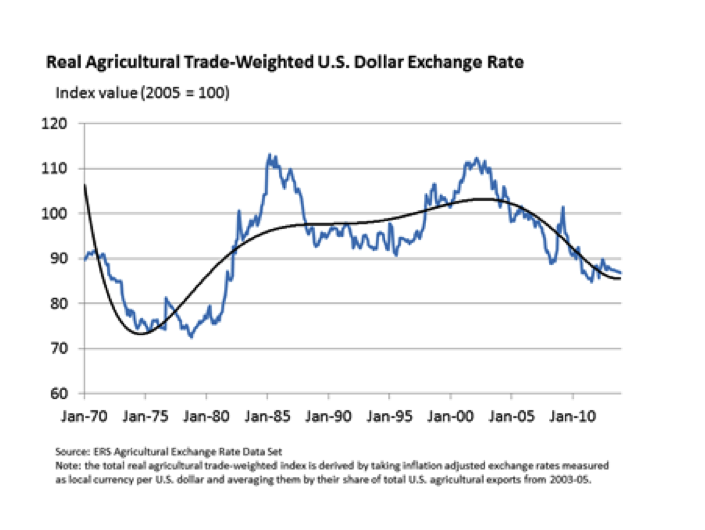

The real dollar exchange rate index, based on an agricultural trade-weighted average of exchange rates in U.S. export market countries, has fluctuated substantially since 1970. Nonetheless, since September 2001, the U.S. dollar has experienced the most prolonged period of depreciation against the currencies of agricultural trading partners since 1970.

While the dollar may not continue to depreciate against other currencies at the same rate, current expectations are that the exchange rate will remain relatively low and support further growth in agricultural exports.Because depreciation of the U.S. dollar tends to increase the global competitiveness of U.S. products, the trend toward a weaker dollar has been a contributing factor in the recent strong growth of U.S. agricultural exports, including farm machinery. A second major factor behind U.S. agricultural export growth has been strong economic growth in developing countries, where consumers tend to spend a relatively larger share of new income on improving their diet, and mechanizing their farming practices.

This chart appears in "Economic and Financial Conditions Bode Well for U.S. Agriculture" in the December 2012 edition of ERS's Amber Waves magazine.

|

Post a comment

Report Abusive Comment