Rising commodity prices, projected improvements in farm net income and farmers’ cash receipts bolster dealers’ confident outlook for the year ahead.

Editor’s Note: The following item appeared in the September 15, 2010, issue of Ag Equipment Intelligence and is excerpted from the October/November 2010 issue of Farm Equipment. The complete 48-page “2011 Dealer Business Trends& Outlook” is available only to subscribers of Ag Equipment Intelligence. The full report presents detailed regional, state and provincial data for the U.S. and Canada. It also provides projected increases/decreases in equipment sales by major equipment brand, dealer size and markets served. To subscribe, please call Lessiter Publications at 800-645-8455. Or visit Farm Equipment’s web site — www.farm-equipment.com — and then click on Ag Equipment Intelligence on the menu bar.

How North American farm equipment dealers’ view prospects for increasing sales in the coming year is in stark contrast to what they anticipated just a year ago.

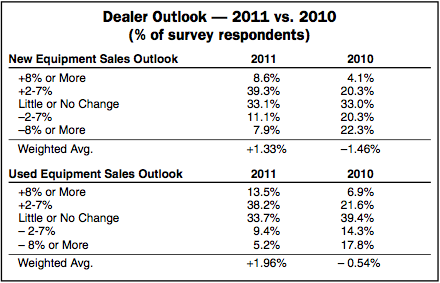

Last year at this time, more than 40% of the equipment retailers surveyed for Ag Equipment Intelligence’s “2010 Dealer Business Trends & Outlook” report expected sales revenues to decline by 2% or more. Only a quarter, or 24.4%, of those polled saw business levels improving by 2% or more for 2010.

Now, as they look ahead to 2011, nearly half of farm equipment dealers see sales revenues for new machinery improving by at least 2%. Add in those who are projecting sales to be about the same as they were in 2010, and that number rises to more than 80% of dealers who believe their sales revenue will come in at least as good or better than what they experienced in the past year.

That’s a nearly 180-degree turn-around from dealers’ sentiments a year ago at this time.

Then vs. Now. Overall, dealers forecast equipment revenues for 2010 to be basically flat or down slightly. Last year, 42.6% of dealers participating in the 2010 survey expected revenues from new equipment sales to drop 2% or more compared with 2009. The weighted average of last year’s forecast was –1.46%.

An examination of tractor and combine sales through August of this year vs. the same period in 2009, shows the dealers were pretty much on the mark in their outlook.

According to the Assn. of Equipment Manufacturers, U.S. unit sales for all farm tractors through the first 8 months of this year are up 2.5% com- pared with the same period of 2009. Unit sales of tractors in Canada rose only 0.1% through August vs. the same 8 months of the previous year.

Unit sales of combines in the U.S. through August ’10 have increased by less than 2% vs. 2009. Canadian combine sales are up 2.5% in August compared to the first 8 months of last year. This year, only 19% of the nearly 300 dealers participating in the 2011 dealer survey are projecting lower sales revenues for 2011 vs. 44.6% in 2010.That’s a swing of 25.6% to the positive side of the ledger.

The percentage of dealers who are forecasting improved sales revenues of at least 2% for 2011 essentially doubled, from 24.4% last year to 47.9% for the coming year.

In total, last year 57.4% of the equipment dealers surveyed expected sales to be as good or better than the previous year. This year’s survey saw that percentage grow to 81% of dealers who believe 2011 revenues will equal or surpass those seen during the past year.

Strong Used Market. Dealers are also optimistic about their prospects for increasing revenues from sales of used equipment.

A little over 85% of the equipment sellers surveyed anticipate that sales of used machinery in 2011 will be at least as good as in 2010. Slightly over half of those (51.7%) say they expect sales to improve by 2% to more than 8% for the year. Only 19% expect lower revenues from used equipment sales during the next selling year.

This compares to more than 30% of dealers, who a year ago expected lower revenues from sales of used equipment. Last year at this time, only 28.5% were forecasting improved revenues from the sale of previously owned farm machinery.

Source: Ag Equipment Intelligence

Post a comment

Report Abusive Comment