In the latest episode we discuss dealer consolidation and Ag Equipment Intelligence’s latest Big Dealer Report, merger and acquisition trends among farm equipment manufacturers, the results of No-Till Farmer’s latest operational benchmark survey and the first quarter results from Art’s Way.

Leave a comment Get New Episodes Delivered to Your Inbox

On The Record is brought to you by DLL.

DLL offers manufacturers and dealers over six decades of committed experience in providing financial solutions within the agribusiness sector. DLL’s expertise in inventory and retail financing allows for programs specifically designed to grow your business. DLL’s efficient processing and customer support enhance and compliment the products offered to vendors, dealers and customers. DLL’s goal is to provide you and your business with an advantage in a competitive marketplace.

We're interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.

You May Also Be Interested In...

Eric Woodford left a successful farming and custom baling operation to start a shortline dealership focused on biomass harvesting equipment.

I’m managing editor Kim Schmidt, welcome to On The Record. Here’s a look at what’s currently impacting the ag equipment industry.

Big Dealer List Grows

Ag Equipment Intelligence released its annual Big Dealer Report this week. This year, the list grew to 192 dealers from 188 dealers last year. For the sake of the report, a Big Dealer is any dealer who operates 5 or more ag equipment stores. The number of Big Dealers has increased by 26.5% since we began tracking it back in 2009.

Likewise, the number of ag stores operated by Big Dealers has grown by 30%, from about 1,500 to almost 2,000 individual store locations.

|

FARM AFN: $38.45 +3.55 Closing Stocks as of 04/21/16 (Compared to Close on 04/07/16) |

George Russell of the Machinery Advisors Consortium, who collaborates with Ag Equipment Intelligence on the report, notes that in 2013 and 2014 we saw a drop in the number of big dealers because big dealers were acquiring or merging with other big dealers. Today, however, he says the more prominent trend has been an increase in dealerships on the lower end of the list.

In the last 2 years, for example, 14 dealers have been added to the Big Dealer list while only a few have dropped off.

Dealers on the Move

Dealers on the Move this week are Washington Tractor and HTS Ag.

John Deere dealer Washington Tractor opened a new location in Sumner, Wash., which will now serve as the dealership’s corporate headquarters. Washington Tractor has 12 total locations.

Precision farming dealer HTS Ag of Harlan and Ames, Iowa, has acquired fellow precision dealer Aeration Management Solutions of Indianapolis.

Ag Manufacturers Consolidate

It’s not just dealers who have been consolidating. Over the last year there’s been a flurry of merger and acquisition activity among ag equipment manufacturers.

Eric Bosveld, Bozveld & Associates

Some trends in the ag equipment M&A market, according to Eric Bosveld president of Bosveld & Associates, include majors buying up shortlines to strengthen their position in areas they may be weaker; manufacturers investing or acquiring technology, specialty market or engineering expertise; and private equity firms entering the market.

Bosveld says a strategy that is a great fit for private equity groups is the rollup or add-on strategy with shortline companies, which provides more revenue stability because of the added diversity. We spoke with Bosveld by phone and he says this is an area he expects to see more activity in going forward.

“So you can add to your dealer network to grow regionally and you can diversify and broaden your product line. And once you get more product lines across more crops, say touch the hay and forage equipment markets, for example, the more stability you’re going to have in your revenue stream going forward. So I think that once we see the ag economy begin to turn the corner, we will start to see more activity by the private equity groups in this space as well.”

No-Tillers to Reduce Spending

According to No-Till Farmer’s 8th annual No-Till Operational Benchmark Survey, 67% of respondents were profitable in 2015. This is down from 81% who said they were profitable in 2014.

No-Tillers are feeling the impact of the down ag economy. According to the survey, no-tillers saw their net profit per farm go down 40.7% vs. 2014.

Looking ahead to 2016 spending, no-tillers will likely reduce overall spending on average by 6.5% for a total of $423,486 for the current growing season. Equipment is one area that will see a cut, with no-tillers estimating spending 17% less in the coming year.

No-Till Farmer readers shared that they plan to spend almost $7,000 less on equipment expenses than they did in 2015, and we expect this to hold true.

In the history of our Benchmark Survey, no-tillers tend to be more conservative in how much they predict they’ll spend in the upcoming season. But in 2015, they actually stayed under their estimated budgets, spending an average $41,133 on equipment, which was about $1,000 less than what they predicted.

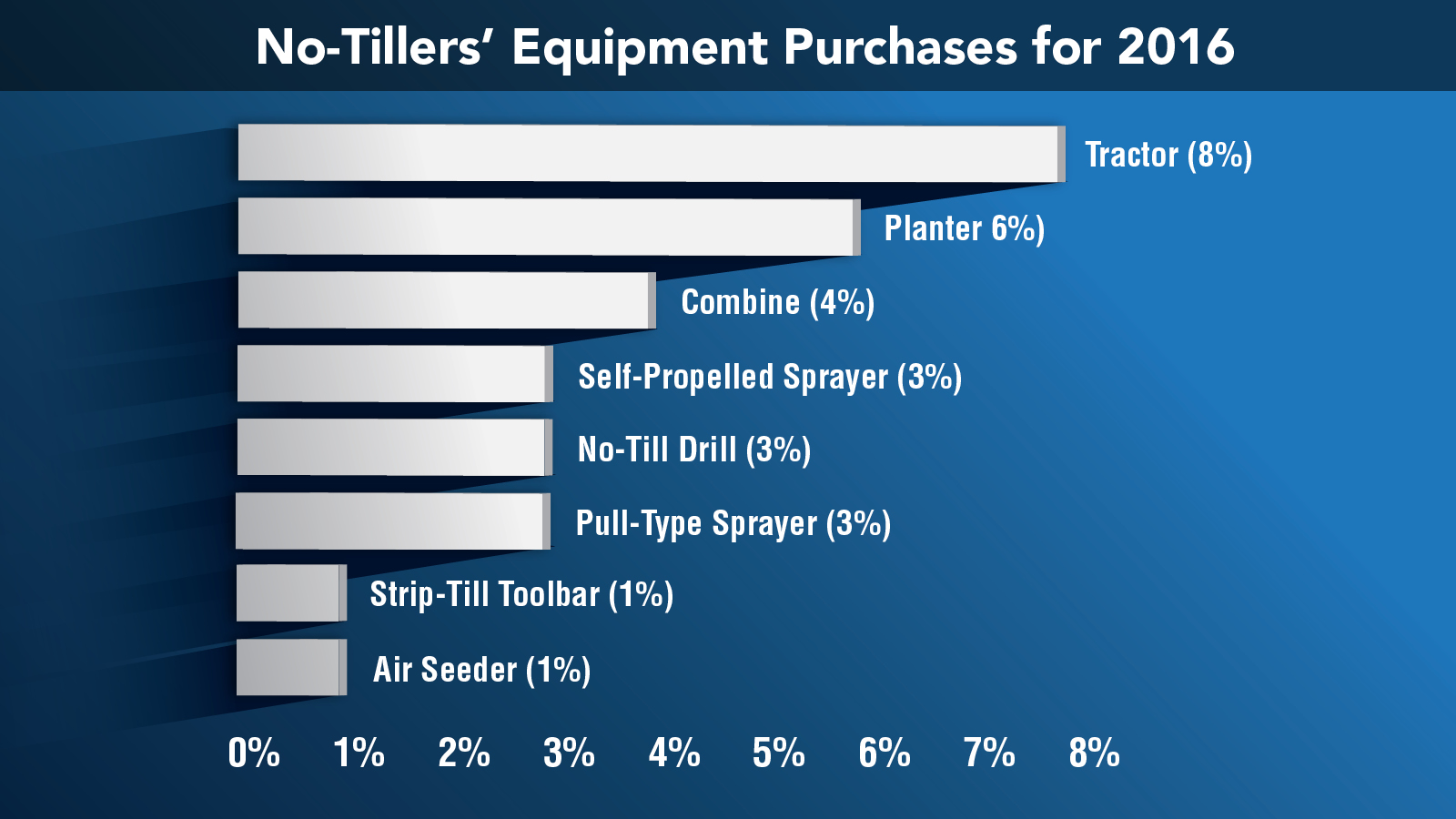

This year they estimate spending just over $34,000 on equipment, with 8% purchasing a tractor, 6% purchasing a planter, and 4% purchasing a combine. Three percent of survey takers said they will buy a no-till drill, self-propelled sprayer or pull-type sprayer.

No-Tillers’ Precision Spending Exceeds 2015 Projections

Moving into the second quarter of 2016, many precision dealers are maintaining a conservative sales outlook for the foreseeable future. But there may be reason for optimism, based on the recent results of No-Till Farmer’s 8th annual Benchmark Study.

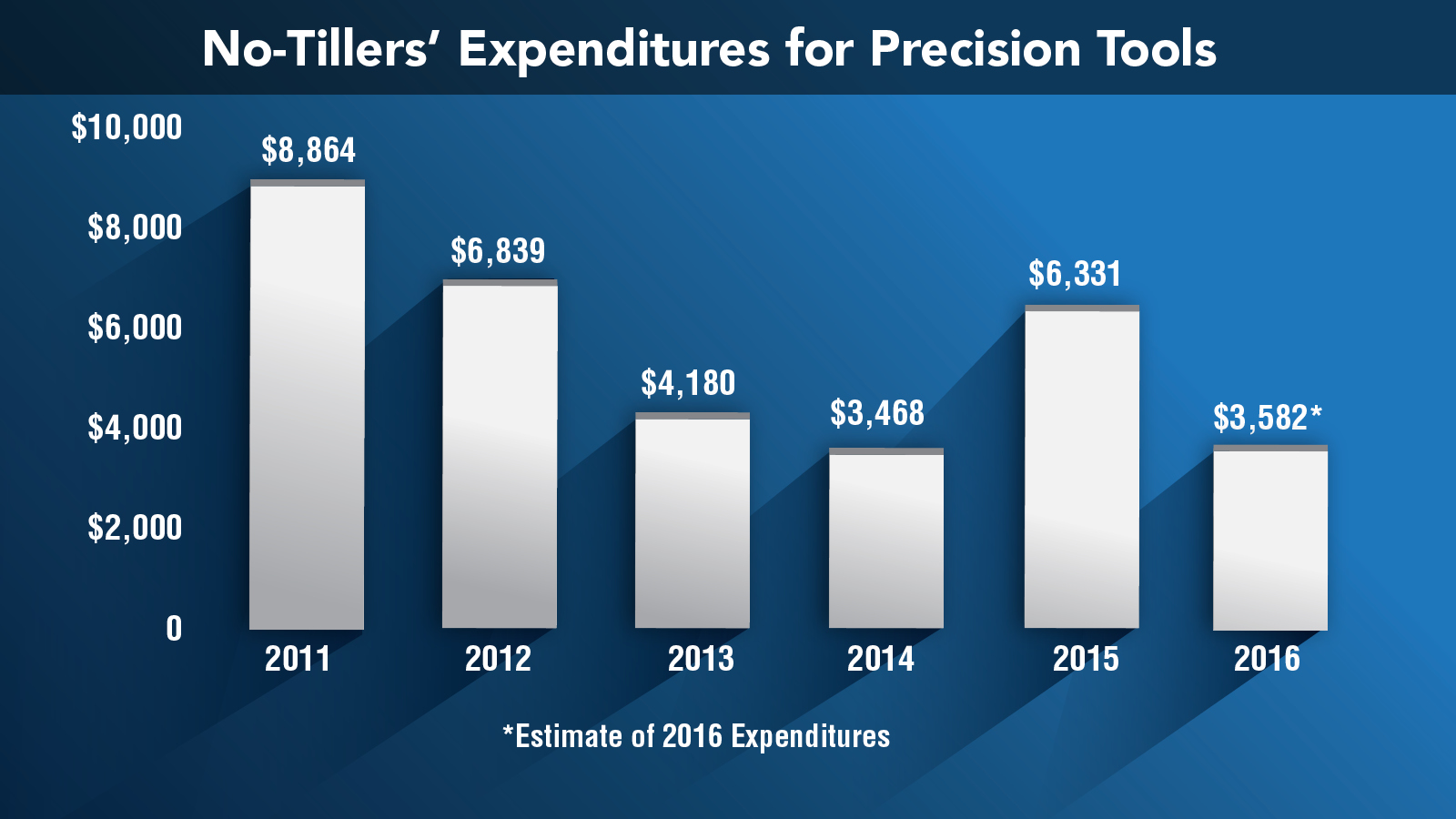

Respondents reported spending more than $6,300, or approximately $5.50 per acre on precision farming technology in 2015, nearly triple the $2,600 that no-tillers had initially forecasted in last year’s benchmark study.

The 2015 total also ended a 4-year downward trend in precision farming expenditures, which peaked at more than $8,800 per farm in 2011.

So was last year’s increase a sign of things to come, or a temporary rebound? That remains to be seen, as no-tillers are forecasting precision expenditures of about $3,500 or $3.13 per acre this year — well below 2015 totals, but on par with 2014 expenditures. In 2013, no-tillers estimated spending about $4,100 on precision farming equipment, well below the approximately $6,800 they invested in 2012.

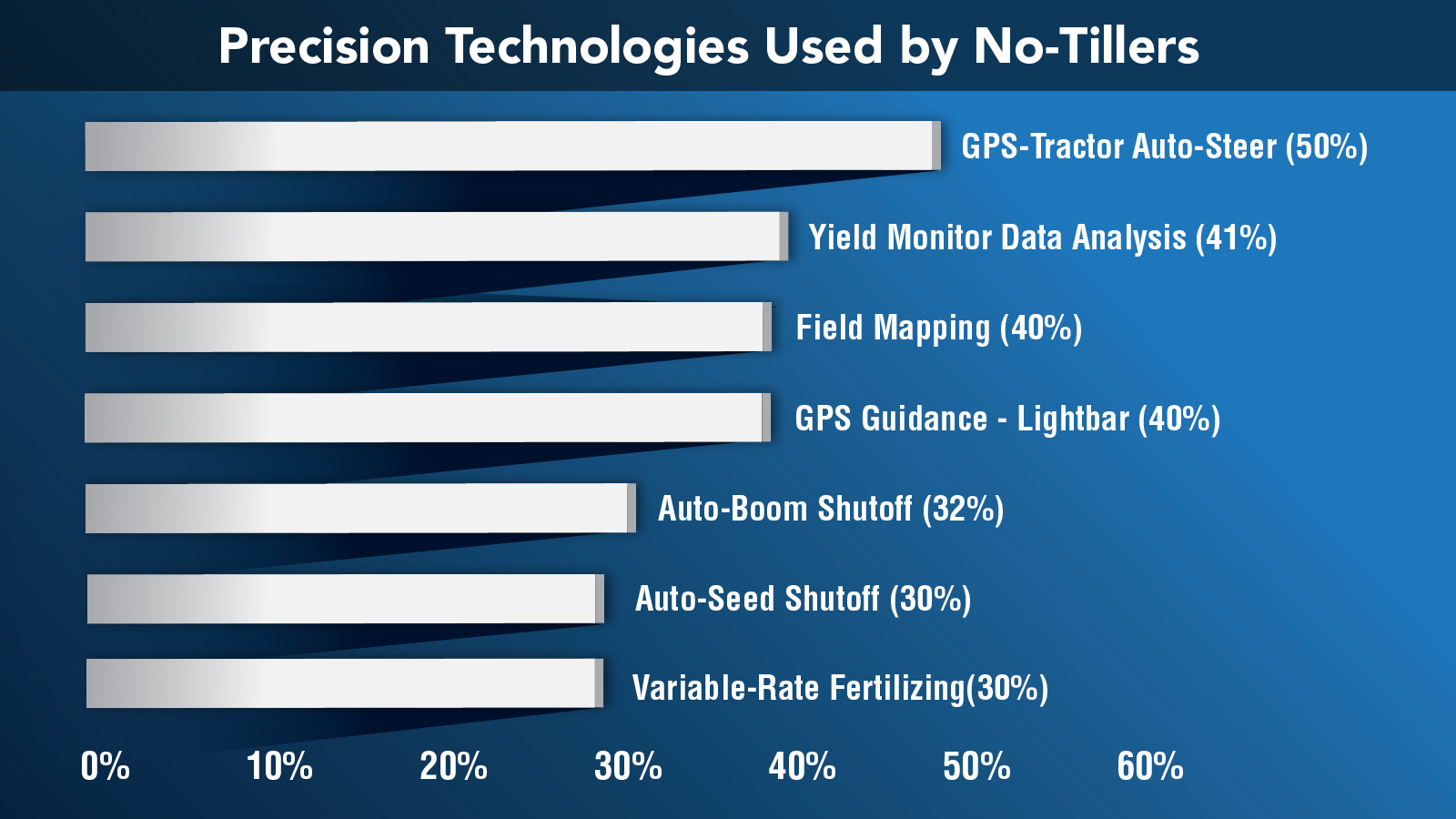

Although overall spending on technology may be fluctuating, the percentage of no-tillers utilizing advanced precision systems remained largely unchanged year-over-year according to the 2016 No-Till Farmer study.

GPS and tractor auto-steer remained the most commonly used technology with 50% of no-tillers utilizing the systems. About 41% of no-tillers do yield monitor data analysis, followed by 40% who do field mapping and 40% who use lightbars for GPS guidance.

Two new categories added in 2016 round out the top 5, with 32% of no-tillers using auto-boom shutoffs and 30% utilizing auto-seed shutoff.

The biggest year-over-year increase came in the number of no-tillers using Unmanned Aerial Vehicles, doubling from 3% in 2015 to 6% this year.

Art’s Way Ag Sales Drop 21% in 1Q

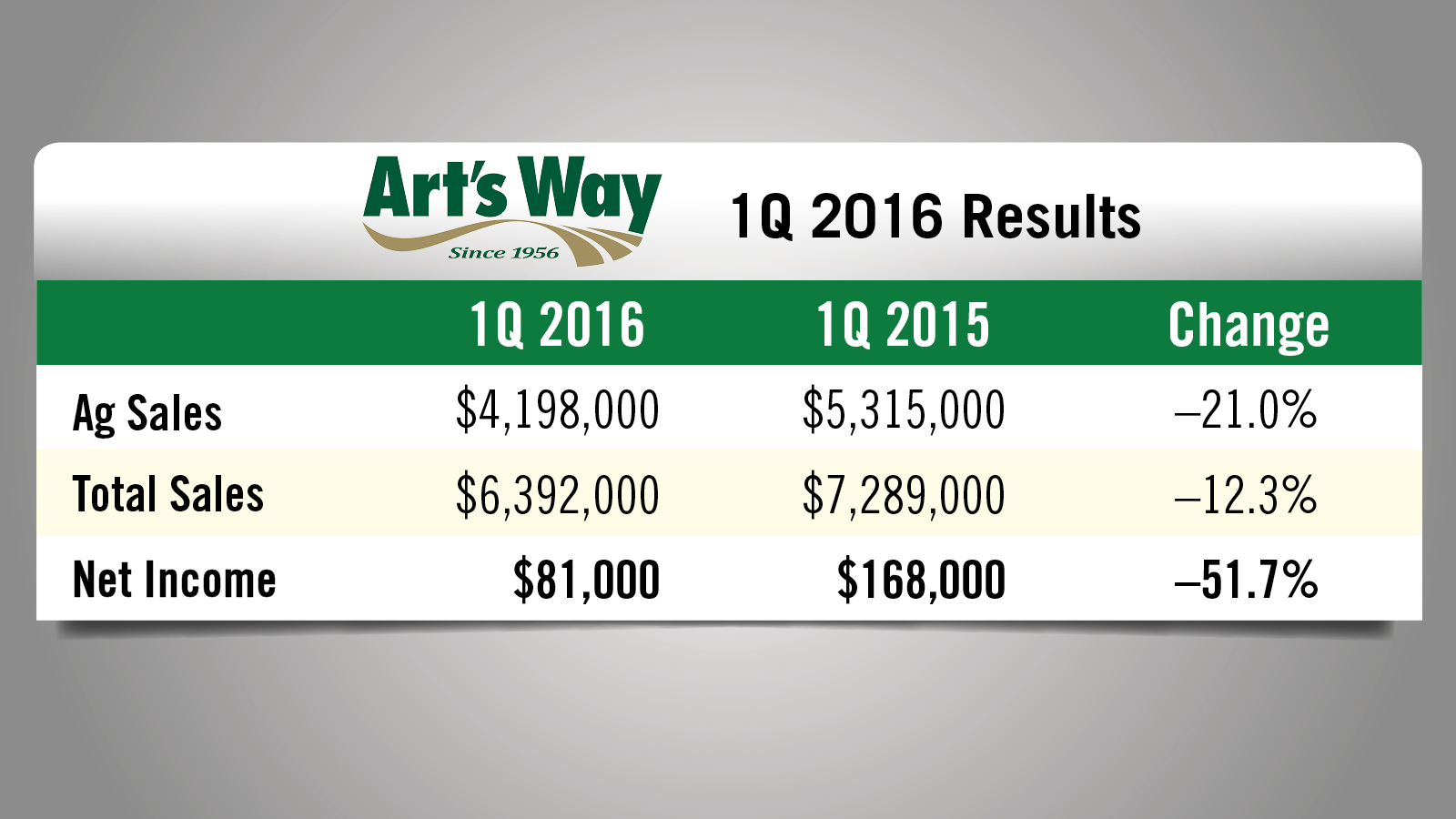

Art’s Way released its first quarter earnings report on April 14. The company reported total sales for the quarter were down 12.3%, while net income was down 51.7%.

The decline in revenue was largely due to decreased demand for its ag products, the company says. Ag sales for the quarter came in at about $4.2 million, a 21% decline compared to the first quarter of 2015.

Art’s Way Chairman Marc McConnell says that while they are in the midst of a challenging year, he believes the management team is doing a good job of giving them the best shot at being profitable under the current circumstances.

McConnell adds that no matter the size of the company, everyone is feeling the weakness in the ag market, and they will just have to adjust to what’s going on so they can succeed and be there when things improve.

Implement & Tractor Archives

In 1984, when Tenneco purchased the ag division of International Harvester and merged it with its Case subsidiary, they invited the International Harvester dealers into a series of meetings to launch the new company. At the first meeting, Case IH brought out a 94 series tractor painted white with the Case International decals. Straub International, a Case IH dealer with 6 locations in Kansas, says there was an uproar among the dealers at the meeting upon seeing the white tractor. By the next meeting, the tractor was painted red.

We always like hearing from you. You can send comments and story suggestions to kschmidt@lessitermedia.com. Thanks for watching, I’ll see you next time.

Post a comment

Report Abusive Comment