Brought to you by USDA's Economic Research Service

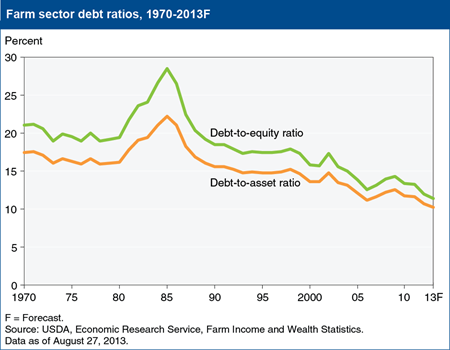

Debt-to-asset and debt-to-equity ratios are traditional measures of the farm business sector’s financial solvency. Based on forecasts of the value of farm business assets and debt, the sector’s debt-to-asset ratio is expected to decline from an estimated 10.7 percent at the end of 2012 to 10.2 percent by the end of 2013. The debt-to-equity ratio is expected to decline from 12.0 percent in 2012 to 11.4 percent in 2013. If realized, these changes would result in new historic lows for both measures, confirming the strength of the farm sector’s solvency. This strength means the sector is better insulated from the risks associated with commodity production (such as adverse weather), changing macroeconomic conditions in the U.S and world economies, and fluctuations in farm asset values. This chart can be found on the ERS topic page, Farm Sector Income and Finances, updated August 27, 2013.

Debt-to-asset and debt-to-equity ratios are traditional measures of the farm business sector’s financial solvency. Based on forecasts of the value of farm business assets and debt, the sector’s debt-to-asset ratio is expected to decline from an estimated 10.7 percent at the end of 2012 to 10.2 percent by the end of 2013.

Post a comment

Report Abusive Comment