Recent startup “pure-players” in the all-electric tractor and implement business — companies that are solely devoted to the use of EV technology — are open about their products and vision for the industry, but legacy tractor manufacturers as a whole are tight-lipped about R&D budgets devoted to electrification of their products. Most say they’re in the development stage or are testing prototypes, but they are reluctant to divulge hard figures or potential timelines for product introductions.

While corporate media policy shrouds a direct look at the state of electric farm machinery product development, a review of who is buying what — and why — gives a glimpse of products to come from major OEMs.

John Deere

Although John Deere officials declined to comment, the company’s acquisition of a majority ownership of Austria’s Kreisel Electric indicates keen interest in battery technology. The European firm is noted for its development of patented immersion-cooled, high-density batteries and CHIMERO, a rapid-charging system to complement its batteries.

Published reports surrounding the acquisition, completed in early February 2022, indicate Deere intends to apply Kreisel technology to its product lines of turf equipment, compact utility tractors, small tractors, compact construction equipment and some road-building equipment. Deere introduced its 310 X-tier E-Power prototype electric backhoe at the Utility Expo in Louisville, Ky., in late 2021, although it was not announced if Kreisel was part of that project.

“Kreisel’s battery technology can be applied across the broad portfolio of Deere products, and Kreisel’s in-market experience will benefit Deere as we ramp up our battery-electric vehicle portfolio,” said Pierre Guyot, senior vice president of John Deere Power Systems, at the time of the acquisition announcement.

The Kreisel acquisition follows Deere’s 2021 purchase of Bear Flag Robotics, a start-up dedicated to the development of autonomous vehicle technology.

CNH Industrial

Selin Tur, CNH Industrial’s vice president for advanced technologies and innovation, says the company is at the beginning of its electrification journey, but it’s well positioned for a net zero carbon future. Tur says CNH aims to become the leader in electrification and alternative fuels through a strategy based on 3 pillars, one of which is electrification in agriculture.

CNH introduced a concept fuel cell hydrogen electric tractor in 2009 and the STEYR diesel-electric hybrid tractor in 2019. CNH also invested in a multi-year marketing/development partnership with Monarch Tractors of Livermore, Calif., a collaboration that aims to leverage Monarch’s EV technological expertise with New Holland’s 11,000-dealer global marketing system.

H. The MK-V electric tractor by Monarch Tractors is a 70-horsepower machine that can run with or without a human operator. Praveen Penmetsa, CEO of Monarch Tractors, the maker of the first fully electric autonomous tractor says it is aimed directly at addressing farm labor challenges. In late 2021, CNH Industrial announced it had entered into a into an exclusive, multi-year licensing agreement for electrification technologies with Monarch Tractor.

New Holland’s Lowery says the relationship currently centers on determining the right fit for EV technology in the ag industry. In its initial stage, he says it involves tractors in the 50-75 horsepower range.

“We are still very much in the prototype phase, still working with dealers and growers to assess the interest in electric vehicles,” he explains. “We just want to provide what’s right for our customers.

“As with our work with our CNG (compressed natural gas) tractor, regardless of where we are on the development curve, any product we release will have to be the right operating weight, have adequate run time and equitable power,” he says. “When the time comes, we want an electric New Holland tractor to have New Holland DNA in its looks and operator experience.”

Lowery’s comments indicate the electric tractor will be more than a Monarch tractor rebadged in New Holland blue.

“Our customers drive our journey into electrification,” Tur says. “Throughout agriculture’s production chain, our customer’s customers are demanding a reduced carbon footprint.”

In addition to electric tractors, Tur says electrically powered implements offer efficiency as they begin to replace PTO and hydraulically driven machinery. CNH introduced its e-Source power pack in 2021, which has been used to supply electric power to a sprayer attached to a traditional tractor.

“e-Source will be the powerpack for electric implements,” Tur says. “It has been proven and production-ready since 2021. Right now, we have various e-implements, such as the sprayer, in the works.”

AGCO

In a 2020 sustainability report, AGCO officials committed the company to producing a fully electric Fendt tractor by 2025.

Currently, AGCO’s Fendt e100 Vario all-electric prototype compact tractor is a harbinger of an eventual larger commercial battery-powered Fendt. Engineers continue to tweak the 100-horsepower machine by complementing its 700-volt rapid-charge batteries with lower-voltage charging circuitry more commonly found on European farms. The e100 Vario features a 5-hour run time and hydraulic and electric implement compatibility.

“We can use one driver to control 6-8 tractors, saving labor and freeing up personnel for other duties on the farm…” – Praveen Penmetsa

AGCO’s tractor electrification development is accompanied by other work involving lightweight electric robots that can plant, weed and handle other activities using less energy than traditional tractors and pull-behind implements. The company is also developing on-the-go field monitoring and data collection capabilities through its 2017 acquisition of Precision Planting from The Climate Corp.

In May 2022, AGCO acquired JCA Industries. Based in Winnipeg, Man., JCA specializes in the design of electronic systems and software development to automate and control agricultural equipment. JCA’s path planning, sensor fusion, and remote-control software products are used today by original equipment manufacturers.

Cummins

Longtime engine-maker Cummins spent $3.7 billion in early 2022 to acquire Michigan-based Meritor, a supplier of drivetrain, braking and aftermarket equipment, and electric powertrain solutions for commercial and industrial markets.

Cummins engines power a variety of construction and over-the-road equipment, as well as Kubota’s 2019-release high-horsepower M8 series farm tractor and most of Buhler Industries’ Versatile tractors.

News of the acquisition in February 2022 comes on the heels of Cummins’ announcement of new engine platforms capable of running on a variety of fuels, including natural gas and hydrogen.

Electric ‘Pure-Players’

West Coast startups Monarch Tractors and Solectrac, a subsidiary of Ideanomics, are both actively supplying high-value crop producers with all-electric tractors in the 40-70 horsepower range with plans of scaling up the power of their current models.

Swiss manufacturer Rigitrac is building a utility tractor powered with an 80-kW battery.

Doosan Bobcat unveiled its T7X total electric and hydraulics-free compact track loader in January 2022, calling it “more powerful than any diesel- fueled track loader that has come before it.”

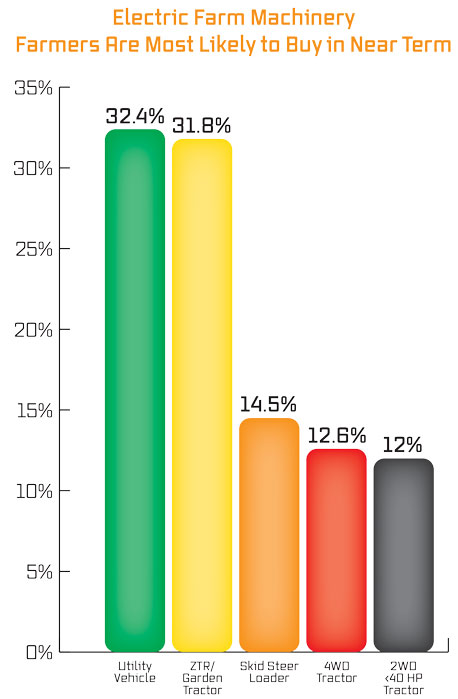

Ag Equipment Intelligence asked a group of more than 700 North American farmers (86% of whom are practicing conservation tillage) how likely they were to purchase 12 different types of electric machinery if the machines were technically feasible and available at a price within 20% of current alternatives. The most likely equipment purchases were utility vehicles, zero-turn mowers/lawn tractors, skid steer loaders, 4WD tractors and 2WD <40 horsepower tractors. < strong>Data from “Electric Farm Machinery: Outlook Through 2027” Report, March 2022

First Green Industries (formerly Kovaco Electric) offers the Elise 900 all-electric wheeled skid steer loader boasting an 8-hour run time with an available 400 amp-hour battery, a 3-hour charge time to 80% capacity and compatibility with more than 75 quick-attach loader tools. Indiana shortline farm equipment dealer Wakarusa Ag LLC was its first U.S. dealer, taking its first shipment in 2020.

In late January 2022, Kubota Corp. announced its newly formed North America Research & Development Unit in Grapevine, Texas, would be actively working to make autonomous agricultural robots and “other future farming technologies” a reality in North America.

Naïo Technologies developed an electric robot designed to weed vineyards. Using RTK guidance, sensors, lasers, cameras and probes, the “Ted” machine travels at 3 mph and can cover 12 acres a day with a battery run time of 8 hours. Ted joins Naïo’s Dino, a robot designed to weed large- scale vegetable fields. Naïo reports it has more than 250 machines running worldwide as of early 2022.

AMOS Power, short for Autonomous, Modular, Omni-Scalable, is an electric autonomous tractor primarily for vineyards and orchards, but its modular design offers opportunities for additional applications in the future. The A3 model is capability of autonomously interseeding cover crops, mowing, spraying and tillage in vineyards. The units began field testing row crops in May 2022 by planting a field of soybeans in Iowa and mowing waterways. Nearly every component on AMOS Power is connected to the central vehicle controller via a Controller Area Network (CAN bus). Messaging and diagnostics will be managed by a laptop via a Wi-Fi connection to the vehicle.

Gridtractor, a partially owned subsidiary of Polaris Energy Services, launched in California in November 2021 to develop charging technology, fleet electrification and energy management services for electric tractors and heavy farm equipment. Terranova Ranch, the company’s first customer, used the Gridtractor Planning Model Software-as-a-Service (SaaS) to determine the best deployments for electric tractors and integration with existing electrical infrastructure at irrigation pump sites and solar arrays. Gridtractor provides site and project managers to help farm operators with implementation and to liaison with utility companies and electrical contractors to ensure the technology is deployed and operating efficiently.

A number of startups are developing electric-powered carrier vehicles that can propel a number of production equipment systems, eliminating the need for a tractor. In 2020, Raven Industries (acquired by CNH in late 2021) purchased DOT Technology for its autonomous power platform that can be used for planting, fertilizing, spraying and grain-cart applications. The machine is currently diesel-hydrostat powered.

NEXAT introduced its “all-in-one” diesel-electric machine in 2021, claiming it can autonomously handle every step in field agriculture with working widths from 19-79 feet.

In 2022, Salin 247 tested its second prototype of an autonomous battery-powered tool carrier capable of planting, spraying and sidedressing crops with 4, 6, 7 and 8-row configurations.

Ford Motor Company’s recent introduction of the all-electric F-150 Lightning electrified the media with its aggressive price point, 300-mile operating range and expanded recharge and battery storage options. Lightning’s introduction and announcements from other major pickup truck manufacturers quickly following suit all but guarantee farmers and ranchers will be getting first-hand experience with EVs and V2G technology in the near term.

More from "Is Ag's Future Electric?" report

Ag Prepares for Electirc-Powered Future

Stockpiling & Pulling Sales Forward: Will There be a Repeat From Diesel’s Tier 4 Days?

OEMs Explore, Acquire Electric Farm Power

Could Electric Machinery Disrupt the Traditional Dealership Model?

Most Realistic Applications of EV Technology on the Farm

Electric Tractors Present ‘Greatest Opportunity in the World’ for Alabama Dealer