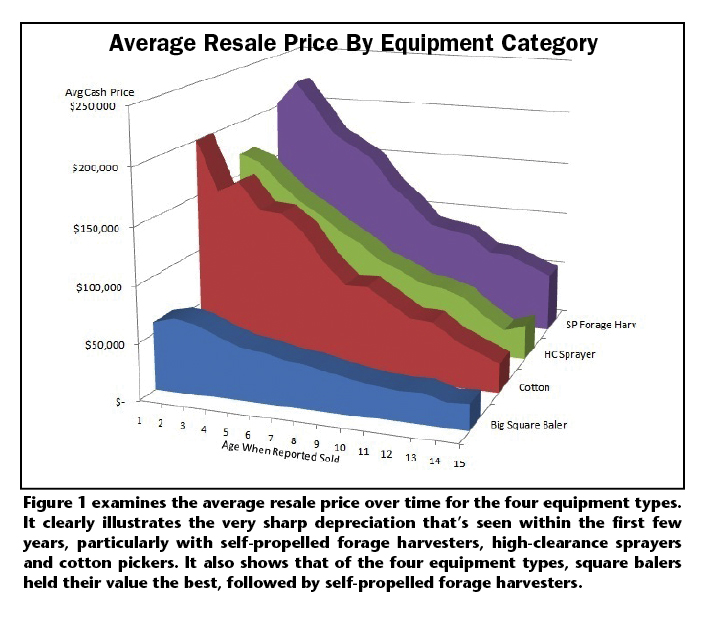

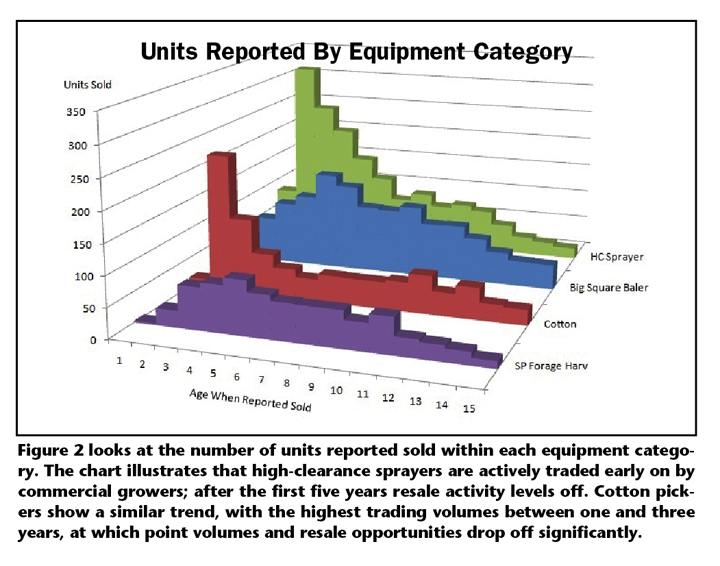

The last installment of Trade Values & Trends (“Self-Propelled Sprayers: Strong Resale Strength,” April 2010) took an in-depth look at the resale values of high-clearance, self-propelled sprayers. This article provides an analysis of resale values for four distinct categories of high-cost, low-volume equipment—high-clearance sprayers, self-propelled forage harvesters, cotton pickers, and large square balers. The study compared resale values of these products from 1 to 15 years, to determine the optimum timing for sales.

Large square balers and self-propelled forage harvesters show a more consistent trading pattern over the 15-year period, with trades most active at around 5 years.

Based on this analysis, it’s probable that 3 key factors are influencing the resale trends for high-cost, low-volume equipment:

- Capacity. With low-volume equipment, the tendency toward more productive, high-capacity machinery is likely to have a more pronounced impact on demand and resale values.

- Maintenance. Repair and maintenance are important cost considerations for owners as machinery ages beyond 5 years; this directly influences resale values. A 5-year-old forage harvester, for example, may require $10,000 to $15,000 in reconditioning costs to meet current operating standards. Buyers will factor that into the total cost and compare it with newer equipment that’s less expensive to maintain.

- Technology. Newer equipment offers productivity features that simply aren’t available on older machines, and when buyers trade sooner, the older equipment is discounted at a higher rate. Today’s high-clearance sprayers, for example, can carry thousands of gallons of liquid, and offer all the benefits of GPS. The resale values of cotton pickers, forage harvesters and high-clearance sprayers all reflect the technological advancements made in recent years.

The above factors apply mostly to high-clearance sprayers — which are also experiencing higher volume sales of new equipment. For both sprayers and cotton pickers — because newer units feature higher capacity, lower maintenance and new technology — the older models are less desirable.

Balers are impacted the least by the above factors, as indicated by the relatively flat depreciation line. With large square balers, for example, there’s been very little change in capacity and technology, and buying volumes have remained consistent through the years.

Key Takeaways

For the 4 equipment categories, fewer customers are buying increasingly more expensive machinery. So for dealers, it’s important to be on the profitable side of the depreciation curve.

Our analysis reveals that high-clearance sprayers offer good market potential for that initial trade within the first 2-3 years, while the resale market for large square balers and forage harvesters remains strong for the first 10 years. With high-clearance sprayers, strong demand has supported resale values through the first several years, as growers increasingly view these machines as vital for preventing crop damage.

With cotton pickers, it’s a good idea to resell units within the first 2 years, rather than risk selling older machines with limited resale potential in this market. As a dealer you may not want to trade for units that are more than 5 years old unless you’ve a known buyer or intend to export.

With both forage harvesters and large balers, the resale opportunities remain solid, even beyond the first 10 years. The technology hasn’t changed as much, so people have fewer reasons to trade sooner.

The bottom line: Be sure to time your used equipment sales according to the market. Resale opportunities can change quickly, depending on the type of equipment and its age.

This study was provided by IRON SOLUTIONS, publishers of the Equipment Industry’s Official Guides based on gold standard equipment data. IRON SOLUTIONS gathers data on used machinery transactions from dealers, auctions and other sources. For information on the Official Guide, the gold standard data and other dealer solutions provided by IRON SOLUTIONS, visit www.ironsolutions.com

Post a comment

Report Abusive Comment