Of the dealers queried, nearly 60% shared their customers would fall into the “likely” or “very likely” category of interest in autonomous farm machinery. They estimate 20% would be unlikely to have an interest and 20% uncommitted or “neutral” in their interest level.

Comments from Dealers

- We see the desire for autonomy in certain markets more than others. Traditional cash crop and dairy would be the least interested with fruit crops the most interested.

- Untested and costly.

- We believe it will eventually happen and take over, but a lot of customers don’t believe so.

- I personally am excited about autonomy, however, I have not heard any clients talking about it.

- Only a few larger customers are interested, most of the average to smaller size customers are against it.

- For a fair number of operations, they’re not sure it’ll be financially feasible. Also, compatibility with implements and different types of field operations will be key.

- When Raven first debuted their AutoCart we had quite a bit of interest, then Raven pulled all of our product back so now we are in a waiting game for a solution again.

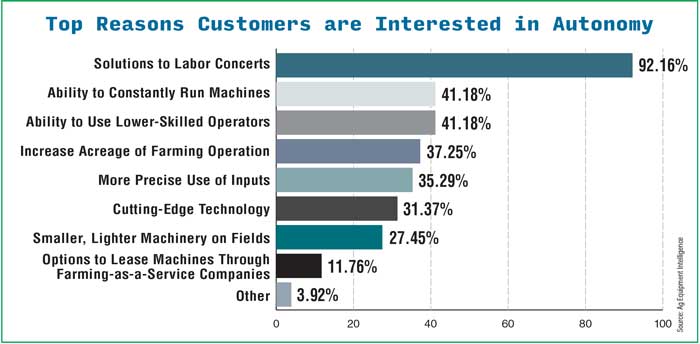

Reasons Customers Would be Most Interested in Autonomous Machinery

Dealers say a full 92% of their customers view autonomous technology as a solution to the growing labor-shortage challenges for agriculture, including 41% who see such equipment as a way to use lower-skilled labor. Another 41% would see value in being able to run machinery 24/7, and 35% would be interested because of autonomous technology’s ability to provide more precise input application. The dealers say more than a quarter of their customers would be interested in fielding smaller, lighter equipment that could come from autonomy.

Ranking Concerns over Selling & Servicing Autonomous Machinery

Availability of qualified technicians leads the pack for the dealers who responded to questions about their concerns about selling and servicing automated farm equipment. More than 80% said they were concerned or very concerned about finding and keeping qualified service personnel familiar with autonomous equipment. Machinery inventory and investment costs for sales and service personnel training was also high on the “concern” list for dealers.

Dealer Comments:

- Finding and retaining employees with a defined skill set who are specialized in technology, agriculture and mechanics is becoming increasingly harder.

- 24-hour service availability for machinery, as well as concerns if units go electric (and smaller) on what service options look like — especially on the turf side of the business.

- The availability of service technicians is a huge concern for all of us in the service industry. It seems to only be getting harder to hire and keep quality techs.

- I’m concerned about availability of qualified people for this technology. Will training come from our manufacture or ag schools? I have been in business 50 years and it is a future I didn't imagine I would have had to deal with.

- Salespeople being able to accurately provide specs on equipment, and not overselling the autonomy without providing realistic expectations for the customer.

- Without more qualified service technicians to choose from and hire, the agriculture sector is going to have a very difficult time prospering in the future. It has reached a critical stage and there is no solution in sight.

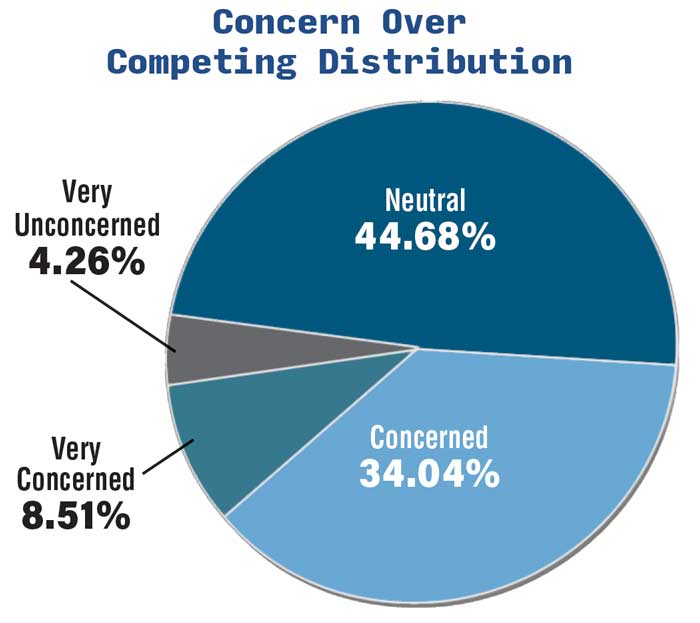

Potential for Different & Competing Distribution Models

More than half of responding dealers (57%) are relatively unconcerned about the emergence of autonomous technology leading to different business models for distribution and sales of farm equipment. Nearly 43%, however, say they are concerned or very concerned about possible changes coming from trends toward autonomy.

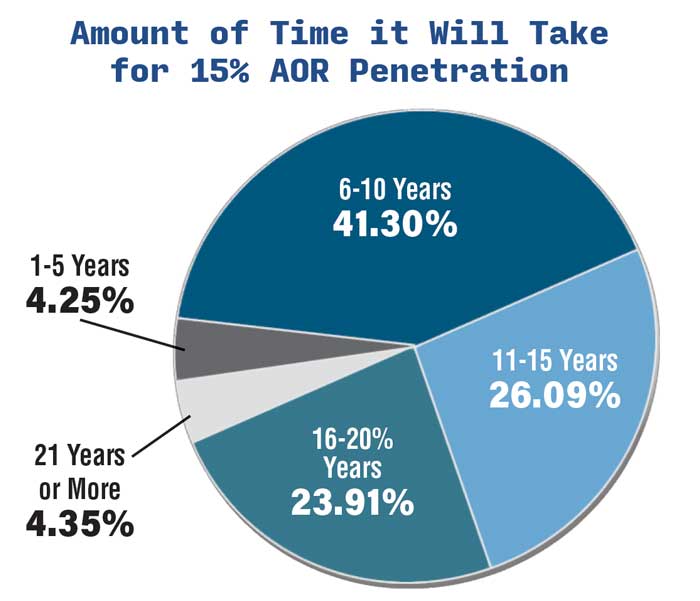

When Will Diesel-Powered Autonomous Machinery Reach 15% AOR Penetration?

About 45% of the dealers responding indicate they would foresee diesel-powered autonomous farm equipment penetrating their dealership’s market area by 15% over the next 10 years.

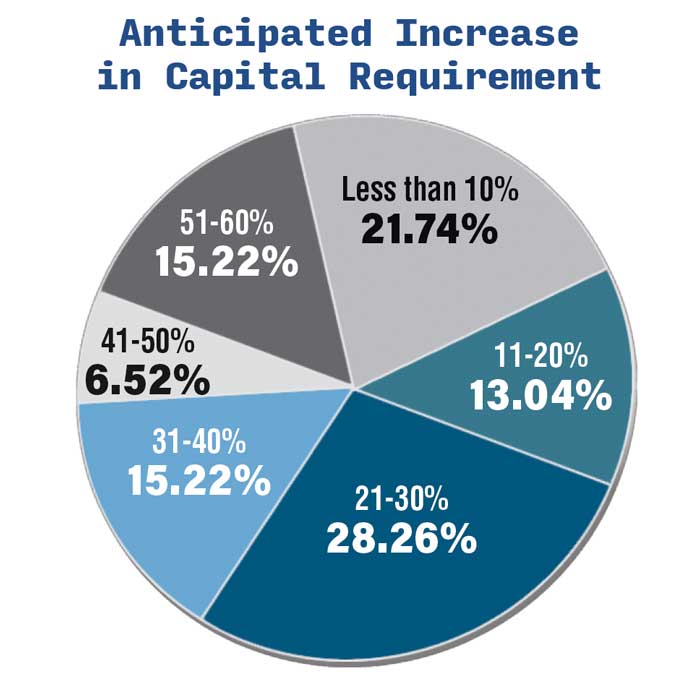

Capital Requirements

If the estimates of the queried dealers are accurate, their dealerships’ capital requirements to sell and service autonomous farm equipment will jump from 20-50%. Twenty-one percent think increases in their capital requirements will be 10% or less, while 15% think those expenditures will have to rise 51-60%.

Source for all graphs on page: Ag Equipment Intelligence

Weighing The Viability of an Autonomous Future

Dealer Perspective: Concerns About & Customer Interest in Autonomous Farm Machinery

Sabanto Works to Make Autonomy Affordable, Reliable & Scalable

Fresno Equipment Prepares for the Future with Entry into Autonomy Arena