In the latest episode we discuss how the latest WASDE report offers an uptick in the ag machinery sales outlook, CEMA’s latest Business Barometer reading and what it says about the state of the industry, the Federal Aviation Administration’s new ruling on UAVs and finally the results of the Agri Media Council’s 2016 Media Channel Study.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by DLL.

DLL offers manufacturers and dealers over six decades of committed experience in providing financial solutions within the agribusiness sector. DLL’s expertise in inventory and retail financing allows for programs specifically designed to grow your business. DLL’s efficient processing and customer support enhance and compliment the products offered to vendors, dealers and customers. DLL’s goal is to provide you and your business with an advantage in a competitive marketplace.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

Grows Business with Shortline Machinery

Willie's Farm Repair took on the Versatile line in 2013 and quickly discovered there was a well-established customer base waiting for a dealer.

I’m managing editor Kim Schmidt, welcome to On The Record. Here’s a look at what’s currently impacting the ag equipment industry.

WASDE Offers ‘Uptick’ for Ag Machinery Sales Outlook

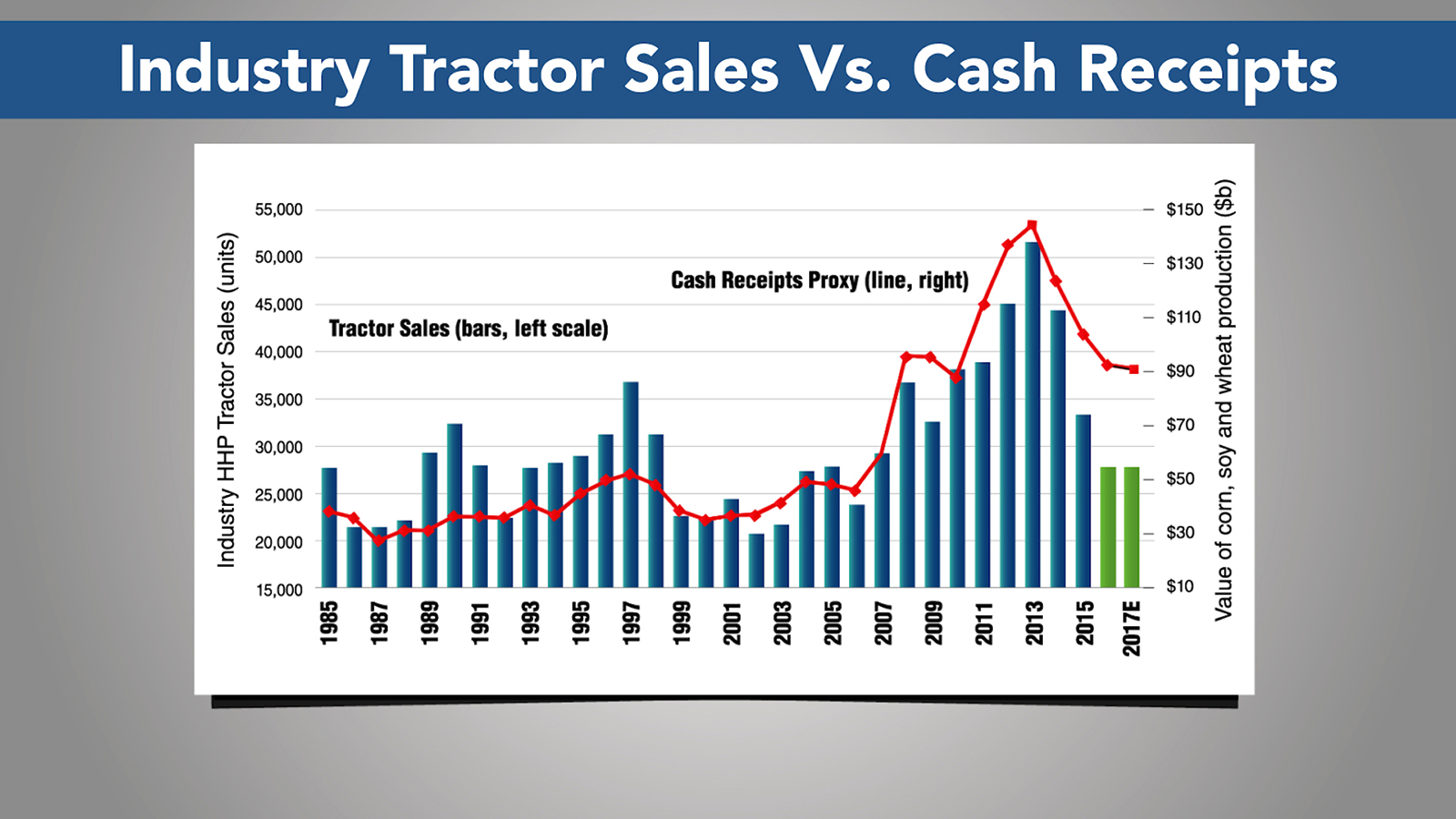

In the current ag economy, even a neutral or flat projection for crop receipts can be viewed as a positive. While no one is quite sure how big an impact the recent rise in crop prices will have on farm equipment sales, for the moment, things don’t appear to be getting any worse.

If nothing else, the June 10 World Agricultural Supply and Demand Estimates report from USDA has improved sentiments among equipment dealers. Responding to the Ag Equipment Intelligence’s most recent Dealer Sentiments survey, one dealer remarked, “April brought increased quoting activity and interest from customers … It seems like customers are keeping their options open and adopting a wait and see approach with capital spending.”

USDA raised the 2016-17 season price range for corn to $3.20-$3.80 vs. $3.05-$3.65 in the previous month. The soybean price range also increased from $8.35-$9.85 per bushel to $8.75-$10.25.

|

FARM AFN: $40.24 +0.91 Closing Stocks as of 06/23/16 (Compared to Close on 06/09/16) |

Analysts covering the industry were also slightly more upbeat about industry prospects. In a note to investors, BB&T analyst C. Schon Williams said, with the cash receipts forecast now flattening out, they are now more neutral on agricultural machinery demand. Cash receipts are forecast to be down 1.1% year-over-year, which is an improvement vs. their May estimate of –2.9%.

Is Recovery Coming?

If the recent increase in commodity prices is sustainable, it has the potential to meaningfully improve the farm equipment industry outlook in the near term, says Igor Maryasis, analyst with Avondale Partners.

He said in a note earlier this week, with corn and soybean prices at their current levels and grain exports running above expectations so far this year, U.S. farmers just might be able to sell their stored crop from last year in addition to this year’s harvest.

Maryasis points out when farmers generate profits, they tend to buy equipment to help minimize their tax burden, and with the changes to Section 179 allowing farmers to deduct $500,000 in equipment expenditures, there’s certainly incentive to make machinery purchases again.

FAA Finalizes Flight Plan for Small Drones

With the agricultural industry in somewhat of a holding pattern for broad use of unmanned aerial vehicles, the Federal Aviation Administration this week finalized its much-anticipated rule for commercial use of small unmanned drones.

The new regulations are set to take effect in late August and provide more detailed, and in some cases, less restrictive requirements for flying UAVs.

One of the biggest changes is that commercial operators will no longer need a pilot’s license and instead be required to pass an aeronautics test every 2 years for a certificate. However, people or companies offering drone-for-hire services will need to pass a written test administered by the Transportation Security Administration.

While smaller drone models have become popular options for scouting crops or grain bins, the new FAA rules will allow for commercial use of UAVS weighing up to 55 pounds, which will have to be flown in daylight hours at elevations of 400 feet or lower.

Privacy and data collection policies are elements that dealers and companies offering drone-based services will still need to consider, according to attorney Jamie Nafziger, chair of the cybersecurity, privacy and social media practice group at Minneapolis-based Dorsey & Whitney.

But she also anticipates that the new FAA rule will clear the air for increased use of UAVs as valuable tools in agriculture.

While some dealers have had success selling UAV systems and related services, other have scaled back on promoting the systems during the down ag market. Once the regulations take effect, it will be interesting to see if dealers alter their approach.

European Ag Equipment Market in ‘Deep Recession’

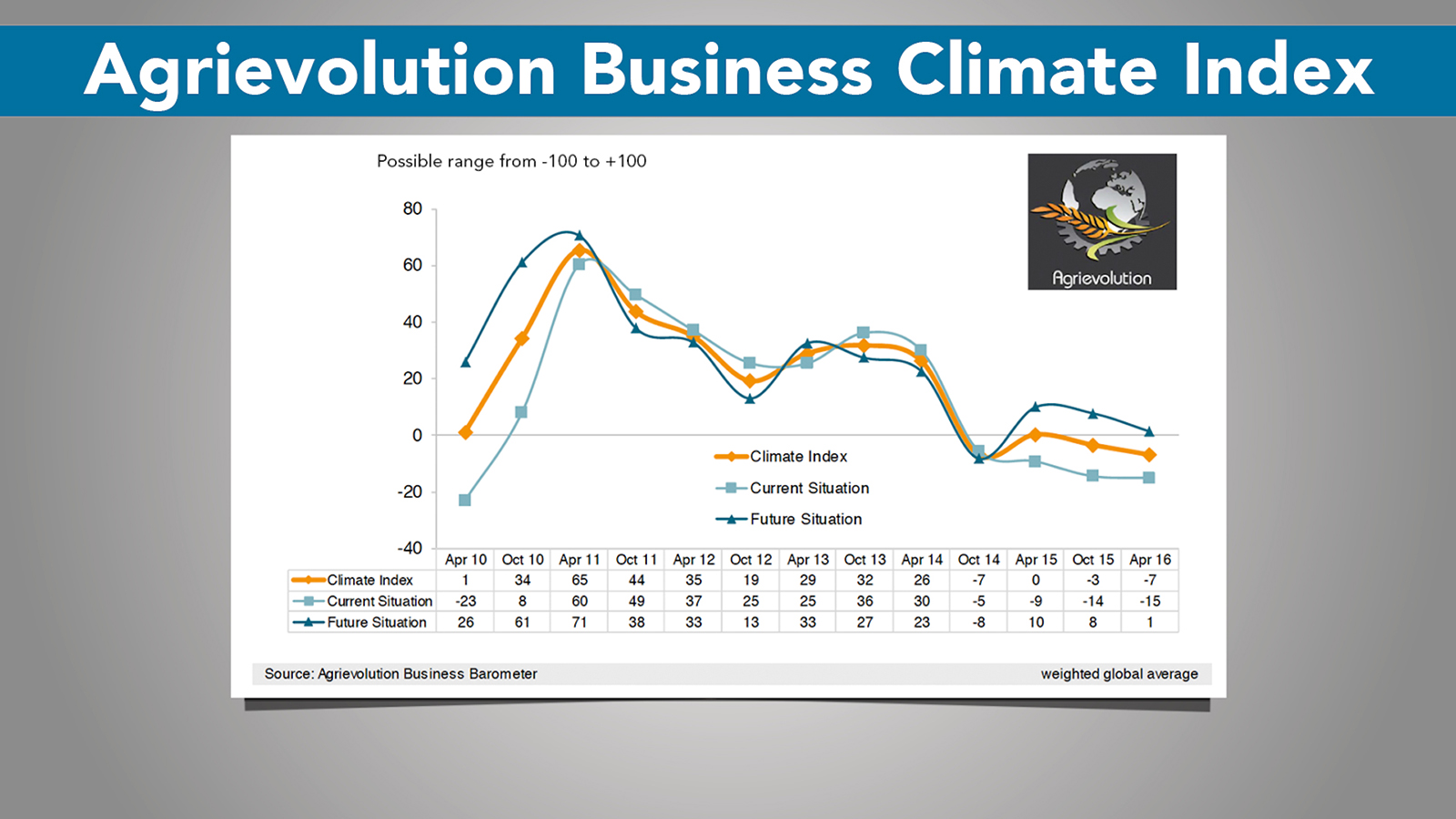

The global downturn in ag machinery sales has stabilized, but expectations for sales recovery remain low for the next 6 months. That’s according to the June release of the CEMA Business Barometer, a monthly survey of the ag machinery industry in Europe. The biannual business barometer survey on global market trends is produced by Agrievolution Alliance.

The survey’s overall business climate index for June is –40, 11 points worse than a year ago and the lowest since October 2014. This is down significantly from the almost neutral –4 reading at the start of 2016. Michael Shlisky, an analyst with Seaport Global Securities, describes the June reading as being at “deep recession” levels.

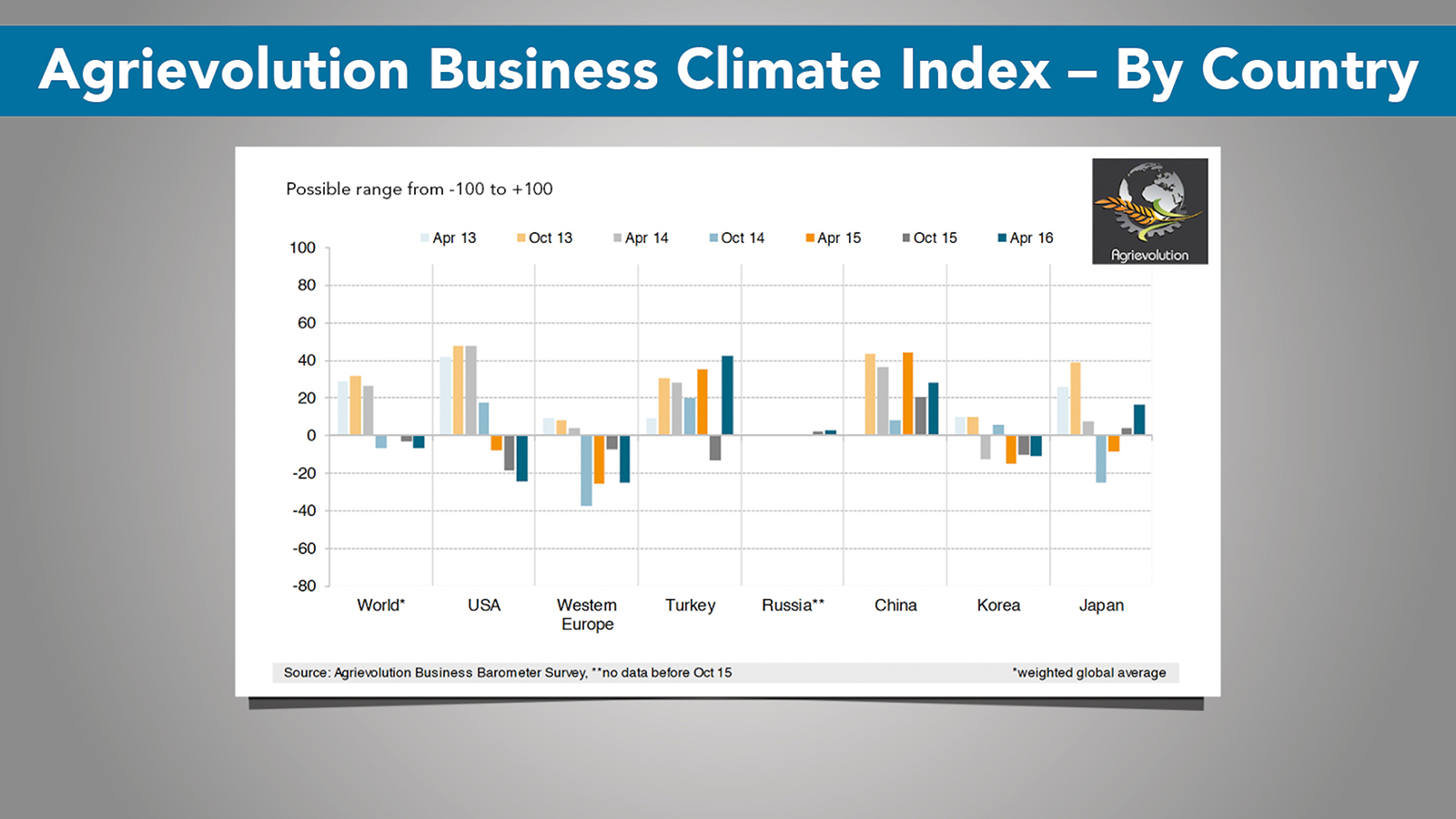

On a global scale, overall projections have improved over previous studies, but many U.S. and Western Europe manufacturers indicated lower optimism compared to 2015.

While France had a slightly positive outlook this month, CEMA notes sales conditions have been deteriorating in France for the last 4 months and could indicate France is “about to crash,” according to Shlisky.

Looking at projections for equipment sales over the next 6 months, East Asia leads the way, followed by Africa. On the contrary, markets in North and Latin America share a less optimistic projection with turnover decreases for the majority of respondents.

Additionally, a large percentage of Japanese, Russian and Turkish respondents credited government programs with providing positive demand for ag machinery in their countries, which helps explain why each of those markets did not experience a drop in volume over the past 6 months.

Overall, industry participants noted current conditions are bearish, Shlisky says. Only 12% of survey respondents considered their current condition as “good” or “very good”, while 58% expressed unfavorable sentiments.

CEMA reports the general mood of farmers toward the ag machinery industry remains largely negative due to low commodity prices, and as a result, low profitability.

Dealers Influence Buying Decisions

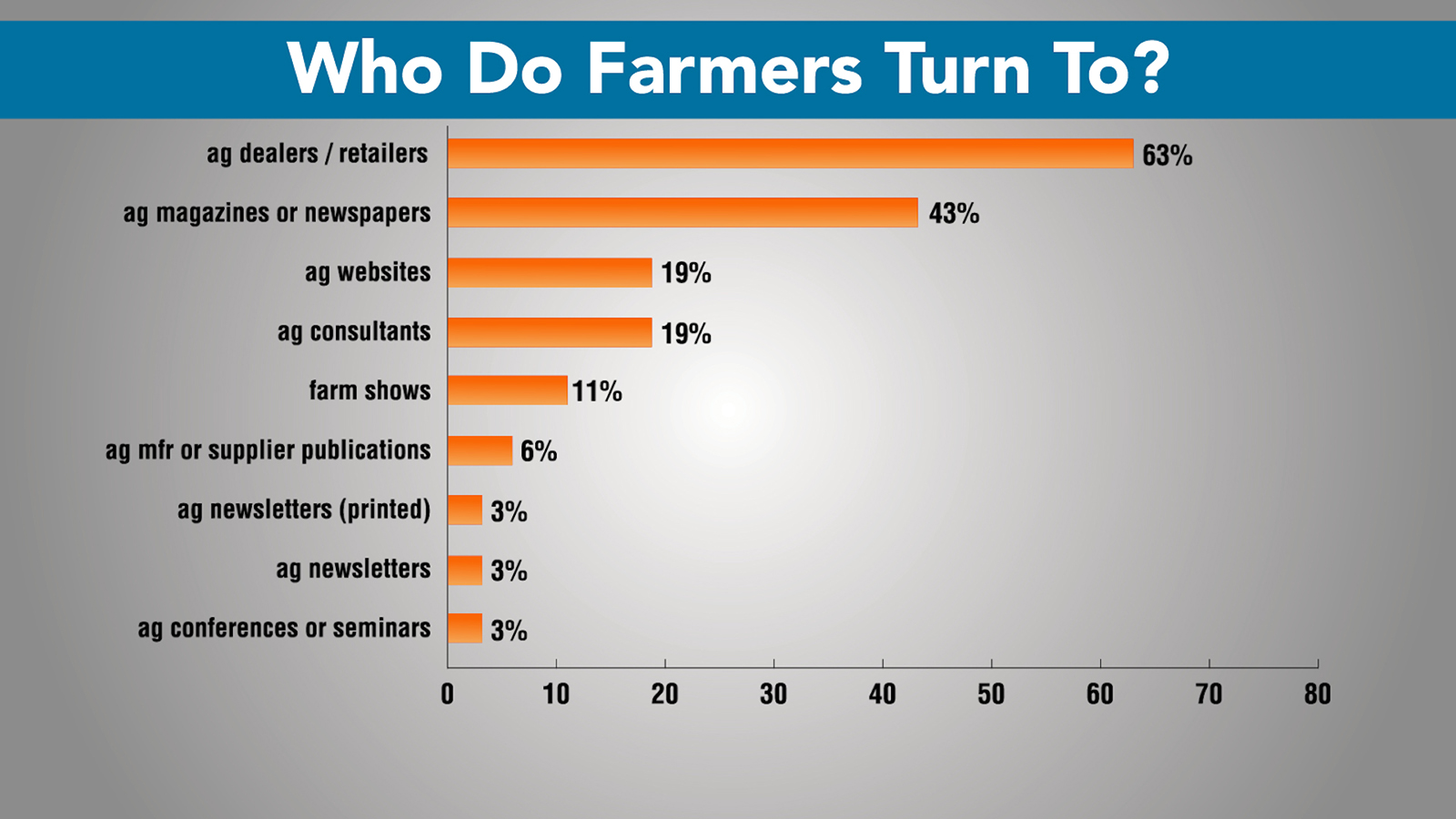

The Agri Media Council recently released its data from the 2016 Media Channel Study. The research analyzed the different platforms that farmers and ranchers use to gather information for buying decisions. The survey results show agricultural dealers and retailers still have a big influence on farmers’ purchasing decisions.

Of the 2,409-survey respondents, 63% of respondents say they rely most on ag dealers and retailers to validate and inform them for purchasing decisions. And 43% of respondents rely on the agricultural dealers and retailers when they have to make the final decision about purchasing a product or service.

While survey respondents predicted that most media platforms will change in the next 3-4 years, traditional media sources and in-person information sources still play a large role in the decision-making process for purchasing products and services.

Implement & Tractor Archives

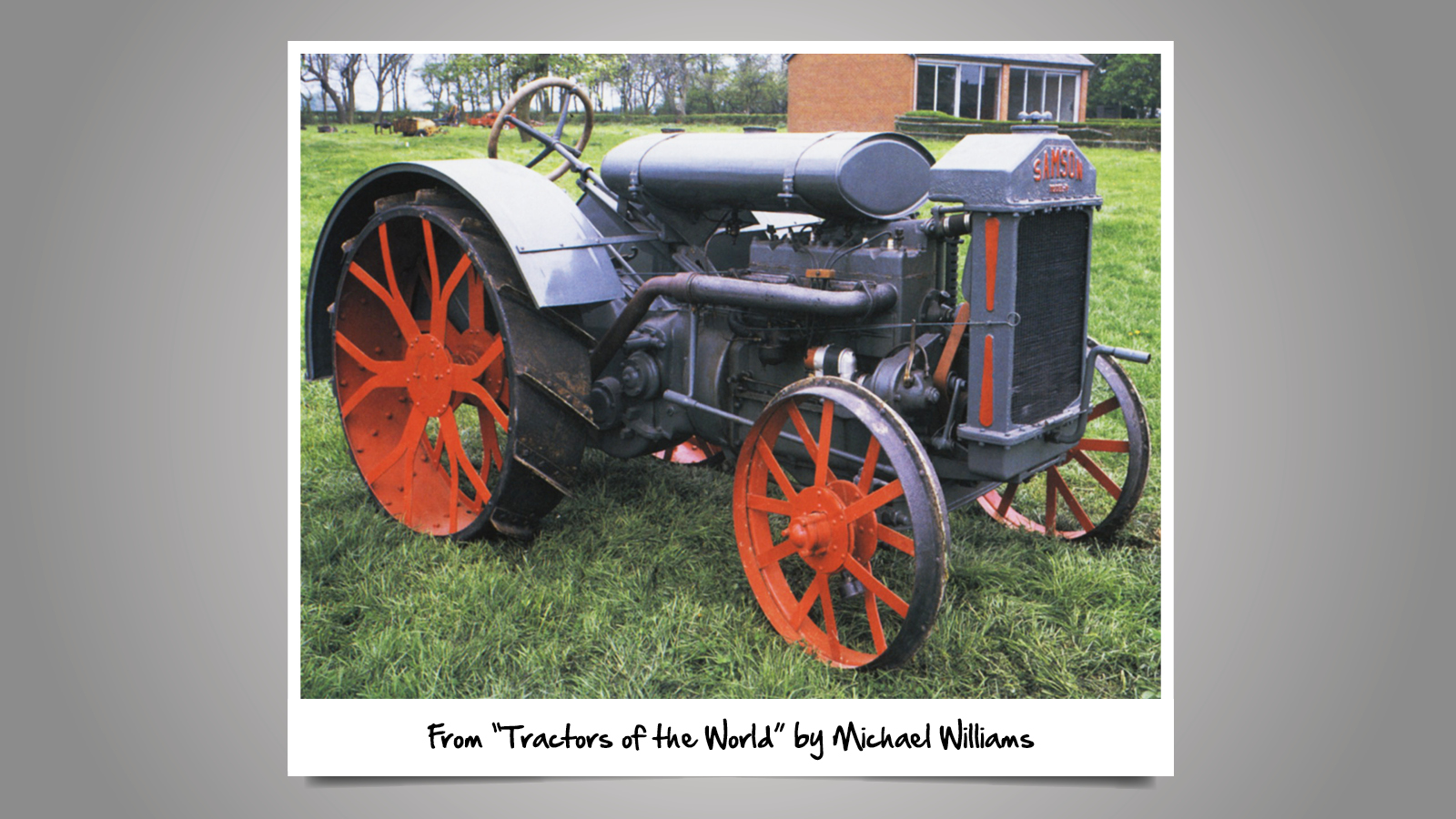

In 1917, General Motors purchased Samson Tractor Co. and then Janesville Machine Co., of Janesville Wis., the following year with the idea of entering the farm equipment market to compete with Ford Motor Co. and its highly successful Fordson Model F tractor. The company’s expectations were high and rested on the Samson Model M tractor, which outperformed the Fordson in test results. However, the Fordson was priced lower and GM was unable to make a profit on the Samson Model M. The farm equipment division was closed in 1923 as a result.

We always like hearing from you. You can send comments and story suggestions to kschmidt@lessitermedia.com. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment