In the latest newscast we look at what the latest Purdue Center for Commercial Agriculture Ag Economy Barometer reveals, how John Deere’s quarterly sales were down but operating profit was up, what’s driving autonomous equipment in ag, how the Hagie deal is helping one Iowa John Deere dealer and the latest earnings report from Titan Machinery.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment – including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business – matching the income stream of ag producers.

Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

In Little League, coaches tell young players to “keep your eye on the ball.” The advice applies to both fielding and batting, but it is just as applicable to running a successful farm equipment dealership. That’s just what Don Van Houweling, owner of the 2016 Dealership of the Year, has done at Van Wall Equipment.

I’m managing editor Kim Schmidt, welcome to On The Record. Here’s a look at what’s currently impacting the ag equipment industry.

Producer Sentiment Improves In July

Ag producers’ outlook improved in July following volatility in the commodity markets in June and early July. That’s according to the latest Ag Economy Barometer survey by the Purdue Center for Commercial Agriculture.

FARM

MACHINERY

TICKER

AFN: $43.58 +0.62

…

AGCO: $48.58 +0.69

…

AJX: $0.65 +0.03

…

ALG: $65.48 +0.62

…

ARTW: $2.86 +0.13

…

BUI: $4.76 –0.01

…

CAT: $82.84 +0.19

…

CNHI: $7.45 –0.07

…

DE: $87.29 +9.14

…

KUBTY: $70.88 –2.87

…

LNN: $74.32 +4.31

…

RAVN: $24.99 +4.14

…

TWI: $9.64 +0.75

…

TRMB: $27.44 –0.15

…

VMI: $132.51 +2.38

…

CVL: $11.75 +0.48

…

RME: $8.87 +1.04

…

TITN: $10.93 –0.05

…

TSCO: $84.76 –0.60

...

Closing Stocks as of 08/25/16 (Compared to Close on 08/10/16)

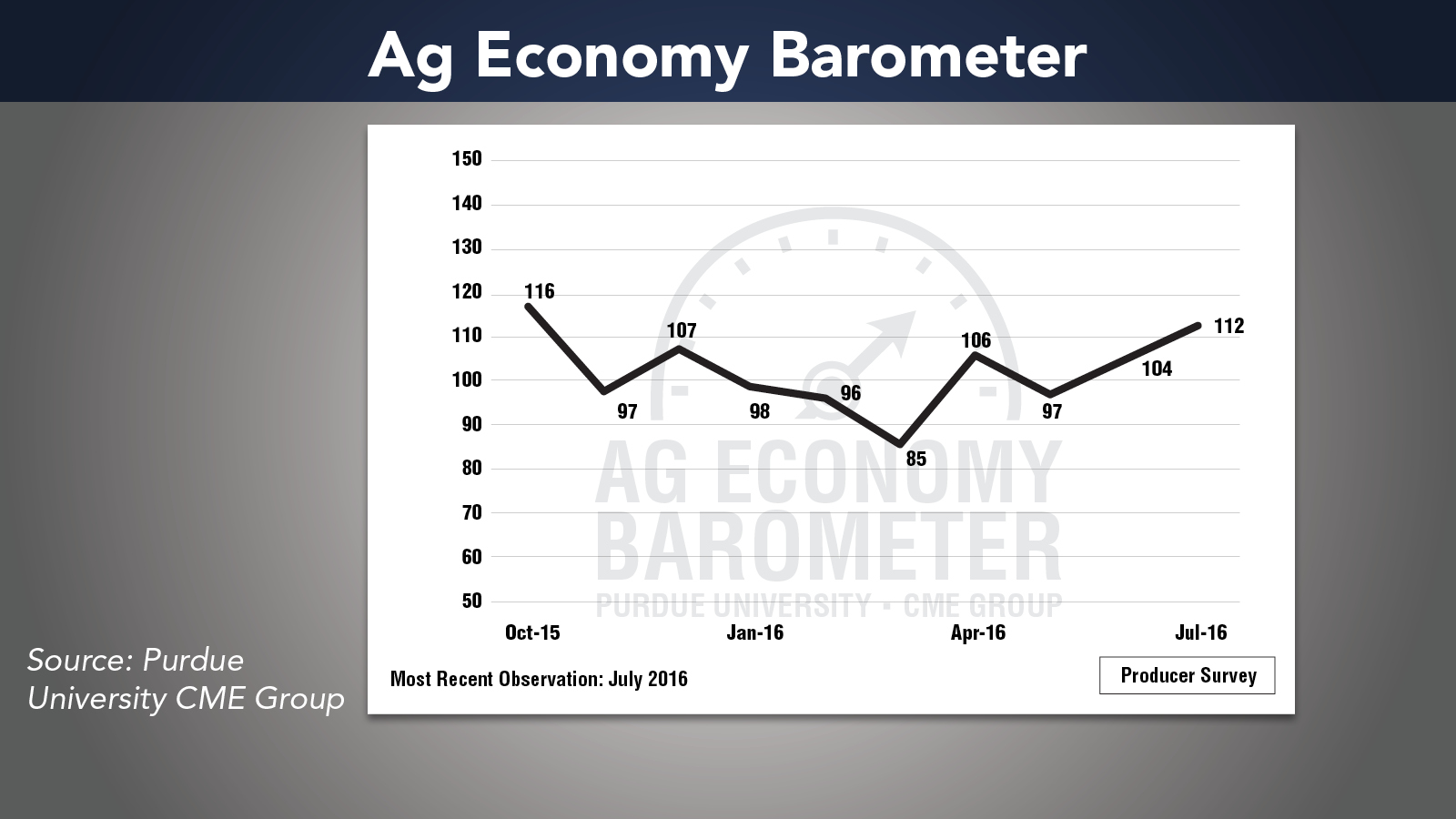

The July reading came in at 112 compared to 104 in June and 97 in May, driven largely by expectations for the future. The producer Index of Future Expectations jumped to 121 in July, well above June’s observation of 107 and the highest reading for the index since data collection began in the fall of 2015. However, when it comes to current conditions, the index dropped to 93, down from June’s reading of 98.

James Mintert, David Widmar and Michael Langmeier, the report authors, say that while this spring’s uptick in crop prices was short lived, it appears the price rally helped boost producers’ expectations of future economic conditions in ag.

Dealers on the Move

This week’s Dealers on the Move are Papé Machinery and Titan Machinery.

Papé Machinery is closing its store in Bonners Ferry, Idaho, citing depressed economic agricultural climate in Northern Idaho as the reason. According to Ag Equipment Intelligence’s 2016 Big Dealer Report, Papé Machinery is the 11th biggest ag equipment dealer in North America. The closing brings the dealership’s total ag locations down to 20.

Titan Machinery plans to build a 20,000 sq. ft. facility in Sioux Falls, S.D. The space will consolidate Titan's two Sioux Falls locations, a Case construction dealership and a New Holland agriculture dealership.

Who Will Drive the

Autonomous Revolution in Ag?

As our staff prepares for the 2016 Farm Progress Show, I’m always particularly interested in seeing what precision innovations companies unveil. It’s worth following the evolution of new technologies, some of which succeed as mainstream systems, while others are perhaps ahead of their time.

One concept which falls in the latter category is autonomous equipment. Seemingly on the verge of revolutionizing the ag industry for the last several years, autonomy is still largely in the trial and error phase, especially in the U.S.

Still, the topic is ripe for debate and I recently had the opportunity to moderate a discussion among 9 precision dealer members of the Independent Precision AgAlliance at its most recent meeting in Gary, South Dakota.

Part of the discussion focused on who dealers anticipate will ultimately be the driving force for autonomous vehicles in agriculture. While smaller companies may be able to maneuver and specialize more quickly to develop autonomous technology, will the large manufacturers be better equipped to finance and market the systems?

This remains to be seen, but group members suggested that autonomous products may start as scalable, aftermarket systems — possibly in the form of miniature planters or sprayers performing field operations in a timelier and potentially safer manner.

“I think just because of how quick that venture capitalist money and/or innovation companies are going to bring something to the table. I think we’re going to see it hit on the aftermarket side first, before the large, green, red OEM type companies will be able to adopt and adjust their businesses to handle something like that and develop their own.”

— Paul Bruns, owner, Precision Consulting Services, Canby, Minn.

Autonomy in ag will continue to be a topic of debate, with little consensus as to the true value of the technology until systems are commercially released, sold and used on farms.

Deere Net Sales Drop, Operating Profits Improve

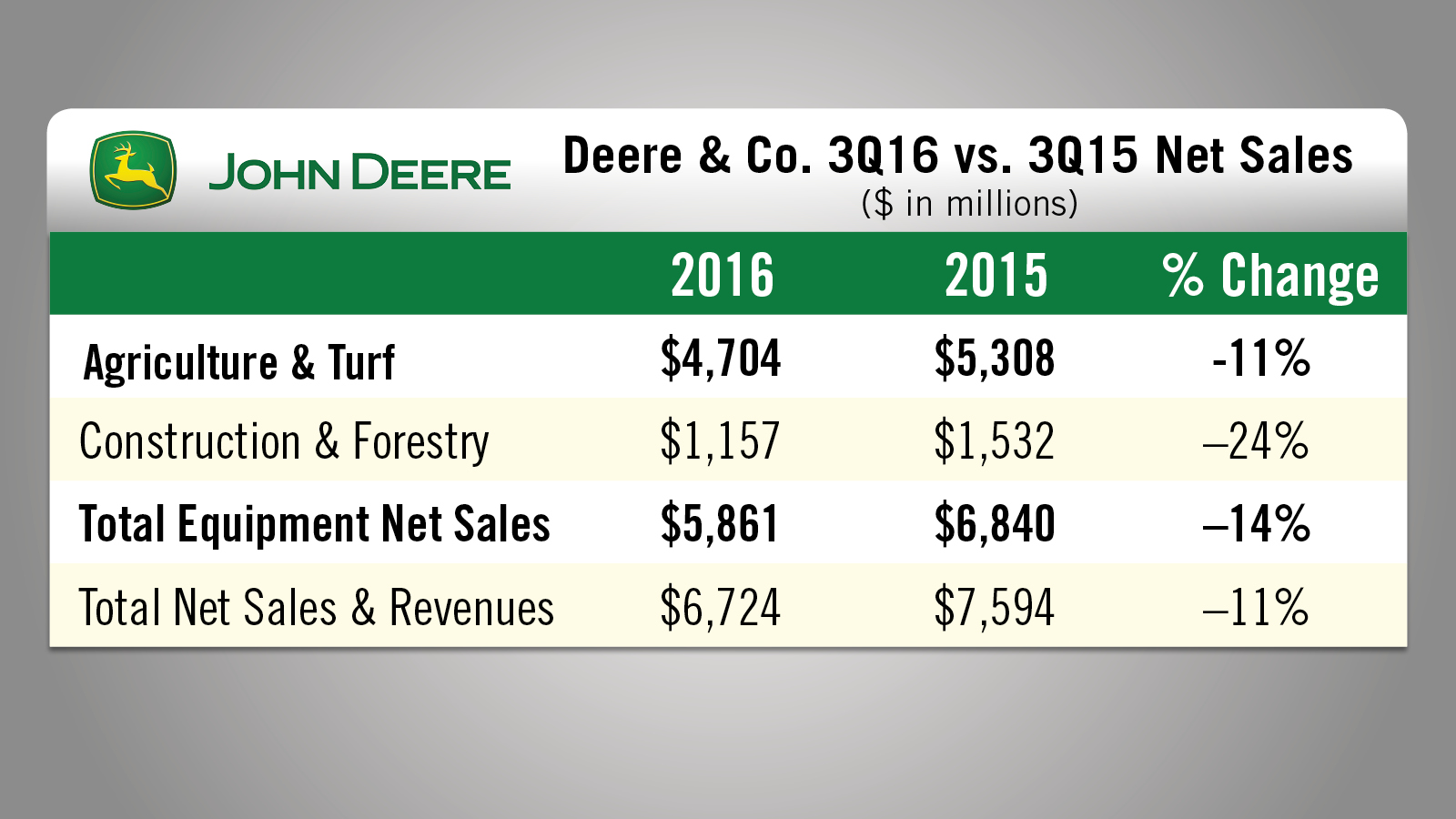

Deere & Co.’s ag sales were down 11% in the third quarter, while worldwide net equipment sales fell 14%. Third quarter net income for the company came in at $488.8 million vs. $511.6 million for the same period last year.

While equipment sales were down for the quarter, operating profits were up 4% for the quarter compared to the third quarter of 2015. This was primarily driven by price realization, lower production costs and a decrease in selling, administrative and general expenses, partially offset by reduced shipment volumes and the unfavorable effects of foreign-currency exchange, the company said.

Commenting on structural cost reduction activities during a call with investors, CFO Rajesh Kalathur, said Deere expects to improve its pre-tax income by at least $500 million by the end of 2018 if the large ag downturn persists at current levels.

Lower production costs are largely due to layoffs. Since the beginning of 2016, Farm Equipment has reported on 4 rounds of layoffs, impacting nearly 500 workers. The latest round was announced this week following Deere’s third quarter earnings release.

The company also reported that worldwide financial services net income fell to $126 billion during the period vs. $153 billion a year ago. Joshua Jepsen, Deere’s manager of investor communications, attributed the decline to “less favorable financing spreads, a higher provision for credit losses and higher losses on lease residual values.”

Commenting further on the lease situation, Tony Huegel, Deere’s director of investor relations, said that in terms of losses that were recognized:

Looking ahead to the fourth quarter the company expects net sales to be down about 8% vs. the same period of 2015. For the full fiscal year, Deere expects total net sales to dip 10% vs. fiscal year 2015 and 8% for its worldwide ag and turf sales.

Hagie Acquisition Good News for Iowa Deere Dealers

Earlier this summer we sat down with Don Van Houweling, owner of Van Wall Equipment, a 25-store John Deere dealership based in Iowa. Van Wall is the 2016 Farm Equipment Dealership of the Year.

We asked Van Houweling what sort of impact Deere’s acquisition of Hagie this spring would have on his business. Given Van Wall’s location in “hybrid country” as Van Houweling put it, they are situated to be very successful with the additional product line Hagie offers them now.

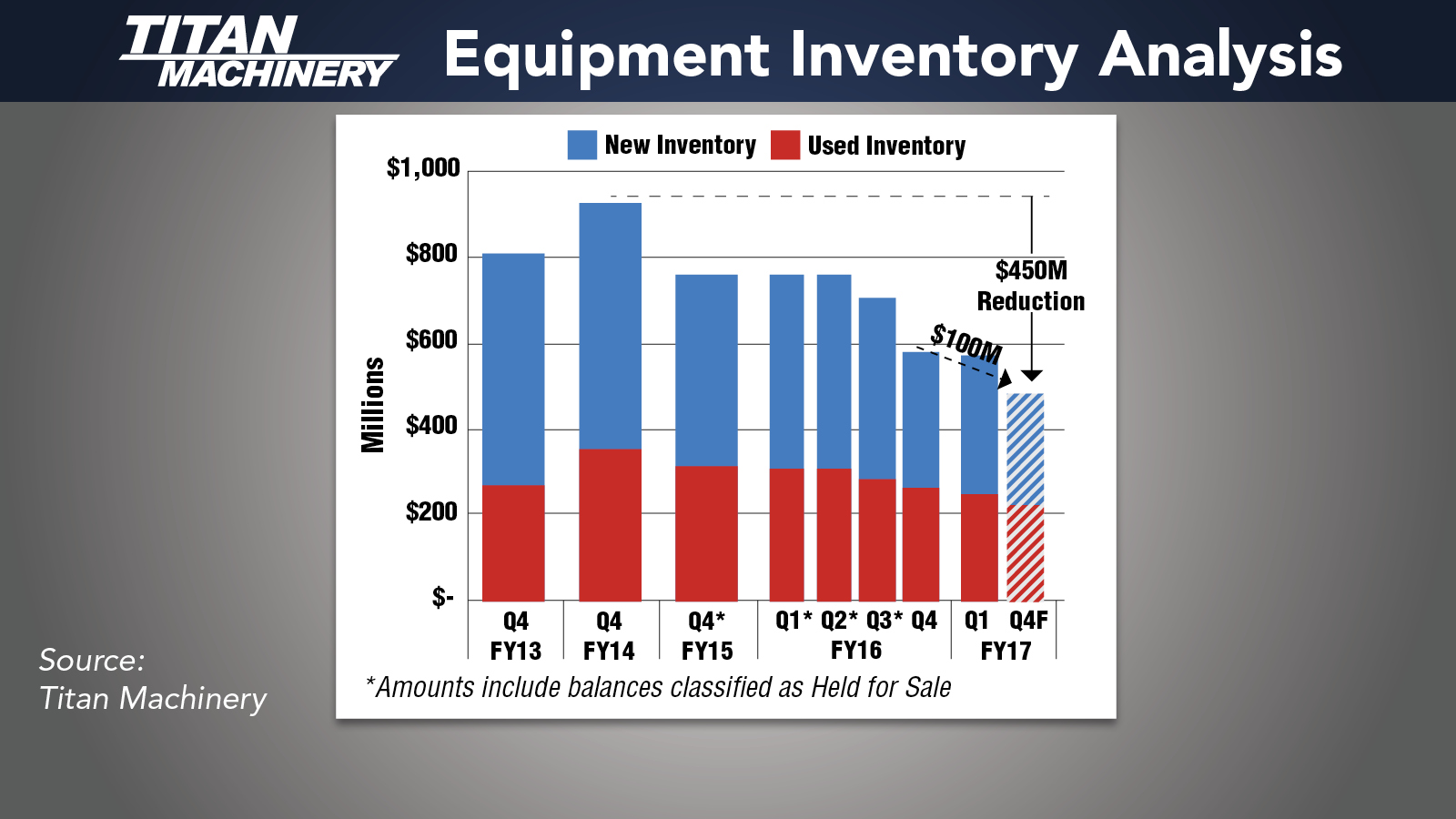

Tough Quarter for Titan Machinery

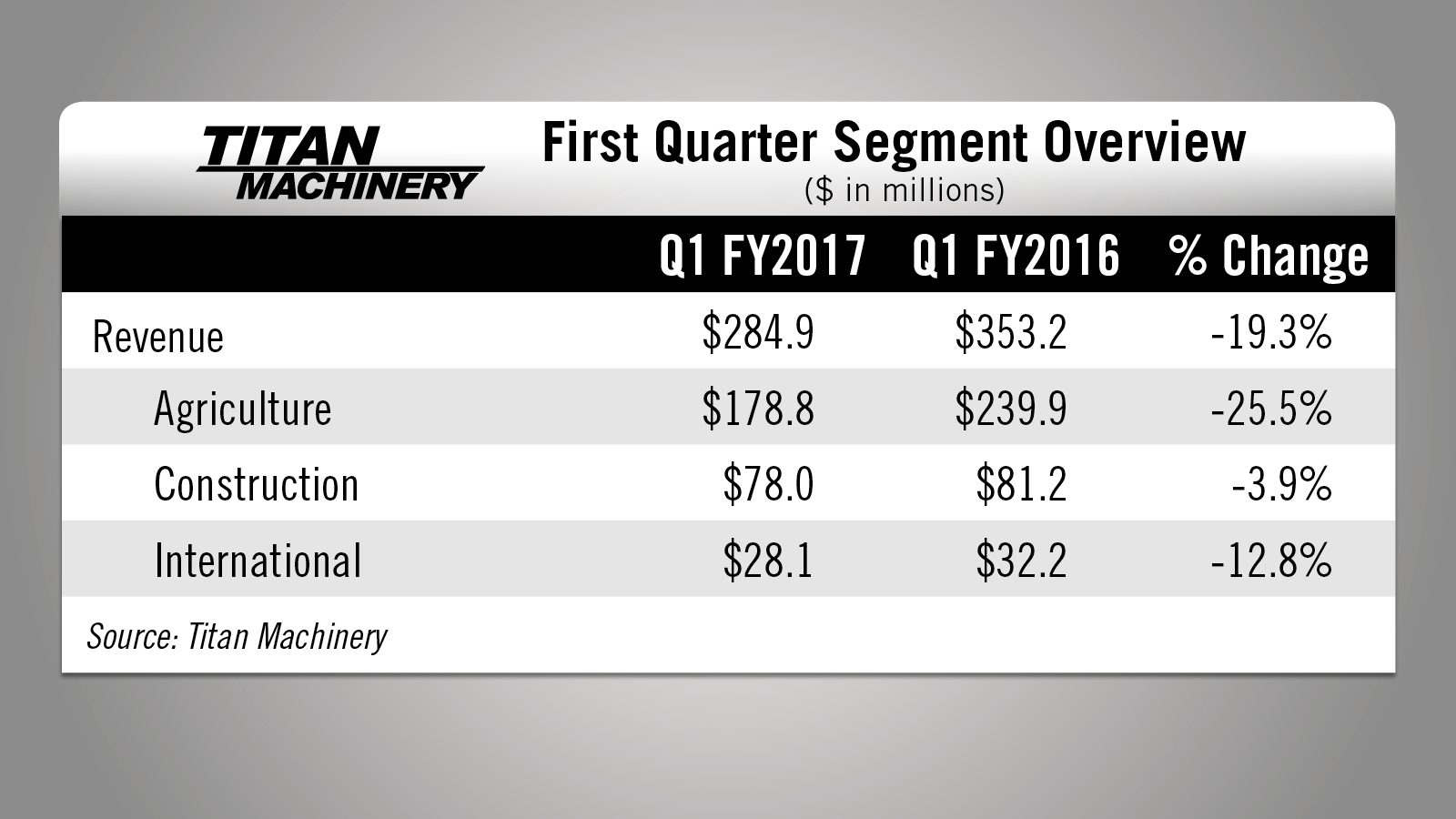

Titan Machinery, the largest farm equipment dealership group worldwide, announced its second quarter fiscal year 2017 earnings on Aug. 25. The company reported that revenues for the period were down 19.3% to $285 million vs. $353 million a year ago.

Revenue from the sales of farm machinery was down by 25.5% and construction equipment revenue declined by nearly 4%. Sale of equipment from its overseas operations also fell by 13%.

Reviewing results for the second quarter, David Meyer, Titan Machinery’s chairman and CEO, said, “We continue to concentrate on our inventory reduction, its positive impact on our balance sheet and expect to achieve the $100 million inventory reduction goal for fiscal 2017. We reduced used inventory in the first half of fiscal 2017 by $39 million or 15%, and through the first six months of this year we exceeded our target by $13 million or 40% on our marketing plan of aged inventory through alternative channels."

For the remainder of Titan’s fiscal year, the dealership group expects same store sales of ag equipment to be down 17-22%, construction equipment sales flat and international sales down 7-12%.

Implement & Tractor Archives

While mobile service from farm equipment dealers seems to be somewhat of a new phenomenon, good dealers have been doing it for more than 60 years.

Kevin Heisterkamp with Vetter Equipment shared this video with us of a mobile service tech by his grandfather Leonard Ryan’s John Deere dealership Ryan Implement near Council Bluffs, Iowa, going out into the field to help a farm who had broken down.

As always, we welcome your feedback. You can send comments or story suggestions to kschmidt@lessitermedia.com. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment