In today’s newscast, we report on CNH Industrial’s purchase of the Soil & Grass line of Kongskilde, the latest Ag Economy Barometer reading from Purdue University and the Center for Commercial Agriculture, dealers’ precision hiring plans for 2017 and the third quarter earnings reports for CNH Industrial and Trimble.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by AgDirect.

Built for agriculture and powered by Farm Credit, AgDirect serves the ag equipment financing needs of equipment dealers across most areas of the U.S. It’s among the fastest-growing equipment financing programs of its kind – offering equipment dealers and manufacturers a reliable, risk-free source of credit for equipment financing and leasing on ag equipment – including irrigation systems. Along with attractive rates, AgDirect’s financing terms are among the most flexible in the ag equipment business – matching the income stream of ag producers.

Discover why more dealers and their customers are choosing AgDirect to finance, lease and refinance ag equipment by visiting AgDirect.com.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

In Little League, coaches tell young players to “keep your eye on the ball.” The advice applies to both fielding and batting, but it is just as applicable to running a successful farm equipment dealership. That’s just what Don Van Houweling, owner of the 2016 Dealership of the Year, has done at Van Wall Equipment.

I’m managing editor Kim Schmidt, welcome to On the Record. Here’s a look at what’s currently impacting the ag equipment industry.

Kongskilde Sells Grass & Soil Line to CNH Industrial

FARM

MACHINERY

TICKER

AFN: $46.84 -0.58

…

AGCO: $49.28 -0.74

…

AJX: $0.65 -0.08

…

ALG: $62.74 -1.37

…

ARTW: $2.90 0.00

…

BUI: $4.43 -0.02

…

CAT: $81.27 -1.74

…

CNHI: $7.20 -0.33

…

DE: $88.32 +1.32

…

KUBTY: $79.08 +0.22

…

LNN: $76.00 -2.10

…

RAVN: $21.30 +0.30

…

TWI: $9.20 -1.01

…

TRMB: $25.34 -2.50

…

VMI: $123.70 -2.65

…

CVL: $12.71 -0.35

…

RME: $8.48 -0.26

…

TITN: $8.69 -0.70

…

TSCO: $65.61 +3.54

...

Closing Stocks as of 11/03/16 (Compared to Close on 10/27/16)

A Danish farmer cooperative’s patriotic experiment with ownership of a machinery manufacturing enterprise is drawing to a close with the sale of a chunk of assets to CNH Industrial.

Managers at the DLG cooperative have been trying to turnaround Kongskilde Industries since acquiring the business in 2007 but concluded last year that it was best prepared for a sale to a buyer focused on farm machinery as its core business.

CNH Industries and its New Holland Agriculture division have emerged as the buyer with the announcement on Monday this week that they had agreed to purchase Kongskilde’s Soil and Grass divisions.

The group’s grain handling and industrial equipment divisions are not part of the deal, but the package does include all tillage and hay tool products, related brands and production plants in Europe and North America.

These include the newly expanded facility in Hudson, Illinois that produces tillage and fertilizer placement equipment and is Kongskilde’s North American base.

Kongskilde assets in the Soil category include mouldboard plows, seed drills and precision planters, inter-row cultivators, fertilizer placement equipment and rock pickers, and in the Grass segment, hay mowers, rakes and tedders, towed forage harvesters and cattle diet feeders.

Carlo Lambro, Brand President of New Holland Agriculture, said the acquisition of the tillage, seeding, hay and forage activities of Kongskilde adds key product ranges that will further broaden New Holland Agriculture’s product offering.

While emphasizing that the current dealer and importer network remains unchanged for now, Lambro said the agreement will provide growth opportunities and create a strong platform to develop the Kongskilde business and its brands as the products are gradually integrated into the New Holland portfolio.

We caught up with Steve Swartzrock of Swartzrock Implement, a New Holland dealer in Charles City, Iowa, during the Farm Equipment Manufacturers Association’s Marketing & Distribution Convention in San Diego earlier this week. Swartzrock says the deal is a win-win for him as a New Holland dealer, as the deal brings in a hay line and tillage tools to the New Holland product offering.

“New Holland has been tracking our used sales and our new sales of tillage and they’re just noticing they had a void there and they’re asking to help us sell more product … I’ve been watching the Kongskilde line. They haven’t been in my dealership to be a dealer for them but they make a product that competes with Kuhn Krause. Kuhn Krause calls it the Excelerator. They have a VT tool that looks very good.”

For the Danish cooperative, the deal removes a business that accounted for less than 1.5% of turnover but impacted on group profits and occupied a lot of management time.

For New Holland, it realizes an ambition to become a true full-liner having been outbid by Kubota in 2012 for the Kverneland Group, which would have provided a similar range of products.

Dealers on the Move

This weeks Dealers on the Move are Sunshine Equipment and Quality Equipment. The two Louisiana-based John Deere dealers merged to form Sunshine Quality Solutions. The combined dealership has 15 locations throughout southern Louisiana.

Case IH, New Holland Forecast Uptick in Precision Hiring

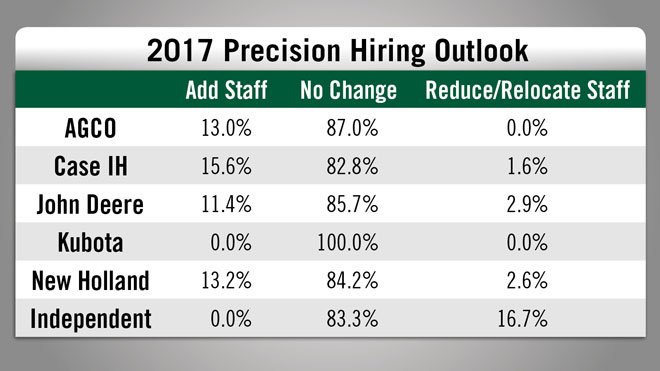

For the third year in a row, U.S. dealers are forecasting fewer additions to their precision farming departments, according to Ag Equipment Intelligence’s 2017 Dealer Business Outlook & Trends report.

The report, which tracks hiring and revenue projections for the coming year, reveals that only about 10% of U.S. dealers plan to add precision staff in 2017. This continues a gradual 13% decline during the last 3 years.

Independent dealers are the least optimistic group according to the report, with none planning to add staff in 2017 and more than 16% anticipating a reduction or relocation of precision specialists — up nearly 12% over this year.

Among the major manufacturers, Kubota dealers forecast the biggest drop in additional precision hires, going from 23% who planned to hire precision specialists this year to zero in 2017, according to the report, followed by John Deere, with about a 6% year-over-year decline.

But there is positive hiring news as well, with both Case IH and New Holland dealers are forecasting increases. Some 13% of New Holland dealers project adding precision specialists in 2017, more than double the percentage this year. About 16% of Case IH dealers are also forecasting hiring growth in the coming year, compared to just over 11% in 2016.

It’s also worth noting that New Holland dealers have the second highest hopes for precision sales growth in the coming year, with more than 34% forecasting precision sales growth of at least 2% in 2017, compared to about 18% this year. Deere dealers lead the way with 60% forecasting revenue growth in 2017, according to the report.

Producer Sentiment Drops in October

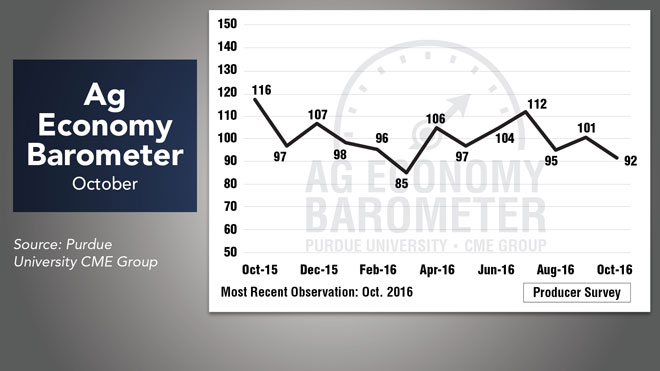

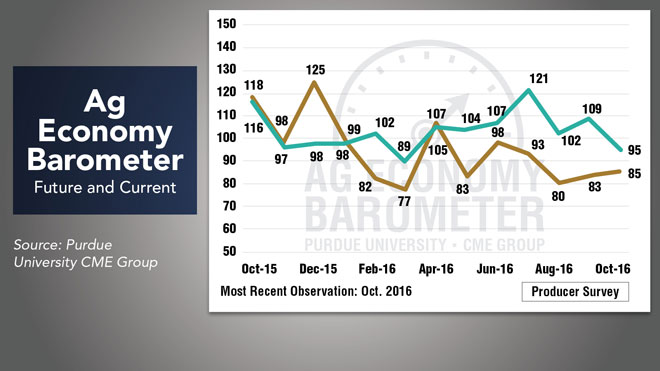

Purdue University and the Center for Commercial Agriculture released their October Ag Economy Barometer reader on Nov. 1. The monthly barometer measures sentiment among U.S. ag producers. For October, sentiment was measured at 92, the lowest reading since March 2016 and the second-lowest Ag Economy Barometer reading since data collection started in October 2015.

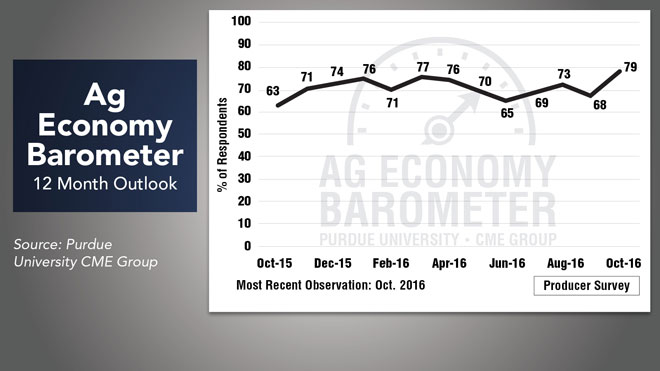

The report authors say the decline in producer sentiment was largely driven by “an erosion in producers’ perspective regarding the long-run health of the U.S. agricultural economy.” The Index of Future Expectations dropped to 95 in October vs. the 109 reading in September and well below the peak reading of 121 in July.

Producers were very pessimistic about the ag economy’s prospects over the next 12 months in the October survey. According to the survey, 79% of producers expect bad times financially over the next 12 months, up 11 percentage points from September and up 16 percentage points from a year ago.

The authors say the change in perspective from October 2015 to this October suggests farm financial conditions have weakened considerably since last fall.

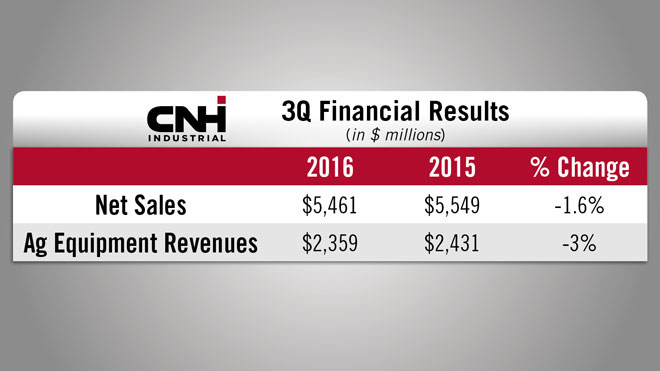

CNH Industrial 3Q Revenues Down 1.7%

On Oct. 31, CNH Industrial reported its total third quarter revenues were down 1.7%. Net sales from ag equipment during the quarter came in at $2.4 billion, down 3% compared to the third quarter of 2015.

Richard Tobin, CNH Industrial CEO, attributed the drop in revenue to an unfavorable industry volume and product mix in the row-crop sector in North America and unfavorable industry volume in the small grain sector in France. He also noted that net sales increased in Latin America due to improvements in Brazil and Argentina and improvements in credit availability.

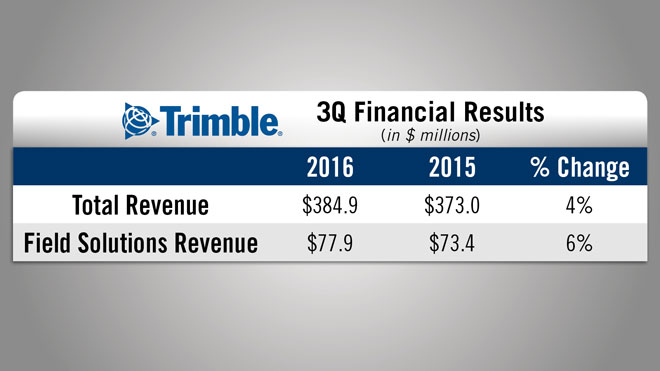

Trimble 3Q Revenues Up 4%

On Nov. 1, Trimble Navigation reported its third quarter revenues were up 4% over 2015. Revenues from the Field Solutions segments, which includes its precision farming products, were up 6% at about $78 million compared to $74 million for the same period last year.

Trimble president and CEO Steve Bergulund noted that last quarter the Field Solutions division had a flat year-to-year revenue performance after nine quarters of declines. This quarter marked the first revenue increase in 11 quarters, he says and adds “Although there was some acquisition contribution, the core agriculture business increased and compensated for a decline in the GIS business.

And now from the Implement & Tractor Archive…

Implement & Tractor Archive

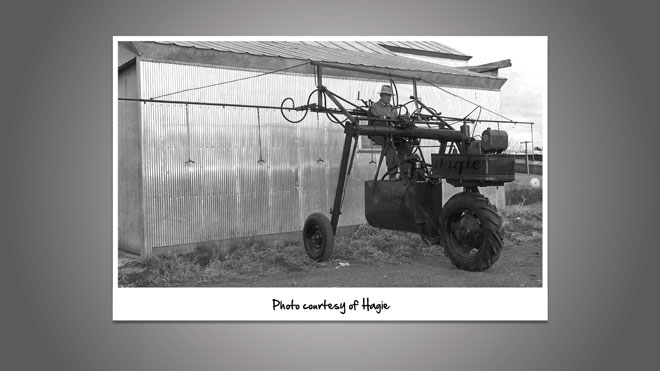

Looking for a way to reduce the painstaking time that came with detasseling, Ray Hagie developed a self-propelled “personnel mover” in 1946. Greatly improving efficiency, the product created high demand. At the end of World War II, following Dow’s release of the pesticide/herbicide, commonly know as 2,4-D today, to control broadleaf weeds, Hagie got back to work to develop an even more efficient solution for application of the product. In 1947, he invented the world’s first self-propelled sprayer.

As always, we welcome your feedback. You can send comments and story suggestions to kschmidt@lessitermedia.com. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment