Financial results presented under U.S. GAAP

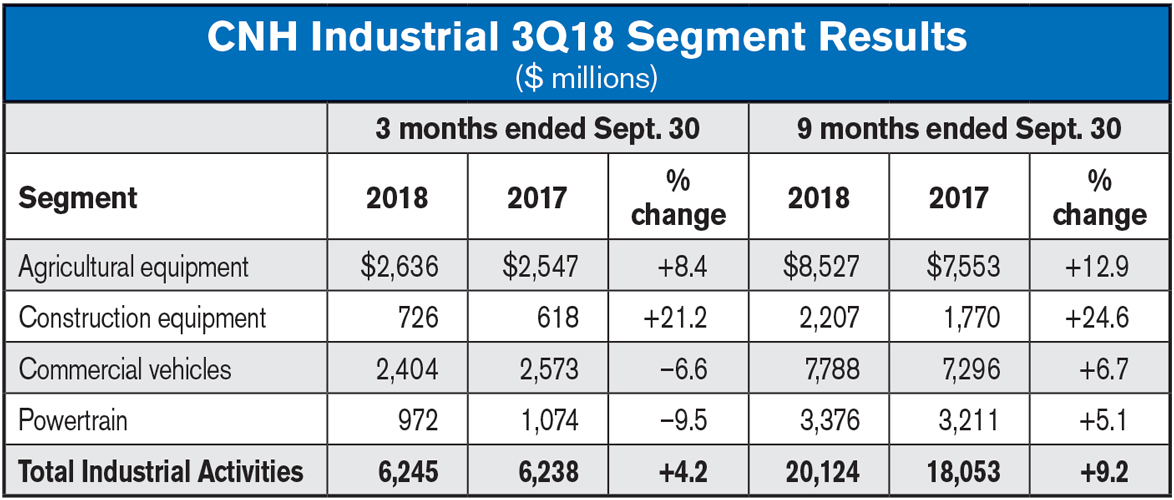

- Industrial Activities net sales were flat compared to the third quarter of 2017 (up 4% on a constant currency basis), with an 18% improvement in Construction Equipment and a 4% increase in Agricultural Equipment offset by declines in Commercial Vehicles and Powertrain

- Adjusted EBIT of Industrial Activities increased 24% to $321 million, with a 5.1% margin (up 1 percentage points). Adjusted EBITDA of Industrial Activities was $591 million, with a 9.5% margin (up 1.1 percentage points)

- Adjusted net income was $222 million (a $71 million increase, or up 47%, compared to the third quarter of 2017), with adjusted diluted EPS(3)(4) of $0.16 (up $0.05 per share)

- Net industrial debt was $2 billion as of Sept. 30, 2018, $0.7 billion higher than on June 30, 2018, due to the seasonal increase in net working capital

London (UK) — CNH Industrial N.V. (NYSE:CNHI / MI:CNHI) today announced consolidated revenues of $6,686 million for the third quarter of 2018, in line with the third quarter of 2017. Net sales of Industrial Activities were $6,245 million in the third quarter of 2018, flat compared to the third quarter of 2017 (up 4% on a constant currency basis).

Net income of $231 million for the third quarter of 2018 included a pre-tax gain of $30 million ($23 million net of tax impact) as a result of the amortization over approximately 4.5 years of the $527 million positive impact from the modification of a healthcare plan following the favorable judgment issued by the United States Supreme Court, as previously announced by the company on April 16, 2018. In the third quarter of 2017, net income included a charge of $39 million related to the repurchase of notes, as well as $53 million of restructuring charges (compared to $8 million in the third quarter of 2018). DU

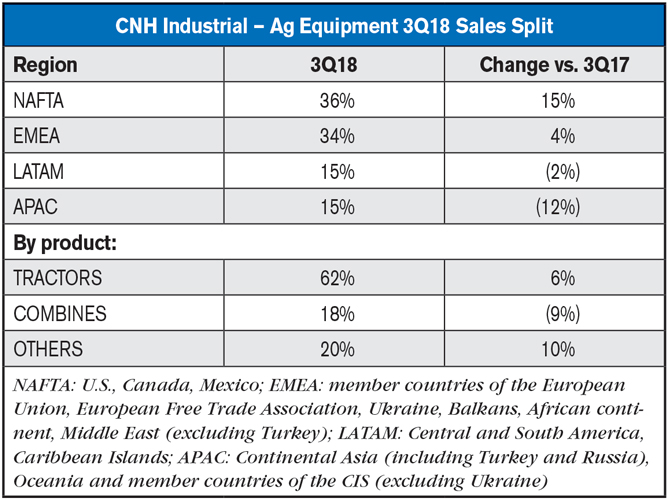

Agricultural Equipment’s net sales increased 4% in the third quarter of 2018 compared to the third quarter of 2017 (up 8% on a constant currency basis). The increase was primarily the result of price realization across all regions and higher sales volumes in NAFTA, partially offset by a revenue decrease in APAC, primarily Australia. Anticipated raw material cost increase was offset by manufacturing efficiencies and lower warranty cost due to improved quality performance. Similar to previous quarters, Agricultural Equipment maintained increased product development spending by 10%, related primarily to precision farming and compliance with Stage V emissions requirements.

Construction Equipment’s net sales increased 18% in the third quarter of 2018 compared to the third quarter of 2017 (up 21% on a constant currency basis), as a result of positive net price realization and favorable end-user demand, primarily in NAFTA and APAC. In the quarter, production levels were 13% above retail demand, in anticipation of the fourth quarter retail seasonality.

Commercial Vehicles’ net sales decreased 7% in the third quarter of 2018 compared to the third quarter of 2017 (down 3% on a constant currency basis), as a result of lower sales volume primarily in heavy vehicle trucks in EMEA partially offset by favorable pricing across all regions. Total deliveries were down 8% year-over-year, as increased volumes in light commercial vehicles and in buses (as a result of increased end-user demand in EMEA and Brazil) were more than offset by the impact of lower EMEA volumes in heavy vehicles. The decline in heavy vehicle sales is attributable to a strategy shift, which focuses sales on a more profitable product portfolio, including alternative propulsion vehicles.

Powertrain’s net sales decreased 10% in the third quarter of 2018 compared to the third quarter of 2017 (down 6% on a constant currency basis), due to lower sales volume, primarily attributable to a different calendarization of the engine sales associated with the transition to the new Stage V regulation. Sales to external customers accounted for 52% of total net sales (48% in the third quarter of 2017).

Services’ revenues totaled $469 million in the third quarter of 2018, a 2% decrease compared to the third quarter of 2017 (up 2% on a constant currency basis), primarily due to a lower average portfolio balance in NAFTA, partially offset by growth in other regions.

In the third quarter of 2018, retail loan originations (including unconsolidated joint ventures) were $2.4 billion, relatively flat compared to the third quarter of 2017. The managed portfolio (including unconsolidated joint ventures) was $25.5 billion as of September 30, 2018 (of which retail was 63% and wholesale 37%), down $0.5 billion compared to September 30, 2017. Excluding the impact of currency translation, the managed portfolio increased $0.4 billion compared to the same period in 2017. Net income was $92 million in the third quarter of 2018, an increase of $6 million compared to the third quarter of 2017.

2018 Outlook

Despite increasing uncertainties related to the trade policy environment and raw material inflationary headwinds, together with foreign exchange volatility in the emerging economies, CNH Industrial is confirming its 2018 guidance, which calls for net sales of Industrial Activities at approximately $28 billion.

Post a comment

Report Abusive Comment