In the latest episode we take a look at the Equipment Dealers Assn.’s Dealer Choice Award recipients, Kubota dealers’ increased interest in precision farming, how the recent up tick in corn and soybean prices could influence farm equipment sales, Titan’s first quarter results and Kubota’s attempts at autonomous farm equipment.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by DLL.

DLL offers manufacturers and dealers over six decades of committed experience in providing financial solutions within the agribusiness sector. DLL’s expertise in inventory and retail financing allows for programs specifically designed to grow your business. DLL’s efficient processing and customer support enhance and compliment the products offered to vendors, dealers and customers. DLL’s goal is to provide you and your business with an advantage in a competitive marketplace.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

We asked a wide range of dealers: "As a dealer, what criteria about the product and manufacturer are most important to you when you consider adding new shortline equipment to your product lineup?"

I’m managing editor Kim Schmidt, on the road this week visiting dealerships. Welcome to On The Record. Here’s a look at what’s currently impacting the ag equipment industry.

EDA Announces 2016 Dealer’s Choice Awards

Yesterday, the Equipment Dealers Association announced its Dealer’s Choice Awards, based on the association’s 2016 Dealer-Manufacturer Relations Survey. The Dealer’s Choice Award is presented to the manufacturers receiving the highest ratings in 12 categories covering operations and support.

Since the award’s inception in 2013, Vermeer has achieved the top rating in the Shortline Manufacturer category all four years. John Deere, LS Tractor and Grasshopper topped their respective category for the second consecutive year.

EDA also bestows Gold Level recognition to the manufacturers that receive exceptional overall ratings. The farm equipment manufacturers receiving Gold Level status include:

Further coverage of the EDA Dealer-Manufacturer Relations Survey and its 2016 award-winners will be featured in the July/August edition of Farm Equipment magazine.

|

FARM AFN: $39.33 +0.08 Closing Stocks as of 06/09/16 (Compared to Close on 05/19/16) |

Dealers on the Move

Dealers on the Move this week include Stotz Equipment, Canada West Harvest Center, Atlanta Kubota and Matsqui Ag Repair.

John Deere dealer Stotz Equipment is acquiring Christiansen Implement’s 3 stores in Burley, Twin Falls and American Falls, Idaho. The deal is expected to close August 1. This brings Stotz’s total locations to 25.

Claas is opening its third Canada West Harvest Centre location in Saskatchewan. The new store in Swift Current is set to open in time for the 2016 harvest and joins locations in Regina and Saskatoon.

Atlanta Kubota held a grand opening at its new facility in Marietta, Georgia., on May 20. The new facility is 45,000 square feet and includes the largest air-conditioned Kubota showroom in the state of Georgia.

Finally, shortline equipment dealer Matsqui Ag Repair in Abbotsford, British Columbia, has joined the JCB dealer network. Their other lines include Deutz-Fahr, McCormick, Kioti, Kuhn and McHale.

Kubota Plans Precision Hiring Increase

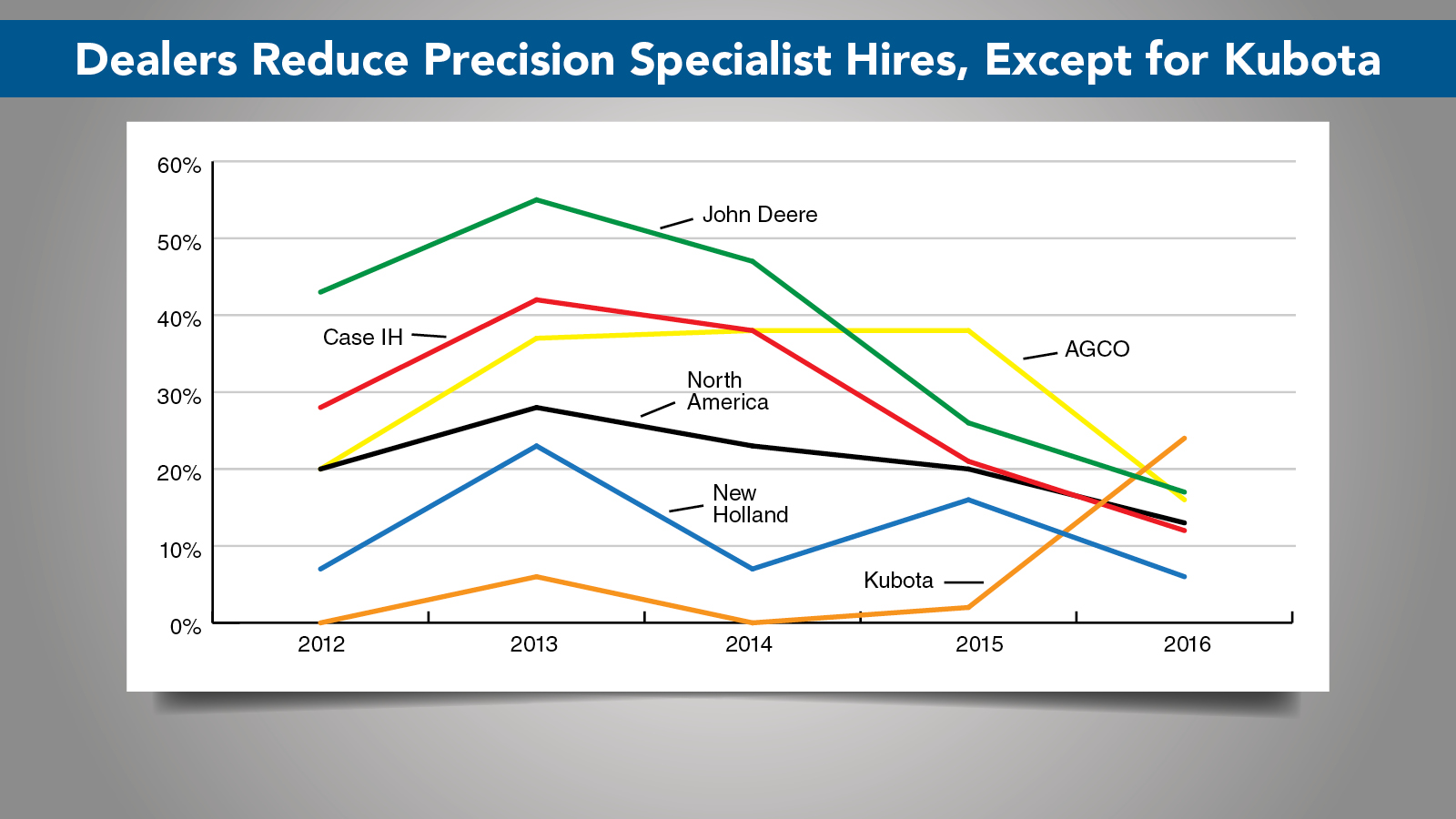

At the pinnacle of the precision farming boom, technology specialists were in high demand, while supply was relatively low.

But as the farm machinery market has slowed, so too have precision hiring plans for most OEM dealers according to Ag Equipment Intelligence’s 2016 Dealer Business Outlook & Trends report.

In 2013, more than 54% of John Deere dealers planned to add specialists to their precision farming departments, compared to about 17% in 2016. Looking at the same 4-year window, precision hiring plans for Case IH dealers declined 30%, AGCO dealers by 21% and New Holland dealers by 17%, according to the Outlook & Trends report.

Overall, precision hiring plans by North American OEM dealers fell from a 5-year high of 28% in 2013 to a low of 13% this year.

But the one exception to the downward hiring trend is Kubota. The manufacturer made news with its recent acquisition of Great Plains and appears poised to become more of a player in the precision farming market.

According to the Outlook & Trends report, nearly 24% of Kubota dealers plan to hire precision specialists in 2016, the highest of any of the major OEMs. The percentage is especially noteworthy given that in 2013, only 6% of Kubota dealers planned to hire precision specialists and 5 years ago, there weren’t any according to the Outlook & Trends report.

Corn & Soybean Prices Rising

Over the last 4 weeks, we’ve seen a nice increase in corn and soybean prices, with corn rising above $4 and soybeans over $10. This represents a psychological threshold for farmers. Generally, when crop prices go above $4 per bushel for corn and $10 for soybeans, farmer sentiment tends to improve.

When farmers are in a good mood, it’s good news for farm equipment dealers. Last week I sat down with Don Van Houweling, owner and general manager of Van Wall Equipment, a 16 store John Deere dealer based in Iowa. He’s already begun to see an improvement in farmer attitude, which is translating into equipment sales.

Van Houweling says if crop prices can hold steady at this level, we could see a pick up in farm equipment sales during the second half of the year.

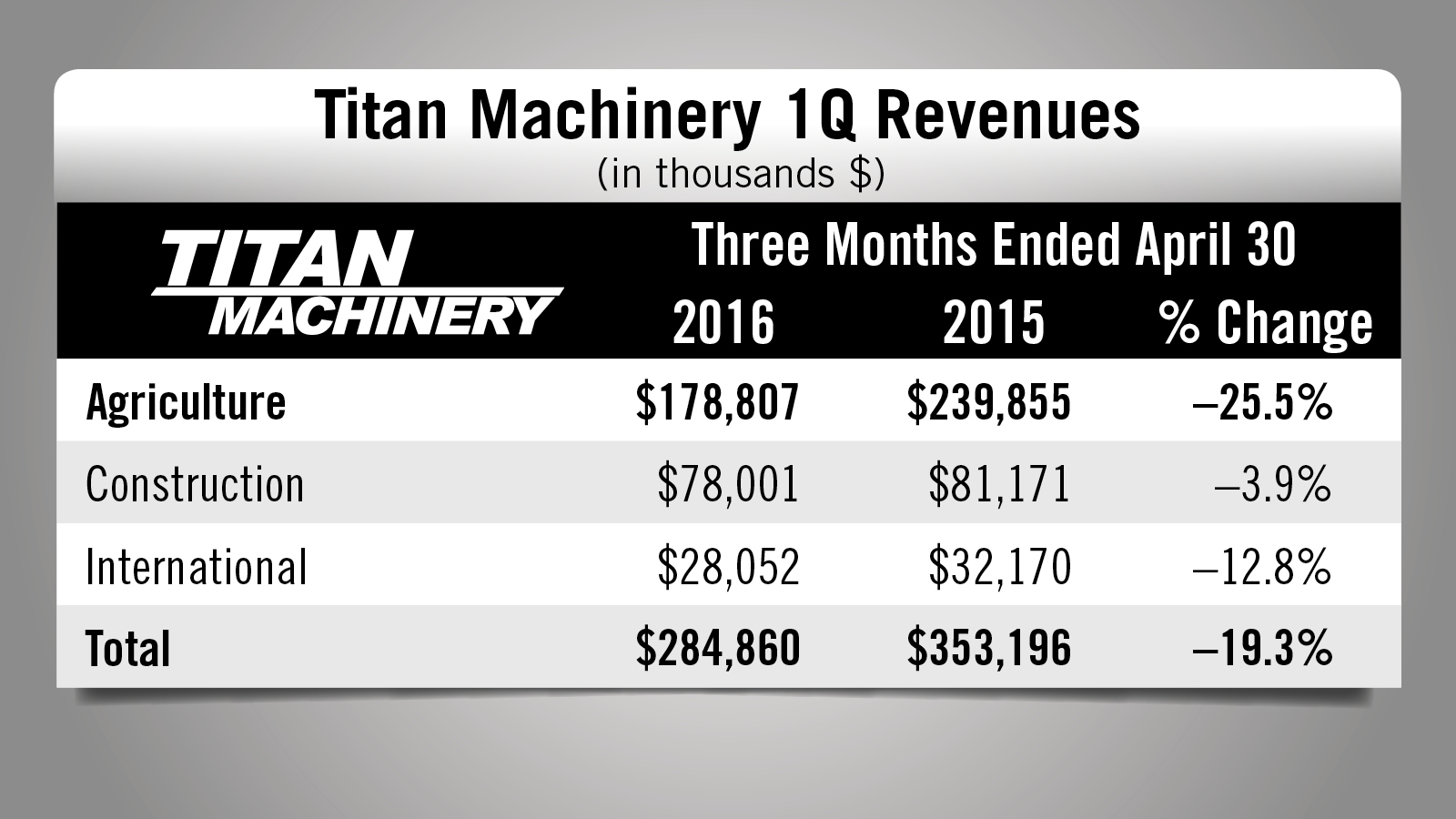

Titan Ag Revenues Drop in 1Q 2017

Titan Machinery, Case IH’s largest dealer group, reported its first quarter financial results for fiscal 2017 on May 26.

Total revenue came in at $285 million, a 19.3% decline from the first quarter of fiscal 2016. Ag revenues for the quarter were $179 million, down 25.5% year-over-year.

The dealership sold $25 million of the $74 million targeted aged equipment inventory during the first quarter. This was above managements $22 million target.

Titan CFO Mark Kalvoda says the dealership is ontrack to achieve its goal of $100 million reduction of equipment inventory in fiscal 2017. They expect the quarterly inventory stocking trend to be similar to that of fiscal 2016, with most of the reduction occurring in the back half of the year, particularly in the fourth quarter.

By the end of fiscal 2017, Kalvoda says they expect to have reduced equipment inventory by approximately $450 million or 48% compared to the end of fiscal 2014, which represents a major improvement in the strength of Titan’s balance sheet.

Kubota Sets Sights on Autonomous Equipment

In an effort to boost farm equipment sales in Southeast Asia and support a graying Japanese ag sector, Kubota and Nippon Telegraph & Telephone are teaming up to develop autonomous farm equipment, according to a report in the Nikkei Asian Review.

The two Japanese companies will partner together on a new precision farming service for farmers, which they plan to use to help put autonomous equipment on the market. They have a target of 2018 to rollout the program.

According to the report, the new service will use sensors positioned around rice paddies to measure temperature and water levels. This data, along with crop images taken by drones, will be used to analyze growth. The system will then determine when to fertilize and harvest each paddy and will send the appropriate directions to equipment via the internet.

Implement & Tractor Archives

The J.I. Case Threshing Machine Co., based in Racine, Wisconsin, primarily dealt in harvesting equipment but for a time built cars as well, and saw the opportunity that the first “International 500” provided.

The company had three drives in the 1911 lineup, but none of them finished the race. One crashed and the other two dropped out with steering failures.

The Case team was popular, according to company history, with its drivers and riding mechanics neatly attired in khaki racing suits and red turtlenecks adorned with white eagles.Its racing cars were never competitive, though. Louis Disbrow was the only Case driver to finish the 500, eighth in 1913, the final year of the program.

According to company history, Case wasn't competitive in the marketplace either. A company that built automobiles as a sideline couldn't keep up with the industry and got out of the business in 1927.

We always like hearing from you. You can send comments and story suggestions to kschmidt@lessitermedia.com. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment