Precision Dealers Look for Sales Comeback in 2017

During the last few years, dealers have been extremely conservative with their revenue growth projections for the precision farming segment of their businesses. This is a direct reflection of their customers’ more prudent purchasing habits. But the results of this year’s Precision Farming Dealer benchmark study reveal a reversal in these recent revenue trends.

2016 Performance

Based on responses from 120 farm equipment dealers compiled during the first quarter of 2017, 23% of dealers reported 2016 precision revenue growth of 8% or more, which was more than double their forecast (10%) from last year’s survey.

On the other end of the spectrum, 8.7% of dealers reported revenue declines of 8% or more last year, about 3 points lower (11.1%) than they forecast during the first quarter of 2016. “This also marks the first time since the study began tracking revenue projections 3 years ago that revenue declines of 8% or more were in single digits,” says Jack Zemlicka, managing editor of Precision Farming Dealer, a sister publication of Ag Equipment Intelligence.

He adds that it’s worth noting 75.6% of respondents identified themselves as traditional farm equipment dealers, the lowest figure since the study began tracking business structure in 2015. Among this group, 41.8% reported 2016 revenue growth of at least 2%. Some 16% of respondents classified themselves as independent precision dealers, with 66.7% of this group reporting at least 2% revenue growth in 2016.

Some 40% of seed, chemical or fertilizer retailers participating in the study reported revenue growth of 2% or more in 2016, including 30% who saw growth of 8% or more.

2017 Outlook

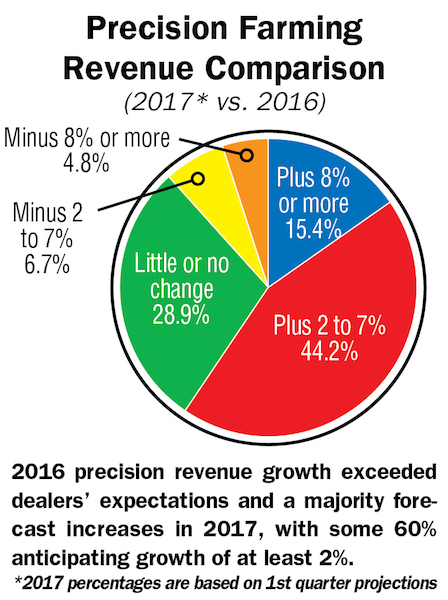

Looking at their current selling year, some 59.6% of all dealers forecast revenue growth of at least 2% this year, with 15.4% projecting growth of at least 8%. This is well ahead of the 40% of dealers who forecast revenue growth of at least 2% at the same time last year, along with the 41% in 2015, and is more in line with 2014 (59.2%) results.

Fewer dealers are also anticipating measurable revenue declines in 2017. Only 11.5% are forecasting a dip of 2% or more, by far the lowest total in the history of the study. Only 4.8% of dealers are projecting revenue decreases of 8% or more.

The complete benchmark report appears in the Summer 2017 edition of Precision Farming Dealer and here.

— June 2017 Ag Equipment Intelligence