Earlier this year I wrote an article titled “The Hangover.” The article talks about the amount of used equipment on the market from Model Years 2010-14. In the article, I talk about machine hours and how they are bottlenecking the used equipment washout cycle. So what does this mean? In my opinion two issues standout: the number of units and the hours on these units. So many of these machines where purchased during 2010-14 and so few were traded in over the last 5 years that now the used equipment market is feeling the residual effects.

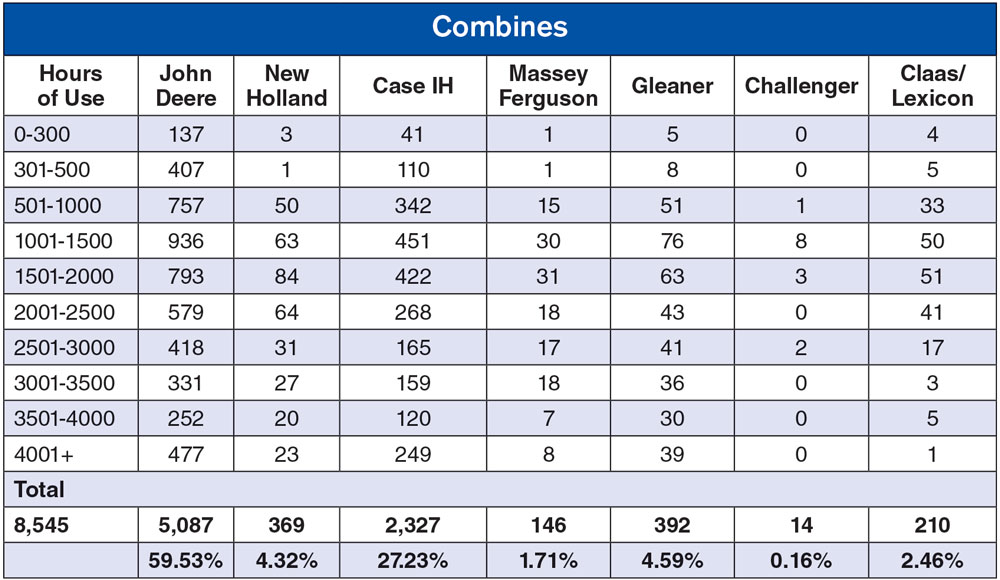

The issue is not only the number of machines but, the number of hours on these machines — combines especially. Most of these machines have been one owner machines and these owners are looking to upgrade. Combines in this group have 1,200-2,500 separator hours and typically by this time they would have had 2-4 owners. They would have trickled in and out of the market in a timelier fashion. Now, as these machines get traded in they have the same relative hours and are creating a sticking point. Mostly, these buyers are looking to upgrade to something with less than 750 hours, for example, on combines.

Likewise, tractors are seeing the same pressures and increased supply. Models from 2010-14 have high demand but the demand is more price driven than anything. The idea of having a spare tractor or combine on the farm is really gaining some traction. Cheap lease payments are driving this. Lease payments as low as $60-$80 per hour on combines and 300-plus horsepower tractors in the $30-$50 per hour range make the conversation a bit easier. This also switches the mindset of renting a machine to leasing a machine.

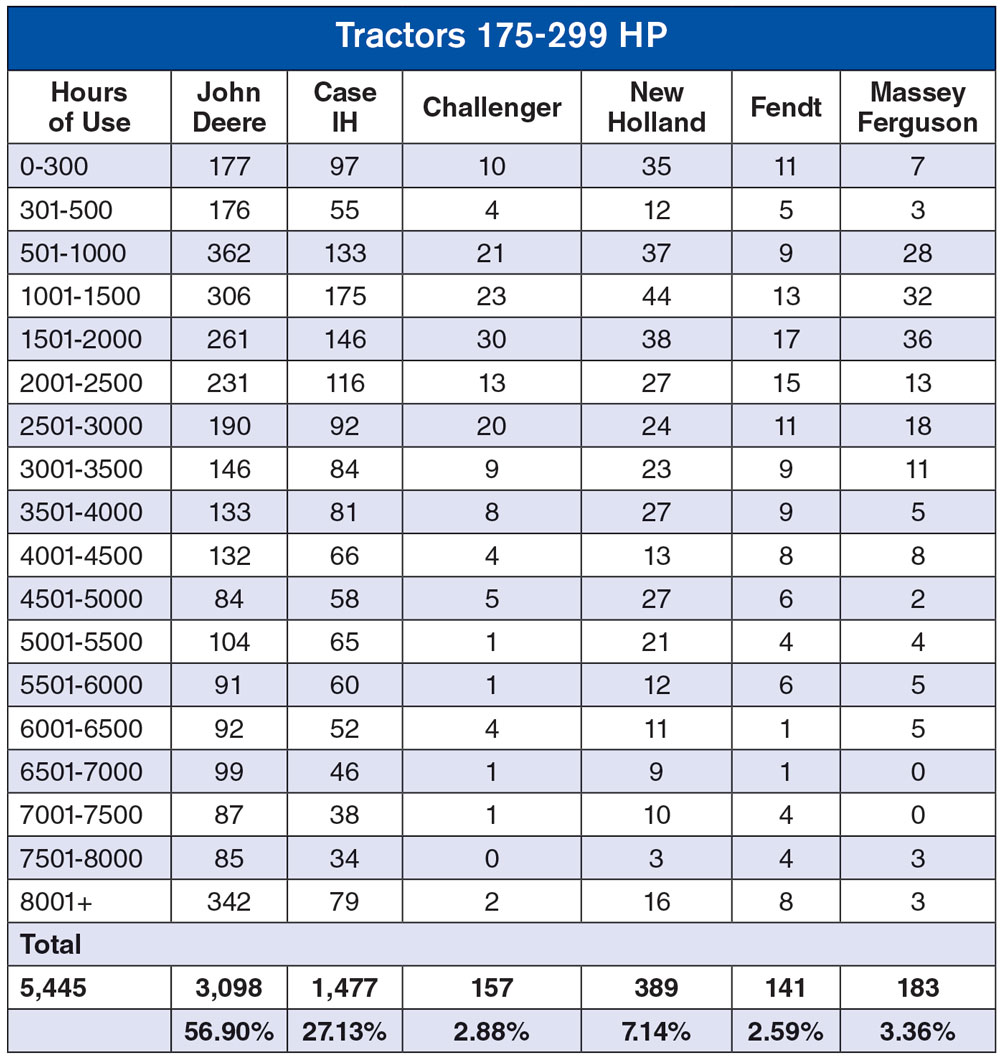

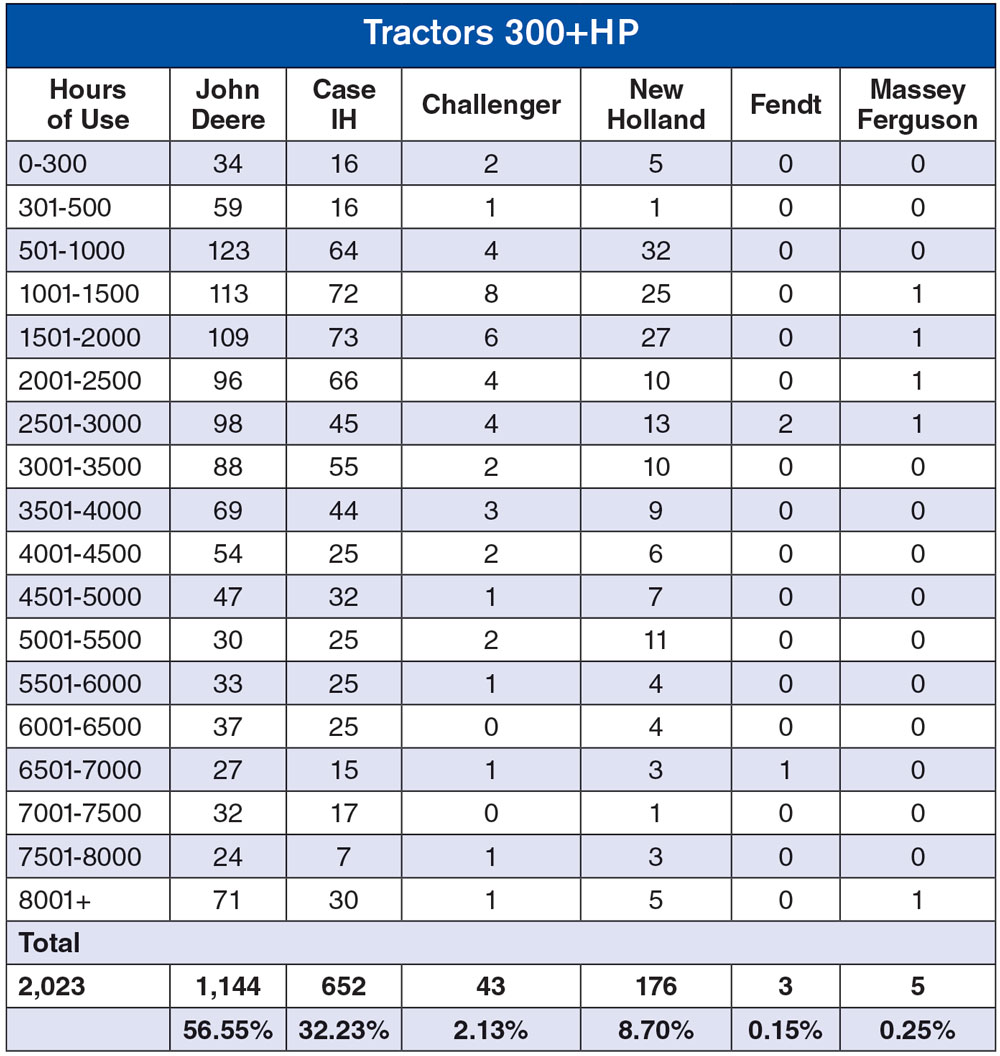

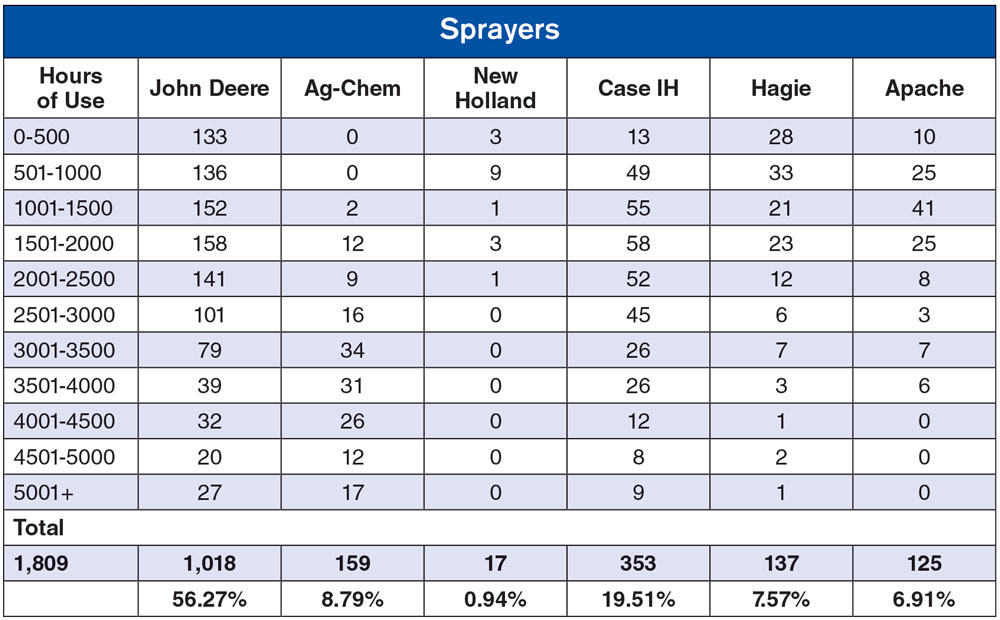

The number of units on market is a problem. These charts show manufacturers broken down into hour segments and number of units in each.

It’s simple supply and demand. The equipment from the 2012-14 model years has become a commodity, and when something becomes a commodity the price get cheaper. Auction values are starting to follow suit. I have watched 2012-14 model combines sell as low as $60,000, but they have been hovering in $85,000-$95,000 range for most of the winter and spring. From the information I have been tracking, this is a 10% year-over-year drop in value. I believe this will have a bigger decline as 2019 ends.

My fear is as the end of 2019 approaches and 2020 begins, there will be a selloff of these models and older equipment values could see a popping of a bubble. What will this do the market? Only time will tell, but I don’t see much positive news coming. As markets heat up and buyers want to trade 2012-14 machines, look at and forecast trends and values accordingly.

One interesting trend I have been following is how the value of late model-low-hour equipment is not showing any signs of residual effects on 2012-14 model equipment. Normally, when there are large numbers in one segment there is a ripple effect across the market but, for now this is not a factor. In my opinion, the need to update equipment is keeping a very solid line between 3 year old and newer and 3 year old and older.

Farm Equipment‘s Ask the Expert: Used Equipment series is brought to you by Iron Solutions.

At Iron Solutions, we provide used equipment valuations, market intelligence and a suite of integrated, cloud-based business systems custom-tailored for the equipment industry. Our proprietary model is built on actual dealer sales transaction data. Learn more…

Post a comment

Report Abusive Comment