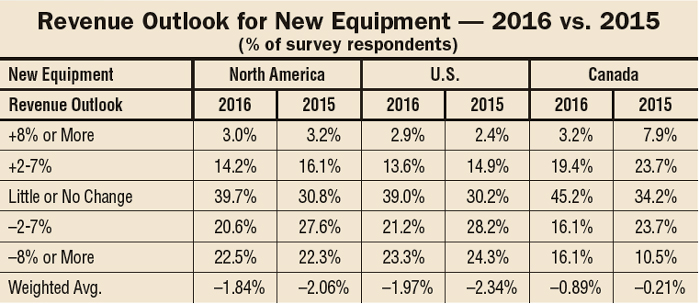

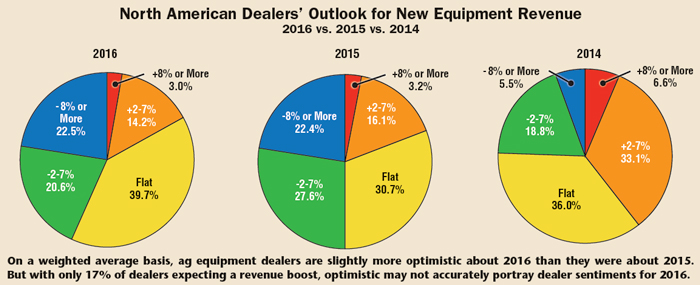

If there’s an upside to how dealers view their business prospects for 2016, it’s that more dealers expect revenue from new equipment sales to be at least as good or better in the year ahead than they were in 2015. Overall, 56.9% of dealers see revenues improving or flat for 2016.

More specifically, 17.2% of the 282 dealers who responded to the 2016 Dealer Business Outlook & Trends survey expect revenue from ag equipment sales to be from 2% to more than 8% better in the year ahead, while 39.7% are looking for overall sales of new machinery to be flat vs. 2015.

This compares with 50% of dealers in last year’s survey who projected increased or flat revenue for the current year. A year ago, 19.3% of dealers expected revenues to increase at least 2% to more than 8%, while 30.7% anticipated flat sales.

Last year, half of all dealers responding to the survey expected sales to drop from 2% to more than 8% throughout 2015. This compares with 42.5% of dealers this year who are forecasting declining revenue from sales of new equipment in 2016.

Couched in relative terms, of course, a projection calling for “flat” revenues isn’t necessarily a neutral outlook for 2016 when it’s compared with 2015. When all is said and done, this year could possibly be the poorest sales year for farm equipment in the last decade, at least for sales of high horsepower tractors and combines.

Mixed Bag for Tractor & Combine Sales

Declining year-over-year sales of high horsepower tractors and combines doesn’t tell the whole story of farm equipment sales during the past year, but it offers a pretty good view of overall industry mood.

How Did North American Dealers Fare in 2015?

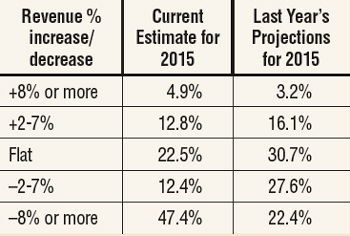

The percentage of dealers who projected a year ago that revenue from new equipment sales would improve vs. 2014 were very close to the percentage who are reporting that business revenue did increase in the past year. Those expecting business to be flat and/or to decrease in 2015 compared to the previous year, on the other hand, missed the mark by a much larger margin.

A year ago, 19.3% of dealers polled expected their revenue from the sales of new equipment to increase vs. the previous year. In actuality, 17.7% of dealers report their sales in 2015 will have improved over their 2014 performance, representing only a 1.6% difference.

Last year at this time nearly 31% of dealers expected new equipment sales to be flat and 50% expected sales to be down. In actuality, nearly 60% of dealers report 2015 sales of new equipment declined vs. 2014 and about 22% said it was flat.

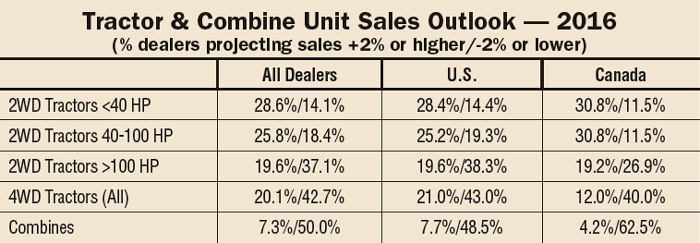

According to the Assn. of Equipment Manufacturers, over the past 12 months, unit sales of row-crop tractors in the U.S. and Canada are down nearly 31% (1,771 units vs. 2,562). The last time the industry saw positive results for a month was in July 2014, when year-over-year sales increased by 1.2%. Beyond this, sales have been in negative territory since February 2014. Just under 20% of dealers expect a pick up in sales of row-crop equipment, while 37% forecast a continued decline in 2016.

Sales of 4WD tractors were down 54.7% in August on a year-over-basis. The last time 4WD tractor sales experienced a year-over-year gain was in December 2013 when North American dealers sold 960 units, which was most likely given a boost by advantageous Bonus Depreciation and Section 179 depreciation schedules. Slightly over 20% of dealers anticipate an increase in the sales of 4WD units, but more than double that, 42.7%, are looking for a drop in sales.

With the exception of sporadic decreases, sales of compact (under 40 horsepower) and utility (40-100 horsepower) tractors have fared far better than their bigger counterparts during the past 12 months.

Year-over-year sales of utility equipment through August were down 5.6% (5,120 units), but this followed a 19.6% increase in July (7,097 units). Over the 12 months between September 2014 and August 2015, sales of utility tractors were up for 8 of those months. And dealers have a more favorable outlook for the sale of utility tractors in the year ahead. Nearly 26% of dealers in this year’s survey expect increased sales of this tractor category in 2016.

Dealers handling compacts are also expressing a higher level of optimism for increasing sales of small tractors during the next year. Nearly 29% are forecasting a boost in sales of compact equipment in 2016. This confidence comes from a solid year of improved sales from September 2014 to August 2015. Year-over-year in August, compact tractor sales slipped by less than 1% (9,688 units), but they’re coming off a 27.5% (14,342 units) sales jump in the month before.

Between a Rock & a Hard Place

The most obvious cause for the downturn in new farm equipment sales is low commodity prices. But if commodity prices are the rock, then the huge backlog of low hour, high priced used equipment many dealers have on their lots is the hard place. This is where dealers found themselves in the past year.

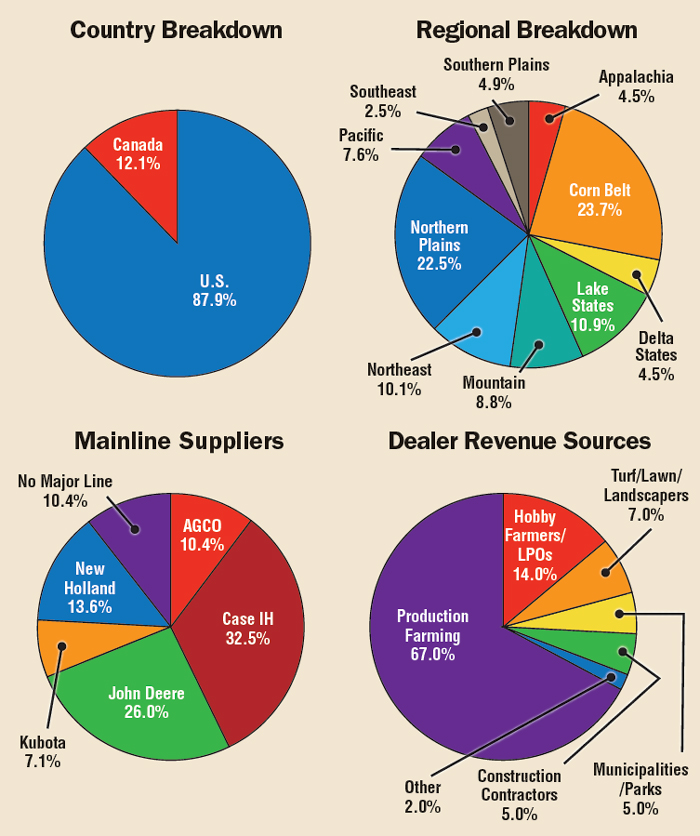

Demographics of 2016 Survey Respondents

Some 282 North American dealers participated in Farm Equipment’s “2016 Business Outlook & Trends” survey. The charts below show how the participants broke out by country, regions, mainline suppliers and dealer revenue sources. This year 88% of the respondents were from the U.S. and 12% from Canada.

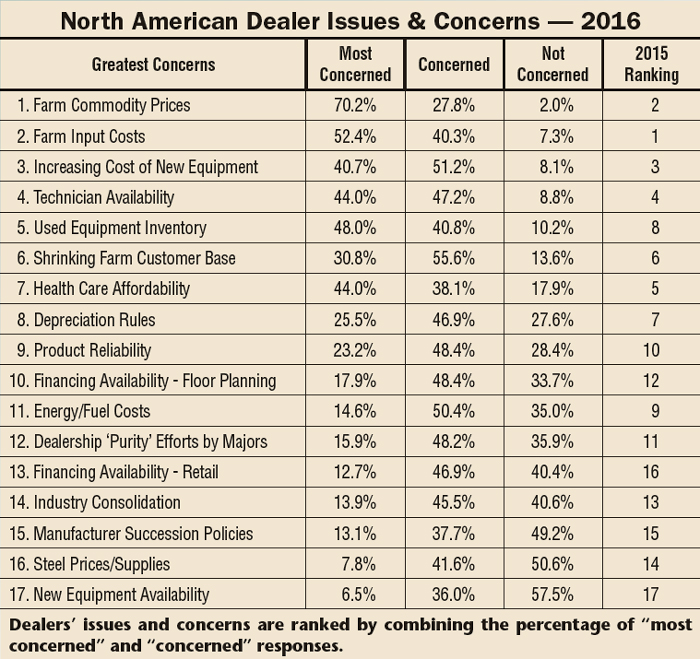

The Rock. No doubt, falling commodity prices are causing farmers to think twice before making capital expenditures. When dealers were asked to rank their biggest concerns going into 2016, number one on their list was farm commodity prices. Of all the dealers responding to this question, 70.2% ranked commodity prices as the issue they are “most concerned” with. Another 27.8% said they were “concerned” with farm prices.

According to USDA, through the first 7 months of the current calendar year, prices U.S. farmers received for corn are down 16% from a year earlier, but they’re down 44% compared to July 2013.

Soybean and wheat prices are even worse off. In July of this year, the average soybean price received was $9.96 per bushel. Last year it was $13.10 and two years earlier it was $15.30 a bushel. For wheat, the average price received was $5.23 vs. $6.16 per bushel a year earlier and $6.93 in 2013. In July of 2012, farmers were getting $7.32 for a bushel of wheat.

Though down somewhat from a year earlier, the price received per hundredweight for cattle was $150 in July vs. $157 a year earlier. Hogs, on the other hand, fetched a record $93.60 per hundredweight in July of 2014. A year later, price received for hogs had fallen to $59.50.

Milk prices have also followed the downward trend of most other farm commodities. The average price received in July 2015 was $16.90 per hundredweight, down from $23.30 in July 2014. The average price received for all of last year was $23.98.

Frayne Olson, North Dakota State University Extension crops economist, responding to a farmer’s question about whether we would see high grain prices again in his lifetime, said, “Yes, it is possible to see high grain prices again, but it likely will not happen this year.”

At the same time, Olson noted, “U.S. and world carryover stocks are not large enough to absorb major supply disruptions. A crop production problem likely will result in higher prices lasting nearly one year, while disruptions in grain flows, often caused by geo-political events, likely will last for several months.”

The Hard Place. Responding to a blog on the investment research website Seeking Alpha that took the position that Deere & Co.’s bubble had finally burst because of low commodity prices, another analyst wrote: “Used inventory on dealer’s lots has slowed new sales more than commodity prices. Farmers bought too much new inventory [the] last few years and now [the] market [is] flooded with late model equipment … might take 2 more years to reduce this surplus.”

A majority of dealers seem to share this view. Of the dealers responding to this year’s survey, 88.8% said they were either “most concerned” (48%) or “concerned” (40.8%) about the current used equipment inventory.

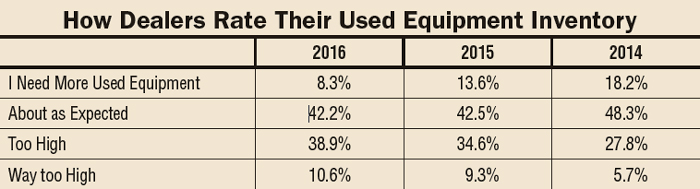

On the more general question of “How would you currently rate your used equipment inventory?” 49.5% replied that it was “too high” or “way too high.” A little over 42% said it was “about as expected,” and 8.3% reported, “I need more used equipment.”

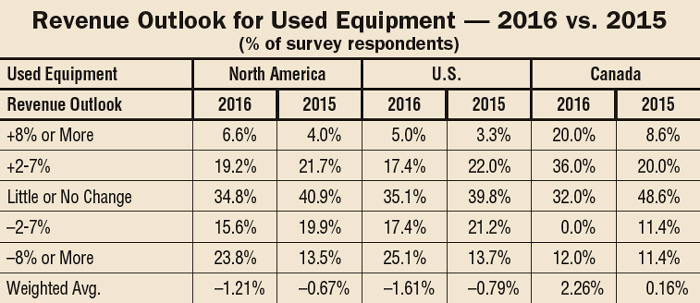

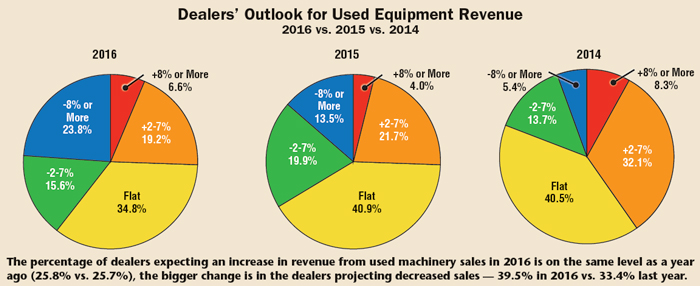

As for dealers’ expectations for revenue from used equipment sales in 2016, the numbers are similar to projections dealers offered a year ago. Just under 26% expect sales of used machinery to increase in 2016. This includes 6.6% who forecast growth of 8% or more, and 19.2% who see increases in the range of 2-7%. Last year 25.7% of dealers projected increased revenue from used equipment. This was comprised of 4% who anticipated revenue growth of 8% or more and 21.7% who forecasted an increase in the 2-7% range.

The bigger difference came with those dealers who project “flat” or increasing sales of used machines. For 2016, 60.6% projected “flat” or increasing sales for the coming year vs. 66.6% who held the same sentiments a year earlier.

As for dealers who are forecasting declining used equipment sales, 39.4% expect a fall off (15.6% in the range of 2-7% and 23.8% see a decrease of 8% or more). This compares with 33.4% who expected declining used machinery sales last year (19.9% in the range of 2-7% and 13.5% dropping 8% or more).

It would seem that reducing their backlogs of used machines is taking much of the dealers’ time and energies these day, and several mentioned this will continue to be their focus in the year ahead. In many cases, they indicate that sales of new equipment may suffer as a result.

One dealer put it this way: “We will be in survival mode and CNH will hate us because we’re planning for a very low level of new orders.”

Another said, “We’ll be taking less trades. Our salespeople must have at least two or three potential homes for trades before they can deal.”

Several dealers simply said, “We’ll continue working on asset reduction and not sell new.”

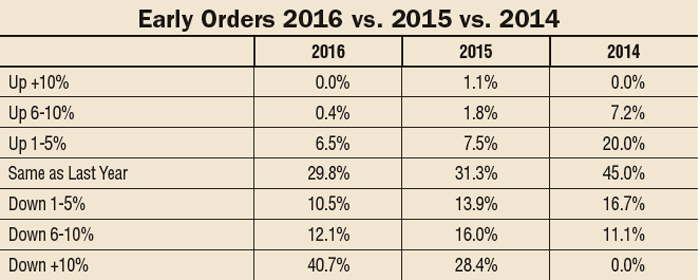

Early Orders Fall

As equipment manufacturers have pushed dealers in recent years to pre-sell product well ahead of ship dates, the level of early orders for farm machinery is typically a reliable signal about farmers’ buying intentions for the next crop year. That may or may not be the case for 2016.

According to dealers who commented on pre-selling trends, the pressure to order early isn’t anywhere near what they’ve experienced in recent years. One dealer said, “Manufacturers are shipping anything you order. They’re running scared.”

Clearly, early orders for 2016 equipment are far off the pace set 2 years ago when more than 27% of dealers reported that pre-sold equipment was up from the previous year. This dropped to 9.3% for 2015 and has fallen even further for the coming year as only about 7% of dealers say early orders are above the levels they saw a year ago.

Two years ago, about 28% of dealers noted a declining number of early orders. This grew to 58.3% of dealers last year who reported that pre-sold products were down vs. the previous year. The percentage of dealers reporting decreasing levels of early order equipment for 2016 has risen even more to a little over 63%.

“Farmers are being told to hold off on equipment purchases by lenders,” said one dealer. “We had to cancel pre-booked orders for 2016, because a lender told our customer he couldn’t trade up.”

Dealers began commenting on the early order situation as early as August in Ag Equipment Intelligence’s monthly Dealer Sentiments & Business Conditions Update survey. Many of the earlier comments were aimed at manufacturer efforts to get dealers to order early vs. pre-selling farmers.

One dealer commented, “Order objectives have kept increasing, like always. The difference is we are not ordering anything. We are willing to sit out and wait for market corrections, and so be it if we lose market share. We aren’t playing the share game anymore, we are focused on a profitable model.”

New Holland dealers were the most vocal in expressing their resistance to place orders early. “New Holland is pushing dealers to order equipment at levels that we are uncomfortable with,” said one dealer.

Another dealer was even more forthcoming. “New Holland has asked all of its dealers to place a hay tools order equivalent to 22 months of inventory, but will deliver that inventory over the next 12 months. I don’t know what they have up their sleeve, but if the cattle price bubble bursts like the row crops, I wouldn’t want to be sitting on excess inventory. I think it is just a matter of when, not if.”

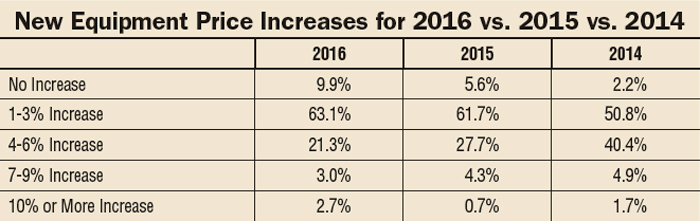

Despite the turndown in equipment sales and a very low level of early orders, some 90% of dealers say they have been told or are expecting a price hike on new 2016 equipment from their mainline equipment supplier. Two-thirds of dealers say the price increases will be in the range of 1-3% and 21% are expecting new equipment prices to rise between 4-6%.

Overall, only 9.9% of dealers do not expect to see increased prices in 2016. This compares with 5.6% last year and only 2.2% of dealers in 2014 who reported no price hikes on new machinery.

Shifting Dealer Concerns

While some dealer concerns going into 2016 shifted compared to 2015, the list of the biggest issues confronting ag equipment retailers in the months ahead pretty much reflect their biggest worries from a year ago.

As already discussed, it’s no surprise that farm commodity prices easily outdistanced any other dealer concerns. Some 98% of dealers rated it as “most concerned” or “concerned.” Dealers’ next biggest concern is farm input costs, where nearly 93% of dealers indicated they were “most concerned” or “concerned.” It’s no wonder, high prices for inputs (seed, fertilizer, etc.) compete directly with investments in farm machinery. Surveys have shown that when a farmer is confronted with high input costs, they will in almost all cases put off spending on equipment.

The increasing cost of new equipment placed #3 on dealers’ ranking of biggest concerns for the year ahead. Nonetheless, dealers are reporting that the major equipment makers are trying to push through small (1.5-2%) price hikes to cover development costs of the new Tier 4 engines. Of the dealers in this year’s survey, 92% said they are “most concerned” or “concerned” with higher costs of new machines. This issue has risen steadily in importance to dealers throughout the 11 years Farm Equipment has conducted this annual survey.

The ongoing challenge of finding and retaining technicians placed #4 on the dealers’ list of biggest concerns, with 91% of dealers checking off “most concerned” or “concerned.” It is followed by used equipment inventories, where 89% of dealers indicated they are “most concerned” or “concerned” with the current backlog that continues to eat away at their available cash.

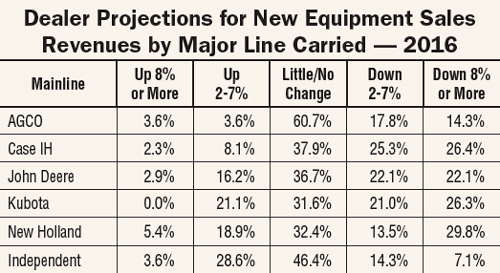

32% of Independent Dealers Expect Revenue Gains in 2016

Considering only the percentage of dealers who expect increased revenues from new equipment sales in 2016, more independent dealers, those not carrying one of the five major brands, expect growth than expect declining revenues in the year ahead.

This isn’t the case for dealers who carry any of the major brands, as those anticipating that revenues will decrease for 2016 outweigh those expecting revenue growth in the coming year.

Even at that, slightly less than one-third of independent dealers (32.2%) are projecting a pick up in sales of new equipment in the coming year. Last year at this time, 52% of Kubota dealers were forecasting an increase in revenues, as were nearly 45% of independent dealers. This year, only 21% of Kubota dealers are forecasting a jump in new equipment revenues.

On the other hand, except for AGCO, dealers representing each of the other major brands, are somewhat more optimistic than they were a year ago. Just about one-quarter (24.3%) of New Holland dealers see increased revenues in 2016, which is better than the 18% from last year.

Slightly over 19% of Deere’s dealers see increased revenues vs. 14.6% last year. For Case IH dealers, only about 10% forecast increased revenues for 2016, but this is better than the 4.4% last year. Only 7.2% of AGCO dealers see a pick up in new equipment revenues, which is down from the 21% last year.

The affordability of health care, which is typically a Top 5 issue, slipped to the #7 spot on the dealers’ list, as 82% of dealers said they were “most concerned” or “concerned” about providing coverage for their employees.

Dead last on the dealers’ list of biggest concerns for 2016 is availability of new equipment. Only 6.5% of dealers said it was the issue with which they are “most concerned” and 36% they were “concerned” with it.

‘Best Bet’ Products for 2016

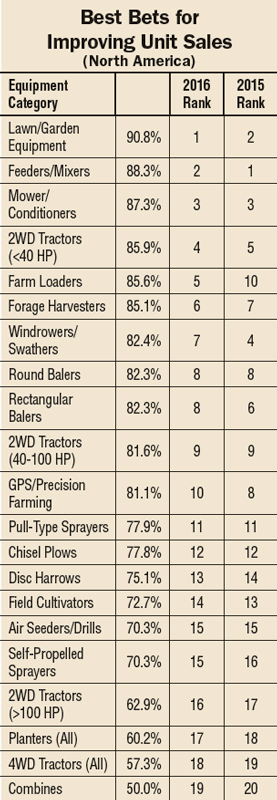

Much like last year, equipment related to the livestock, rural lifestyle and light construction markets are at the top of dealers’ list as those holding the most potential to grow unit sales in the year ahead, according to dealers responding to the 2016 Dealer Business Outlook & Trends survey.

In July, U.S. residential construction put in place was up 16% and non-residential building was up 20% year-over-year. These are positive trends and usually bring with them increased spending on light construction and lawn and garden equipment. Of dealers’ top picks for growing unit sales in the year ahead, lawn and garden equipment finished #1, up from #2 last year, while 2WD compact tractors moved up one spot from a year ago and placed #4 on the list. Farm loaders were ranked as #5 on the ‘best bets’ list for 2016, up from #10 last year.

Much of the rest of the Top 10 products were aimed at the livestock, hay and forage markets. These included feeder/mixers at #2, mower/conditioners #3, forage harvester #6, windrowers/swathers #7, round balers and rectangular balers, which shared the eighth spot. Ranking #9 was utility tractors, the tractor class most often used in the livestock segment. Rounding out the Top 10 was GPS/precision farming equipment, which was #8 last year, but previously had ranked #1 or #2 on dealers’ ‘best bets’ lists.

The rest of the list, or bottom 10, is largely comprised of equipment typically used in production of row crops. Dead last are combines, preceded by 4WD tractors, planters, row-crop tractors, self-propelled sprayers and air seeders/drills. Tillage tools, including chisel plows, disc harrows and field cultivators filled the #12, #13 and #14 spots on the list.