morgan says if he’s a 1,500 acre corn grower, he will likely feel comfortable with about a third of his land. “If we can implement this strip-till process, the bottom line increase per year on those 50 acres should be $30,000,” Morgan says.

Of course, this all comes with an investment. Morgan says whether it’s a 6-row or 8-row strip-till rig, with or without fertilizer, the starting point is going to be about $100,000 for the equipment, plus RTK upgrades they might not have yet as well as an implement steering hitch. “So this person could be looking at a $125,000 investment. And whenever you make the down payment and annualize it over 5 years, the return is a little greater than the cash outlay. But we know this is a process. We know they’re going to learn from one year to the next. They’re going to be more efficient. They’re going to learn they can change these thresholds. They’ll get comfortable at a 20% reduction. And they’ll also recognize that 10 bushels is conservative. They’re probably at 20 bushels. And they’ll also see that instead of the 500 acres, they can probably bump that up.

“So with this same $20 or $25,000 cash outlay a year, you could probably get a $90-plus return. And this is reality. Your first year’s not going to be as good as some of your future years as you learn the process.”

At this point, Morgan says he still hasn’t even brought up brand to the customer. They are strictly talking about the process in general because the concept is so new in the region.

“One of the themes that I try to focus on, or instill is focus on the right number. The right number here is return on investment. We’ve not focused on the fact that this strip-till rig really could be $100, $125 or $150,000 investment. That is really, irrelevant. What’s relevant about this is it’s not how much it costs. It’s what it’s worth,” says Morgan.

Related Content

How Dealers Can Use ROI to Sell More than Farm Equipment: To successfully sell customers on ROI, determine the numbers that are important to them — hours saved, fuel savings, yield increases — and go from there.