Third Quarter Highlights

- Achieved a $30 million draw down in used equipment excluding inventory acquired through acquisitions;

- Total inventory reduced by $38 million, excluding the $30 million of inventory acquired through acquisitions.

- Increased RME’s annual dividend to $0.49 per common share (an increase of $0.03 or 6.5%);

- Acquired John Bob Farm Equipment (JBFE), a Saskatchewan-based dealer of New Holland agriculture equipment which reported average historical revenues of $39 million (unaudited) from its locations in Outlook and Tisdale; and

- Acquired the New Holland Agriculture dealership in Olds, Alberta, which reported average historical revenues of $14 million.

CALGARY, Alberta — (BUSINESS WIRE) — Rocky Mountain Dealerships Inc. (TSX:RME) Canada's largest agriculture equipment dealer, today reported its financial results for the 3 and 9 months ended Sept. 30, 2018. RME also announced today that it has commenced an initiative to sell late-model used equipment to farmers based in the U.S. via an outlet store in Tonganoxie, Kan., which is located on the outskirts of Kansas City.

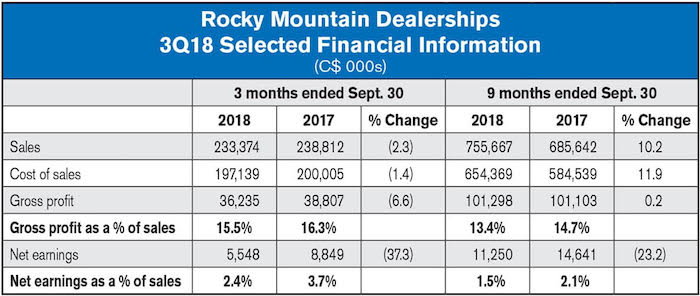

On the financial side, RME reported that total sales decreased 2.3% or $5.4 million to $233.4 million compared with $238.8 million for the same period in 2017. Gross profit declined by 6.6% or $2.6 million to $36.2 million from $38.8 million for the same period in 2017.

Early snowfalls across the Canadian Prairies stalled harvest activity throughout mid- to late-September, decreasing in-season demand across all categories. Despite the impact of the unusual harvest, compared to the second quarter of 2018, RME continued to draw down its inventory of new and used equipment even with the addition of $30 million in inventory from the JBFE and Olds acquisitions in the third quarter.

Commenting on the quarter, Garrett Ganden, president & chief executive officer said, “The advantage of RME's strong and geographically diverse dealer network becomes even more evident when growing or harvest conditions are not ideal. This past harvest season, snowfalls halted September activity, most notably in Alberta, where only 40% of crops had been harvested by the end of September, compared to a 5 year average of 80%. While most, if not all of this harvest shortfall was made up during October, our third quarter performance was supported by the strength of our network, which enabled us to provide exceptional support to our customers while also delivering results to our shareholders.

“We continue to execute on our growth strategy announced in May 2018. On the acquisition front, we added two more locations to our network in the heartland of Saskatchewan agriculture. We also added a location in Olds, Alberta, which will complement our existing operations in the surrounding area. Although we acquired $29.7 million in inventory with the addition of these new locations, we were still able to draw down RME's total inventory during the quarter, keeping our balance sheet strong for future undertakings.

“We remain mindful that our capital allocation strategy must reflect the long-term interests of RME and its shareholders. In the wake of recent volatility in the global equity markets, many companies, including RME, are experiencing contracting price to book multiples. With that in mind, as we look at acquisitive growth prospects that will create long term shareholder value, we will also contemplate a number of different capital deployment strategies.”

Kansas Used Equipment Outlet

Rocky Mountain’s move into the U.S. was expected. During an interview with Ag Equipment Intelligence last summer, the dealership group said expanding its geographical reach would be part of its 5 year growth plan.

According the RME, the new facility is situated in close proximity to the sizeable U.S. agricultural markets of Kansas, Iowa, Nebraska, Missouri and Oklahoma as well as manufacturing facilities from which new equipment is routinely being shipped to RME locations within Canada. “By backhauling late model used equipment to our new Kansas location, we are able minimize the associated transportation costs.”

Ganden remarked on this announcement saying, “This undertaking establishes a beachhead for RME in the U.S. market at a time when the equipment profile is aging due to several years of depressed new unit deliveries. We believe that our lightly-used, competitively-priced equipment is well positioned to refresh this aging profile. This additional equipment distribution channel represents a new growth avenue for RME and does so with minimal capital commitments and start-up costs.”

Post a comment

Report Abusive Comment