With the upheaval in the housing and financial markets beginning to trickle down to an otherwise strong agricultural industry, many financial analysts see farm equipment sales peaking during the first half of 2009. But, based on historic trends, a continuing strong demand for food and fuel and the aging of the American farm fleet, one market pundit is projecting solid sales at least through the first half of 2010.

Despite the economic uncertainties prevailing in the U.S. economy, Barry Bannister, analyst for Stifel Nicolaus, says farm equipment sales will maintain momentum through the first half of 2010. In a report to investors, Bannister bases his analysis on historic trends for the Producer Price Index, which he says has not yet peaked, as well as the average age of the American farm fleet, which he says is "old" and will need to be updated soon.

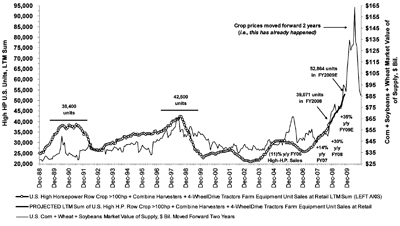

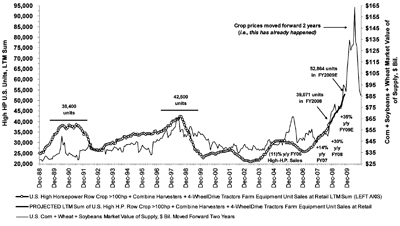

Figures 1 through 4 were developed by Bannister to support his analysis and projections of the ag equipment market in the near term.

Fig. 1. The value of U.S. crop production (lagged 2 years in this chart) aligns with past peaks for unit sales of high-horsepower U.S. farm equipment. In the past two cycles, 1990 and 1998, sales of this equipment did not peak until crop values peaked, which implies sales should rise strongly until the first half of 2010. "We remain bullish on energy prices and thus crop values as we look to fiscal year 2009," says Barry Bannister of financial investment firm of Stifel Nicolaus.

Fig. 2. Using Deere & Co. as a benchmark, this chart shows how the stock rises and falls with the Producer Price Index (PPI) for farm products. "We don't think the PPI has peaked, as there has not been the prolonged pricing power needed to replenish the aging agriculture fixed assets in this cycle," says Bannister.

Fig. 3. This chart depicts the replacement cycle of ag machinery. Historically, it has taken prolonged pricing power, or lack thereof, to replenish or deplete capital goods engaged in the production of natural resources. This chart show the U.S. tractor fleet age (on an inverted scale) moving in tandem with the PPI for ag products for the past 8 decades, highlighting 3 cycles of farm fleet replenishment (1920, 1950 and 1980). Another such cycle should emerge, continuing from last year until 2010, according to Bannister.

Fig. 4. U.S. unit sales of high-horsepower tractors rise and fall as part of a fleet replacement cycle that renders the fleet alternately "old" and "young" again, as demonstrated since 1970. "Although total unit sales of large U.S. farm tractors may not return to the 1970s level, even after the recent increase in large tractor sales, fleet ages are still 'old,' as shown in the chart," says Bannister. "This example is illustrative since global sales of larger farm equipment are supported by farm consolidation and demand for technologies that improve crop production."

Post a comment

Report Abusive Comment