Never have more tools been available to accurately value and sell used inventory (equipment) while farmers’ online shopping habits continue to grow at a rapid pace. At the recent Dealership Minds Summit, five representatives of six marketing entities shared successful techniques that clients of theirs have utilized to increase used inventory turns.

Creating Urgency With “Pre-Auction” Equipment

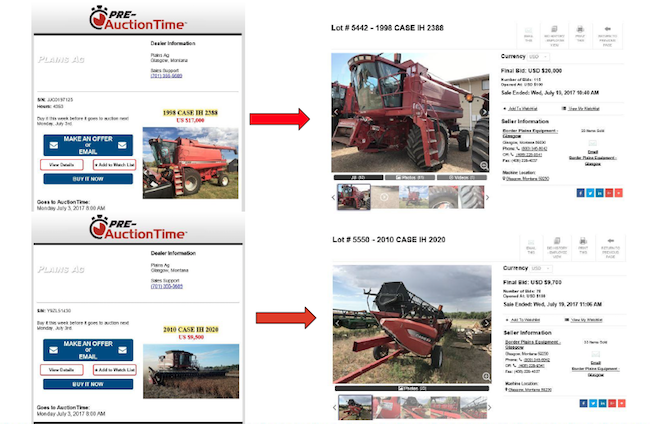

Nate Meiergerd is a sales manager for TractorHouse, who administers AuctionTime, an online platform to liquidate used farm equipment by selling machines to highest bidders with no minimum. A new wrinkle has been added in the last 6 months that is helping to market items before the auction. Meiergerd explains Pre-Auction Time. “I’d call it one final step to push the machine out through the wholesale network before it goes to auction and brings what the market will bear.” He says submissions work just like AuctionTime has worked in the past. “When equiupment dealers post entries, they choose an end date; they’ll also pick how long they want the item listed through Pre-AuctionTime. When they submit the listing, it sends an email to all dealers that are signed up on our wholesale network, giving them an opportunity to bid on the machine before the auction. If nobody buys it within that pre-auction period, then it goes to AuctionTime and will sell there.”

Those e-mails have two components that may assist in moving equipment before the auction. One is a “Buy It Now” function and the other is called “Add to Watch List.” Meiergerd says both have been successful. “On some machines dealers are hitting the ‘Buy It Now’ button and making the transaction that way. The ‘Add to Watch List’ feature lets dealers follow machines they may feel are priced high and bid below the ‘Buy It Now’ price just before it goes to the auction platform.”

The other advantage of Pre-Auction Time is within the internal operation of the farm equipment dealership. “It puts a hard end date there for sales guys by giving them a deadline; it adds to the motivation to sell to a local customer or neighboring dealer before it goes away and they have no potential to get commission from selling it.”

TractorHouse offers additional benefits for using the feature. Meiergerd says, “When a machine gets put on pre-AuctionTime, it moves up to the top of search listings on that TractorHouse web page. So, it’s in the number one position of all like models. Some dealers also have a platform set up on their website linking to the machines they have on AuctionTime so they can be bid on by the local customer base as well.”

Meiergerd sites a recent example of any older combine listed by Plains Ag, a 10-store Case IH dealer in North Dakota and Montana, at $17,000 as a Pre-AuctionTime price. “At the end of the day it went out to AuctionTime selling for $20,000. We saw in the bid history there were wholesalers and dealers that bid it up to that price, then the end users, bid over the top of that.”

Geotargeting and Co-Branded Remarketing

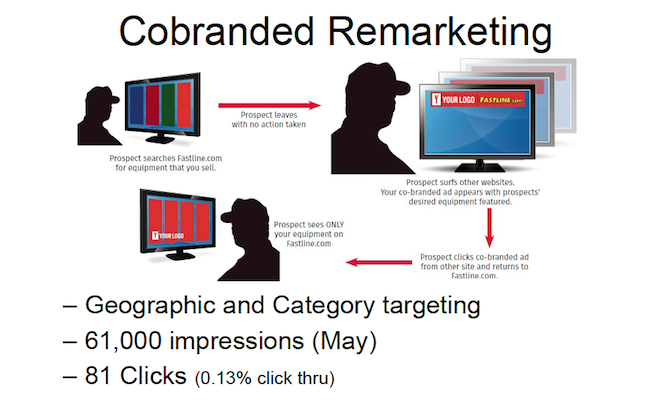

Susan Arterburn of Fastline has been working with farm equipment dealers to leverage relationships with farmers in their community. She explains, “If you can get your equipment in front of new local people, or talk again to previous customers, you might get it moved and not be forced into an auction decision.”

Arterburn has been working with P&K Equipment and P&K Midwest, a 19-store John Deere dealership group, to increase digital presence, targeting their area of responsibility. Then focus on machinery they needed moved, including 4WD tractors, harvesting and hay equipment, planters and sprayers. “So what we did is a multi-level digital campaign,” Arterburn says, “trying geo-targeted category-specific banner ads on Fastline.com, cobranded remarketing and a new feature that we’re beta testing, called the ‘Item Reminder’ and supporting this campaign with print.”

Arterburn offered a visualization of the campaign. “You’re driving to work and hear a radio ad for McDonald’s, but you’re not hungry. You drive farther and see a billboard for McDonald’s and recall the McMuffin commercial, now you’re a little hungry. Then you drive past a McDonald’s and all of a sudden, even though you had oatmeal at home, you pull in. The McMuffin is just 99 cents and you really want one. So we wanted to recreate that multi-layer approach with our client and put them in front of the customer throughout their shopping journey.

“We started with three banner sizes on Fastline.com: leaderboard, wide scraper and big box, and we put them in multiple positions,” Arterburn says. This allowed them to have 60,000-75,000 localized, geo-targeted, category-targeted impressions. People who come to Fastline.com are searching for used equipment, but then they leave and go to ESPN, for example, to weather, or they shop on different networks or websites. What we’re able to do is take our client along with them on that journey through a co-branded remarketing campaign. We’re staying geographically and also category targeted, so we’re only showing these messages to those folks who have already looked at a certain type of equipment and live in the dealers’ geography.

Fastline also has a new function called “Item Reminder.” Arterburn says farmers are looking at a lot of equipment online. “We wanted to make sure that if they’ve looked at a machine during a previous search, the next time they come back, we don’t want to make them look for it again, so we put it right in front of them when they land on the home page. There are additional return views on those pieces of equipment when someone comes back to Fastline.com.”

Arterburn says Fastline is finding successful ways of migrating marketing strategies from primarily print into more digital exposure. “We got one client over 120,000 impressions in May, which is higher than we could get them in print with our regular distribution. We’re continuing to improve that product mix, so we’re adjusting the creative content based on the seasons and the specials that they have going on; we’re just trying to keep it relevant in the minds of the consumers.”

Wholesale Machinery Network to Satisfy Equipment Retail Needs

A.J. Neifert is president of Iron Connect, a company with a platform capable of linking every machinery dealer together to increase wholesale trade and retail sales. He works with dealers who want to go into each selling season with a customer targeted offering of used equipment, which can’t be generated through trades from their existing farmer base.

Neifert says predicting demand, for a sprayer offering for example, can create challenges. He provided a case study about how Iron Connect worked with Alliance Tractor, a 4-store John Deere dealership in Illinois and Indiana. “Do we go out and buy 8 sprayers, or is that number 10, and are those units equipped correctly? Maybe we have 750-hour machines with 100-foot booms, but farmers want those with 300 hours and 120-foot booms. Then, are we finding those units at the best prices? Dealers may buy from auctions and manufacturer’s bid lists, but they don’t know every dealer and what units they have.”

“Iron Connect offers a ‘Want to Buy’ feature,” Neifert says, “and instead of pre-stocking units and a couple million dollars of inventory, this can be done on an ‘on-demand’ basis.” He emphasizes that the platform’s success starts with having true salespeople vs. order takers. “It is extremely important to send sales personnel out to talk to farmers and uncover needs. Certainly, you’re going to try to push the equipment you have in inventory first, but in the market today, we can’t let those customers go buy from someone else.”

Once the need is determined, Neifert says it’s important to get all the specs required on that machine, as well as the desired price. “At that point, a ‘Want to Buy’ message can be posted on Iron Connect, which goes out to every single farm equipment dealer in North America who might have access to wholesale a unit. If it’s a piece that they really need to liquidate, they’re going to send a pretty strong price. If it’s only been there 30 days, they won’t be as aggressive. The dealer with the potential for the retail can have maybe 10 or 15 options to present to that customer and find the best deal and make the sale.”

“We’re finding machines that aren’t even on the market,” Neifert says, ”when salespeople are out trying to make a trade and might be evaluating one of those exact machines. It’s possible to pre-sell equipment while they’re still sitting in the customer’s barn. We see dealers posting, ‘I’ve got this customer trying to trade this machine in. Here are some photos, make an offer.’ We’re helping both sides and they’re able to move units before they even hit the used market.”

Neifert’s platform matches buyers with sellers in a timely manner. “If that salesman walks off the farm at noon on Monday and we put a ‘Want to Buy’ out, he realistically could go back on Tuesday afternoon with three to five options of machines that might work for them.” That helps satisfy the demand when the customer is in the buying mode. “We want to make sure that no customer walks out of our clients’ dealerships without them having at least a chance of making a sale, even if they don’t have a machine with the exact specs of the unit the customer wants.”

Improving Farm Equipment Turns Through Consistent Trade Booking

Manda Patrick is sales manager for Iron Solutions, a company that takes a different avenue toward moving used equipment. They offer a platform called Iron HQ, which configures price quotes and develops consistent trade evaluations between multiple locations, while improving visibility of used inventory. Patrick recently worked with a Plains Ag, which had multiple processes in place for managing used equipment. “They had Excel sheets that went out sporadically with available inventory, and text messages and email chains about trade–ins. Their used machine approvals were done at the store level vs. the corporate level; and all that was causing a lot of chaos.”

Iron HQ was able to solve those problems by standardizing trade-in processes utilizing Iron Guides, an online platform that calculates used farm equipment values based on a number of market factors. Patrick says, “Trades are now sent to the director of sales for approval, making decisions that are best for the company vs. the single store, creating a more consistent process.”

She says the Iron HQ system improved communication about used equipment availability for the dealership. “The trade-in sales notifications are sent to all salespeople three times a day vs. maybe once a week previously, making everyone aware of what’s available to sell and what’s been sold. It could be sent instantly if you wanted that many notifications. Included in Iron HQ is Iron Search, so with a click of a button, they can list their inventory publicly on an online search platform. This is going to get equipment sold as fast as possible.”

She adds that salesperson accountability has improved using another function of the platform. “Sales reps have metrics to meet, certain calls to make, and farmers to visit. That’s all tracked through Iron HQ, where they can check a box at the end of the week when they’ve done their activities, increasing accountability. Post sale lists can be created for parts and service calls or to send out special offers. They can also send emails to their current customers that might be coming up to trade, all easily tracked in Iron HQ.”

Iron Forecast is another service Patrick’s company offers, which enables dealers to re-price their entire inventory with a click of a button. Another function can help forecast values out to 7 years and estimate the influence of changing commodity prices. “So if corn moves a dollar, what does that do to equipment values? That creates a proactive re-pricing process, mitigating risk, reducing lot rot, and helping navigate seasonality.”

Leveraging Data to Market to Farmers

Brad Long is senior vice president of sales with Machinery Pete. While relatively new to the agriculture business, he has over 30 years of publishing and media experience with corporations like Gannett Tribune Co. and Cars.com, and he’s seeing more farm operators shop online. “Most dealers today are focusing in advertising online. They’ve realized the digital transformation is constant; it’s ongoing and doesn’t seem to be stopping. We’re spending over 25% of our time on digital platforms; even our children aren’t learning through textbooks any longer, they’re using laptops. I have a daughter in high school, who hasn’t had a textbook in years.”

He notes that the digital world is evolving with over a billion people getting information on mobile devices now. “There’s a reason that, in this last quarter, some of the largest laptop manufacturers had one of their slowest sales quarters. It’s because we’re getting information from mobile devices, whether it be Android, iPhone or a Surface tablet, for example. So what does this mean to you as you try to market to your customers? We have an opportunity to leverage technology to make the buying process easier, and it’s a very effective way to reach your target audience.”

“So what does this mean to you as you try to market to your customers? We have an opportunity to leverage technology to make the buying process easier, and it’s a very effective way to reach your target audience…”

— Brad Long, Machinery Pete

“One of the things we’ve been doing at Machinery Pete,” Long says, “is designing programs to target the audience more cost effectively and efficiently. We’re used to the old media ways and the print background, and back in the day, it was all about inserts. Whether it was Target, Home Depot, or Handy Andy, it was getting those inserts out to customers, sending them to millions of people. As advertisers and retailers became more sophisticated, they wanted zip code specific deliveries. Then they made it more granular, targeting people that were interested in, for instance, golf. So maybe Sports Authority or Dick’s Sporting Goods could target people they knew were interested in a specific sport. So marketing became more about targeting.”

Long says, “Think about all the different ways that people are advertising to you on mobile apps. How often are you seeing sponsored messages? It’s over 5,000 a day, so how do you stand out? Whether you’re a sales rep or running marketing for your equipment dealership, it’s important. It’s that old adage, ‘What gets measured gets done.’ You have to measure your advertising programs, whether it’s through leads that you’re getting, phone calls or emails. There has to be some kind of attribution model, not just that gut feeling that I think they saw my print ad or my inventory on that digital platform.

“What we’ve been doing with customers,” Long says, “is email marketing, a cost effective way to reach a targeted audience. At Machinery Pete, we measure how people opt-in to our database, if they’ve given permission to send promotional messages and how that permission was granted. We follow up with them two or three times annually to make sure that we have the correct email address and that our data on that consumer is accurate.

“We’re selling to a database of over 1.6 million farmers and we can help you select the customers you’re trying to reach.” Long continues, “We can target them by crop size, by manufacturer loyalty, by city, state and zip code. So you may want to do a specific promotion, such as an auction at your dealership or if you want to move certain types of equipment, an email program is a great way to do that. And you can highly target with the program vs. casting a wide net.

“So retargeting is another thing that you can leverage,” Long says, “if I’m shopping for a specific piece of equipment on Machinery Pete and then I go to another website, that piece of equipment may follow me. If I’m shopping on Cabela’s and looking at a specific type of boot and I go to Yahoo, that boot may follow me through the web. So it’s highly targeted, an opportunity to brand your product or service and to give your equipment more digital exposure.”

Melding Print Ads with Online Equipment Listing

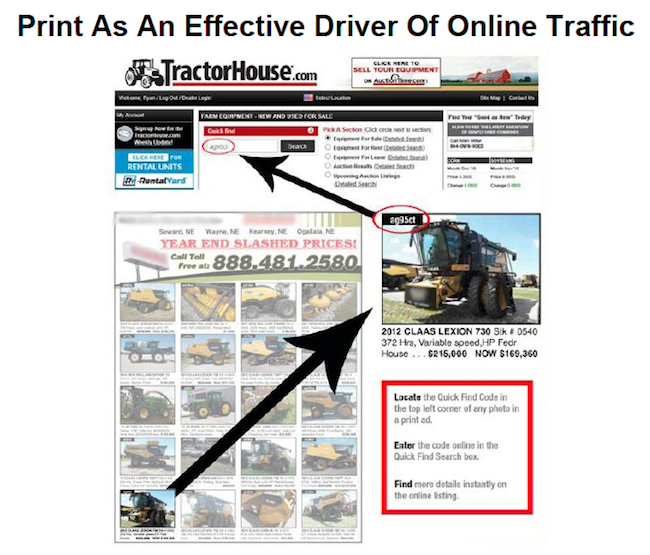

Nate Meiergerd, who earlier discussed AuctionTime, outlined a 2016 TractorHouse campaign put together to sell specific machines seasonally. It was a print campaign, but tied to online listings targeting mostly combines and headers in June through August. The campaign measured “Quick Find” traffic. “Quick Find” is a 6 digit number in the TractorHouse print ad that if entered on their webpage, will take shoppers directly to that machine.

“The equipment dealer started out with 20 machines with Quick Find numbers in their print ad,” Meiergerd says, “then they tracked the results as the ad size changed. When they doubled the ad size, they increased that traffic by six times. And then when they went from the two pages that they were running to four pages, it went up by another three times, so there is still a lot of crossover traffic between print and online.”

Meiergerd says that crossover traffic doesn’t do any good unless it leads to sales and this experiment did just that. “In terms of moving those items, getting the phone to ring, and getting buyers connected with salesmen, as they went from the two-page to the three-page ad, they quadrupled those inquiries and they’ve tripled those phone calls from the beginning of the year to now.”

Meiergerd says increasing overall impressions and number of website views on machines involved additional marketing strategies. “They also utilized featured listings on specific units, pulling those machines that are priced aggressively up close to the top of searches, getting more eyeballs on them, and increasing detailed page views. One of the key factors is looking at pricing and making sure that they’re priced right. Dealers have done similar campaigns and without the same results. But usually, it’s because they’re looking to push some aged machinery that they have not re-priced.”

Each case study presented highlighted the growing trend of farmers’ online shopping and examined new and innovative platforms offered by different vendors to reach customers with highly targeted messages. Closely managing equipment trade practices, utilizing targeted customer demographics and analyzing specific potential markets for all products, especially trade-ins, can lead to faster turns, greater margins and an improving bottom line.

Click here to watch the full presentation