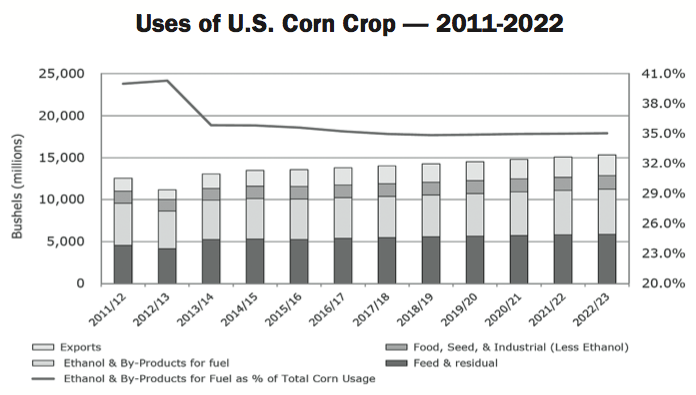

It has been shown that U.S. sales of farm machinery closely correlate with the price of U.S. corn. With the two core components of demand for corn being exports and ethanol, equipment dealers and manufacturers closely scrutinize the trends in both these segments.

On the surface, the news in the last few months has been less than encouraging for both, but the outlook isn’t totally bleak and the industry appears to have switched its focus from production to demand.

First, it appears that Big Oil and anti-ethanol groups will finally get their way and EPA will reduce the amount of mandated ethanol blended into fuels. This means that the industry will not continue to see the rapid expansion of ethanol production that it has experienced for the last several years. But demand for corn ethanol will not collapse either.

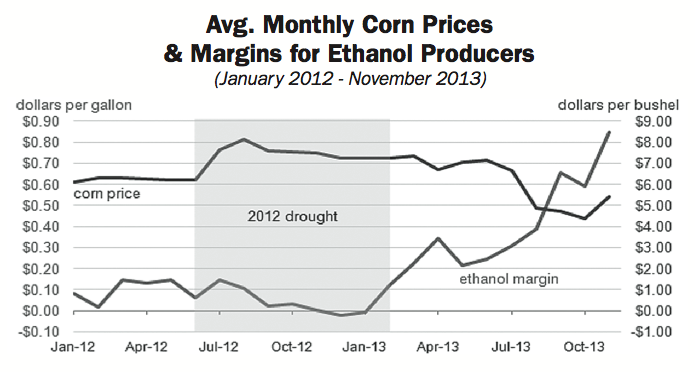

In fact, despite EPA’s proposed cut in the ethanol mandate to 13 billion gallons from 14.4 billion gallons, the demand for ethanol production has picked up in recent weeks due to favorable blending margins. With margins approaching 3 year lows, ethanol production during the first week of December increased by 31,000 barrels a day to 944,000 barrels a day, the highest level in the past 2 years.

On the export side, USDA’s December 10 World Agricultural Supply and Demand Estimates included a 50 million bushel increase to the estimate for U.S. corn exports in 2013-14 due to growing global demand.

Back to $5?

Societe Generale, the French multinational banking and financial services company headquartered in Paris, has suggested that corn will return to nearly $5 a bushel by the end of 2014.

According to a November report in Agrimoney.com, the bank was ahead of the curve in foreseeing the fall in corn futures from August 2012 highs. “While the market is focused on the sheer volume of the U.S. harvest after a year of volatile production estimates, we contend that the true focus should be shifted to the demand side of the crop balances,” SocGen analyst Christopher Narayanan said. “Demand has been notable in the first quarter” of the 2013-14 marketing year, which began in September.

“U.S. exports continue to outpace even the latest U.S. Department of Agriculture revision.” The analyst also noted the drop in feed prices and continued shortage of cattle has encouraged higher poultry egg sets and pork production with the gains in margins on consumers shifting to cheaper meats and lower input costs.

If this is the case, any drop off in farm equipment sales in 2014 could be short lived.

Post a comment

Report Abusive Comment