What happens when you assign a sales person a territory comprised of three counties and 634 customers and prospects?

They’ll find out very quickly that they can’t cover all of the accounts. So, they will filter the customers they call on based on time involved and expected results. They’ll eventually trim the list down to what they can handle.

Why frustrate them (and yourself) by giving them more than they can actually handle? Instead, we encourage you to take a big step and organize all dealership sales and service by “account.” This involves assigning each account to a specific sales person (and other revenue producers in parts and service) so they can take advantage of their limited time.

The account management approach is customer focused and allows you effectively manage the time of your key people. In our experience, the quickest way for a farm equipment dealer to increase their top line revenue is to implement account management.

Segmenting Accounts

For many dealerships, this is new approach that requires new thinking. Don’t constrain yourself with your current customers. Get a list of all farms and contractors in your assigned area. Improved coverage starts with knowing all of your customers and prospects and segmenting them by potential.

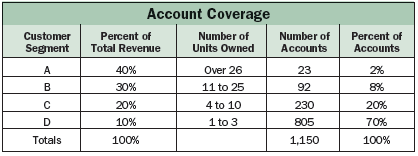

There are many ways to determine the total potential (wholegoods sales, parts, service, etc.) of a customer account. The simplest is to simply count the number of major machine units they own. The customers with the most number of units owned are “A” accounts and those with the least are “D” accounts. “B” and “C” accounts fall somewhere in between.

The number of units will correlate strongly to how much money these accounts will spend to replace machines and the amount they’ve spent on parts and labor to repair them. In the long run, the number of units will correlate to the total potential business of these accounts.

If you list all accounts from the largest to the smallest based on equipment ownership, you probably will be surprised at the small number of accounts in the “A” group as well as the large number of accounts in the “D” group. Our years of work with dealers’ customers shows that about 2% of the accounts are in the “A” group, about 8% in the “B” group and 20% in the “C” group. That leaves 70% in the “D” group.

What drives the segmentation is that the “A” accounts should be 40% of your potential revenue, and the “B” accounts 30%. Together, they comprise 70% of your revenue. Or said another way, the average account, based on potential revenue is a “B” account.

Segmenting Prospects

Don’t be surprised if your salespeople tell you that the average account is in the “D” group. Based on the average number of accounts and the number of units they own, those employees are correct. But those customers don’t drive enough business to qualify as an “average revenue account.”

Where should your people be spending their time, and what accounts should your dealership be covering thoroughly? Obviously, if the “A” and “B” accounts drive 70% of the business, you should be working on getting and keeping them.

Managing Revenue Producers

What we’ve done so far is to “segment” the accounts based on their total potential. Your share of market will depend on the control you exert on your “A” and “B” accounts. With a small number of large accounts and a lot of small accounts, you need to decide whether to focus on the small but high volume top side of the market, or the large, low volume bottom side.

We mentioned “coverage” earlier. When you look at the previous tablet, we believe that your dealership should put 40% of your marketing efforts into the “A” accounts who generate 40% of the business, 30% of your efforts or call activity in the “B” accounts and so on.

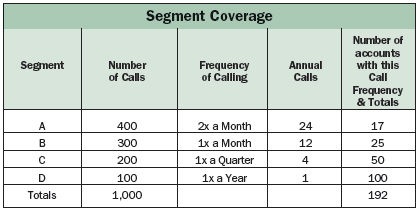

Let’s look at a single sales person’s efforts in the market. If a salesperson could make 5 calls a day for 4 days a week, over 50 weeks during the year, he can make 1,000 calls a year. This is the time inventory of the salesperson.

How do salespeople allocate their time to get the best return? Of 1,000 calls a year, should they spend 40% on “A” accounts, 30% on “B” accounts?

Because the “A” accounts are most important, salespeople should call on them most frequently. The table [above/below] indicates how to prioritize the available annual calls of a salesperson, the frequency of calls based on the account priority, and the derived the number of accounts the sales person can handle. In this case, he can effectively cover about 200 accounts.

Analyze & Organize

This example may or may not fit your current situation, but it gives you an idea of how call activity of sales people can be organized, and how many accounts they can realistically cover.

If good salespeople can make 1,000 calls a year, and can be stretched to cover, say, 250 accounts, how many accounts are they really covering? How many are left “uncovered?” Instead of the 634 assigned accounts we mentioned earlier, the number should be much lower.

Organizing the dealership’s sales efforts is the job of sales managers and owners. Your job as a dealership manager is not just about managing money or assets, but to also manage the “time” resources of your staff.

We encourage you to analyze your sales coverage and to implement a disciplined account management approach.

In sum, this approach:

- Organizes prospective and active accounts by size.

- Allocates sale’s time based on annual number of calls and frequency of calls by account size.

- Assigns accounts by salesperson and determines how to cover those accounts that fall into the “C” and “D” categories.

Post a comment

Report Abusive Comment