While farmers understand they can’t control the weather, many of them do what they can to minimize its impact. Too dry? Irrigate. Too wet? Drain it. Both of these options can be effective in improving crop yields, but, typically, they are costly options that result in paybacks that can take several years to realize.

But what if the land is being leased under either a cash rent or share cropped arrangement? Would it ever make sense to invest in improving land that the operator doesn’t own?

This is the question that Sam Clark knew he would face when he proposed that a farmer, who was leasing farmland from one of his landowner clients, share in the costs of upgrading a portion of it.

Case Study Scenario

Clark is the area representative for Halderman Farm Management Service, which provides complete or partial management services for over 650 farms with a market value in excess of $1 billion across the western hemisphere.

According to Clark, the farmer in this case was committed to improving the soil on the land he worked, whether he owned or leased it. “This operator has been incorporating no-till and minimum tillage practices into his operation for over 10 years in an effort to reduce soil erosion, improve soil health and increase organic matter,” he says.

Operation at a Glance

Location: Indiana

Operation: Sole proprietorship growing corn and soybeans (in rotation)

Total Acres: 2,800 (30% owned, 55% cash rent, 15% leased on shares)

Employees: 1 main operator/manager, 2 part-time/seasonal employees

Annual Revenue: $2.6 million (average of past 5 years)

The challenge for this grower was that about 120 acres on the lease were very wet. Not only did the farm have low areas that ponded, but also it naturally held water across all areas and soil types, Clark explains. “This made drying the soil out in the spring for planting a challenge. Nitrogen applications and post applications of herbicide were often also challenging depending on the weather and timing of the rainfall. Additionally, this farm had the potential for increased crop stress and damage during wet periods.”

At the same time, Clark believed this farm could be highly productive if the water issues could be controlled with a drainage system. Soil fertility was in good shape from years of management, and the farm is mostly good black soil, he says.

Really fixing the drainage issues across the farm required the land to be systematically tiled. But Clark knew it would be a costly fix. “Installing drainage tile like this is a major investment,” he says. “Typically, the landowner is responsible for tile improvements and repairs, but many property owners don’t have or want to make this kind of capital investment.”

Professional Consultant’s View

To lessen the impact of the costs involved in tiling 120 acres, Clark proposed the novel approach of cost sharing between the landowner and the farmer leasing the land.

“My recommendation was for the farmer to work together with the landowner and invest in the tile system as partners,” he explains. “A landowner and a farmer are already much like business partners in a typical lease arrangement, so I felt that this should not be much of a stretch. By making some adjustments to the lease structure we could develop an arrangement that would be advantageous and profitable for both parties.”

He estimated the total cost for installing the drainage tile on the 120 acre parcel would be a little over $100,000, and splitting the cost between the landowner and farmer would amount to $51,000 each.

The major benefits for the landowner were obvious. The tiled acreage would fetch a higher lease price vs. non-tiled area and this would go on for as long as he owned the property. But to take on the entire investment himself would double the payback period needed to recoup dollars required to complete the project.

While the per-acre rent landowners receive is based on several factors including soil type, according to Clark, the going rate in this particular area of Indiana has been somewhat fluid considering the change in commodity prices. In his analysis, the cash rent is based on rent from the previous year, which was in the range of $300-$320 per acre. He adds, “Things could change a lot this year when it comes to cash rents.”

Clark also understood that selling the concept of investing in land improvements on property the farmer did not own would take more detail with solid dollar figures to demonstrate the benefits for the grower.

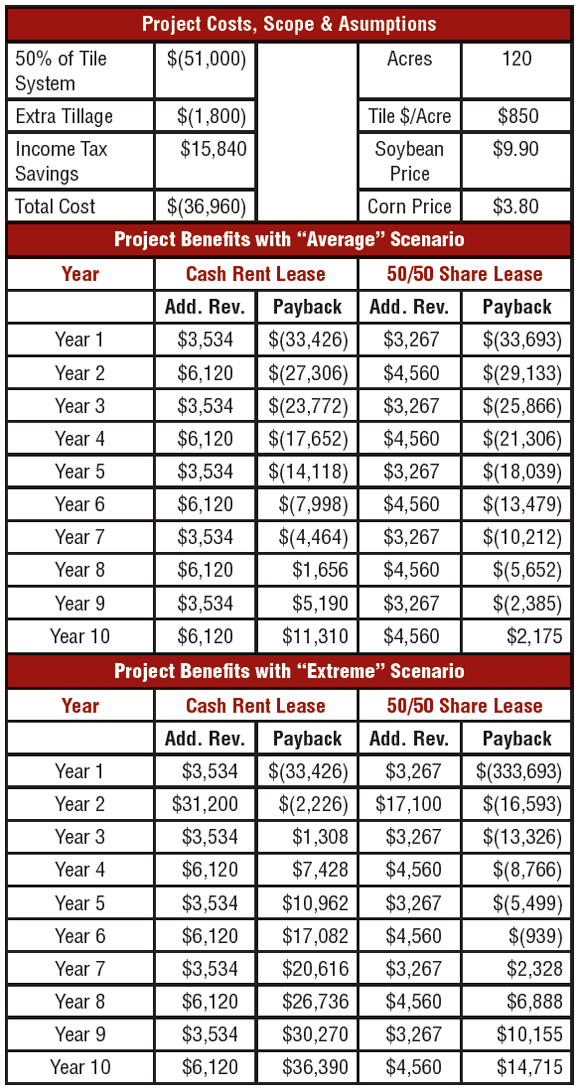

To do so, Clark prepared a report that illustrated the feasibility of systematically installing the drainage tile. The proposal included payback schedules using various scenarios that would demonstrate how investing in the project would result in higher crop yields and profits for the producer.

Underlying Assumptions

In order to produce a reasonable payback schedule, Clark developed a detailed list of “assumptions” based on local conditions and his experience managing farmland. The following assumptions were made in Clark’s analysis:

Drainage Tile Specifications & Costs

To illustrate payback for the proposed tile drainage system, a detailed schedule was developed that included two different scenarios, along with cash rent or share lease options.

• Farm being tiled is one field that encompasses 120 tillable acres.

• Tile would be installed on 80 foot centers using 4 inch laterals across the field.

• In particularly wet areas, the middles are split to create a 40 foot spacing. (About one-third of the field would be on 40 foot spacing.)

• Cost to install the system including mains and outlet to a nearby open ditch would be $850/acre.

Cropping, Pricing & Yield Projections

• It is typically planted all to one crop (corn-soybean rotation) and would be planted to soybeans after tile installation in the spring.

• Average cash corn prices are estimated at $3.80/bushel.

• Average cash soybean prices are estimated at $9.90/bushel.

• Projected average yield advantage is 20 bushels/acre for corn and 5.5 bushels/acre for soybeans.

• Extreme yield advantage (anticipated during current record wet year in Indiana) is 75 bushels/acre for corn and 22 bushels/acre for soybeans.

• Additional tillage cost after tile installation is $15/acre.

Other Considerations

• Marginal tax rate is estimated at 30%.

• Cost would be shared 50% between the landlord and the farmer.

• Lease options include a 50/50 share lease or a cash rent lease at $25/acre higher than market rent.

• Under either lease arrangement, an agreement would be incorporated stating that if the farmer leaves the farm within the next 7 years, he would be reimbursed for his investment on a prorated basis.

Examining Project Specs

In explaining the drainage system and layout, Clark noted that past practice meant the landowner would simply run strings of tile to drain individual wet holes. “This was helpful but what we found is if you want to really make a farm highly productive, you tile on a grid over the entire farm.

“In this case, we proposed putting in a whole system that has larger main tiles, smaller sub-mains and laterals to feed into. Basically, we would have tile spaced across the whole farm for uniform and even drainage and drying. This system would be designed with 80 foot centers, except in the areas that were excessively wet and where ponding occurs, which was about 40 of the 120 acres. In these areas the tiles were spaced every 40 feet rather than 80 feet,” Clark explains.

The cost of $850 per acre is the contracted price, which includes material and labor to install the complete system.

Expected Improvements

Typically, this farm produced an average of 185 bushels of corn and 56 bushels of soybeans per acre without the additional drainage. Clark estimates that by installing the recommended tile system, the drainage control would significantly increase yields.

He says prior experience with installing field tile showed yields could be improved by 5-10%. Initially, he estimated an improvement of 8% for this particular farm. “In the end, I decided this farm would probably be toward the higher end of a yield boost given its excellent soils. So I went with a 10% increase in yields in the ‘average’ scenario when I put the proposal together. I figured the ‘extreme’ yield boosts at about 4 times normal.”

For example, the 5.5 bushel increase for soybeans represents about a 10% increase over the typical average of 56 bushels per acre. This would produce a yield of about 62 bushels per acre. In the “extreme” scenario, Clark estimates that yields would be at 4 times normal (4 x 5.5), so the increase in soybean yield would be about 22 bushels per acre.

In defining “extreme” conditions, Clark says, “This year in this part of Indiana, we’ve set records for rainfall in both June and July. Some parts of the state saw 4 times the average amount of rain in June and 2-3 times the normal rainfall in July. So we saw late planting and farmers weren’t able to apply anhydrous when they would normally and decided to sidedress later. When the rains came, a lot of these plants weren’t quite mature enough to withstand this kind of stress, and on top of water stress, they experienced nitrogen losses.”

But tiled fields dried out earlier and more uniformly. This allowed farmers to plant a bit earlier and apply nitrogen when the plants needed it. “The fields that were tiled are doing a lot better,” says Clark. “In addition to the earlier planting, they experienced much less nitrogen loss and actually benefited from all the rain. In the past we’ve seen that, particularly in the wet years, tiled fields could do 4-5 times better in yield than fields without good drainage.

3 Homework Questions

Sam Clark, area representative for Halderman Farm Management based in Noblesville, Ind., says if he was a farmer and a land manager proposed that he share in the cost of installing drainage tile in acreage that he was leasing, three of the most important questions he would pose include:

1. How would my investment in this leased land be protected?

2. How do you know if the tile spacing being proposed will be adequate to produce the expected results?

3. How much might the actual cost differ from the estimated cost or what is the biggest variable in the cost of the project?

Click here for the expert’s responses to these three questions.

“Year in and year out, with the improvements and good weather, the farm could easily be a 225-230 bushel per acre farm,” he says. “For soybeans, we should be looking at 70-plus bushels an acre.”

Other Considerations

While this farmer is committed to no-tillage, in this case he would need to work down the tile lines and level out the seedbed by discing and possibly using a vertical tillage tool prior to planting. For this additional operation, Clark included an “extra tillage” cost of $1,800.

At the same time, he estimated a $15,840 savings in income taxes on the project. This resulted from utilizing Section 179 expensing allowed in the tax code.

Depending upon an individual’s need, Clark says some people prefer to depreciate costs involved with installing a drainage system. “Providing our client has enough income, we will almost always advise them to take the expense all in one year. This means that they can take the full $51,000 required to do the land repairs and apply it against their taxes in the year the project is done. Every situation is a bit different, so it is always best to check with your accountant or tax professional before moving forward.”

This would bring the total cost of the project down to $39,960, according to Clark. “This is an advantage for both the landowner and the farmer. While the farmer doesn’t own the land, they can typically expense the cost as a repair.”

Calculating Payback

Clark produced detailed 10 year payback schedules that included calculations for both “average” and “extreme” scenarios to present to both the landowner and the farmer who is leasing the farm. In each of these cases, he separated out the payback if the lease is based on cash rent or on a 50/50 crop share basis.

By calculating the “additional revenue” that would be derived from installing the proposed drainage system (yield increase x $3.80 bushel for corn and yield increase x $9.90 per bushel for soybeans), under an “average” scenario, it would take 7 years to pay off the tile system if the lease is covered on a “cash rent” basis.

“I’ve estimated that the yield boost in a year like we’re having this year could be almost 4 times better than the yield boost in a regular year...”

If the lease were a “50/50 share” arrangement, under the “average” scenario, the system would be totally paid off after 9 years.

Using the “extreme” scenario where a tiled field not only produces the normal expected increases in crop yields by allowing timely planting and application of nitrogen, etc., but also limits yield losses from water damage, the payback under a “cash rent” arrangement could be as little as 2 years, delivering increased profits by year three.

“We expect farms with tile systems to have significant yield boosts over non-tiled farms,” says Clark. “I’ve estimated that the yield boost in a year like we’re having this year could be almost 4 times better than the yield boost in a regular year. The regular yield boost for a corn rotation year is 20 bushel. Year 2 of the ‘extreme’ scenario illustrated in Table 3 shows a yield boost of 75 bushel. The additional revenue shown is the difference in yields between a regular 20 bushel advantage and the 75 bushel advantage.”

Meet the Expert

Sam Clark

Area Representative

Halderman Farm Management

Noblesville, Ind.

317-442-0251

samc@halderman.com

Sam Clark is an area representative for Halderman Farm Management & Real Estate Services, one of the largest family-owned professional farm management and real estate organizations in the U.S. He works as part of a father-son team with Jim Clark covering Central Indiana. Together they have 34-plus years of experience managing, selling and appraising farms. Clark is a 2011 graduate of Purdue University and holds a B.S. in agricultural finance and an M.S. in agricultural economics.

In the case of a “50/50 share lease,” payback using the “extreme” scenario would take an estimated 6 years.

Easing the Farmer’s Concern

The obvious question that would inevitably arise when proposing this cost-sharing arrangement is, “What happens to the farmer’s upfront investment if he or she has a short-term lease that would not cover the payback period?”

Clark explains that Halderman Farm Management had developed a stipulation covering situations like this. In the agreement, if the grower does not farm the tiled ground for a specific period of time — usually 5-7 years — then the farmer is reimbursed for his portion of the investment on a prorated basis.

The agreement not only safeguards the farmer’s investment, it is set up so the landowner will never foot the bill for the farmer’s half of the tiling costs. Clark says, “We make sure that, if the original farmer leaves, the next farmer to lease the land assumes the original farmer’s portion of the cost-sharing agreement and covers the cost for the reimbursment.”

Clark says they are finding that many farmers see such cost-sharing arrangements as attractive and worthwhile investments. While they may not own the land, they still strive to make every acre count when it comes to productivity and profits.

Web Exclusive: Expert Responses

Click below to view other case studies from this report:

Post a comment

Report Abusive Comment