In today’s newscast we discuss the improvements farm equipment dealers are seeing in used equipment inventories as well as used equipment pricing, Titan’s growth in Germany, Little Equipment Ventures acquisition of Stanble’N, and CNH Industrial and AGCO’s first quarter earnings.

On the Record is brought to you by Spader Business Management.

Spader Business Management’s team of industry experts provide business insights, ideas and concrete tactics through training and consulting. Generations of business owners and operators have also relied on our 20 Groups to capitalize on new opportunities and industry trends by learning directly from their peers. Learn more at spader.com.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

I’m managing editor Kim Schmidt. Welcome to On the Record! Here’s an update on what’s currently impacting the ag equipment industry.

Used Equipment Inventory Improving

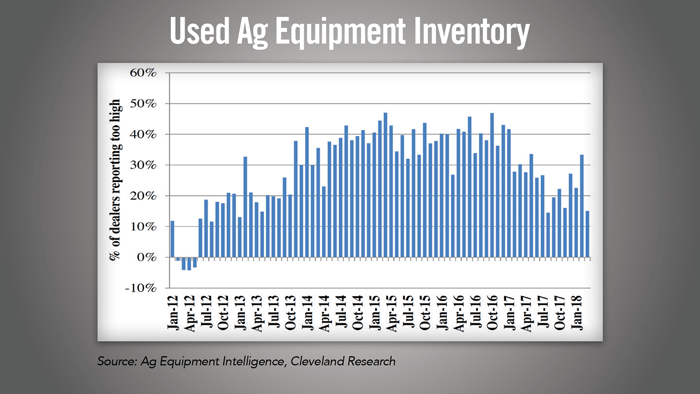

Farm equipment dealers report that their used equipment inventories are becoming more manageable. According to Ag Equipment Intelligence’s April Dealer Sentiments survey, a net 15% of dealers report used equipment inventory is “too high.” Of those responding, 33% said their used inventory was “too high,” 50% said it was about right and 18% said it was “too low.”

This is an improvement from the 23% reporting heightened inventory in February and the 26% average in 2017. Only twice since the ag economy took a turn downward have less than a net 20% of dealers reported their used equipment inventory was “too high.” That was in November 2017 and August 2017.

The last time dealers reported their used equipment inventory was “too low” was back in May 2012 when a net 3% of dealers reported not having enough inventory.

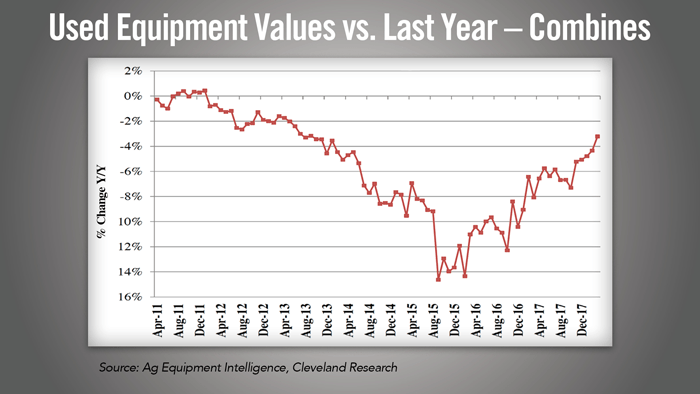

Used equipment pricing is showing improvements as well, according to dealers. Used tractor pricing was down 2% in March and used combine pricing was down 3%, after improving to down 4% in February.

Dealers on the Move

This week’s Dealers on the Move are Redline Equipment and Titan Machinery.

Redline Equipment has added the Miller sprayer contract to its 5 Ohio locations. Redline will also become the local servicing Miller dealer for customers who already own one of the sprayers.

Titan Expands into Germany

Titan Machinery, Case IH’s largest North American dealership group, announced this week it entered into a definitive agreement to acquire AGRAM Landtechnikvertrieb and AGRAM Landtechnik Rollwitz. The acquisition, expected to close in July, adds 4 stores in the German cities of Burau, Altranft, Rollwitz and Gutzkow.

Titan’s chairman and CEO David Meyer says that since their first European acquisition in 2011 the dealership group has been keeping an eye out for a profitable store complex in a mature market, ideally Germany. AGRAM was the perfect fit, he says.

“Germany is consistently one of the largest tractor markets in Europe. Germany has a strong economy, stable geopolitical situation, and a solid banking and credit environment. We’re excited to add the German stores of Burkau, Altranft, Rollwitz and Gutzkow to our European footprint and welcome the quality and experience AGRAM employees to our Titan Machinery European team.”

He adds AGRAM’s market has larger acre farming units similar to the markets in the Balkans and Ukraine, where Titan currently operates. In addition, these stores border Poland and the Czech Republic providing access to customers in those markets for both used equipment and parts.

Now here’s Jack Zemlicka with the latest from the Technology Corner.

Little Engine Ventures Acquires Stable’N Start-Up

As planting ramps up after spring was slow to arrive in many parts of North America, farmers will be closely monitoring their early-season fertilizer applications to ensure crops get off to a strong start.

The use of nitrogen stabilizers are a staple on some farms to prolong the effectiveness of spring-applied nutrients. But a new company is beta-testing a unique alternative to chemically-applied nitrogen inhibitors.

Lafayette, Ind.-based investment company Little Engine Ventures, recently acquired technology company Stable’N, developers of an aftermarket system that creates high-voltage electrical pulses to sterilize a 3-inch section of soil in the seedbed made during a spring fertilizer application or tillage pass.

Renamed Boden Technology (the system or company?), after the German word for soil, new company CEO Bill Gass, says the science behind the technology creates a 5 week window before applied nitrogen in the seedbed will covert to nitrates.

“It’s about 100,000 volts, kind of like a sparkplug in your car. There’s a burst of energy, a very high burst of energy. In a field situation, because you are going across the field, you can go about 6 mph and you are charging (the soil) so it takes a lot of energy to do that. You are basically impacting a field and the soil in an area 3 inches wide and it’s usually about 5-7 inches deep because of the shape and the way the electricity flows through the soil.”

Gass adds that field testing will continue this spring, after which time the company will set a price for the system and plans are for a limited release this fall.

CNH Industrial 1Q Ag Revenues +15.1%

CNH Industrial reported its first quarter earnings on April 27. For the quarter ending March 31, revenues were up 17.1% to $6.8 billion.

Ag equipment net sales were up 15.1% in the first quarter. Commenting on the North America market, CEO Rich Tobin said NAFTA row-crop tractors are trending positive for the first time in a number of years, with a strong performance in used equipment pricing that is driving solid support for pricing of new equipment.

Tobin also said that price realization estimates take into account that they will likely face some raw material headwinds in the second half of the year. He adds, however, they don’t think it will be so problematic that additional surcharges on top of the pricing that they have in the market right now will be necessary.

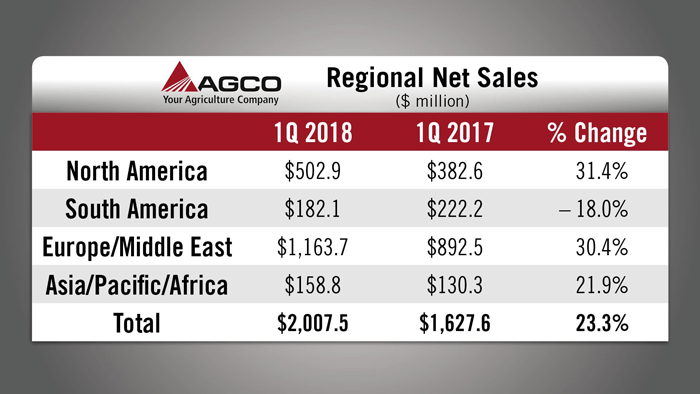

AGCO 1Q Net Sales Up 23.3%

AGCO also reported improved sales for its first quarter. On May 1, the company announced net sales for the quarter were up 23.3% year-over-year to about $2 billion.

On a regional basis vs. the first quarter of 2017, North American sales were up 31.4%, Europe/Middle East was up 30.4%, Asia/Pacific/Africa was up 21.9% and South American sales were down 18%.

AGCO CEO Martin Richenhagen attributed the loss in South America to challenging industry environment, lower levels of production, as well as the transition costs associated with localizing newer product technology in AGCO’s Brazilian factories. He added that they anticipate South American results to improve substantially throughout the course of the year.

Looking ahead, CFO Andy Beck says the North America farm equipment fleet has begun to age and row-crop farmers are now starting to look at replacements. AGCO has increased its outlook for 2018 and is now projecting North America industry tractor sales to be up modestly, compared to 2017, with larger equipment driving the increase.

And now from the Implement & Tractor Archive…

Implement & Tractor Archives

The beginning of the 20th Century — up until the stock market crash of 1929 — saw unparalleled growth and prosperity in the farm equipment business, writes Robert N Pripps in the book “Threshers.” The political conditions in both the U.S. and Canada were conducive to agricultural expansion. The western prairies were opened up for settlement and high immigration provided the people to make it all work. Pripps says technology also contributed to the good times. In the late 1800s, the development of steel alloys allowed for the redesign of most farm tools and implements and made ball and roller bearings available in place of bushings. J.I. Case also introduced the first all-steel threshing machine in 1904.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining us.

Post a comment

Report Abusive Comment