In today’s newscast, we look into AGCO’s announcement that it’s acquiring Precision Planting from The Climate Corp., the Challenger branded equipment will no longer be sold in Europe and the Middle East, John Deere Financial is now the No. 5 ag lender, and CNH Industrial and AGCO’s second quarter earnings.

Leave a comment Get New Episodes Delivered to Your Inbox

On the Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment — including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business — matching the income stream of ag producers. Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

On the Record is now available as a podcast! I encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

In Little League, coaches tell young players to “keep your eye on the ball.” The advice applies to both fielding and batting, but it is just as applicable to running a successful farm equipment dealership. That’s just what Don Van Houweling, owner of the 2016 Dealership of the Year, has done at Van Wall Equipment.

FARM

MACHINERY

TICKER

AFN: $56.17 -0.40

…

AGCO: $72.26 +2.58

…

AJX: $0.53 -0.03

…

ALG: $93.51 +0.98

…

ARTW: $2.75 +0.15

…

BUI: $4.15 -0.08

…

CAT: $114.37 +5.90

…

CNHI: $11.47 -0.30

…

DE: $128.44 +4.04

…

KUBTY: $87.09 +1.45

…

LNN: $91.10 +1.58

…

RAVN: $34.00 -0.85

…

TWI: $12.87 +0.64

…

TRMB: $37.80 +0.54

…

VMI: $155.70 +5.05

…

CERV: $12.32 +0.77

…

RME: $10.04 -0.07

…

TITN: $17.95 +0.46

…

TSCO: $57.53 +7.18

...

Closing Stocks as of 7/27/17 (Compared to Close on 7/13/17)

I’m managing editor Kim Schmidt, welcome to On the Record! Here’s an update on what’s currently impacting the ag equipment industry.

AGCO to Acquire Precision Planting

Three and a half months after Monsanto canceled its deal to sell Precision Planting to John Deere, AGCO has signed a definitive agreement to acquire Precision Planting from The Climate Corp., a subsidiary of Monsanto.

This is the most significant acquisition AGCO has made in the last decade, as it will likely make waves in the market and AGCO will now have an entry point into the high-speed planter market.

Greg Peterson, director of investor relations at AGCO, anticipates the deal will be finalized during the third quarter. He stresses that in the short term, nothing will change in terms of the distribution network. In addition, Precision Planting equipment will still be available for other brands of planting equipment.

Peterson says that as time goes on, AGCO will increase distribution of Precision Planting products, particularly outside of the U.S.

Nathan Zimmerman, precision farming manager with A.C. McCartney an AGCO dealership in Mount Sterling, Ill., says the acquisition will have a positive impact on their service business.

Zimmerman says:

“We’ve been Precision dealers for about a year, but we expect our service side will grow quite a bit more now. We’re required to stock Precision parts and going forward, I see us as having an advantage over some of those dealers who don’t stock as much inventory in addition to us having the manufacturer support under the AGCO umbrella. As a dealership, I think this will position us well in the planter market moving forward, especially with new customers who maybe weren’t necessarily AGCO customers.”

Case IH dealers are uneasy about the news, with many of the same concerns they had when Deere was in line to acquire Precision Planting. One Case IH dealer says while there is still a lot to be discovered right now with the way AGCO will approach Case IH dealers, all of his dealership’s planters are tied to Precision Planting currently. If AGCO were to pull that business away from them, it would significantly impact the dealership’s business.

However, he goes on to say that it’s still too early to tell if the deal will even be approved.

AGCO Drops Challenger Brand in Europe

AGCO also announced this week that it is dropping its Challenger brand of ag equipment in Europe and the Middle East. Those products will be folded into the company’s Fendt line, which will be strengthened with the adoption of sprayers and tracked tractors formerly sold under the Challenger name.

Challenger products will continue to be sold through the AGCO network in North America, South America, and Asia-Pacific and Africa regions.

While Massey Ferguson is AGCO’s volume brand in Europe, it has been limited to the track tractors, and more recently, self-propelled and trailed sprayers.

Fendt, on the other hand, has gone from being a tractor specialist to a brand with combines, a forage harvester and — starting this year — a full set of hay tools that will gain baler and forage wagon products from AGCO’s acquisition of Lely’s grass line earlier this year.

Dealers on the Move

This week’s Dealer on the Move is Kibble Equipment.

Kibble Equipment, a multi-store John Deere dealership with stores in Minnesota, Iowa and South Dakota, has acquired Ag. Power Enterprises, effective July 10. This latest acquisition brings Kibble’s total stores to 22.

Now here’s Jack Zemlicka with the latest from the Technology Corner.

Case IH, Trimble Integrate Telematics Platform

Advanced telematic services continue to take shape in precision farming as suppliers partner to integrate and deliver data sharing platforms through their dealer networks.

Continuing the trend, Case IH and Trimble announced this week a wireless data sharing partnership enabling wireless connectivity between Trimble’s ag software and Case IH Advanced Farming Systems (AFS) Connect and New Holland Precision Land Management (PLM) Connect telematics platforms in North America.

According to Brian Stark, marketing communications manager for Trimble Ag Software, the collaboration will allow farmers with mixed fleets of equipment to wirelessly transfer task data, planting, fertilization and yield maps or guidance lines from third party displays into Trimble’s ag software platform.

So what will the partnership mean for dealers? We caught up with Stark at this week’s InfoAg event in St. Louis to discuss the opportunity and impact the integration will have on the company’s retailers.

“It will streamline things a lot better for them because what happens is you eliminate the USB drive. So a lot of dealers are still downloading data from these displays via USB and anyone who has done that process knows it takes a long time to extract data from a USB. So a dealership will really thrive on this because, hey, they are supporting all kinds of displays out in the field. So that API, all they have to do is set up a Trimble account, set up the API wireless flow and hit a button.”

Telematic services continue to be an evolving source of revenue for dealers, and looking at data from the 2017 Precision Farming Dealer benchmark study, nearly 59% of respondents said they offer remote service to farm customers and 51% viewed data management services as the most important source of precision revenue growth during the next 5 years.

Deere Now 5th Largest Ag Lender

All the major farm equipment OEMs have a financing arm to their operations, but Deere & Co. has extended is financing to include more than just equipment. The manufacturer now provides short-term credit for consumables like seed, chemicals and fertilizer. And, The Wall Street Journal reported on July 19, that Deere is now the No. 5 agricultural lender behind Wells Fargo, Rabobank, Bank of the West and Bank of America, according to the American Bankers Assn.

According to the report, farmers’ short-term credit accounts are up 38% since the end of 2015. As of early this year, Deere Financial had lent $2.2 billion, not far behind the No. 4 ag lender Bank of America, which has lent $2.6 billion.

During the first half of 2017, the volume of loans for farm operations dropped by 7% from a year earlier, according to the Federal Reserve Bank of Kansas City. While bank loans are down, Deere has expanded its financing reach. The financing arm of the company accounted for a third of its net income in fiscal 2016, up from 16% in 2013, reports the Wall Street Journal.

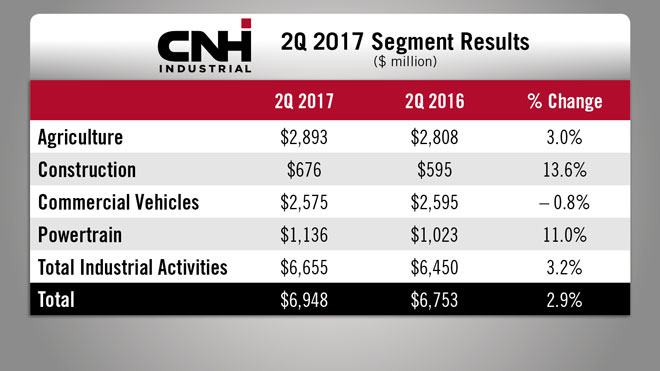

CNHI Earnings Up 3% in 2Q

CNH Industrial released its second quarter earnings on July 26. Revenue for the quarter was $6.9 billion, up about 3% vs. the same quarter last year. For the first half of the year, revenues are up 4.2% at $12.1billion.

Industrial revenues were up 3.2% year-over-year to $6.66 billion. Ag equipment accounted for $2.89 billion, a year-over-year increase of 3%. Construction equipment revenues were up 13.6% to $676 million.

Michael Shlisky, analyst with Seaport Global, said in a note to investors, “Most of the key segment drivers played out as expected; in Ag, strong volumes in LATAM were offset by weaker conditions in NAFTA.”

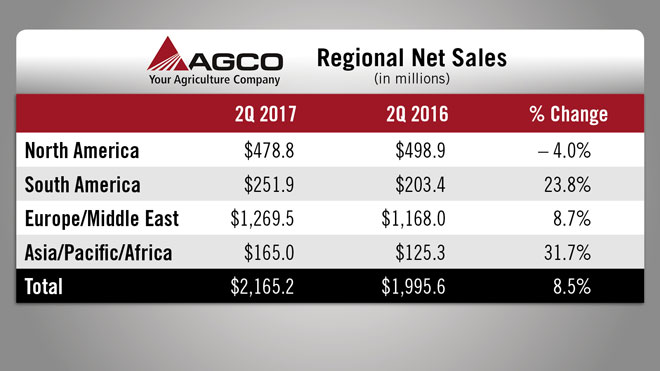

AGCO Net Sales Up 8.5% in 2Q

On July 27, AGCO reported its second quarter earnings. For the quarter, net sales were about $2.2 billion, up about 8.5% vs. the second quarter of 2016. Net sales for the first half of 2017 are approximately $3.8 billion, a 6.7% year-over-year increase.

Regionally, North American sales were down 4% for the quarter vs. 2016 at $478.8 million. Sales declines were most significant in hay tools and GSI grain equipment. These declines were partially offset by increased sales of mid-range and high horsepower tractors.

South American and Asia/Pacific/Africa sales both saw double-digit growth at 23.8% and 31.7%, respectively. Significant sales increases in Brazil and Argentina produced most of the growth. Second quarter sales for Europe/Middle East were up 8.7%.

And now from the Implement & Tractor Archives…

Implement & Tractor Archives

McFarlane Manufacturing celebrates its 100th anniversary this year and its roots are based in the Wisconsin Tractor Co., which Earl McFarlane started in 1917. Here’s Earl’s grandson, Dick McFarlane with more details on the company’s early tractors.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Until next time, thanks for joining us.

Post a comment

Report Abusive Comment