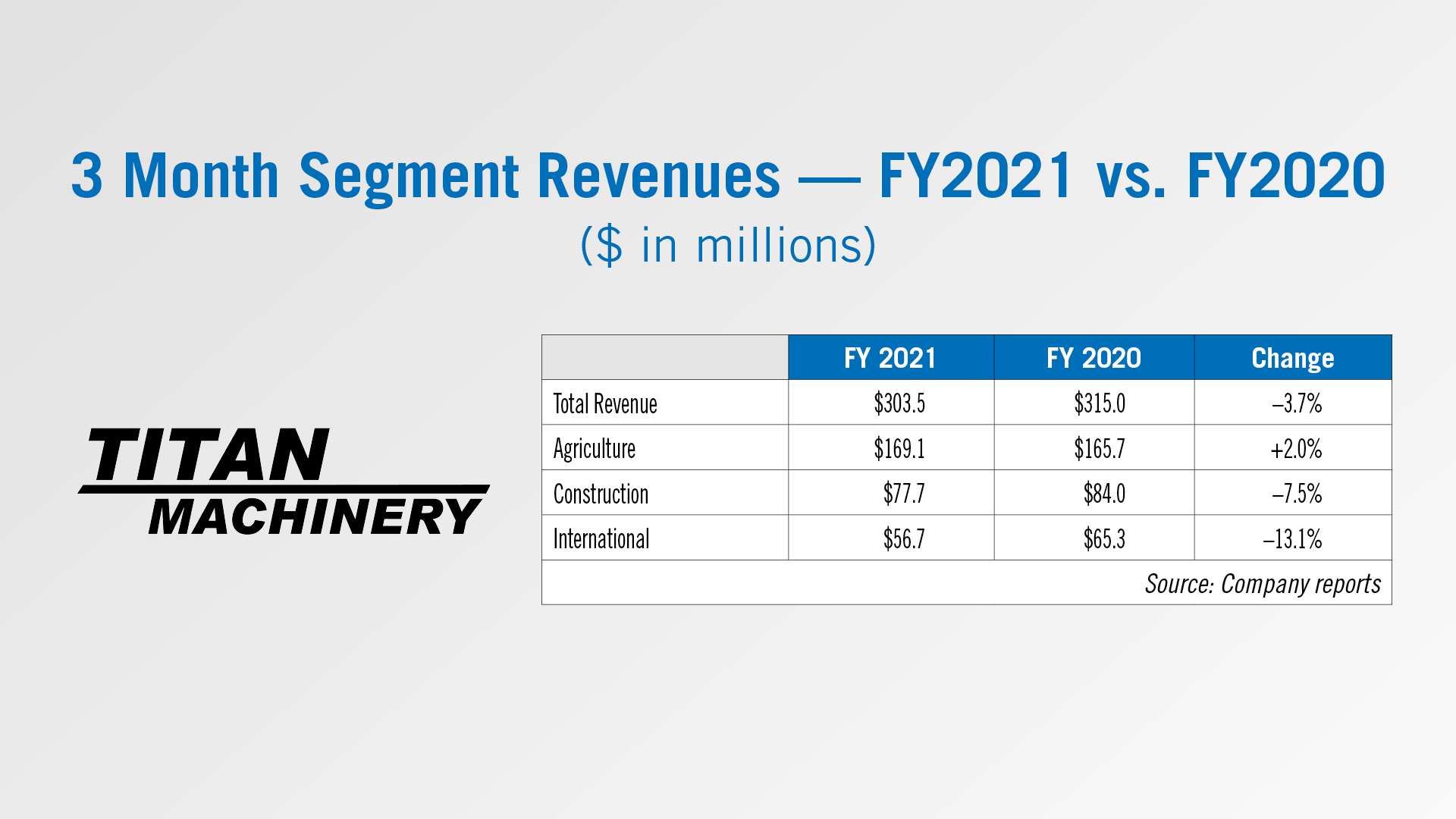

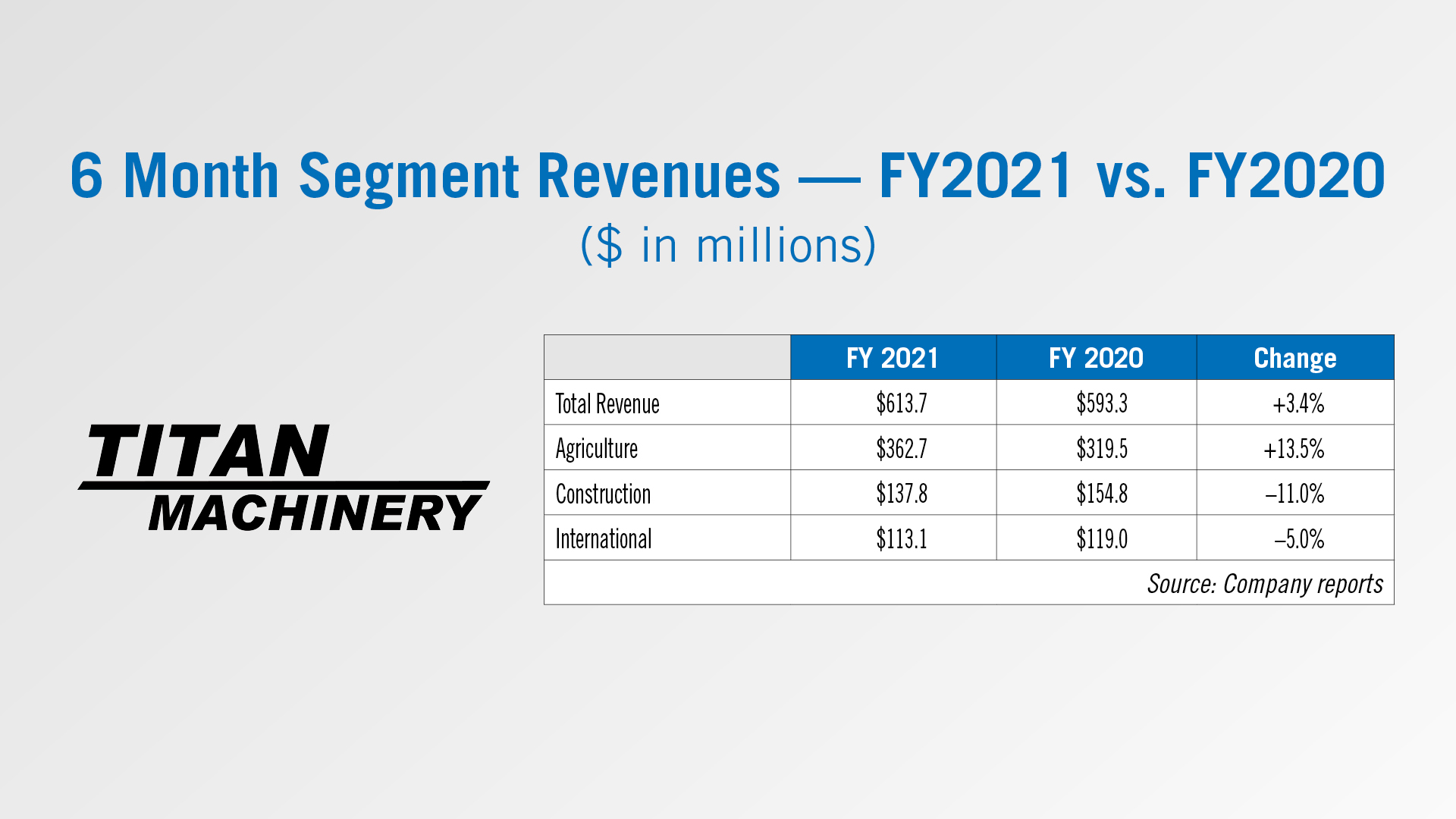

Titan Machinery, Case IH’s largest dealer of farm equipment, reported consolidated revenues slipped 3.7% for the period ended July 31,2020, but year-over-year sales from its agriculture segment increased by 2% for the quarter. Through the first half of the year, Titan’s ag revenues were up 13.5%.

Overall, Titan’s revenues were nearly $304 million vs. $315 million a year ago. Equipment sales were $202.7 million for the second quarter of fiscal 2021, compared to $214.4 million in the second quarter last year. Parts sales were $61.5 million vs. $59.2 million in the second quarter last year. Revenue generated from service was $28 million for the second quarter compared to $26.8 million last year. Revenue from rental and other was $11.4 million during the company’s most recent reporting period compared to $14.5 million a year ago.

Gross profit for the second quarter of fiscal 2021 was $62.7 million, compared to $64 million in the second quarter last year. Gross profit margin increased 40 basis points to 20.7% vs. the comparable period last year. The increase in gross profit margin was primarily due to an increased mix of higher margin parts and service business, as compared to the second quarter of last year.

Operating expenses decreased by $1.8 million to $53.1 million for the second quarter of fiscal 2021, compared to $54.9 million in the second quarter last year. Operating expenses as a percentage of sales increased slightly to 17.5% for the second quarter of fiscal 2021, compared to 17.4% of revenue in the prior year period due to lower revenue.

Floorplan and other interest expense was $1.9 million in the second quarter of fiscal 2021 compared to $2.4 million for the same period last year. The decrease was due to a lower interest rate environment as well as a lower interest rate spread under our new 5 year Amended and Restated Credit Agreement that was finalized in April 2020.

In the second quarter of fiscal 2021, net income was $6.4 million compared to $5.5 million for the second quarter of last year.

Segment Results

Agriculture Segment: Revenue for the second quarter of fiscal 2021 was $169.1 million, compared to $165.7 million in the second quarter last year. The increase in revenue was driven by on-going momentum in parts and service business. Pre-tax income for the second quarter of fiscal 2021 was $6.8 million, compared to $6.2 million of pre-tax income in the second quarter last year.

Construction Segment: Revenue for the second quarter of fiscal 2021 was $77.7 million, compared to $84 million in the second quarter last year. The decrease in revenue was primarily the result of lower equipment and rental demand due to COVID-19 related macroeconomic challenges and uncertainty. Pre-tax income for the second quarter of fiscal 2021 was $1.4 million, compared to a pre-tax income of $1.3 million in the second quarter last year.

International Segment: Revenue for the second quarter of fiscal 2021 was $56.7 million, compared to $65.3 million in the second quarter last year. Lower revenue was driven by decreased customer demand due to below average small grain yields in certain areas of the company’s International footprint as well as overall challenging economic and business conditions due to COVID-19. Pre-tax loss for the second quarter of fiscal 2021 was $0.4 million, compared to income of $0.5 million last year. Adjusted pre-tax loss for the second quarter of fiscal 2021 was $0.6 million, compared to adjusted pre-tax income of $0.4 million a year ago.

FY 2021 Outlook

The company said it was introducing annual modeling assumptions for fiscal year 2021. “We believe modeling assumptions will continue to be impacted by the challenging global economy due to the COVID-19 pandemic, creating a higher degree of uncertainty in these assumptions compared to a normal environment.

| Segment | Current Assumptions |

| Agriculture | Up 0-5% |

| Construction | Down 5-10% |

| International | Down 10-15% |

Post a comment

Report Abusive Comment