QUINCY, Ill. — Titan International Inc. (TWI), a global manufacturer of off-highway wheels, tires, assemblies and undercarriage products, today reported results for the third quarter ended Sept. 30, 2020.

Net sales for the third quarter of 2020 were $304.8 million, compared to net sales of $345.9 million for the third quarter of 2019, representing a $41.1 million, or 11.9% decrease. On a constant currency basis, net sales for the third quarter 2020 would have been $324.9 million. The third quarter of 2020 results include an expense of $5 million for a contingent legal accrual related to an anticipated litigation settlement. Net loss applicable to common shareholders for the third quarter of 2020 was $12.6 million, equal to a loss of $0.21 per basic and diluted share, compared to loss of $19.6 million, equal to a loss of $0.33 per basic and diluted share, in the third quarter of 2019.

Net sales for the first 9 months of 2020 were $932.4 million, compared to net sales of $1,146.9 million for the first 9 months of 2019, representing a $214.5 million, or 18.7%, decrease. On a constant currency basis, net sales for the first 9 months of 2020 would have been $985.2 million.

Paul Reitz, president and chief executive officer commented, “We’re proud that we again produced very solid financial results this quarter on almost all fronts despite an environment filled with uncertainty and challenges. In many aspects the third quarter financial results were a continuation of what we achieved during the second quarter as we again had strong margin performance, good working capital management and improvements in our balance sheet leading the way to another solid quarter. During the quarter, we increased our cash balance by more than $18 million while also continuing to lower our debt. At $366 million, our net debt represents the lowest level since 3Q 2018 and has improved $85 million over the past 12 months. During the course of the pandemic, we have outlined several steps we would take to weather the uncertainty and position Titan for the future, and I am very pleased with the accomplishments we have made thus far both operationally and financially. We now anticipate full year adjusted EBITDA to be in the range of $40 million to $44 million.

“We are currently in the midst of our planning process for 2021 and believe next year has plenty of reasons to be optimistic. Latin American ag has seen a strong jump in orders with good visibility into next year for that growth to continue. The North American harvest season is going well as corn prices are in that important $4 range and soybean prices have reached a multi-year high. As a result, farmer income is expected to increase over 20% with farmer sentiment and dealer expectations significantly improving in recent polls. As everyone knows, the age of fleet in the large ag segment is well above the replacement trend lines, and inventory levels are also at relatively low levels. Couple that with higher commodity prices and government support programs, and the catalysts are there for market growth. We are optimistic for what that will mean for demand in North American ag in upcoming months.

“Titan’s third quarter financial results and our impressive improvements in our balance sheet and liquidity position demonstrate that we continue to navigate the pandemic challenges quite well; positioning ourselves for a stronger 2021 and ultimately for refinancing our bonds which mature in 2023. Our team has and will continue to remain diligently focused on making good, timely decisions and taking swift actions to adjust to an evolving world while we have our eyes on a future that continues to look better.”

Results of Operations

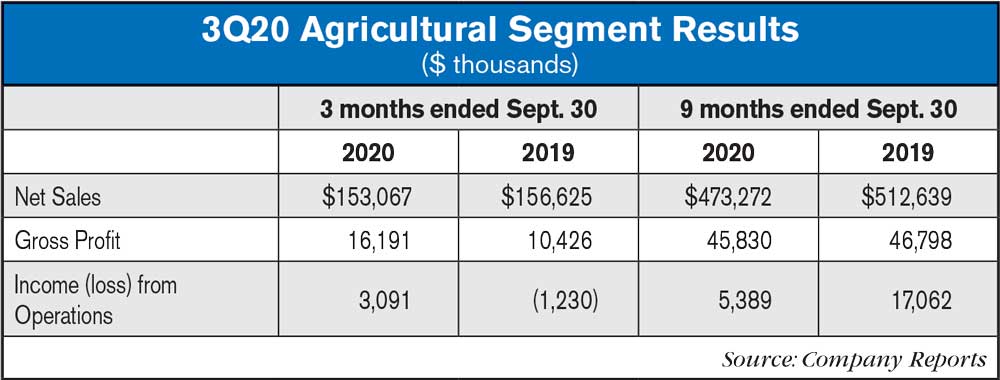

Net sales for the third quarter ended Sept. 30, 2020, were $304.8 million, compared to $345.9 million in the comparable quarter of 2019, a decrease of 11.9% driven by sales decreases in all segments. Overall net sales volume was down 9.7% from the comparable prior year quarter, due primarily to challenges in the earthmoving/construction market as a result of a slowdown of the global construction market, particularly in Europe. Approximately $8 million in reduced sales, in comparison to the same period of 2019, was attributable to disrupted markets in Europe and Asia resulting from the COVID-19 pandemic. Contributing factors in the sales decrease in the Agriculture market included global trade issues and the impact of COVID-19, which resulted in lower volume from OEM customers as well as the negative effect of foreign currency translation. Overall, unfavorable currency translation negatively impacted net sales by 5.8% or $20.2 million. Favorable price/mix partially offset these declines and contributed to a 3.6% increase in net sales.

Net sales for the 9 months ended Sept. 30, 2020, were $932.4 million, compared to $1,146.9 million in the comparable 9-month period of 2019, a decrease of 18.7% driven by sales decreases in all segments. Overall net sales volume was down 15.6% from the comparable period in the prior year, due primarily to the aforementioned economic factors. The overall net sales volume was also impacted by approximately $53 million in reduced sales in comparison to the same period of 2019 due to COVID-19 related plant closures and market disruption in Europe, Asia and Latin America. Unfavorable currency translation negatively impacted net sales by 4.6%. Favorable price/mix partially offset these declines and contributed to a 1.5% increase in net sales.

Gross profit for the third quarter ended Sept. 30, 2020 was $31.3 million, compared to $27.1 million in the comparable prior year period. Gross margin was 10.3% of net sales for the quarter, compared to 7.8% of net sales in the comparable prior year period. The increase in gross profit was driven by initiatives to reduce labor and overhead costs across global production facilities as well as lower raw material prices relative to the prior year. Lower sales volume and a $2.5 million unfavorable gross profit impact from the COVID-19 pandemic mentioned above partially offset the year-over-year gross profit margin increase.

Gross profit for the first 9 months of 2020 was $88.4 million, compared to $110.7 million in the comparable prior year period. Gross margin was 9.5% of net sales for the first 9 months of 2020, compared to 9.6% of net sales in the comparable prior year period. The decrease in gross profit was driven by the impact of lower sales volume across most geographic regions. The decrease in gross profit was driven by the impact of lower sales volume across most geographic regions. The unfavorable gross margin impact from the COVID-19 pandemic mentioned above was approximately $13 million.